How To Enter A New Client

If you are new to the system, we recommend keeping your

" Enable popup help" function ON while you are acclimating to

the system. It will help you become familiar with key Fields of

special importance so that you can make operational decisions

as to how your company wishes to use particular settings or user-defined

Fields with special properties.

On any screen, there are two types of online Help:

- Dynamic link to online Help Docs on our website.

By pressing F1 while clicked into a target field of interest on

your screen, you will see your web browser open and take you directly

to the spot in our online Help Docs which describes that field in detail.

You will find yourself on a page that relates entirely to the screen you are

working in. Links for additional pages of possible interest appear

at the bottom of the page you are taken to, if applicable.

- Popup Help screens. This requires that you

have your online Help function enabled via the menu path

\Help\Enable Popup Help. To use Popup help, allow your mouse

to hover a few seconds over any field, and a help box will appear on the

screen with information about that field or screen you are on.

To disable popup help, click the menu path "Help\Disable popup help".

Before you are ready to enter the Client into your system,

there are preliminary key details about your Client's operational

preferences that must be determined and decisioned within the

software prior to data entry of the Client information.

For example:

1. What are the contingency terms?

- Commission rate plan structure

- Legal/collection cost handling

- Remittance type Net/Gross/Combined

- Remittance Schedule Monthly/Weekly/Biweekly/ Daily

- New or different regional taxes to be applied

2. Are there specific Securities or Portfolio staffing mandates?

- Portfolio isolation

- Multiple accounts group within Client only OR across full database

- Collectors for the project are general or project-specific with

security settings

3. Are there custom letter or report requirements?

4. Do they intend to assign accounts on manual listing sheets OR

will they be giving you a text or spreadsheet file for electronic

data import?

5. Do they require electronic reporting, such as payment or

account activity data files in a specific layout from you on

a fixed or ad hoc basis?

6. Do they require a realtime login to your system to review/audit

their own Debtor accounts?

7. Will their accounts be reported to the Credit Bureau(s)?

8. If your Agency uses an Electronic Payment Processing

company for Credit Cards or ACH checks/debits, does the

Client permit or prohibit convenience fee charges?

9. Are there contractual workflow requirements or guarantees for

frequency of:

- Account activity

- Manager review

- Compliance audits

10. Do any of these requirements necessitate the creation of

Client-specific Contact (Action) Plans to ensure that workstandards

with Milestone Triggers reach the key personnel responsible for those

functions?

The answers to these questions determine how the Client is set up

in the system and what areas of the software will require

specific configuration to meet the Client's needs as well as Project

Requirements.

Many default Operator IDs, Letters and Contact Plans

ship with Collect!. Upon review, you may find that these

provide the building blocks you need to get

started, OR, that you have a need to modify

these stock shipping items to suit your specific

operational needs. New items can be created and

changes can be made as needed.

Many default Operator IDs, Letters and Contact Plans

ship with Collect!. Upon review, you may find that these

provide the building blocks you need to get

started, OR, that you have a need to modify

these stock shipping items to suit your specific

operational needs. New items can be created and

changes can be made as needed.

It is your responsibility to ensure that any letters

you send to Debtors or contact plan automations

you enact with the system are compliant to

legislation and regulations in your region with

respect to format, content and actions launched.

SAMPLE letters shipped with Collect! or available

on the Member Center are SAMPLE only and intended

to be rudimentary templates for your own

modification(s).

It is your responsibility to ensure that any letters

you send to Debtors or contact plan automations

you enact with the system are compliant to

legislation and regulations in your region with

respect to format, content and actions launched.

SAMPLE letters shipped with Collect! or available

on the Member Center are SAMPLE only and intended

to be rudimentary templates for your own

modification(s).

How To Enter A New Client

Having gathered all the information that you will need

to completely configure your new Client, you

can proceed with their entry into the system.

- If you have not yet created your own login, sign into

the system with the login ID "OWN" and the Password "own".

The password is case sensitive. This login ships with the

system and is available when you receive the product. It

is configured with Level 10 set of access

rights/permissions.

- Click the menu path \Browse\Clients from the

menu bar at the top of the screen. This will display the list of all

Clients in your database. Press F3 or the NEW button at the

bottom of this list to open an empty Client setup screen.

The Client Number field fills itself as the system

keeps track of what your next available number is. It is important

to make sure you don't allow duplicate Client Numbers. This

will cause data integrity corruption because the database will

have no way to distinguish between the two unrelated Clients

and the data for both of them will be intertwined.

- Fill in the business information that you have for this Client

along the left side of the screen. Navigate through the basic

intake Fields using your TAB or ENTER keys.

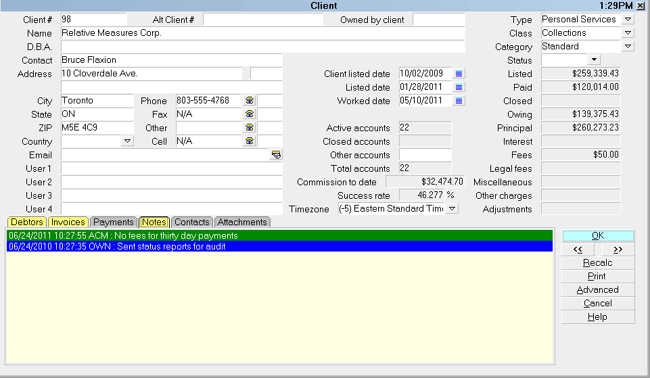

When you are done entering in your basic intake information, your

screen should look like this:

Client Basic Intake Information

The following are descriptions of Fields with special characteristics

or usages in Collect!:

D.B.A.

This acronym stands for "Doing Business As". Some Clients have

a corporate name to whom you are contracted but operate under

a trade or business name that is different. Use this field to

store that information.

If your Client uses this field and it is to be displayed in

Client reports and remittances, you must make sure that the field @cl.dba

is expressed in the requisite documents. Similarly, if your Client

requires that their name be fully expressed with the corporate name

and the D.B.A. trade name, then you must make sure that any letters

you send to their Debtors contain the Printable field Code @cl.dba beside

the field Code which outputs the Client name (@cl.na) for every

instance in letters you generate to their Debtors.

Contact

Use this field to input the name of the individual who is the

primary contact inside the Client company to communicate with

your Agency or receive statements/reports issued to the Client.

Remember to edit your reports to include an "Attention: @cl.co<"

line if you wish your reports to show an individual's name

with the company name/address that mailings are to be

directed to upon delivery.

Remember to edit your reports to include an "Attention: @cl.co<"

line if you wish your reports to show an individual's name

with the company name/address that mailings are to be

directed to upon delivery.

User 1 to User 4

These are free-form Fields which you may use for

any purpose you require. You can relabel these

fields by mousing into the field of interest and

right-clicking. The popup offers you the highlighted

choice "Properties". Enter or click on selection

to enter the Access Rights window for this field.

Relabel the field by entering what you want to display

in the "Alias" field.

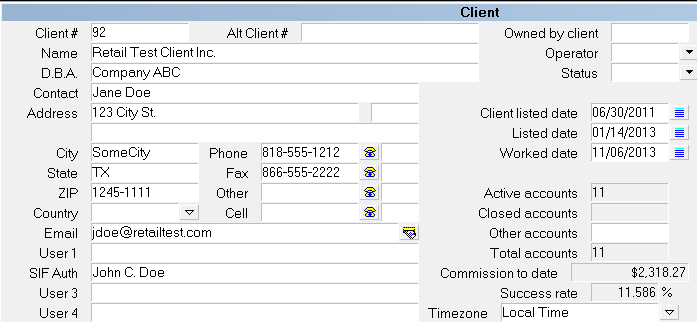

In the following example, the User 2 field was renamed

"SIF Auth" to indicate that a separate individual for

this Client is to be contacted for settlement authorizations.

User 2 Field Aliased as SIF Auth

The User 1 field is a 'special properties' field.

If one of your clients has multiple client numbers and wishes to

have access to your system to view ALL of their accounts, then the

User 1 field will be spoken for by the software for use as the

Group Client code which will need to be input into your system. For the

purposes of this example, this means that you may wish to hold this

field unused as a standard in the event you will be giving your clients

access to your system to view ALL of their accounts with a single login.

For more information on Client Groups and how this relates to the Client

and Operator setup windows, see the Help Page "How to Add a User To Web

Host", specifically "Add a Client Group" for more details. The

User 2 to 4 fields on the Client screen are not tied or committed to

any other system functionality and are open for site specific user

defined entry.

Owned By Client

Use this field when you have a Client which has multiple Client

Numbers in your office and they require any of:

- A single Invoice/Statement and Check for all their Client

Numbers.

- A single report to reflect inventory reporting, performance

metrics or other data that is compiled from information being

derived from multiple client account numbers sources.

Timezone

Collect! ships with embedded control files (scripts) that

read the area code of phone numbers on file for Clients

and Debtors. This logic will constantly make the comparison

between what is the timezone known constant for your location

and the Client (or Debtor) now on the screen. Your calculated

local time for the Client (or Debtor) currently on your screen

is displayed in title bar of the active window, on the extreme

right side. The title bar is the color tinted stripe which says

"Client" (or "Debtor").

Type

If you will be sending this Client's Debtors to any of the Credit

Bureaus, (Equifax, Trans Union or Experian), it is required that you

set the "Type" field in the upper right corner of the screen by

selecting one of the choices in the pick list.

These choices should NOT be modified as they represent

all the VALID Creditor Classification types that are defined by,

and recognized by the Credit Bureaus for reporting in a standard

Metro2 file format.

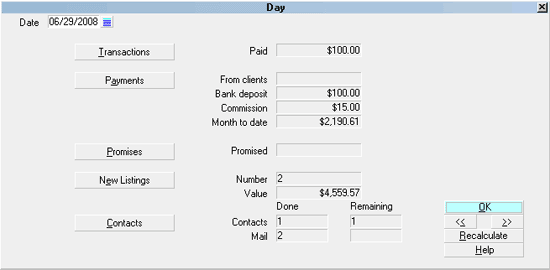

General Figure and Financial Fields Visible

As you complete the basic intake information on the left hand side

of the main Client screen, you will note that the Financial Fields

on the right hand side of the screen appear greyed out/Read Only.

They are blank this way when you do not have any Debtors entered.

It is recommended to run the batch process Recalculate

Client Totals daily to keep your figures up-to-date on-screen.

It is also possible to recalculate an individual Client ad hoc

by clicking the Recalc button in the lower

right corner.

It is recommended to run the batch process Recalculate

Client Totals daily to keep your figures up-to-date on-screen.

It is also possible to recalculate an individual Client ad hoc

by clicking the Recalc button in the lower

right corner.

Additional Setup Screens And Button Functions

In the lower right corner of the main Client Screen, you will

see a bank of buttons. Their purpose and general operation is

described as follows:

OK

Click here when you have completed entering all your Client

information to save any new or updated information you have

entered.

<< AND >>

The double arrow buttons will quick key you to the next Client

forwards and backwards in your Client list.

Recalc

Click this button to initiate an individual Client figure

recalculation of all financial Fields on the Client screen.

It is recommended that you update your Client figures

regularly but in particular, before running reports or

letters which will draw upon the data in the Client

stored figure buckets. This may be done as a batch

process through the menu path

\ Daily Administration\ Daily Batch Processing\Calculate

All Totals\Recalculate Client Totals. Examples of

processes that affect financials that require process Recalc

are new business entry, mass closeouts, writeback reports used

to adjust commissions.

It is recommended that you update your Client figures

regularly but in particular, before running reports or

letters which will draw upon the data in the Client

stored figure buckets. This may be done as a batch

process through the menu path

\ Daily Administration\ Daily Batch Processing\Calculate

All Totals\Recalculate Client Totals. Examples of

processes that affect financials that require process Recalc

are new business entry, mass closeouts, writeback reports used

to adjust commissions.

If you prefer keyboard navigation to mouse point/click, then

observe which letter is underlined when entering menus or needing to

make a button choice. The letter in the item title that is underlined

is a quick key to enter the menu or screen. Quick key options are not

case sensitive. Example - to fast path into the Daily Administration

menu from the Main Menu, keyboard "D" or "d".

If you prefer keyboard navigation to mouse point/click, then

observe which letter is underlined when entering menus or needing to

make a button choice. The letter in the item title that is underlined

is a quick key to enter the menu or screen. Quick key options are not

case sensitive. Example - to fast path into the Daily Administration

menu from the Main Menu, keyboard "D" or "d".

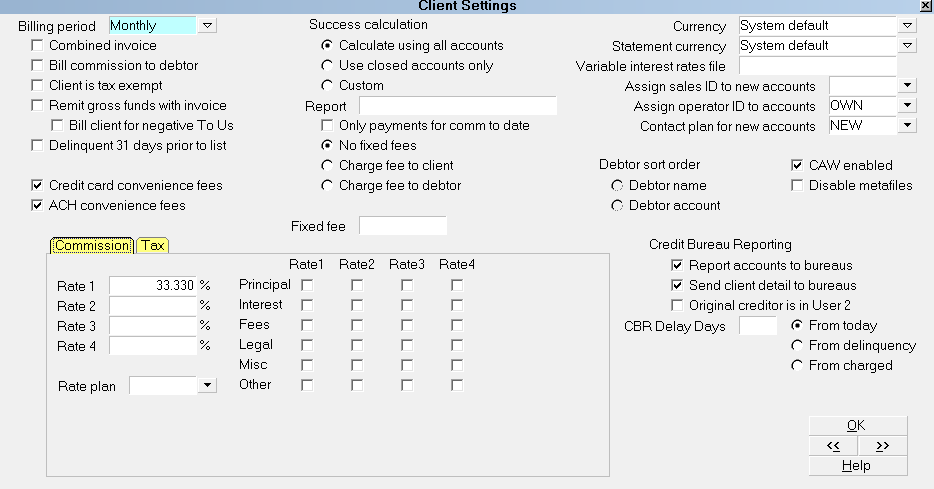

Advanced Client Settings

The Client Settings screen contains the many software switches

and preference settings that will determine how Collect! manages

this Client's data. Having these preferences auto-managed

streamlines your operations, optimizing both time efficiency

and quality control.

The Advanced screen must be completed before you begin

entering new Debtors.

The Advanced screen must be completed before you begin

entering new Debtors.

Setting entries or updates made to Clients do not retroactively

update the Debtors already in the system. Instead of trying to

find a mass process or create a custom writeback report

after-the-fact, better to make sure you have thoroughly entered

all the requisite information for this Client from the outset.

The Advanced Settings Screen looks as follows:

Advanced Client Settings

Before proceeding, it is necessary to have the following areas

preset as pertains to the Client you are about to enter so

that the information is readily available to the system and usable

in this setup where applicable. All of these should be accomplished

prior to entry of any Debtors for this Client.

Many default Operator IDs, Letters and Contact Plans

ship with Collect!. These are SAMPLE only. Some may be usable

for your purposes as is OR you can use the samples to assist in

creating your own customized items.

Many default Operator IDs, Letters and Contact Plans

ship with Collect!. These are SAMPLE only. Some may be usable

for your purposes as is OR you can use the samples to assist in

creating your own customized items.

It is your responsibility to ensure that any letters

you send to Debtors or contact plan automations

you enact with the system are compliant to

legislation and regulations in your region with

respect to format, content and actions launched.

SAMPLE letters shipped with Collect! or available

on the Member Center are SAMPLE only and intended

to be rudimentary templates for your own

modification(s).

It is your responsibility to ensure that any letters

you send to Debtors or contact plan automations

you enact with the system are compliant to

legislation and regulations in your region with

respect to format, content and actions launched.

SAMPLE letters shipped with Collect! or available

on the Member Center are SAMPLE only and intended

to be rudimentary templates for your own

modification(s).

Getting Started

If you are not already situated on a Client Advanced Settings

screen, click the menu path of \Browse\Clients, select an

existing demo Client or create a New Client. Click the

Advanced button in the lower right corner of the main Client screen.

Be sure to have all your Client requirements available as covered

in the Overview section of this topic. Specifically,

- Details of your contingency terms for commission

- Requirements for charges, fees, and taxes

- Remittance Type and Frequency

- Credit bureau reporting requirements

The Client-specific defaults you select in the Client Settings

screen are automatically applied as applicable for every Debtor

entered under that Client and all processes which access this

Client's data for output of key information.

Billing, Reporting And Fees

You will notice that the left-most and middle columns of the

Client Settings window pertain to details of your contractual

agreement with your Client.

Remittance Options

Billing Period

This identifies which Remittance frequency on which your Client

wishes to receive their Invoice/Statement and Checks.It is NOT

recommended to leave this field blank. Even if your

current Client base is the same cycle, there may be a future point

in time where you have Clients with different remittance cycles and

have need for reporting purposes to have this field populated in all

your Clients.

The default Remit Type in the system is Net. There is no tangible

switch to set this preference. It is presumed in the absence of

either Combined or Gross being selected.

Choose to remit Net if your Client has not stipulated otherwise.

This means you deduct your commission right away on the

current Invoice/Statement instead of billing your client

for your fees and having to wait to be paid by them.

Choose to remit Net if your Client has not stipulated otherwise.

This means you deduct your commission right away on the

current Invoice/Statement instead of billing your client

for your fees and having to wait to be paid by them.

The calculation of the Net Remit is:

Check Sent to Client = Total Paid Agency - (Commissions + Fees due Agency

+ Taxes + Balances Past Due)

Net remittances use documents called "Statement" and "Check" in your

Print menu to create their output when invoked.

WARNING: Switching from one type of remittance to the other can

produce undesirable results if you have already

generated invoices for this Client using the type you are

switching from. If your Client is current now, with no

outstanding amounts owing, and is always current, this

is not a problem. However, if your Client has amounts

outstanding, please see below for guidelines on making the

change from one type of remittance to the other.

WARNING: Switching from one type of remittance to the other can

produce undesirable results if you have already

generated invoices for this Client using the type you are

switching from. If your Client is current now, with no

outstanding amounts owing, and is always current, this

is not a problem. However, if your Client has amounts

outstanding, please see below for guidelines on making the

change from one type of remittance to the other.

Combined Invoice

Check this box if your Client requires the type of remittance

which treats Paid Agency funds as "Net" while treating

the Paid Client directs as "Gross". This means all Paid

Agency transactions are handled first with the Total Paid Agency

amount calculated. From that amount, any commissions/fees/charges/taxes

due the Agency will be subtracted and a check will be written for the

Net difference. The Client will be invoiced for any

commissions/fees/charges/taxes due to the Agency as a result of any

Paid Client directs reported in the same billing period.

If you use this setting, you must have a CStatement and

a CCheck report in your Print menu to use when generating

statements for this Client.

Bill Commission to Debtor

This switch is used if you add your commission to all

Debtors' balances as a Collection Charge for this Client.

You are responsible for using this switch ONLY if it is

permissible by law to apply Collection Charges in

your region.

You are responsible for using this switch ONLY if it is

permissible by law to apply Collection Charges in

your region.

Client is Tax Exempt

With this switch enabled, Collect! will not calculate tax on

any commission amounts from monies collected for this Client.

This can be overridden at the Debtor or Transaction level.

Remit Gross Funds with Invoice

All funds paid to the Agency are returned to the Client at the end

of the billing period and they are billed for any commission/fees/charges/

taxes due to the Agency as calculated on collections both 'To Agency' and

'To Client' direct. The system will create a check for the gross

collections recovered to be remitted to the Client.

If you use this setting, you must have a GStatement and a

GCheck report in your Print Menu.

This switch becomes nullified if you have checked the 'Combined Invoice'

field above.

There are times when you will have a Client who is going

to want to change their billing type. Since the

differences between the types radically depart from each

other in terms of how accounting calculations are computed,

it is recommended that you request your Client have a zero

balance forward before cutting them over to a different

billing type. If this is not possible to do, be aware that

you will need to make manual adjustments the first time the

statements are generated under the new billing type.

There are times when you will have a Client who is going

to want to change their billing type. Since the

differences between the types radically depart from each

other in terms of how accounting calculations are computed,

it is recommended that you request your Client have a zero

balance forward before cutting them over to a different

billing type. If this is not possible to do, be aware that

you will need to make manual adjustments the first time the

statements are generated under the new billing type.

Bill Client for Negative To Us

Switch this ON for a Gross Client when you need your statements

to reflect amounts owed to you for transactions posted with a

NEGATIVE To Us amount, i.e. NSF. By default, Collect! does not

bill a Gross Client for a NEGATIVE amount.

Switching A Client To A Different Remittance Type

If you need to change your method of remitting funds to your

Client because they have requested or mandated the change,

there are some preliminary considerations to be made before

proceeding.

The cleanest way to accomplish such a modification is when

you are making a change for a Client who does NOT

owe you any money. If there is an existing 30/60/90+

past due amounts for this Client, there will be need to

modify figures at the invoice level so that the new cycle

will produce figures as expected once switched.

If your Client is adamant about the change and they owe you

for any past invoices, request that they bring their account

current/up-to-date in order for you to accommodate their request.

If they elect to not do so and require that you accommodate

their change request ahead of their account being brought

current, then you will be needed to migrate data in the last

invoice issued in your Invoices tab before you run your next

set of statements.

Artificially massaging figures into different Fields to

accommodate a new/different remittance type for any Client

is mechanically simple but rather detail complex. What

happens as a result of these manipulations will have impact

on future remittances. We strongly recommend that you contact

Tech Support for assistance. If you elect to attempt the

changes on your own, we recommend taking a Snapshot of your

database BEFORE any changes are made so that you have

rollback capability.

Reconstructing Client figures is a considered a

billable technical service. It is recommended

to consult Technical Services prior to attempting

these manipulations to Invoice line items on your

own or to contract Technical Services to do the

manipulations for you.

Reconstructing Client figures is a considered a

billable technical service. It is recommended

to consult Technical Services prior to attempting

these manipulations to Invoice line items on your

own or to contract Technical Services to do the

manipulations for you.

Report To Credit Bureaus

Report Accounts to Bureaus

This switch functions as an indicator that for this

Client ONLY, you are permitted to report Debtors to Credit Bureaus

as having an open Collection Item with your office.

It does NOT function as the trigger to activate

accounts for credit reporting when new accounts

are entered for this Client.

It does NOT function as the trigger to activate

accounts for credit reporting when new accounts

are entered for this Client.

There are two ways to activate an account for credit reporting:

- Manually enter the CBR tab on a Debtor screen and check

the "Report to Credit Bureau" box, OR

- Via the batch process, "Prepare accounts for reporting

to credit bureaus"

At all times, Cosigners that you wish to report

MUST be manually activated in both the CBR tab AND in the

Cosigner window. The batch process activates ONLY the

primary Debtor on the account.

At all times, Cosigners that you wish to report

MUST be manually activated in both the CBR tab AND in the

Cosigner window. The batch process activates ONLY the

primary Debtor on the account.

For more information on setting up credit reporting, refer

to Credit Bureau topics.

Send Client Detail to Bureaus

You must switch ON "Send Client detail to bureaus"

if you are reporting as a Collection Agency.

This is for legislative compliance to include the identity

of the original creditor with each Debtor that your Agency

reports to the Credit Bureau. In the Metro2 credit reporting

record layout, this is known as the F1 segment.

If you are the original Creditor and are reporting as first

party, you would leave this switch unchecked in the OFF

position. You would additionally need to ensure you have

checked the " Report as credit grantor" in the menu path

"Tools\Credit Reporting\ Credit Bureau Setup".

Original Creditor is in User 2

If your company is a Debt Purchaser AND you do not have the

original Creditor name entered in the Client Name

field in Collect!, check this switch ON to meet your F1 segment

compliance requirement. When you manually data enter OR

electronically import new Debtors, this switch relies on the

original creditor name being stored in the User 2 field on the

main Debtor screen.

Delinquent 31 Days Prior to List

The Credit Bureaus require a delinquency date for all Debtors

you will report and they will reject any record which comes

in with that field blank.

If your Client is not providing a Delinquency or Last Charged

date with the assignments, you may check this switch into the

ON position to write a date that is 31 days prior to listing

as the Credit Bureau required field when new accounts are being

reported.

If this switch is left unchecked in the OFF position, you must

include EITHER a delinquency OR last charge date when you

input new accounts. If you electronically import new Debtors

for this Client, make sure you MAP or SET at least one of the

two required Date Fields.

For legislative compliance, do NOT use the listing

date as the Delinquency or last Charge date

when you enter new Debtors.

For legislative compliance, do NOT use the listing

date as the Delinquency or last Charge date

when you enter new Debtors.

Success Rate

On the main Client setup screen, you will notice that there is

a greyed out/read-only field labeled "Success Rate" that contains

a percentage figure. This is a system-generated liquidation

rate and you have control of the equation that calculates this figure.

There are software switches in the Advanced screen which offer

you three ways to calculate this field. The chosen calculation and

results displayed do not impact liquidation percentages calculated

elsewhere in reports. It is an internal measure for your company to

gauge performance that is meaningful to your Profitability Analysis

on a per Client basis.

The three options from which you can select your calculation

preferences are:

1. Calculate Using All Accounts: This calculation uses

data from all files assigned.

Equation: Gross Paid X 100 / ((All Listed + All Fees) - Adjustments)

- "All Listed" includes figures from closed accounts

- "All fees" includes Debtor and Client fees

- "Adjustments" includes all transaction series types 300's,

400's and 500's, if you are using the stock Transaction

Types that ship with Collect!

2. Use Closed Accounts Only: This calculation

uses data from MODE CLOSED accounts ONLY. An example of where

this calculation might be meaningful is if this Client is a

Pre-collect/Cure type portfolio where it isn't until an account

is closed that it is considered liquidated, this would be the

internal metric to use.

Equation: (All Paid (closed accounts) / All Listed (closed accounts)) X 100

3. Custom Success Rate: If you need your own custom

calculation for liquidation rate, click the radio button beside

"Custom" and enter the "Report" name you have created and stored

in your Print menu that performs the calculation / writeback to the

Success Rate field for this Client.

You may also use a control file on the Client screen

to change the liquidation rate to your custom

calculation. This would enable the field to

dynamically refresh every time the Client was

accessed.

You may also use a control file on the Client screen

to change the liquidation rate to your custom

calculation. This would enable the field to

dynamically refresh every time the Client was

accessed.

If you are not familiar with creating reports and/or

control files, you may wish to contract us to

provide you with products to meet your needs

at the very reasonable rates for custom Technical

projects.

If you are not familiar with creating reports and/or

control files, you may wish to contract us to

provide you with products to meet your needs

at the very reasonable rates for custom Technical

projects.

Fixed Fees

These switches govern whether there are any special fee

handling requirements for this Client.

Use this switch if you have contractual agreement with

your Client to impose a charge on them for each account

assigned OR if you are charging the Debtors for a specific

fee.

You are responsible for ensuring that any fees

you charge a Debtor are permitted by law

in your region.

You are responsible for ensuring that any fees

you charge a Debtor are permitted by law

in your region.

No Fixed Fees

This is the default setting that should be selected if there are

no special fee handling requirements for this Client.

Charge Fee to Client

When you enter a new Debtor, the system will automatically

post a Transaction Type 397 for the amount determined here

that will appear on statements as a 'due Agency' charge billed

to your Client.

You will not see this fee in the Debtor balance breakdown.

You can see this charge if you click the Principal field on the

main Debtor screen and enter the " Financial Details\Fee" Tab.

Charge Fee to Debtor

When you enter a new Debtor, the system will automatically

post a Transaction Type 398 for the amount determined here

that will appear in the Debtor balance breakdown. You will

see it in the "Fee" field on the main Debtor screen. This

amount does become included in the Debtor's balance owing.

Commission And Tax

Commission and tax tabs in the lower portion of the

Client Settings screen are used in calculating the contingency

amounts due you when your run statements for this

Client.

Commission

If your contingency agreement with your Client has hierarchical

conditions for what rates are to be applied on what segment

of a balance is being paid (i.e. Principal versus Interest

verses Fees etc.), you may enter custom Client rate plans

with up to four levels of rates on a per Client basis in this tab.

These settings are embedded into each new Debtor you enter

into the system for the Client. If there are reasons to do

so, the default settings you affix to this Client can be

overridden at the Debtor or Transaction level on a per posting basis.

Rate

Decision which of the three possible methods for attaching

your contingency terms with your Client is the most applicable:

1. Individual, custom rate structure

To assign a flat commission rate for all accounts, enter

the commission percentage amount into the field under the label

Rate. You do not have to enter anything below

this amount if you have only one rate that will be charged.

To differentiate between where the money is being applied with

respect to the Debtors owing breakdown (i.e. principal, interest,

fees etc.), enter the applicable rate and check the box for the

financial type that rate is to apply against. For example:

- Rate: 25% on Rate 1: Principal

- Rate: 100% on Rate 2: Interest

- Rate: 0% on Rate 3: Fees

2. Company-wide flat commission rate

If your company charges all Clients the same flat rate, you can

fast path your Client and new Debtor entry by including this

flat contingency rate in your Company Details. If entered there,

you will see the Rate field populate automatically for every Client

and Debtor entered into the system, reducing the number of keystrokes

required to set them up.

3. Rate Plan

If you wish to define your commission structures in rate plans

that allow considerable fine tuning for contingencies on the

basis of assigned balance, remaining balance, age of account,

paid to date etc., you can set up such terms in the menu

path "System\ Financial Settings\ Commission Rate Plan" then

select the code for that plan using the pick list on this field.

It is recommended to use a Rate Plan as defined by

setup outside of the Client screen when there

are more than two rates to be applied.

It is recommended to use a Rate Plan as defined by

setup outside of the Client screen when there

are more than two rates to be applied.

If you are using method #1 or #3 above, it is important

to NOT input both a rate plan and a manual commission

structure in the Fee tab on the same Client. Leave

the Rate plan field blank if you are not using a plan.

If you are using method #1 or #3 above, it is important

to NOT input both a rate plan and a manual commission

structure in the Fee tab on the same Client. Leave

the Rate plan field blank if you are not using a plan.

Tax

The rules for setting up tax percentages follow the same

logic as discussed above for Commission. You have three

methods for how you want to affix a tax schedule:

- company-wide in Company Details

- on each Client separately

- at the Debtor payment level on a per transaction basis

In some regions, taxes may not be applicable and should be

left blank. In other regions, you may have different

tax percentage rates based on where the Debtor lives.

It is each Agency's responsibility to ensure that

they are compliantly charging and remitting taxes

to governing bodies in their region as per the laws

of their areas in which they do business.

It is each Agency's responsibility to ensure that

they are compliantly charging and remitting taxes

to governing bodies in their region as per the laws

of their areas in which they do business.

Currency And Statement Currency

These Fields are only visible if you selected to turn ON

the "Multi- Currency" switch in the "System\Preferences\Company

Details"screen. If that switch is turned OFF, neither of these two

fields are visible in the Advanced Client setup screen.

At present, both serve informational display purposes only.

The default is "System Default" for both.

What the Multi-Currency switch in Company Details does presently

do if you have it turned ON, is it will auto-print North

American "$" signs before monetary Fields printed in reports

and letters. The dollar sign must be manually embedded if the

"Multi-Currency" switch in Company Details is turned OFF.

Sales ID

If your Company tracks revenue by Inside Sales Rep, this

field is where you will enter the salesperson's Operator

ID for tracking purposes. House Clients can be identified

by using the owner's ID or HSE as the salesperson.

This field may remain blank (or be used for alternate tracking

meaningful to your company) if you do not utilize inhouse sales

staff.

Operator ID

If all new accounts are initially assigned to any of the

following you may wish to enter that ID here to save steps

when new accounts are entered:

If there is an Operator ID on the Client, all new listings

will be assigned to that Operator when you enter them

manually or via import.

Operator ID settings embedded by the Client

when new accounts are listed may be

overridden by BOTH selection of a

different ID at time of manual or import

entry.

Operator ID settings embedded by the Client

when new accounts are listed may be

overridden by BOTH selection of a

different ID at time of manual or import

entry.

It is not mandatory to input anything into this field if you

utilize Account Toss batch processing to distribute your

new accounts to multiple collectors.

Contact Plan For New Accounts

It is not mandatory that a Contact Plan be run on new assignments.

However, if you wish to batch process a series of perfunctory

initialization steps, it is helpful to create a NEW Contact Plan

that does the minimum number of housekeeping steps. Example:

- Set Mode to Active

- Set Status to NEW

- Queues up your first dunning letter

- Inserts a Review or Phone contact so that the account will appear

in a collector's WIP list.

If you enter accounts either manually or by electronic

import and do not insert a Review/Phone contact on the

account, then you are creating Orphaned

Accounts which are on desks but NEVER appear in

anybody's WIP list. ALL accounts expected to appear

in a WIP list MUST have an In Progress contact event in

one of the default types being Review, Phone, Promise or

Other.

If you enter accounts either manually or by electronic

import and do not insert a Review/Phone contact on the

account, then you are creating Orphaned

Accounts which are on desks but NEVER appear in

anybody's WIP list. ALL accounts expected to appear

in a WIP list MUST have an In Progress contact event in

one of the default types being Review, Phone, Promise or

Other.

It is your responsibility to ensure that any letters

you send to Debtors or Contact Plans

you enact with the system are compliant to

legislation and regulations in your region with

respect to format, content and actions launched.

SAMPLE letters shipped with Collect! or available

on the Member Center are SAMPLE only and intended

to be modified by each site before usage.

It is your responsibility to ensure that any letters

you send to Debtors or Contact Plans

you enact with the system are compliant to

legislation and regulations in your region with

respect to format, content and actions launched.

SAMPLE letters shipped with Collect! or available

on the Member Center are SAMPLE only and intended

to be modified by each site before usage.

Debtor Sort Order

This switch determines how accounts with payments will be presesnted

on Client Statements. Some Creditors have a preference which they

require their agencies adhere to. If your Client wants alphabetic

sorting on their statements, click the radio button beside "Debtor Name".

If your Client wants their statements to be numerically sorted by

their own account number, click the radio button beside "Debtor

Account".

Client Tabs - Description, Purpose And Use

All multi-part screens in Collect! with a Tab section will

evidence a visual signal indicating whether there is,

or is not, any data contained inside that tab. A Grey tab

contains no data. A Yellow tab means there is data inside.

A convenient way to train staff to watch for this is to

suggest if the Tab 'light' is ON, then something is in

there that can be viewed.

Debtors Tab

The left-most tab is labeled 'Debtors'. This is where you can

most directly access all Open,

Closed and Archived Debtors

for any given Client: . There are four key

ways that this tab is time-saving for staff

in areas of Clerical/Accounting, Administration, Client

Services, Sales and Operational/Project Management:

- It is possible to manually data enter new business for the Client

from the Debtor Tab. The Fields pertaining to Client Name and

Client Number in your system will be auto-filled, saving your entry

operator the redundant time of repeatedly entering the Client detail

with each piece of new business.

- It is the fastest way to create ad hoc batch letters for Debtors

belonging ONLY to a certain Client or run reports that will query the

Debtor File to gather data for a specific Client.

- It is the fastest way to run Contact Plans and Batch Processes

(such as Collector desk reshuffles, etc) that pertain only to Debtors

under a specific Client number.

- It is also the most convenient way for your Sales/Client Services

team to access Debtor accounts when Clients call in to request or provide

info about one of their accounts.

Invoices Tab

This tab contains the invoice/statement history of the Client.

The invoice/statement screens display all the line items from

each remittance as well as the 30/60/90 Accounts Receivable

balance forward(s) which the Client may have with your office.

From this tab, you are able to reprint a specific statement

for a Client, if needed.

You can adjust your List View options to add the 30/60/90

Fields so that from a Browse List of Invoice/Statements, you

are able to see at a glance if your Client owes you any

money and the age of that Receivable. To do this, click into

the tab so that you have a scrollable list showing you have

entered the sub-menu Invoices tab. Then Right click

in the list column header line to obtain the popup that

prompts you to do any of Edit/Move/Insert/Remove/Restore

Default.

The option to enable invoice #s to appear on your remittances

on a per Client basis is controlled from the invoice screens

contained in this tab. This latter is a 3-step process

discussed in detail under "How to create invoice numbers

for statements" in " Month End" topics.

If you are setting up a new Client and enter the Invoice tab

before any Statements have ever been generated, you will be

prompted to as to whether you want to create a new Invoice

if none exists. Click "NO". The only

place you can create/generate a Statement for a Client is

from the Month End menu, " Generate Statements" option.

Payments Tab

This is your historical listing of all Client payments, Client

reversals/charges and where you can post new Client transactions.

How To Post Client Payments / Receivables

The Month End process creates your Remittance Invoice/Statements

and Checks for your Clients. Irrespective of billing types

Net/Gross/Combined, there will be Invoices where your Client owes

your company for services/ costs/taxes. The Month End Invoice

will contain a dialog line "Please remit your check to Agency

for...." and state the amount which you are owed.

When your Client sends you the check for the Balance Due

for that remittance period, you will have a Client Payment

that needs to be applied in the system to offset their Account

Receivable on your books.

How to enter that Payment is as follows:

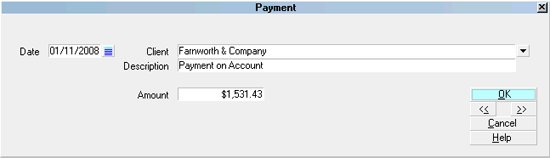

Payment Screen

Select the Payments tab in the lower portion of the Client

screen. This will display the Payment window. If you have

never entered a payment for this Client before, it will tell

tell you there are no payments and ask if you want to create

a new one. The screen stores the historical transaction

history of all payments the Client has sent you. If there

are payments for this Client already in the system, you will

get a display which looks like the transaction history on a

Debtor file which has financial history.

When you open a New Client Payment transaction window,

you are presented with a very simple input screen.

Client Payment Screen

Date

Enter the date you received the remittance from your Client

or the date you are applying a charge to your Client.

Client Name

If you are on a Client screen, this will auto-fill with the

Client Name on record. If you are in a Browse list of Client

payments, the Name field will be blank but offer you a dropdown

arrow to select the target Client from the pick list of Clients.

Description

This is where you enter a meaningful memo line to identify the

association of what the money was remitted for. Example:

"Payment for Sept 2013 Invoice".

Since this same screen would be used to charge-back to a Client

for an amount that is not associated with a specific Debtor,

your Description line could also be for a scenario such as

"Charge-back for Jan Invoice check accidentally stale-dated

Jan 2013"

Amount

Enter the amount of the remittance payment or charge to the Client.

Ensure you are correctly signing your amounts:

- Positive amount reflects a payment

received and reduces the Client's account receivable with your company.

- Negative amount reflects a reversal

and adds to the Client's account receivable with your company.

OK

Click OK to confirm acceptance and finalize the transaction in the

Client's Payment History.

Accessing Client Payments

You can navigate to Client Payments by four separate methods,

provided your Operator ID Access Rights permits you into

all of the areas. User level access rights is the reason

why we have multiple paths to the same information pool:

not all users who require access have the same menu

permissions or displays.

The following are the paths to access Client Payments:

- From the menu bar at the top of screen, click

Browse and you will be presented with a drop-down

menu. Select Payments.

This will provide a listing of all Client payment

transactions. In this list, it is possible to View,

Delete, Edit and enter New Client transactions.

- From the menu bar at the top of the screen, click

Browse to and you will be presented with a drop-down

menu. Select Daysheets.

Select a date of interest from the Daysheet calendar

and open the display.

Daysheet, Individual Calendar Day

The Payments button below the Transaction button contains

all Client transactions received and posted from ALL Clients

that day.

- From the Main Menu, click Daily Administration to

display the Daily Administration menu. Click Payments

and Charges, then in the next menu popup, select

Client Payments and Charges. This navigates to the same

Browse Client transaction list as in #1 above.

- If you need to view/edit/delete or enter a new Client

transaction for a single Client only, you can lookup the

target Client from your Browse Clients list, select it and

enter into the Payments tab on that single Client's screen.

Notes Tab

This tab is a free-form note area where you can copy/ paste email

correspondence to/from the Client as well as keep a comprehensive

log of any information pertaining to individual Clients. Your

Sales Personnel and Client Services Reps can store their contact

notes from Client conversations in this tab.

Contacts Tab

If you have the Client Management option enabled with

your Collect! software license, you will see a "Contacts" tab.

This functions like the Contact tab on the Debtor screen, and

pertains to Client issues. In this tab you can schedule Client

mailings/emailings, reviews to CSRs who have follow-up calls

they want to make etc. Review and Phone events would create

a working WIP list and appear for the Operator for whom the

the contact event was assigned to. In this way, your staff in

any of Admin/Accounting/Client Services/Sales can use Collect!

to schedule Client specific tasks within the software without

having to rely on external calendars to prompt them.

This tab functions for Clients like the Contact tab does on Debtor

accounts. If your sales or CSR staff want to create a WIP list

for themselves regarding Clients, they can enter Review or Phone

Contacts on the Clients for whom they have reason to follow up.

This type of queuing can also be used for Client balance due

follow-up calls.

Letter/Report contacts can also be scheduled in this tab.

Example, if a Client requires a Client Status Report

every month, you can set up a repeating contact to automatically

queue up this report every month and have it created through

Batch Processing, Schedule Batch Letters for Clients whenever

you are ready to print them after each month end.

Attachments Tab

Like Contacts, this tab appears if you have the Client

Management option enabled in your software license.

This tab functions the same as it does on Debtor accounts.

You may use the free-form entry Fields in whatever manner you

choose and the tab provides a place to affix Client

correspondence or documents received that need to be

accessible on the Client's file history with your company.

You can customize the contents of this tab to suit your

needs. Unlimited Attachment entries categorized by user

defined Class, with or without the sub-category Type can

be created.

If you wish to make a global change to an Attachment field

label, meaning a designated field will be renamed for all

Attachment entries, then mouse into the field of interest

and Right click. You will get a popup asking you to select

what you want to do. Click on "Properties" to gain entry.

A more advanced utilization of this feature is for the field

name labels to be contingent on a specific Class, meaning the

same field can be used for different purposes depending on a

logic condition such as Class is "Contract" or Class is

"Correspondence". This is accomplished by creating a

script/ control file which defines what field Alias names are

displayed as a function of what Class of Attachment is selected.

Depending on what you need, you may find a script/control file

that is very close to your need on the Member Center which you

can download and install. Alternatively, if you would like

Tech Support to create a custom script/control file for you,

contact us for pricing.

Keep your Alias label names short enough to fit in

the physical screen space allotted for that field to avoid

cut off portions of word(s) and congested visuals presented

to your staff. Cluttered screens are hard on the eyes and make

it difficult to locate the information at-a-glance.

Keep your Alias label names short enough to fit in

the physical screen space allotted for that field to avoid

cut off portions of word(s) and congested visuals presented

to your staff. Cluttered screens are hard on the eyes and make

it difficult to locate the information at-a-glance.

To make additions and customizations to the Class and/or Type

pick-lists, refer to " How To Use Pick Lists" for more detailed

instructions.

If you put a url in the File field, the system will

call your web browser and take you directly to

the website when you click on the 'File Folder'

icon (that you'd normally use to Open an attached

file) at the end of the File Name line.

If you put a url in the File field, the system will

call your web browser and take you directly to

the website when you click on the 'File Folder'

icon (that you'd normally use to Open an attached

file) at the end of the File Name line.

See Also

- Client Topics

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org