How To Post A Transaction

This document steps through the process of posting a Transaction in Collect!.

Requirements

- Setup Transaction Types

- Setup Client, Debtor, Company Details, Operators, Contact Plans

- Setup Commission Rate, Tax Rate, Reports and Letters

- Review help on Payment, Interest, Fee, Adjustment, Principal

- Review tutorials for an overview of Collect!

Overview

A Transaction is any financial interaction that you need to enter in your accounts regarding

payments and charges related to a Debtor. The amounts entered are used for many calculations

including, Debtor Balance Owing, Month End totals for Invoices and Operator Commissions.

There are many types of transactions that you handle in the course of your business operations,

including many types of payments, legal fees, interest charges, adjustments. Each of these must be

entered into the system as information attached to a particular Debtor.

Positive Or Negative Amount?

When posting a Transaction, a POSITIVE amount DECREASES the Debtor's Owing while a NEGATIVE amount

INCREASES the Debtor's Owing.

After posting a Transaction, check the figures displaying in the Debtor form. Are they the opposite

of what you expected? Try changing the sign of the amount you entered!

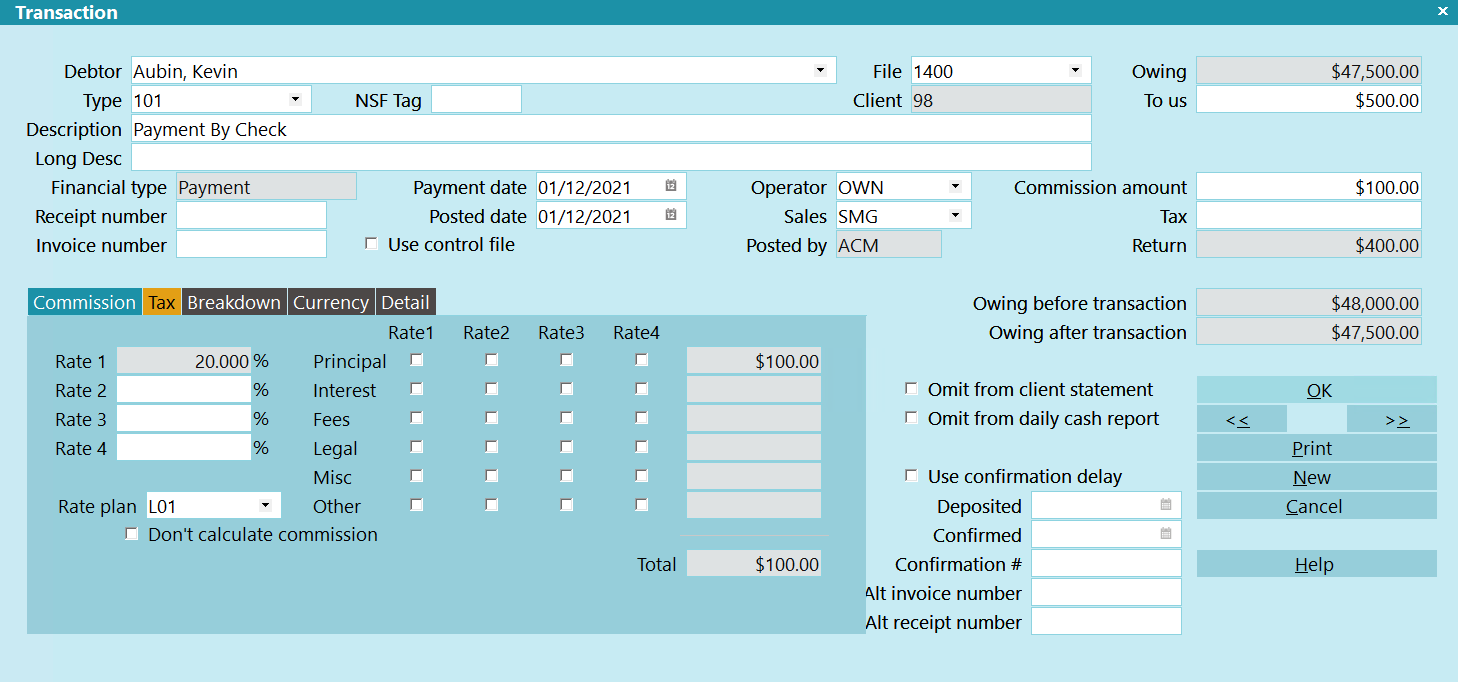

Transaction Form

Click Here to View this Form.

Click Here to Close this Form.

The Transaction form displays many fields where you can

enter the details of a payment or charge posted to a

debtor's account. The information you enter in the

Transaction form is used for many calculations, including,

Debtor Balance Owing, Month End totals for Invoices, Fees

and Operator Commissions.

Transaction

Debtor

This is the Debtor account the transaction pertains to. Press

F2 to pick from the list of Debtors.

If you accessed the Transaction form through

the Transactions tab on the Debtor form, the

Debtor will already be displayed in the Debtor

field and certain financial information will be

filled in already from the Debtor form.

If you accessed the Transaction form through

the Transactions tab on the Debtor form, the

Debtor will already be displayed in the Debtor

field and certain financial information will be

filled in already from the Debtor form.

Type

Select the down arrow or press F2 to view the list of all

Transaction Types in the system. Select the type for

this transaction and its Code will be displayed in the

Type field. You may also notice that several fields on

the Transaction form fill immediately with values taken

from the Transaction Type settings.

The Type enables you to easily identify what kind of

transaction this is. It is often used in reports to classify

or group transactions for calculations or summaries.

Examples of types of transactions:

- Payment

- Charge for items such as NSF charges or NSF check returns

- Legal fees or interest charges

- Commissions

Transaction types are used to organize your

transactions for reporting and accounting purposes.

When you select a Type to categorize the transaction

you are about to post, Collect! applies the settings for

this Transaction Type. Certain fields on the Transaction

form are only visible for a particular Transaction Type.

Also, certain calculations are only performed when a

particular Transaction Type is selected.

Transaction types also fall into groups such as Principal,

Interest, Legal Fees, Adjustments and Other Expenses.

All these details are used by Collect! when printing

Trust Summary Reports. Separate lists and totals are

displayed for various transaction types and groups of

transaction types.

There are several built-in Transaction Types provided

in the Demonstration database. You can copy any of

these to the Masterdb database and you can also create

your own transaction types.

NSF Tag

This field is for posting payment reversals. Normally,

this field can be left blank, but if you have multiple

reversals for the same Payment Date and the same amount,

then you will need to enter a number in this field and

the original payment's NSF Tag field that matches.

Example:

Payment 1 posted on January 1 for $100

Payment 2 posted on January 1 for $100

Payment 1 was reversed on January 3

Payment 2 was reversed on January 5

Payments 1's NSF Tag field should have the number 1 for

both the January 1 and January 3 transactions.

Payments 2's NSF Tag field should have the number 2 for

both the January 1 and January 5 transactions.

File

This is the File Number of the debtor the transaction

pertains to. Press F2 or click on the drop-down arrow

while this field is highlighted to select a debtor.

Client

This is the Client Number of the Client who assigned the

chosen debtor to your company. It is taken from the

Debtor form.

Description

This field stores a brief explanation of this type of

transaction. The Description will be copied automatically

from the Transaction Type settings if you switch ON 'Copy

Description to Transaction' in the Transaction Type form.

You may also add details about this particular Transaction,

such as NSF check number, expense reference number or

other information.

Long Desc

This is a user-defined field that can store up to 999 characters.

Financial Type

The Financial Type sets the financial category of each

transaction. Account types can be Payment, Interest,

Fee, Legal, Misc, Other, Adjustment or Principal.

Whichever type is displayed in the field sets the financial

type of the transaction. This is very important for Collect! to

know how to process the transaction that is being

posted. Transactions are posted to whichever financial

type is displayed, either Payment, Interest, Fee, Legal,

Misc, Other, Adjustment or Principal. The financial type

determines which financial money field on the Debtor

screen is affected.

The available Financial Types are described below.

Payment

Select Payment from the Financial Type pick list

to flag this transaction as a Payment. When you select

a transaction type that is a Payment, the Financial Type

field will automatically display Payment.

A Payment is any amount received by your agency

from a debtor to settle outstanding principal, interest

and fees. The amount is entered in the To Us or

Direct field on the Transaction form. A POSITIVE

Payment amount DECREASES the debtor's Owing.

Payments and charges can be assigned to any

debtor account. Normally, commission is automatically

calculated on transactions flagged as Payment.

Principal

Select Principal from the Financial Type pick list

to flag this transaction as Principal. When you select

a transaction type that is Principal, the Financial Type

field will automatically display Principal.

Amounts posted as Principal include the original amount

owed by the Debtor, or a judgment amount or legal costs.

Depending on the nature of your business, Principal amount

can also be the original price of goods or services rendered,

including finance charges. A POSITIVE Principal amount

DECREASES the debtor's Owing.

When using Compound Interest calculations

in Collect! you MUST post an Original

Principal transaction so that Collect! can

display the breakdown of Principal, Interest

and Fees.

When using Compound Interest calculations

in Collect! you MUST post an Original

Principal transaction so that Collect! can

display the breakdown of Principal, Interest

and Fees.

Collect! internally tracks principal, interest, adjustments

and fees. Fees are also broken down further to provide a

summary of legal fees only.

Interest

Select Interest from the Financial Type pick list

to flag this transaction as Interest. When you select

a transaction type that is Interest, the Financial Type

field will automatically display Interest.

Interest can be entered when you first list an account.

Adjustments can be made as needed to existing interest

calculations. Amounts are entered in the To Us or

Direct fields. A POSITIVE Interest amount DECREASES

the debtor's Owing.

Collect! internally tracks principal, interest, adjustments

and fees. Fees are also broken down further to provide a

summary of legal fees only.

Fee

Select Fee from the Financial Type pick list to flag this

transaction as a Fee. When you select a transaction type

that is a Fee, the Financial Type field will automatically

display Fee.

Any fee charged to the debtor can be entered through

the Transaction form. Amounts are entered in the To Us

or Direct fields. A POSITIVE Fee amount DECREASES

the debtor's Owing.

Collect! internally tracks principal, interest,

adjustments and fees. Fees are also broken down

further to provide a summary of legal fees only.

Legal

Select Legal from the Financial Type pick list to flag this

transaction as Legal. When you select a transaction type

that is Legal, the Financial Type field will automatically

display Legal.

Misc

Select Misc from the Financial Type pick list to flag this

transaction as Misc. When you select a transaction type

that is Misc, the Financial Type field will automatically

display Misc.

Other

Select Other from the Financial Type pick list to flag this

transaction as Other. When you select a transaction type

that is Other, the Financial Type field will automatically

display Other.

Adjustment

Select Other from the Financial Type pick list to flag this

transaction as an Adjustment. When you select a transaction

type that is an Adjustment, the Financial Type field will

automatically display Adjustment.

Adjustments can be posted for interest amounts, fees

or any other type of payment. A POSITIVE Adjustment

amount becomes a negative adjustment, that is, it

DECREASES the debtor's Owing. Negative adjustments

are shown enclosed in parentheses and are deducted

from the debtor's Owing.

Collect! internally tracks principal, interest, adjustments

and fees. Fees are also broken down further to provide a

summary of legal fees only.

Receipt Number

Switch this ON with a check mark if you want Collect!

to automatically assign a Receipt Number to transactions

of this type.

Receipt Numbers need these requirements:

- This switch must be turned ON with a check mark.

- The transaction must be posted to the Payment

account.

- The amount posted must be a positive payment

(credit) To Agency.

If these conditions are not met, Collect will not assign

a Receipt Number even if the switch is ON.

You can also generate receipt numbers for

payments to Commission if you switch

ON "Generate on Commission."

You can also generate receipt numbers for

payments to Commission if you switch

ON "Generate on Commission."

The Receipt Number is determined by adding

one to the highest numbered receipt already

in Collect!. You can change an existing

Receipt Number so that Collect! will start at a

number of your choice.

The Receipt Number is determined by adding

one to the highest numbered receipt already

in Collect!. You can change an existing

Receipt Number so that Collect! will start at a

number of your choice.

Generate On Commission

Switch this ON with a check mark if you want Collect!

to automatically assign a Receipt Number to transactions

of this type.

Receipt Numbers will be generated if:

- The "Receipt Number switch is also ON."

- The transaction must be posted to the

Payment account.

- The transaction must be posted as a positive

amount (credit) to Commission.

Invoice Number

An Invoice Number may be assigned automatically to

this transaction. For Collect! to create an Invoice Number,

three conditions must be met.

- The transaction must be posted to the Fees account.

- The amount posted must be a negative amount (debit)

To Agency or To Client, or a positive Commission

amount.

- The Invoice Number switch must be turned ON in the

Transaction Type settings for this Transaction Type.

If these conditions are not met, Collect does not

automatically assign an Invoice Number to the transaction.

The Invoice Number is determined by adding one to the

highest numbered invoice already in Collect!. You can change

an existing Invoice Number so that Collect! will start at a

number of your choice.

If you're upgrading from an earlier version of

Collect! make sure you set the access rights

to Read Only for this field to avoid Users

changing your Invoice Number sequence.

If you're upgrading from an earlier version of

Collect! make sure you set the access rights

to Read Only for this field to avoid Users

changing your Invoice Number sequence.

Use Control File

Switch this ON with a check mark to tell Collect! to run a

control file on this Transaction. When this switch is enabled,

a "control file" field becomes visible where you can enter

the name of the control file you want to use.

Collect! expects the control file to be in the

{database}\control folder.

Collect! expects the control file to be in the

{database}\control folder.

When enabled, Collect! will not perform any transaction breakdown

for payments. It is assumed that all financial calculations are

handled in the control file.

Control File

Enter the name of the control file you want Collect! to run

on this Transaction. Collect! will add the ".ctf" extension.

If you have set a control file in the Transaction Type, then

this field will fill automatically when you select the Transaction

Type.

This field is only visible when the "Use control file" switch

is enabled.

Collect! expects the control file to be in the

{database}\control folder.

Collect! expects the control file to be in the

{database}\control folder.

Payment Date

This is the actual Date that the Payment is made to

the debtor's account. This is very important for many

financial calculations on the account. It is used to

tally the total displayed in the Paid field on the Debtor

form. When there is interest to be calculated, this

Payment Date is used to accurately compute the interest

for the account. Interest calculation is based on the

ACTUAL Payment Date rather than the date the payment

is reported by the client or posted to the account.

By default Collect! displays today's date. Press F2

to pop up the calendar where you can choose a

different date.

If "Automatically Manage Promises" is switched on

in Payment Posting Options, the Payment Date

will use the Promise Due Date when there is a

Promise Contact set up on the account.

NSF Transactions:

Enter the PAYMENT Date to match the Payment Date of the

transaction being REVERSED. This links the NSF transaction

to the original transaction so the payment breakdown is

properly reversed.

NSF Tag

If you have multiple NSF transactions on the same day for the

same debtor, go to each of the Original Transactions and put

numbers into the NSF Tag field and put the corresponding number

into the reversal's NSF Tag field. This is a secondary link

for multiple transactions. You can use any number (1, 2, 3)

as long as it is unique to the Payment Date and Amount.

Posted Date

This is the calendar date this transaction is entered

into the system. This is very important for financial

reporting on the account. The Posted Date is used

when generating statements to determine if the

transaction falls within the statement Date Range.

By default Collect! displays today's date. Press F2

to pop up the calendar where you can choose a

different date.

One way to keep track of post-dated checks and

promised payments is to post transactions with

no Posted Date. Collect! will ignore the transactions

when calculating debtor Owing and generating

statements.

Operator

This is the Collector the account is assigned to.

It is used in the Operator Analysis Report to

determine Operator commissions.

Select the down arrow or press F2 to view the

list of Operators. This field is automatically filled

from the Debtor form or the Transaction Type

settings.

Sales

This is the Sales person or team assigned to this

account. It is used for commission calculations in

the Operator Analysis Report. Please refer to the

help on that report for more information.

Select the down arrow or press F2 to view the

list of Operators. This field is automatically filled

from the Debtor form or the Transaction Type

settings.

Owing

This is the total amount of the outstanding debt for this

debtor. It is taken from the Debtor's Owing on the Debtor

form. It is used in calculations, statements and reports.

To Us

The To Us field is used to record payments made to the

agency. This field is a positive value for checks or cash,

while NSF charges and similar fees are entered as a

negative value. Positive payments are listed in the daily

bank deposit listing. Entering a positive value decreases

the debtor's Owing and a negative value increases

the debtor's Owing. A commission is calculated from

this amount and is entered into the Commission field.

Transaction Type settings determine

whether this field is displayed. If you don't

see this field and expect to, please review

the Transaction Type you've selected.

Transaction Type settings determine

whether this field is displayed. If you don't

see this field and expect to, please review

the Transaction Type you've selected.

Direct

The Direct field is used to record payments made directly

to the client. A commission is calculated from this

amount and is entered into the Commission field.

The payment is not listed in the daily bank deposit

listing. Entering a negative value increases the

debtor's Owing.

Transaction Type settings determine

whether this field is displayed. If you don't

see this field and expect to please review

the Transaction Type you've selected.

Transaction Type settings determine

whether this field is displayed. If you don't

see this field and expect to please review

the Transaction Type you've selected.

Commission Amount

This Commission Amount will appear on the Client

Statement at the end of month. The Commission

Amount is calculated from the Commission Rate and

the Payment amount To Us or Direct. You can change

the amount or delete it altogether. A positive value will

result in the client being billed for the amount of the

Commission and entering a negative value credits the

client's account.

The calculation percentage depends on

the switch controlling 'Add Commission

to Owing' in the Debtor Financial Detail

form in the Commission section. When that

switch is set, the actual percentage used

when calculating the Commission Amount

will be less than if the switch was not set.

The calculation percentage depends on

the switch controlling 'Add Commission

to Owing' in the Debtor Financial Detail

form in the Commission section. When that

switch is set, the actual percentage used

when calculating the Commission Amount

will be less than if the switch was not set.

If you do not want to calculate the commission,

you can delete the amount in this field. To

have Collect! do this automatically, please

use the 'Don't calculate commission'

setting. But you must set it BEFORE you

enter the payment amount.

If you do not want to calculate the commission,

you can delete the amount in this field. To

have Collect! do this automatically, please

use the 'Don't calculate commission'

setting. But you must set it BEFORE you

enter the payment amount.

Tax

This is the amount of Tax payable on the Commission.

The client will be billed this amount in the next

statement. Tax calculated from the Commission

amount. The Tax Rate is taken from the debtor

information as described above under "Tax Rate."

A positive value causes the client to be billed the

Tax amount on the next statement. A negative

value credits the client with the Tax amount displayed.

Return

The Return indicates the amount of any payment that is not

retained by the agency. This is calculated as the sum of the

To Us and Direct amounts minus the Commission Amount

and Tax.

If you have transactions posted in your system

that predate this feature, this field will most

likely be BLANK. You can tab out of the To Us

or Commission field to refresh the value.

If you have transactions posted in your system

that predate this feature, this field will most

likely be BLANK. You can tab out of the To Us

or Commission field to refresh the value.

Owing Before Transaction

This field indicates the Owing amount on the account before

the transaction is taken into account. This allows you to

preserve information pertaining to the account's owing

history.

If you have transactions posted in your system

that predate this feature, this field will most

likely be BLANK. The feature is on a go forward

basis for new transactions. It reads the current

Owing for the Debtor.

If you have transactions posted in your system

that predate this feature, this field will most

likely be BLANK. The feature is on a go forward

basis for new transactions. It reads the current

Owing for the Debtor.

Owing After Transaction

This field indicates the Owing amount on the account, taking

the totals of this transaction into account. This allows you to

preserve information pertaining to the account's owing history.

If you have transactions posted in your system

that predate this feature, this field will most

likely be BLANK. The feature is on a go forward

basis for new transactions. It uses the current

Owing for the Debtor.

If you have transactions posted in your system

that predate this feature, this field will most

likely be BLANK. The feature is on a go forward

basis for new transactions. It uses the current

Owing for the Debtor.

Omit From Client Statement

While in this field, select the mouse or press the space

bar to flag the field with a check mark. This field may

already be flagged if it is set in the Transaction Type

settings.

When this field is flagged, this transaction will not be

included in the Client Statement generated at period

end. This setting is read from the Transaction Type

settings but can be changed here.

Omit From Daily Cash Report

While in this field, select the mouse or press the space

bar to flag the field with a check mark. This field may

already be flagged if it is set in the Transaction Type

settings.

When this field is flagged, this transaction will not be

included in the Daily Cash Report. This setting is read

from the Transaction Type settings but can be

changed here.

Use Confirmation Delay

If this is switched ON, this transaction will be reported on a

statement only after the period of confirmation delay set in

the Payment Posting Options form. This allows time for a

check to clear before it is included in a client statement.

If you enter a date in the 'Confirmed' field when

this switch is ON, Collect! will evaluate that

date as well when it generates the statement.

Please refer to

How to Use Confirmation Delay of Transactions

for details.

If you enter a date in the 'Confirmed' field when

this switch is ON, Collect! will evaluate that

date as well when it generates the statement.

Please refer to

How to Use Confirmation Delay of Transactions

for details.

Deposited

Date field for your own use to keep track of

check clearing.

Confirmed

This Date field enables you to control how Collect! handles cleared

checks when generating statements.

This date is evaluated for statements ONLY when

the 'Use Confirmation Delay' switch is ON and you

have a value entered in Payment Posting Options

for Confirmation Delay. If you are NOT using

Confirmation Delay, then this field is for your own use.

This date is evaluated for statements ONLY when

the 'Use Confirmation Delay' switch is ON and you

have a value entered in Payment Posting Options

for Confirmation Delay. If you are NOT using

Confirmation Delay, then this field is for your own use.

Enter the Date the check was cleared. If you are using

Confirmation Delay, the date you enter here will override

the Confirmation Delay, enabling you to process checks

as soon as they are cleared, even if the Delay period

has not expired. When statements are generated, the

date entered here will be evaluated, rather than the

Payment or Posted Date, to decide whether or not to

include the transaction in the statement.

You can enter a date in the future to prevent the

transaction from appearing on the statement

until a specific date.

You can enter a date in the future to prevent the

transaction from appearing on the statement

until a specific date.

Please refer to How to Use Confirmation Delay of Transactions

for details.

Confirmation #

Alphanumeric field for your own use to keep track

of check clearing.

Alt Invoice Number

This is a user-defined alphanumeric field.

Alt Receipt Number

This is a user-defined alphanumeric field.

Posted By

This read-only field displays the ID of the Operator

who posted this Transaction.

Commission

Enter up to four commission rates with payment

breakdown settings. Total commission will be

tallied in the Total field.

This is the percent of the debtor's payment which the

agency charges as a fee for services. The dollar amount

of the commission is calculated from this percentage (a

number from 0 to 100) and is automatically entered into

the Commission field. The Commission Rate is read from

the Debtor form or from the Transaction Type settings. It

can be modified on an individual transaction.

Entering a 0 results in $0.00 commission. Enter 100

to retain all of a fee.

Don't Calculate Commission

While in this field, select the mouse or press the space

bar to flag the field with a check mark. This field may

already be flagged if it is set in the Transaction Type

settings.

When this field is flagged, the system will NOT

calculate Commission for this transaction. However,

if you switch this on after you complete entering

your transaction, it will have no effect.

Set this switch BEFORE you enter your

payment amount in the To Us or Direct

fields. If you fail to do this, and you see

an amount in the Commission Amount

field, simply delete it to remove the

calculated Commission.

Set this switch BEFORE you enter your

payment amount in the To Us or Direct

fields. If you fail to do this, and you see

an amount in the Commission Amount

field, simply delete it to remove the

calculated Commission.

Tax

Enter up to four tax rates with payment breakdown

settings. Total tax will be tallied in the Total Tax

field.

This is the rate at which the tax is calculated on

the Commission Amount value displayed in this

transaction. You can enter a rate here or accept

the default rate that may be displayed already

for you.

The default Tax Rate is taken from the debtor

information available when you select the Rate field

in the Debtor form. This displays the

Financial Detail form with a Tax section. Values in

Tax fields are copied to each transaction that you

post with commission and tax calculated.

To switch OFF the calculation of tax, make sure

the box next to 'Don't Calculation Tax' is checked.

Don't Calculate Tax

While in this field, select the mouse or press the space

bar to flag the field with a check mark. This field may

already be flagged if it is set in the Transaction Type

settings.

When this field is flagged, the system will NOT

calculate Tax for this transaction.

Breakdown

This section displays how the transaction amount

is broken down.

Currency

Multi currency settings. This section displays the

Currency the payment was made in. This should be

the Currency of the account if you are using the Collect!

Month End statement process.

If the Debtor pays in a Currency other than the one the

debt was recorded in you MUST convert the Currency

before entering the payment into Collect!

Collect! does not calculate using exchange

rates and currencies. These fields are

provided for your own informational purposes

only.

Collect! does not calculate using exchange

rates and currencies. These fields are

provided for your own informational purposes

only.

Press F1 for details when this section is highlighted.

Detail

This section contains user defined fields for storing

information for reports or your own record keeping.

Press F1 for details when this section is highlighted.

OK

Select this button to save any changes you may

have made to this transaction and return to the

previous form.

<<

Select this button to navigate to the

previous transaction in the database.

>>

Select this button to navigate to the

next transaction in the database.

Last Payment

Select this button to schedule a Plan Contact with a

Due Date matching this Transaction's Payment Date.

This button is visible only if you have

set up Last Payment Plan in the

Payment Plan Setup form.

This button is visible only if you have

set up Last Payment Plan in the

Payment Plan Setup form.

The switch is processed for new transactions only.

For existing transactions it is completely ignored.

If an In Progress Plan Contact already exists, it will be

updated with the new date, otherwise, a new Plan

Contact will be created.

Please refer to Help topic,

How to Run a Contact Plan on the Last Payment Date

for details.

New

Select this button to save any changes you may

have made to this transaction and then display

an empty Transaction form for you to continue to

enter new transactions.

Print

Select this button to view the list of all reports you

can print relating to debtor transactions.

Cancel

Select this button to ignore any changes you may

have made to this transaction and return to the

previous form.

Help

Select this button for help on the Transaction form

and links to related topics.

Payment Details

Click this button to display more information about the

payment from the payment gateway.

This button is only visible on transactions

processed via the Payment Processing Module.

This button is only visible on transactions

processed via the Payment Processing Module.

Delete

This button is visible on the list of all transactions.

Select it to delete the highlighted record from the

database.

Edit

This button is visible on the list of all transactions.

Select it to open highlighted record for editing.

Post A Transaction

To enter the details of these different types of financial transactions we use the Transaction form.

If you have not setup your transaction types, please do that before you begin to post

transactions.

If you have not setup your transaction types, please do that before you begin to post

transactions.

- Pull down the Browse menu and choose All Debtors. The list of all debtors will display.

- Start typing the Debtor's name and the list will scroll to the closest match. Click on the

Debtor of your choice and the Debtor form will open displaying this Debtor's record.

- Select the Transactions tab in the Debtor form. A list of this Debtor's transactions will be

displayed.

- Press F3 for a new Transaction form or click the New button. A new Transaction form will be

displayed for the Debtor. Notice that the Debtor's name is entered automatically.

- Press F2 to choose a Transaction Type. Certain fields on the Transaction form will be visible

or invisible depending on settings for the Transaction Type you choose.

Financial transaction accounts need to be set according to your specifications. Settings on

the Transaction form designate how information is reported and calculated. This set up is

very important and is directly related to how you use fee structures, how you want to report

information and deal with your client monthly statements. You can assign the Transaction to

a specific operator and schedule follow up every time you post a particular transaction.

Financial transaction accounts need to be set according to your specifications. Settings on

the Transaction form designate how information is reported and calculated. This set up is

very important and is directly related to how you use fee structures, how you want to report

information and deal with your client monthly statements. You can assign the Transaction to

a specific operator and schedule follow up every time you post a particular transaction.

- Fill in additional fields as needed. Press F1 for Help on the fields in the Transaction

form.

- Press Enter when your cursor is flashing on the OK button to save the charges to the account.

The Debtor and Client totals will be automatically recalculated.

Posting Debits And Fees

Debits or fees charged to the Debtor are posted as a negative amount. Negative amounts are shown in

parentheses. i.e. ($7.52) means (- $7.52)

Fees to clients are posted by leaving the To Us and Direct blank and posting the fee in the Commission

field.

How To Post A Debtor Payment

When a debtor makes a payment to your agency or to your client, we post a Payment transaction

to the debtor's account. There are several ways to do this. The most direct way is from the

Debtor form. The steps are covered in this document. We will post a check payment, as an example.

The steps are:

- Open the Debtor form where you want to post the payment.

- Create a Payment transaction and enter the details.

- Examine the Debtor to make sure the new financials are correct.

The rest of this document walks you through these steps.

Open the Debtor Form

- Start Collect! and sign in as you would normally. Select Browse from the top menu bar and then

select All Debtors from the drop-down choices. The list of all debtors will display.

- Begin typing the name of the debtor you wish to post the payment to. As you type, Collect! will

take you through the list and stop at the closest match.

- Click on the debtor, or if the debtor is highlighted, just press Enter or F5 to open the Debtor

form. The debtor you selected should be displayed.

The Find By menus allow for searching a variety of fields for quicker look up.

The Find By menus allow for searching a variety of fields for quicker look up.

Create a Payment Transaction

- Select the TRANSACTIONS tab to post the payment. If there are no transactions for this debtor,

you will be prompted to enter a new one. Select the YES button to create a new transaction.

If the TRANSACTIONS tab is lit up, this quickly informs you that there are existing

transactions posted to this debtor. When you select the TRANSACTIONS tab, you will see a list

of all transactions posted to this debtor. Press F3. You should now have an empty Transaction

form on your screen.

If the TRANSACTIONS tab is lit up, this quickly informs you that there are existing

transactions posted to this debtor. When you select the TRANSACTIONS tab, you will see a list

of all transactions posted to this debtor. Press F3. You should now have an empty Transaction

form on your screen.

- Press F2 to display the Transaction Type list.

- Select Type 101, Payment by Check. Once the Type 101 is selected, a lot of information is

entered automatically.

- Fill in the payment amount in the field labeled To Us if the payment was made

to the agency, or in the field labeled Direct if the payment went to directly

to the client. The payment is entered as a POSITIVE amount. This reduces the debtor's Owing.

Press F8 or the OK button to save the transaction. You will be returned to the Transaction

list showing you the newly posted transaction.

- Select OK to return to the Debtor form.

Examine the Debtor

Inspect the money fields on the Debtor form to make sure the results are correct.

How To Post A Compound Interest Adjustment

This section discusses posting a transaction to adjust the interest amount on a Debtor account. It

applies to Compound Interest calculations.

Requirements

- Transaction Type 401

- Experience entering Transactions

- Original Principal was posted as a Transaction Type 196

Overview

When performing Compound Interest calculations on Debtor accounts, you may find that the numbers

do not match amounts that you want to post for a particular account. It is possible to post a

Transaction that adjusts the Interest amount. The new amount will be used for all future calculations

on the account.

This adjustment routine applies to Compound Interest calculations. It only works when you

have posted a Transaction for the Debtor's Original Principal as Transaction Type 196.

This adjustment routine applies to Compound Interest calculations. It only works when you

have posted a Transaction for the Debtor's Original Principal as Transaction Type 196.

Transaction Type 401

Collect! uses Transaction Type 401 Interest Adjustment to handle adjustments that are made to

automatic interest calculations. Collect! performs all necessary steps behind the scenes to correct

the compounding amounts to reflect to new Interest amount.

Post a Transaction to Adjust Interest

- From the Debtor form, select the TRANSACTIONS tab.

- Choose New or press F3 when the list of Transactions for this Debtor is displayed.

- Choose Transaction Type 401 for this new Transaction. Information is filled in automatically.

Make sure you have the correct Debtor name.

- Using the BACK [ << ] record navigation button, scroll through the Debtor transactions

until you reach Transaction Type 196. Note the Payment and Posted Dates for this Transaction

which posted the Original Principal.

Whenever you intend to use Compound Interest methods, the Original Principal must be posted

as a Transaction Type 196. Your Adjustment Transaction MUST have the same Posted and Payment

dates.

Whenever you intend to use Compound Interest methods, the Original Principal must be posted

as a Transaction Type 196. Your Adjustment Transaction MUST have the same Posted and Payment

dates.

- Using the FORWARD [ >> ] record navigation button, scroll forward to your new Transaction

401 and enter the SAME date in the Posted and Payment Date fields for your Interest Adjustment

Transaction that you found on the Transaction 196 for the Original Principal.

- Enter the amount that you want to add or subtract from the Interest either in the To Us or the

Direct field, depending on your own business procedures. Be sure to enter a negative (-) amount

to lower the interest amount.

Negative amounts are displayed in parentheses.

Negative amounts are displayed in parentheses.

- Click OK to complete the Transaction.

Collect! will automatically recalculate compounding figures to synchronize with this new amount.

How To Post Debtor NSF Payment And Fees

This section explains how to process a check payment that has been returned to you as NSF, and how

to charge an NSF fee to the account.

Let's assume that an operator posts a check payment to a debtor account. A few days later, the

check is returned to you NSF. You process the check, including your NSF fee. Later on, you receive

another payment from the debtor that covers both the NSF check and your NSF fee.

The steps for processing include:

- Posting the NSF check as an identical transaction but with a NEGATIVE amount.

- Adding an NSF fee to the debtor.

- Posting the replacement payment when a good payment is received.

Requirements

- Setup Transaction Types (see below)

- Experience entering Transactions

- Original Payment (EX: Check for this exercise) already posted

Three transaction types are used in the following example:

- 101 - Payment by Check

- 301 - NSF Charge due Agency

- 106 - Payment of Agency NSF Fee

The step by step instructions may follow a different method of posting transactions than you

normally use. Try working through these steps, as this is the basic method. Once this theory

is understood, you can apply it to your own method of posting transactions.

The step by step instructions may follow a different method of posting transactions than you

normally use. Try working through these steps, as this is the basic method. Once this theory

is understood, you can apply it to your own method of posting transactions.

Posting the NSF Check

Let's assume that a week has passed and the bank has returned a check to you NSF. You must reverse

the original Payment transaction and also create a new transaction to add your NSF fee to the

debtor's Owing.

A check payment entered in Collect! can be reversed by posting a reversal payment transaction. This

is a payment transaction with the EXACT same dollar value, identical to the original amount posted

as payment for the debtor. What makes it a reversal is that this time, the amount of the payment is

entered as a NEGATIVE amount.

For your accounting and paper trail, it is best to use for the reversal NSF transaction, the

exact same Transaction Type as the initial payment, as well as the exact dollar value but as

a NEGATIVE amount. Using the same Type is a recommendation, not a requirement.

For your accounting and paper trail, it is best to use for the reversal NSF transaction, the

exact same Transaction Type as the initial payment, as well as the exact dollar value but as

a NEGATIVE amount. Using the same Type is a recommendation, not a requirement.

We will go to the Debtor and reverse the original payment. We will use the exact same Transaction

Type and information, entering the same dollar value, but making it NEGATIVE. This reverses the

payment.

That is, a Payment transaction is entered exactly the way it was first posted, EXCEPT, entering the

amount in the TO US or DIRECT field as a NEGATIVE amount.

If the initial payment was posted as TO US then the NSF transaction must be posted as TO US.

If the initial payment was posted as DIRECT, then the NSF transaction must be posted as DIRECT.

If the initial payment was posted as TO US then the NSF transaction must be posted as TO US.

If the initial payment was posted as DIRECT, then the NSF transaction must be posted as DIRECT.

- Select the TRANSACTIONS tab to display the list of transactions for this debtor. Press F3 to

enter a new transaction.

- Enter 101 in the Type field. Or, press F2 to view the list of transaction

types and select Code 101 from the list. Alternatively, you can setup a Transaction Type, such

as 105, to post the NSF transaction. This can allow you to run a Contact Plan when the

transaction is created that will post the NSF Fee automatically, setup a letter contact, and

more.

- Enter the amount of the original check payment, in the TO US or DIRECT field, but make it

NEGATIVE.

- Enter the POSTED Date as today's date or the date the amount was reversed from your bank

account.

- Enter the PAYMENT Date to match the Payment Date of the transaction being REVERSED. This links

the NSF transaction to the original transaction so the payment breakdown is properly reversed.

WARNING: Do not skip this step as Collect! needs the payment date to determine the breakdown. If

the payment date is the same as the posted date, then Collect! will use the breakdown

on the payment prior to the NSF payment. If you are posting daily payments, this will

cause issues with your breakdown.

WARNING: Do not skip this step as Collect! needs the payment date to determine the breakdown. If

the payment date is the same as the posted date, then Collect! will use the breakdown

on the payment prior to the NSF payment. If you are posting daily payments, this will

cause issues with your breakdown.

If you have multiple reversals on the same day for the same debtor, go to each of the

Original Transactions and put numbers into the NSF Tag field and put the corresponding

number into the reversal's NSF Tag field. This is a secondary link for multiple transactions.

If you have multiple reversals on the same day for the same debtor, go to each of the

Original Transactions and put numbers into the NSF Tag field and put the corresponding

number into the reversal's NSF Tag field. This is a secondary link for multiple transactions.

- Press F8 or OK to save the transaction and return to the Transaction list. Here, you should see

the reverse entry.

Adding an NSF Fee

To post NSF fees to a debtor, you must use a Fee Transaction Type. We will use the NSF Charge Due

Agency Transaction Type that is in the Demonstration database. It is Type 301. By default, this adds

a $25.00 NSF Fee to the debtor.

- Select F3, or select the NEW button, to open a new Transaction form.

- Enter 301 in the Type field. Or, press F2 to view the list of transaction

types and select Code 301 from the list. Because this Transaction Type was set up previously,

Collect! will fill in the following data automatically.

- $25.00 NSF fee has been filled in as a NEGATIVE amount in the To Agency

field.

- Omit From Daily Cash Report is switched ON.

- Omit From Client Statement is switched ON.

- Press F8 to save the transaction and return to the Transaction List. The initial payment, the

reversal and the NSF Fee transactions are all displayed in the Transaction list.

- Select OK to return to the Debtor record.

- Ensure that the money fields on the Debtor screen have all been updated correctly. If they

don't appear to be correct, select the RECALC button on the lower right of the Debtor

form.

- If the totals still do not appear to be correct, select the TRANSACTIONS tab and open the

posted transactions. Make sure that dates and settings are correct.

If your NSF Fees are always the same, you can set up a transaction type for your NSF fees.

You may edit the Type 301 transaction type by entering your own fee amount in the To

Agency field. Make sure you enter it as NEGATIVE amount.

If your NSF Fees are always the same, you can set up a transaction type for your NSF fees.

You may edit the Type 301 transaction type by entering your own fee amount in the To

Agency field. Make sure you enter it as NEGATIVE amount.

Posting the Replacement Payment

When the debtor makes a "good" payment, you can now go to the account and post it.

- Select the Transactions tab. Press F3 or the NEW button to display a new Transaction form.

- Select a Payment Transaction Type and fill in the rest of the payment details, as per

normal.

- Click OK to save.

The payment and posted dates should be left as today's date, or the date of the payment.

Do not back-date either of them to match the NSF payment.

The payment and posted dates should be left as today's date, or the date of the payment.

Do not back-date either of them to match the NSF payment.

When you view the debtor's account, the Owing will reflect the payment to the account.

How To Post Legal Fees

This section assumes that you are very familiar with the use of Transactions and Transaction Types.

It is a quick run through for advanced users.

To Charge Legal Fees to the Debtor

This is a way of charging legal fees to the Debtor while not adding commission or charges to the

client.

- Create a new Transaction Type (let's say 225 to stay in the legal fees section)

- Description: Legal fee to Debtor

- Account: Fee

- Enter amount on posting

- Omit from client statement

- Omit from daily cash report

- Don't calculate commission

- Don't calculate tax

- Optionally, Create a second Transaction Type (let's say 125 to stay in payments).

- Description: Legal fees paid by Debtor

- Account: Payment

- Enter amount on posting

- Omit from client statement

- Omit from daily cash report

- Don't calculate commission

- Don't calculate tax

- Post Debtor information in the usual manner. Then post a Transaction for the initial fee

using the Transaction Type 225 that you created. Enter the amount.

This will not appear in your statements or cash report. It will appear in other reports

which include all transactions, or you may wish to create a report specifically to track

legal expenses.

This will not appear in your statements or cash report. It will appear in other reports

which include all transactions, or you may wish to create a report specifically to track

legal expenses.

The next step is optional. If your existing transaction types are setup to use payment

breakdown, then posting the regular payment will pay the legal fees as per the order that

is set in the breakdown.

The next step is optional. If your existing transaction types are setup to use payment

breakdown, then posting the regular payment will pay the legal fees as per the order that

is set in the breakdown.

- To handle payment posting, first, post the amount of the fee as the Transaction Type 125 that

you created. Then, post the remainder of the payment as a new Transaction - your normal payment

by check, Type 101.

How To Post Attorney Fees

This section explains a procedure for handling your accounts when they have been turned over to an

attorney for collection.

Ordinarily, you may have a client setup with a commission rate. When you setup debtors for this

client, the commission rate is automatically displayed in the Rate field of the debtor form. Whenever

you post a new transaction for this debtor, the commission rate is displayed on the transaction form

and is used to calculate the commission for the transaction you are posting, if there is commission

to be calculated.

When an account is turned over to an attorney, you may want to charge a different commission rate.

You will want to keep track of the portion that the attorney keeps when a payment is made. You will

want to change the status code for the debtor, delete pending contacts and perform other related tasks.

There are several steps to setting up Collect! to handle your legal accounts properly. There are

also some additional settings you can create for advanced features. First, we will discuss the basics.

Changes to the Debtor Record

When an account is turned over to an attorney, there are a few areas where you may need to change

your settings, depending on your procedures.

- Commission Rate: If you charge a different commission rate when an account

has been turned over to an attorney, enter this new commission rate in the Rate field of the

debtor's account as soon as the account goes legal. Then, whenever a payment is posted, the

new commission rate will be used to calculate commission.

- Debtor Status Code: Change the debtor's status code to Legal.

- Pending Contacts: Choose Contacts from the debtor form and delete all pending

contacts for the debtor whose account has been turned over to an attorney.

WARNING: To ensure 100% recovery of the Attorney Fee, you must enter 100% into any of the

Commission Rate 2-4 fields and check the applicable boxes. Make sure the check Legal

for the rate that has 100%.

WARNING: To ensure 100% recovery of the Attorney Fee, you must enter 100% into any of the

Commission Rate 2-4 fields and check the applicable boxes. Make sure the check Legal

for the rate that has 100%.

Keeping Track of Attorney Fees

First, you will need a special transaction type for the Attorney Fees that you paid out or the attorney

kept. This transaction type should be numbered in the Legal series. (i.e. 200 - 299)

Transactions with Financial Type Legal are totaled by Collect! as Total Legal Costs. This is

displayed in the Financial Summary Totals form that pops up when you click into the Owing

field of the debtor form.

Transactions with Financial Type Legal are totaled by Collect! as Total Legal Costs. This is

displayed in the Financial Summary Totals form that pops up when you click into the Owing

field of the debtor form.

The following settings are switched ON when you create your Attorney Fee transaction type.

- Financial Type: Legal

- Write to notes (optional)

- Omit from client statement

- Omit from daily cash report

- Don't calculate commission

- Don't calculate tax

If you intend to enter an actual dollar amount for the attorney fee, switch on Enter amount on

posting when you create the transaction type for attorney fees.

If you want Collect! to calculate the dollar amount based on the attorney's commission rate, switch

on Percent of principal or Percent of owing. Enter the commission percentage AS A NEGATIVE VALUE

in the Commission field when you create the transaction type for attorney fees.

Contact Technical Support for more complex ways of doing calculations.

Contact Technical Support for more complex ways of doing calculations.

Posting Attorney Fees

Next, we will enter a transaction to keep track of your attorney fees so that your internal

record-keeping is accurate.

Follow these steps to accurately record your attorney fees:

- Create a NEW transaction for the debtor who incurred an attorney fee.

- Choose your new Attorney Fee for the transaction type.

- Enter the amount that is the Attorney's portion in the COMMISSION field on the transaction

form AS A NEGATIVE AMOUNT.

If you chose to enter a percentage that the attorney keeps, you will notice that Collect!

automatically calculates the attorney fee based on the information you entered when you

created the transaction type for Attorney Fee.

If you chose to enter a percentage that the attorney keeps, you will notice that Collect!

automatically calculates the attorney fee based on the information you entered when you

created the transaction type for Attorney Fee.

Posting a Payment Made to an Attorney

When the debtor makes a payment, the attorney may keep their portion and give you the rest. This is

an area that needs to be recorded correctly so that the proper information is displayed on your

statements and your daily cash report.

- Posting a Payment: When the debtor makes a payment, post a transaction for

the FULL AMOUNT of this payment. Do not subtract the portion that the attorney keeps. When you

post the transaction for this payment, you will notice that your legal commission rate is

displayed in the transaction automatically. Collect! will calculate your total commission

accurately for this transaction.

- Client Statement: When you generate your statements for this period, the

entire payment and total commission will be displayed on the statement.

Setup an Attorney

This is optional, but useful for reporting, especially if you have multiple law offices that you work

with.

You can setup your attorney as a client and report all account activity for this attorney. You will

probably never actually add accounts to this record. It is used for linking attorney information to

reports.

- Pull down the Browse menu and choose Clients.

- Press F3 to create a new client. Enter the attorney's information in the appropriate

fields.

- In the Category field, choose "Legal" from the pick list.

If you do not see this choice in your pick list, you can add it. Please refer to

How to Use Pick Lists. Make sure that the KEY value is 1.

If you do not see this choice in your pick list, you can add it. Please refer to

How to Use Pick Lists. Make sure that the KEY value is 1.

- From the debtor screen, in the Legal field, select your attorney from the Client list.

Reporting Attorney Fees

Once you have recorded your attorney fees, you can include them in your Daily Cash Report or print

a separate report.

The code that is displayed here uses transaction type 203 for attorney fees. You can

substitute your own code here. You can paste this code into the external Daily Cash Report

supplied in the demonstration database.

The code that is displayed here uses transaction type 203 for attorney fees. You can

substitute your own code here. You can paste this code into the external Daily Cash Report

supplied in the demonstration database.

You can have legal fees separate out on your Client Statements. Please contact Technical

Support for more information.

You can have legal fees separate out on your Client Statements. Please contact Technical

Support for more information.

Use this code as a new report or add it to an existing report.

@varfeeamt$ = 0.00

@varfeetot$ = 0.00

@varforward* = " "

@H

@%Forward / Attorney Report@%

@A

@!Debtor Name Attorney Name Date Attorney Fee@!

@!------------------------ ------------------------ ---------- ------------------@!

@de NO TOTAL

@cl NO TOTAL where (@cl.cl = @de.leg)

@varforward = @cl.co

@cl

@de.tr NO TOTAL where (@tr.ty = 203) where (@tr.pda = ?)

@varfeeamt = @(0-tr.ca)

@varfeetot = @(varfeetot+varfeeamt)

@de.na<24> @varforward<25> @tr.pda>10> @varfeeamt>18>

@de.tr

@de

@!------------------------ ------------------------ ---------- ------------------@!

@!Total Attorney Fees: @varfeetot>18>@!

You can create a contact plan to automate your procedure when a debtor's account is turned over to

an attorney.

Some events in this plan might be as follows:

- Delete all pending contacts.

- Change the commission to your Legal rate.

- Change the debtor's status to Legal.

- Write to the debtor's notes.

- Schedule a Review by an operator.

- Perform other functions that your business requires when an account goes to an attorney.

How To Post Court Or Legal Costs

This section covers assigning court or legal costs to a Debtor or Client.

Court and other costs can be assigned to a Debtor or to a Client. This can be done by posting

transactions to the Debtor's account.

First, it is necessary to create Transaction Types to handle your legal fees. For this, please use

the 200 series in the Transaction Type categories, since types 200 to 299 are set aside for

Legal Costs.

For example:

- Code 205 - Serve Papers

- Code 210 - Docket Cost

With the following settings:

- Financial Type: Legal

- Write to notes (optional)

- Omit from client statement

- Omit from daily cash report

- Don't calculate commission

- Don't calculate tax

Any legal cost that is posted as a transaction with Financial Type Legal is automatically

tallied by Collect! in to the Legal field on the Debtor form.

Any legal cost that is posted as a transaction with Financial Type Legal is automatically

tallied by Collect! in to the Legal field on the Debtor form.

Posting a Legal Transaction

After you have created your transaction types, you can use them to assign fees to debtors or clients.

To try this out, go to the Debtor form and select the TRANSACTIONS tab. Create a new Transaction of

type 205, assuming you created a 205 transaction type.

ADD FEE TO DEBTOR

To add the fee to the Debtor, enter it as a negative (minus) amount in the 'To Us' field. This will

add the amount to the Debtor's Owing.

BILL FEE TO CLIENT

To pre-bill the Client this fee and NOT add it to the Debtor, enter the cost as a positive amount in

the 'Commission Amount' field. When you generate the statement, Collect! will bill the amount to the

Client and not affect the Debtor's Owing.

Please refer to the Help topic How To Request A Legal Fee Advance From Your Client for more

information.

How To Post Client Fees And Charges

You may charge fees to your client without affecting the debtor. The method you use to post fees and

charges to a client depends on whether or not you want a paper trail and how you want this set up.

Method 1 - Transaction

You can create a specific Transaction Type for these charges. Please see

How To Setup Transaction Types for details. Your transaction type can be set up as a Fee, with Omit

from daily cash report, Don't calculate commission, and Don't calculate tax all switched ON.

When you want to charge a fee to the client using this method, open the Debtor form for the debtor

involved and post this transaction. However, we do not put anything in the fields labeled To

Us or Direct, but we put the amount into the field labeled Commission

Amount. A letter/statement can be used to reflect this Transaction Type to bill the client.

When the Client pays, you post the same transaction with a negative commission amount. The description

can always be changed to reflect the purpose of the transaction.

- Open the debtor the charge relates to.

- Select the TRANSACTIONS tab.

- Post a new transaction with the following settings:

- Account: FEE is selected

- Omit from daily cash report is checked

- Don't calculate commission is checked

- Don't calculate tax is checked

- Make sure the 'Omit from Client Statement' switch is OFF.

- Enter the amount of the fee in the Commission Amount field.

You can create a Transaction Type that shows only the Commission field to make it easier

for the user to know where to put the amount. The default transaction type code is 397.

You can create a Transaction Type that shows only the Commission field to make it easier

for the user to know where to put the amount. The default transaction type code is 397.

Posting an amount, either a charge or a credit, as a Commission, is a way of handling

financial transactions with a Client, without affecting the debtor's balance.

Posting an amount, either a charge or a credit, as a Commission, is a way of handling

financial transactions with a Client, without affecting the debtor's balance.

Example:

You might charge a fee to a client for court costs. Later on, you may win a settlement, get an

amount from the debtor and need to reimburse the client.

You would post two transactions that have no To Us or Direct amounts, just a Commission amount. One

transaction would be a positive amount, when the client is charged. The other would be a negative

amount, when the client is reimbursed.

You can also apply fees or charges to a client using the Payment section of the Client. You would

post a negative amount for the amount of the fee. Then post a payment with a positive amount when

the Client pays. The Description may be used to detail the reason for the charge and the debtor the

fee relates to. This can also be used in a statement or letter to the Client.

Testing:

- Choose the Month End menu and Generate Statements.

- Browse the statements generated, looking for the client to whom the fee was charged.

- Open the statement and then open the Line Items to see whether the charge you posted appears

correctly.

- Delete the Invoice/Statement that was just created.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org