Financial Summary Totals

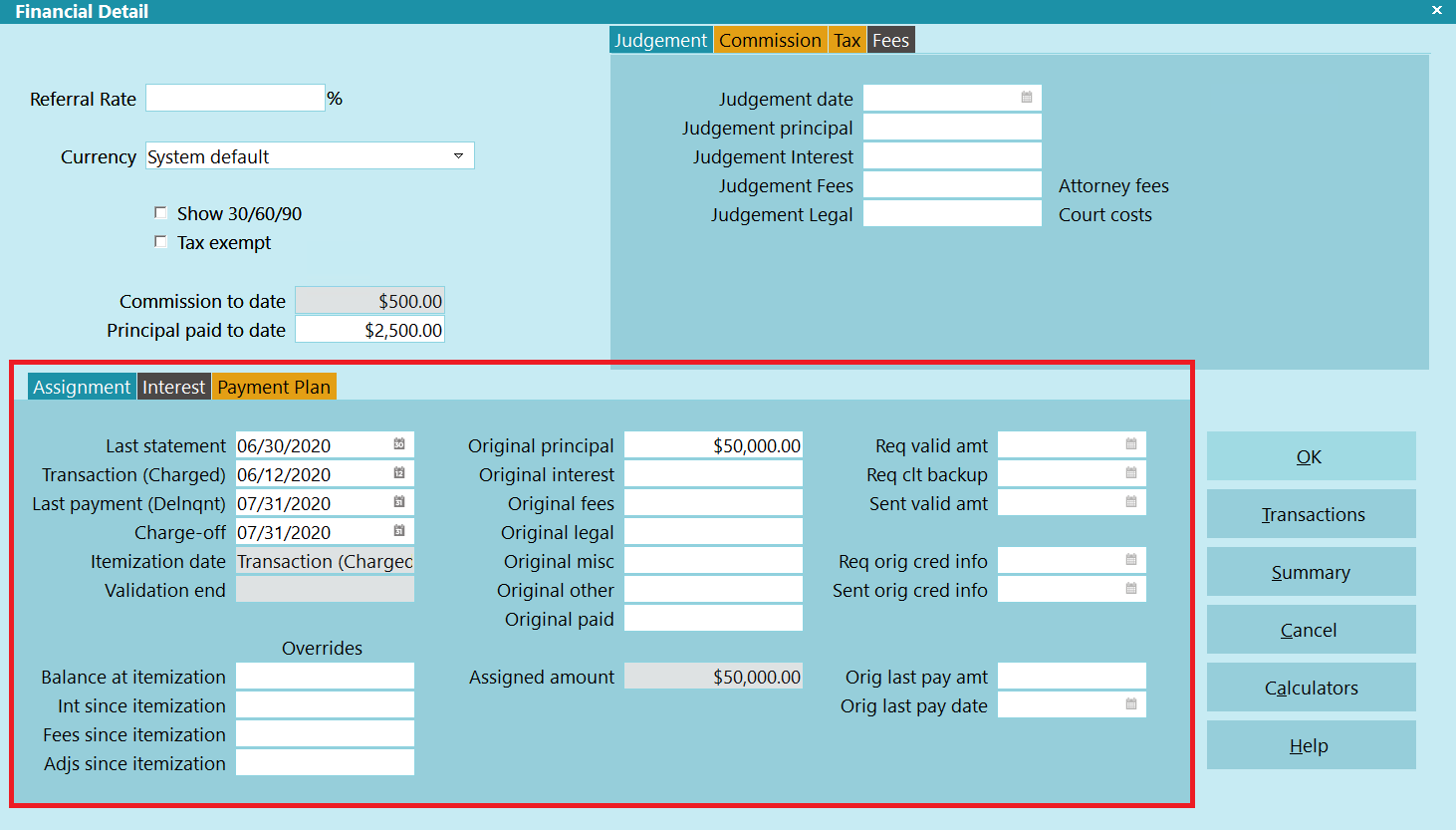

This section of the Financial Detail form is used to

enter debt assignment details.

To access this form, select the Principal field on

the Debtor form. Select the Assignment tab.

To access this form, select the Principal field on

the Debtor form. Select the Assignment tab.

Financial Summary Totals

Last Statement Date

As per the USA CFPB, the last statement date is the date

of the last periodic statement or written account statement

or invoice provided to the consumer by a creditor.

TRANSACTION (CHARGED)

As per the USA CFPB, the transaction date is the date of

the transaction that gave rise to the debt. On the Debtor

form, this is displayed as the Charged date.

LAST PAYMENT (DELNQNT)

As per the USA CFPB, the last payment date is the date the

last payment was applied to the debt. On the Debtor form,

this is displayed as the Delnqnt date.

Charge-Off

As per the USA CFPB, the charge-off date is the date the

debt was charged off.

Itemization Date

The itemization date is copied down from the Client Settings

when an account is created. When sending your first letter,

the itemization date is a reference date for the account

balance.

For example, if your client uses the Transaction Date

as the Itemization Date, and the Client also charged

Interest, then the Balance at Itemization must be the

original Transaction amount, without interest.

For example, if your client uses the Transaction Date

as the Itemization Date, and the Client also charged

Interest, then the Balance at Itemization must be the

original Transaction amount, without interest.

Validation End

If you have specified a Validation Report on the Company Detail

form or in a Contact Control record, then this field will populate

with the date the Validation Report/Letter was sent ( Contact

marked done via print, email, or text), plus the number of

business and calendar days specified on the Company Detail

form or the Contact Control record.

Example, if you specify Letter 1 for the Validation Report,

5 business days, and 30 calendar days, then when Letter 1

is printed, Collect! will take the current date, add 5

days (excluding Saturday, Sunday, and holidays), then add

30 days (including weekends and holidays).

Example, if you specify Letter 1 for the Validation Report,

5 business days, and 30 calendar days, then when Letter 1

is printed, Collect! will take the current date, add 5

days (excluding Saturday, Sunday, and holidays), then add

30 days (including weekends and holidays).

Overrides

WARNING: This is an override section.

WARNING: This is an override section.

The fields here are meant for sites that cannot provide proper

itemization values, but can provide the applicable information

for the Validation Notice.

Balance AT Itemization

This is the balance of the account at the date referenced by

the Itemization Date. This is not a calculated field. It must

be provided by the client.

If you are using the Assigned Amount, then this becomes a

user-defined field, if you remove the reference to it in

the Model Validation Notice.

WARNING: By default, this field acts as an override to the

Assigned Amount field in the Model Validation notice.

To turn this into a user-defined field, open the

Model Validation notice, if you have it, and remove

the references to @fst.bai.

WARNING: By default, this field acts as an override to the

Assigned Amount field in the Model Validation notice.

To turn this into a user-defined field, open the

Model Validation notice, if you have it, and remove

the references to @fst.bai.

Int Since Itemization

This is the interest on the account since the date referenced by

the Itemization Date. This is not a calculated field. It must

be provided by the client.

If you are using the Assigned Amount, then this becomes a

user-defined field, if you remove the reference to it in

the Model Validation Notice.

WARNING: By default, this field acts as an override to the

Assigned Amount field in the Model Validation notice.

To turn this into a user-defined field, open the

Model Validation notice, if you have it, and remove

the references to @fst.isi.

WARNING: By default, this field acts as an override to the

Assigned Amount field in the Model Validation notice.

To turn this into a user-defined field, open the

Model Validation notice, if you have it, and remove

the references to @fst.isi.

Fees Since Itemization

This is the fees on the account since the date referenced by

the Itemization Date. This is not a calculated field. It must

be provided by the client.

If you are using the Assigned Amount, then this becomes a

user-defined field, if you remove the reference to it in

the Model Validation Notice.

WARNING: By default, this field acts as an override to the

Assigned Amount field in the Model Validation notice.

To turn this into a user-defined field, open the

Model Validation notice, if you have it, and remove

the references to @fst.fsi.

WARNING: By default, this field acts as an override to the

Assigned Amount field in the Model Validation notice.

To turn this into a user-defined field, open the

Model Validation notice, if you have it, and remove

the references to @fst.fsi.

Adjs Since Itemization

This is the adjustments on the account since the date referenced by

the Itemization Date. This is not a calculated field. It must

be provided by the client.

If you are using the Assigned Amount, then this becomes a

user-defined field, if you remove the reference to it in

the Model Validation Notice.

WARNING: By default, this field acts as an override to the

Assigned Amount field in the Model Validation notice.

To turn this into a user-defined field, open the

Model Validation notice, if you have it, and remove

the references to @fst.asi.

WARNING: By default, this field acts as an override to the

Assigned Amount field in the Model Validation notice.

To turn this into a user-defined field, open the

Model Validation notice, if you have it, and remove

the references to @fst.asi.

Original Principal

This is the amount of the original debt. Normally, you

enter a dollar amount here, but you can also let Collect!

calculate the Original Principal from transactions posted

to the 'Principal' account.

WARNING: If you manually enter multiple transactions that

are Code 196 and Type Principal, then only the

first transaction entered will update this field.

After entering your transactions, you can also

update this field manually.

WARNING: If you manually enter multiple transactions that

are Code 196 and Type Principal, then only the

first transaction entered will update this field.

After entering your transactions, you can also

update this field manually.

WARNING: If you import multiple transactions that are Code

196 and Type Principal, then all of them will be summed

up and entered in to this field. After that, this

field will not automatically update. You can import

to this field, if you want to enter a specified value.

WARNING: If you import multiple transactions that are Code

196 and Type Principal, then all of them will be summed

up and entered in to this field. After that, this

field will not automatically update. You can import

to this field, if you want to enter a specified value.

This field is grayed out when compound interest is being

charged on the account.

When the debtor has a Judgment, instead of the

Original Principal, the Judgment Principal is used

for financial calculations.

Original Interest

This is the amount of the original interest for the debt,

usually provided by the client. Normally, you enter a dollar

amount here, but you can also let Collect! calculate the

Original Interest from transactions posted to the 'Interest'

account.

WARNING: If you manually enter multiple transactions that

are Code 197 and Type Interest, then only the

first transaction entered will update this field.

After entering your transactions, you can also

update this field manually.

WARNING: If you manually enter multiple transactions that

are Code 197 and Type Interest, then only the

first transaction entered will update this field.

After entering your transactions, you can also

update this field manually.

WARNING: If you import multiple transactions that are Code

197 and Type Interest, then all of them will be summed

up and entered in to this field. After that, this

field will not automatically update. You can import

to this field, if you want to enter a specified value.

WARNING: If you import multiple transactions that are Code

197 and Type Interest, then all of them will be summed

up and entered in to this field. After that, this

field will not automatically update. You can import

to this field, if you want to enter a specified value.

When the debtor has a Judgment, instead of the

Original Interest, the Judgment Interest is used

for financial calculations.

Original Fees

This is the amount of the original fees for the debt,

usually provided by the client. Normally, you enter a dollar

amount here, but you can also let Collect! calculate the

Original Fees from transactions posted to the 'Fees'

account and '181' Transaction Type.

WARNING: If you manually enter multiple transactions that

are Code 181 and Type Fee, then only the

first transaction entered will update this field.

After entering your transactions, you can also

update this field manually.

WARNING: If you manually enter multiple transactions that

are Code 181 and Type Fee, then only the

first transaction entered will update this field.

After entering your transactions, you can also

update this field manually.

WARNING: If you import multiple transactions that are Code

181 and Type Fee, then all of them will be summed

up and entered in to this field. After that, this

field will not automatically update. You can import

to this field, if you want to enter a specified value.

WARNING: If you import multiple transactions that are Code

181 and Type Fee, then all of them will be summed

up and entered in to this field. After that, this

field will not automatically update. You can import

to this field, if you want to enter a specified value.

Original Legal

This is the amount of the original legal amount for the debt,

usually provided by the client. Normally, you enter a dollar

amount here, but you can also let Collect! calculate the

Original Legal amount from transactions posted to the 'Legal'

account and '182' Transaction Type.

WARNING: If you manually enter multiple transactions that

are Code 182 and Type Legal, then only the

first transaction entered will update this field.

After entering your transactions, you can also

update this field manually.

WARNING: If you manually enter multiple transactions that

are Code 182 and Type Legal, then only the

first transaction entered will update this field.

After entering your transactions, you can also

update this field manually.

WARNING: If you import multiple transactions that are Code

182 and Type Legal, then all of them will be summed

up and entered in to this field. After that, this

field will not automatically update. You can import

to this field, if you want to enter a specified value.

WARNING: If you import multiple transactions that are Code

182 and Type Legal, then all of them will be summed

up and entered in to this field. After that, this

field will not automatically update. You can import

to this field, if you want to enter a specified value.

Original Misc

This is the amount of the original miscellaneous amount for the debt,

usually provided by the client. Normally, you enter a dollar

amount here, but you can also let Collect! calculate the

Original Misc amount from transactions posted to the 'Misc'

account and '183' Transaction Type.

WARNING: If you manually enter multiple transactions that

are Code 183 and Type Misc, then only the

first transaction entered will update this field.

After entering your transactions, you can also

update this field manually.

WARNING: If you manually enter multiple transactions that

are Code 183 and Type Misc, then only the

first transaction entered will update this field.

After entering your transactions, you can also

update this field manually.

WARNING: If you import multiple transactions that are Code

183 and Type Misc, then all of them will be summed

up and entered in to this field. After that, this

field will not automatically update. You can import

to this field, if you want to enter a specified value.

WARNING: If you import multiple transactions that are Code

183 and Type Misc, then all of them will be summed

up and entered in to this field. After that, this

field will not automatically update. You can import

to this field, if you want to enter a specified value.

Original Other

This is the amount of the original other amount for the debt,

usually provided by the client. Normally, you enter a dollar

amount here, but you can also let Collect! calculate the

Original Other amount from transactions posted to the 'Other'

account and '184' Transaction Type.

WARNING: If you manually enter multiple transactions that

are Code 184 and Type Other, then only the

first transaction entered will update this field.

After entering your transactions, you can also

update this field manually.

WARNING: If you manually enter multiple transactions that

are Code 184 and Type Other, then only the

first transaction entered will update this field.

After entering your transactions, you can also

update this field manually.

WARNING: If you import multiple transactions that are Code

184 and Type Other, then all of them will be summed

up and entered in to this field. After that, this

field will not automatically update. You can import

to this field, if you want to enter a specified value.

WARNING: If you import multiple transactions that are Code

184 and Type Other, then all of them will be summed

up and entered in to this field. After that, this

field will not automatically update. You can import

to this field, if you want to enter a specified value.

Original Paid

This is the amount of the original paid amount for the debt,

usually provided by the client. Normally, you enter a dollar

amount here, but you can also let Collect! calculate the

Original Paid amount from transactions posted to the '189'

Transaction Type.

WARNING: If you manually enter multiple transactions that

are Code 189, then only the first transaction entered

will update this field. After entering your transactions,

you can also update this field manually.

WARNING: If you manually enter multiple transactions that

are Code 189, then only the first transaction entered

will update this field. After entering your transactions,

you can also update this field manually.

WARNING: If you import multiple transactions that are Code

189, then all of them will be summed up and entered

in to this field. After that, this field will not

automatically update. You can import to this field,

if you want to enter a specified value.

WARNING: If you import multiple transactions that are Code

189, then all of them will be summed up and entered

in to this field. After that, this field will not

automatically update. You can import to this field,

if you want to enter a specified value.

Assigned Amount

This is a summation of Original Principal, Interest, Fees,

Legal, Misc, and Other. Once populated, the "Original" fields

will never update again automatically. You can manually edit

the above fields, if you need to.

WARNING: Editing the "Original" fields will NOT update the

corresponding Transactions and Vice Versa. The

"Original" fields are to allow an agency to track the

amount of the debt at the time of placement, not

the changes since then. If you need to update the

Debtor Owing amount, then you need to update the

applicable Transactions.

WARNING: Editing the "Original" fields will NOT update the

corresponding Transactions and Vice Versa. The

"Original" fields are to allow an agency to track the

amount of the debt at the time of placement, not

the changes since then. If you need to update the

Debtor Owing amount, then you need to update the

applicable Transactions.

Req Valid Amt

This field is to track when an agency receives a request

from a Debtor for validation of the amount of the debt.

Req Clt Backup

This field is to track when an agency contacts the Client

to get supporting documentation for the Debtor for validating

of the amount of the debt.

Sent Valid Amt

This field is to track when an agency sends the supporting

documentation regarding the validation of the amount of the

debt to the Debtor.

Req Orig Cred Info

This field is to track when an agency receives a request

from a Debtor for original creditor information.

Sent Orig Cred Info

This field is to track when an agency sends the original

creditor information to the Debtor.

Orig Lay Pay Amt

This is a dollar field for tracking the last payment amount

at the time of placement. This field will not update automatically.

Orig Last Pay Date

This is a date field for tracking the last payment date

at the time of placement. This field will not update automatically.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org