Transaction

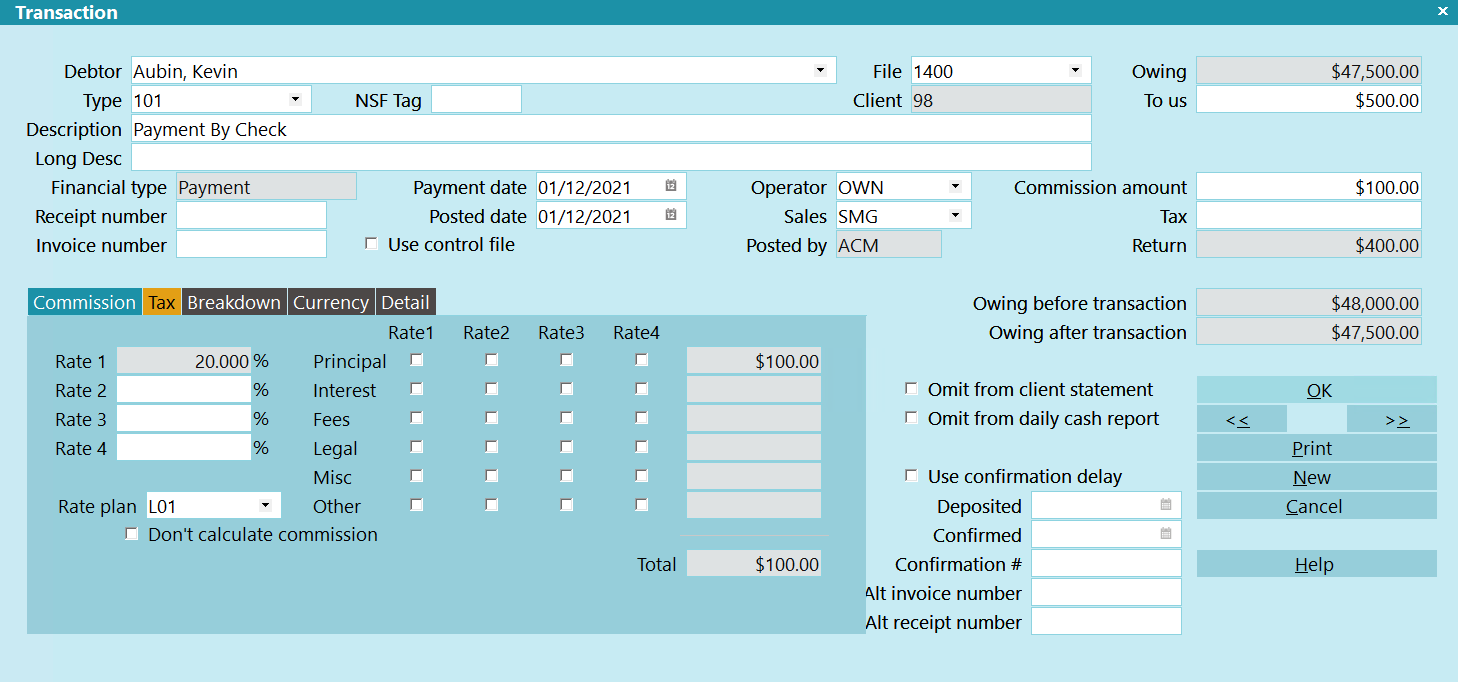

The Transaction form displays many fields where you can

enter the details of a payment or charge posted to a

debtor's account. The information you enter in the

Transaction form is used for many calculations, including,

Debtor Balance Owing, Month End totals for Invoices, Fees

and Operator Commissions.

Transaction

Debtor

This is the Debtor account the transaction pertains to. Press

F2 to pick from the list of Debtors.

If you accessed the Transaction form through

the Transactions tab on the Debtor form, the

Debtor will already be displayed in the Debtor

field and certain financial information will be

filled in already from the Debtor form.

If you accessed the Transaction form through

the Transactions tab on the Debtor form, the

Debtor will already be displayed in the Debtor

field and certain financial information will be

filled in already from the Debtor form.

Type

Select the down arrow or press F2 to view the list of all

Transaction Types in the system. Select the type for

this transaction and its Code will be displayed in the

Type field. You may also notice that several fields on

the Transaction form fill immediately with values taken

from the Transaction Type settings.

The Type enables you to easily identify what kind of

transaction this is. It is often used in reports to classify

or group transactions for calculations or summaries.

Examples of types of transactions:

- Payment

- Charge for items such as NSF charges or NSF check returns

- Legal fees or interest charges

- Commissions

Transaction types are used to organize your

transactions for reporting and accounting purposes.

When you select a Type to categorize the transaction

you are about to post, Collect! applies the settings for

this Transaction Type. Certain fields on the Transaction

form are only visible for a particular Transaction Type.

Also, certain calculations are only performed when a

particular Transaction Type is selected.

Transaction types also fall into groups such as Principal,

Interest, Legal Fees, Adjustments and Other Expenses.

All these details are used by Collect! when printing

Trust Summary Reports. Separate lists and totals are

displayed for various transaction types and groups of

transaction types.

There are several built-in Transaction Types provided

in the Demonstration database. You can copy any of

these to the Masterdb database and you can also create

your own transaction types.

NSF Tag

This field is for posting payment reversals. Normally,

this field can be left blank, but if you have multiple

reversals for the same Payment Date and the same amount,

then you will need to enter a number in this field and

the original payment's NSF Tag field that matches.

Example:

Payment 1 posted on January 1 for $100

Payment 2 posted on January 1 for $100

Payment 1 was reversed on January 3

Payment 2 was reversed on January 5

Payments 1's NSF Tag field should have the number 1 for

both the January 1 and January 3 transactions.

Payments 2's NSF Tag field should have the number 2 for

both the January 1 and January 5 transactions.

File

This is the File Number of the debtor the transaction

pertains to. Press F2 or click on the drop-down arrow

while this field is highlighted to select a debtor.

Client

This is the Client Number of the Client who assigned the

chosen debtor to your company. It is taken from the

Debtor form.

Description

This field stores a brief explanation of this type of

transaction. The Description will be copied automatically

from the Transaction Type settings if you switch ON 'Copy

Description to Transaction' in the Transaction Type form.

You may also add details about this particular Transaction,

such as NSF check number, expense reference number or

other information.

Long Desc

This is a user-defined field that can store up to 999 characters.

Financial Type

The Financial Type sets the financial category of each

transaction. Account types can be Payment, Interest,

Fee, Legal, Misc, Other, Adjustment or Principal.

Whichever type is displayed in the field sets the financial

type of the transaction. This is very important for Collect! to

know how to process the transaction that is being

posted. Transactions are posted to whichever financial

type is displayed, either Payment, Interest, Fee, Legal,

Misc, Other, Adjustment or Principal. The financial type

determines which financial money field on the Debtor

screen is affected.

The available Financial Types are described below.

Payment

Select Payment from the Financial Type pick list

to flag this transaction as a Payment. When you select

a transaction type that is a Payment, the Financial Type

field will automatically display Payment.

A Payment is any amount received by your agency

from a debtor to settle outstanding principal, interest

and fees. The amount is entered in the To Us or

Direct field on the Transaction form. A POSITIVE

Payment amount DECREASES the debtor's Owing.

Payments and charges can be assigned to any

debtor account. Normally, commission is automatically

calculated on transactions flagged as Payment.

Principal

Select Principal from the Financial Type pick list

to flag this transaction as Principal. When you select

a transaction type that is Principal, the Financial Type

field will automatically display Principal.

Amounts posted as Principal include the original amount

owed by the Debtor, or a judgment amount or legal costs.

Depending on the nature of your business, Principal amount

can also be the original price of goods or services rendered,

including finance charges. A POSITIVE Principal amount

DECREASES the debtor's Owing.

When using Compound Interest calculations

in Collect! you MUST post an Original

Principal transaction so that Collect! can

display the breakdown of Principal, Interest

and Fees.

When using Compound Interest calculations

in Collect! you MUST post an Original

Principal transaction so that Collect! can

display the breakdown of Principal, Interest

and Fees.

Collect! internally tracks principal, interest, adjustments

and fees. Fees are also broken down further to provide a

summary of legal fees only.

Interest

Select Interest from the Financial Type pick list

to flag this transaction as Interest. When you select

a transaction type that is Interest, the Financial Type

field will automatically display Interest.

Interest can be entered when you first list an account.

Adjustments can be made as needed to existing interest

calculations. Amounts are entered in the To Us or

Direct fields. A POSITIVE Interest amount DECREASES

the debtor's Owing.

Collect! internally tracks principal, interest, adjustments

and fees. Fees are also broken down further to provide a

summary of legal fees only.

Fee

Select Fee from the Financial Type pick list to flag this

transaction as a Fee. When you select a transaction type

that is a Fee, the Financial Type field will automatically

display Fee.

Any fee charged to the debtor can be entered through

the Transaction form. Amounts are entered in the To Us

or Direct fields. A POSITIVE Fee amount DECREASES

the debtor's Owing.

Collect! internally tracks principal, interest,

adjustments and fees. Fees are also broken down

further to provide a summary of legal fees only.

Legal

Select Legal from the Financial Type pick list to flag this

transaction as Legal. When you select a transaction type

that is Legal, the Financial Type field will automatically

display Legal.

Misc

Select Misc from the Financial Type pick list to flag this

transaction as Misc. When you select a transaction type

that is Misc, the Financial Type field will automatically

display Misc.

Other

Select Other from the Financial Type pick list to flag this

transaction as Other. When you select a transaction type

that is Other, the Financial Type field will automatically

display Other.

Adjustment

Select Other from the Financial Type pick list to flag this

transaction as an Adjustment. When you select a transaction

type that is an Adjustment, the Financial Type field will

automatically display Adjustment.

Adjustments can be posted for interest amounts, fees

or any other type of payment. A POSITIVE Adjustment

amount becomes a negative adjustment, that is, it

DECREASES the debtor's Owing. Negative adjustments

are shown enclosed in parentheses and are deducted

from the debtor's Owing.

Collect! internally tracks principal, interest, adjustments

and fees. Fees are also broken down further to provide a

summary of legal fees only.

Receipt Number

Switch this ON with a check mark if you want Collect!

to automatically assign a Receipt Number to transactions

of this type.

Receipt Numbers need these requirements:

- This switch must be turned ON with a check mark.

- The transaction must be posted to the Payment

account.

- The amount posted must be a positive payment

(credit) To Agency.

If these conditions are not met, Collect will not assign

a Receipt Number even if the switch is ON.

You can also generate receipt numbers for

payments to Commission if you switch

ON "Generate on Commission."

You can also generate receipt numbers for

payments to Commission if you switch

ON "Generate on Commission."

The Receipt Number is determined by adding

one to the highest numbered receipt already

in Collect!. You can change an existing

Receipt Number so that Collect! will start at a

number of your choice.

The Receipt Number is determined by adding

one to the highest numbered receipt already

in Collect!. You can change an existing

Receipt Number so that Collect! will start at a

number of your choice.

Generate On Commission

Switch this ON with a check mark if you want Collect!

to automatically assign a Receipt Number to transactions

of this type.

Receipt Numbers will be generated if:

- The "Receipt Number switch is also ON."

- The transaction must be posted to the

Payment account.

- The transaction must be posted as a positive

amount (credit) to Commission.

Invoice Number

An Invoice Number may be assigned automatically to

this transaction. For Collect! to create an Invoice Number,

three conditions must be met.

- The transaction must be posted to the Fees account.

- The amount posted must be a negative amount (debit)

To Agency or To Client, or a positive Commission

amount.

- The Invoice Number switch must be turned ON in the

Transaction Type settings for this Transaction Type.

If these conditions are not met, Collect does not

automatically assign an Invoice Number to the transaction.

The Invoice Number is determined by adding one to the

highest numbered invoice already in Collect!. You can change

an existing Invoice Number so that Collect! will start at a

number of your choice.

If you're upgrading from an earlier version of

Collect! make sure you set the access rights

to Read Only for this field to avoid Users

changing your Invoice Number sequence.

If you're upgrading from an earlier version of

Collect! make sure you set the access rights

to Read Only for this field to avoid Users

changing your Invoice Number sequence.

Use Control File

Switch this ON with a check mark to tell Collect! to run a

control file on this Transaction. When this switch is enabled,

a "control file" field becomes visible where you can enter

the name of the control file you want to use.

Collect! expects the control file to be in the

{database}\control folder.

Collect! expects the control file to be in the

{database}\control folder.

When enabled, Collect! will not perform any transaction breakdown

for payments. It is assumed that all financial calculations are

handled in the control file.

Control File

Enter the name of the control file you want Collect! to run

on this Transaction. Collect! will add the ".ctf" extension.

If you have set a control file in the Transaction Type, then

this field will fill automatically when you select the Transaction

Type.

This field is only visible when the "Use control file" switch

is enabled.

Collect! expects the control file to be in the

{database}\control folder.

Collect! expects the control file to be in the

{database}\control folder.

Payment Date

This is the actual Date that the Payment is made to

the debtor's account. This is very important for many

financial calculations on the account. It is used to

tally the total displayed in the Paid field on the Debtor

form. When there is interest to be calculated, this

Payment Date is used to accurately compute the interest

for the account. Interest calculation is based on the

ACTUAL Payment Date rather than the date the payment

is reported by the client or posted to the account.

By default Collect! displays today's date. Press F2

to pop up the calendar where you can choose a

different date.

If "Automatically Manage Promises" is switched on

in Payment Posting Options, the Payment Date

will use the Promise Due Date when there is a

Promise Contact set up on the account.

NSF Transactions:

Enter the PAYMENT Date to match the Payment Date of the

transaction being REVERSED. This links the NSF transaction

to the original transaction so the payment breakdown is

properly reversed.

NSF Tag

If you have multiple NSF transactions on the same day for the

same debtor, go to each of the Original Transactions and put

numbers into the NSF Tag field and put the corresponding number

into the reversal's NSF Tag field. This is a secondary link

for multiple transactions. You can use any number (1, 2, 3)

as long as it is unique to the Payment Date and Amount.

Posted Date

This is the calendar date this transaction is entered

into the system. This is very important for financial

reporting on the account. The Posted Date is used

when generating statements to determine if the

transaction falls within the statement Date Range.

By default Collect! displays today's date. Press F2

to pop up the calendar where you can choose a

different date.

One way to keep track of post-dated checks and

promised payments is to post transactions with

no Posted Date. Collect! will ignore the transactions

when calculating debtor Owing and generating

statements.

Operator

This is the Collector the account is assigned to.

It is used in the Operator Analysis Report to

determine Operator commissions.

Select the down arrow or press F2 to view the

list of Operators. This field is automatically filled

from the Debtor form or the Transaction Type

settings.

Sales

This is the Sales person or team assigned to this

account. It is used for commission calculations in

the Operator Analysis Report. Please refer to the

help on that report for more information.

Select the down arrow or press F2 to view the

list of Operators. This field is automatically filled

from the Debtor form or the Transaction Type

settings.

Owing

This is the total amount of the outstanding debt for this

debtor. It is taken from the Debtor's Owing on the Debtor

form. It is used in calculations, statements and reports.

To Us

The To Us field is used to record payments made to the

agency. This field is a positive value for checks or cash,

while NSF charges and similar fees are entered as a

negative value. Positive payments are listed in the daily

bank deposit listing. Entering a positive value decreases

the debtor's Owing and a negative value increases

the debtor's Owing. A commission is calculated from

this amount and is entered into the Commission field.

Transaction Type settings determine

whether this field is displayed. If you don't

see this field and expect to, please review

the Transaction Type you've selected.

Transaction Type settings determine

whether this field is displayed. If you don't

see this field and expect to, please review

the Transaction Type you've selected.

Direct

The Direct field is used to record payments made directly

to the client. A commission is calculated from this

amount and is entered into the Commission field.

The payment is not listed in the daily bank deposit

listing. Entering a negative value increases the

debtor's Owing.

Transaction Type settings determine

whether this field is displayed. If you don't

see this field and expect to please review

the Transaction Type you've selected.

Transaction Type settings determine

whether this field is displayed. If you don't

see this field and expect to please review

the Transaction Type you've selected.

Commission Amount

This Commission Amount will appear on the Client

Statement at the end of month. The Commission

Amount is calculated from the Commission Rate and

the Payment amount To Us or Direct. You can change

the amount or delete it altogether. A positive value will

result in the client being billed for the amount of the

Commission and entering a negative value credits the

client's account.

The calculation percentage depends on

the switch controlling 'Add Commission

to Owing' in the Debtor Financial Detail

form in the Commission section. When that

switch is set, the actual percentage used

when calculating the Commission Amount

will be less than if the switch was not set.

The calculation percentage depends on

the switch controlling 'Add Commission

to Owing' in the Debtor Financial Detail

form in the Commission section. When that

switch is set, the actual percentage used

when calculating the Commission Amount

will be less than if the switch was not set.

If you do not want to calculate the commission,

you can delete the amount in this field. To

have Collect! do this automatically, please

use the 'Don't calculate commission'

setting. But you must set it BEFORE you

enter the payment amount.

If you do not want to calculate the commission,

you can delete the amount in this field. To

have Collect! do this automatically, please

use the 'Don't calculate commission'

setting. But you must set it BEFORE you

enter the payment amount.

Tax

This is the amount of Tax payable on the Commission.

The client will be billed this amount in the next

statement. Tax calculated from the Commission

amount. The Tax Rate is taken from the debtor

information as described above under "Tax Rate."

A positive value causes the client to be billed the

Tax amount on the next statement. A negative

value credits the client with the Tax amount displayed.

Return

The Return indicates the amount of any payment that is not

retained by the agency. This is calculated as the sum of the

To Us and Direct amounts minus the Commission Amount

and Tax.

If you have transactions posted in your system

that predate this feature, this field will most

likely be BLANK. You can tab out of the To Us

or Commission field to refresh the value.

If you have transactions posted in your system

that predate this feature, this field will most

likely be BLANK. You can tab out of the To Us

or Commission field to refresh the value.

Owing Before Transaction

This field indicates the Owing amount on the account before

the transaction is taken into account. This allows you to

preserve information pertaining to the account's owing

history.

If you have transactions posted in your system

that predate this feature, this field will most

likely be BLANK. The feature is on a go forward

basis for new transactions. It reads the current

Owing for the Debtor.

If you have transactions posted in your system

that predate this feature, this field will most

likely be BLANK. The feature is on a go forward

basis for new transactions. It reads the current

Owing for the Debtor.

Owing After Transaction

This field indicates the Owing amount on the account, taking

the totals of this transaction into account. This allows you to

preserve information pertaining to the account's owing history.

If you have transactions posted in your system

that predate this feature, this field will most

likely be BLANK. The feature is on a go forward

basis for new transactions. It uses the current

Owing for the Debtor.

If you have transactions posted in your system

that predate this feature, this field will most

likely be BLANK. The feature is on a go forward

basis for new transactions. It uses the current

Owing for the Debtor.

Omit From Client Statement

While in this field, select the mouse or press the space

bar to flag the field with a check mark. This field may

already be flagged if it is set in the Transaction Type

settings.

When this field is flagged, this transaction will not be

included in the Client Statement generated at period

end. This setting is read from the Transaction Type

settings but can be changed here.

Omit From Daily Cash Report

While in this field, select the mouse or press the space

bar to flag the field with a check mark. This field may

already be flagged if it is set in the Transaction Type

settings.

When this field is flagged, this transaction will not be

included in the Daily Cash Report. This setting is read

from the Transaction Type settings but can be

changed here.

Use Confirmation Delay

If this is switched ON, this transaction will be reported on a

statement only after the period of confirmation delay set in

the Payment Posting Options form. This allows time for a

check to clear before it is included in a client statement.

If you enter a date in the 'Confirmed' field when

this switch is ON, Collect! will evaluate that

date as well when it generates the statement.

Please refer to

How to Use Confirmation Delay of Transactions

for details.

If you enter a date in the 'Confirmed' field when

this switch is ON, Collect! will evaluate that

date as well when it generates the statement.

Please refer to

How to Use Confirmation Delay of Transactions

for details.

Deposited

Date field for your own use to keep track of

check clearing.

Confirmed

This Date field enables you to control how Collect! handles cleared

checks when generating statements.

This date is evaluated for statements ONLY when

the 'Use Confirmation Delay' switch is ON and you

have a value entered in Payment Posting Options

for Confirmation Delay. If you are NOT using

Confirmation Delay, then this field is for your own use.

This date is evaluated for statements ONLY when

the 'Use Confirmation Delay' switch is ON and you

have a value entered in Payment Posting Options

for Confirmation Delay. If you are NOT using

Confirmation Delay, then this field is for your own use.

Enter the Date the check was cleared. If you are using

Confirmation Delay, the date you enter here will override

the Confirmation Delay, enabling you to process checks

as soon as they are cleared, even if the Delay period

has not expired. When statements are generated, the

date entered here will be evaluated, rather than the

Payment or Posted Date, to decide whether or not to

include the transaction in the statement.

You can enter a date in the future to prevent the

transaction from appearing on the statement

until a specific date.

You can enter a date in the future to prevent the

transaction from appearing on the statement

until a specific date.

Please refer to How to Use Confirmation Delay of Transactions

for details.

Confirmation #

Alphanumeric field for your own use to keep track

of check clearing.

Alt Invoice Number

This is a user-defined alphanumeric field.

Alt Receipt Number

This is a user-defined alphanumeric field.

Posted By

This read-only field displays the ID of the Operator

who posted this Transaction.

Commission

Enter up to four commission rates with payment

breakdown settings. Total commission will be

tallied in the Total field.

This is the percent of the debtor's payment which the

agency charges as a fee for services. The dollar amount

of the commission is calculated from this percentage (a

number from 0 to 100) and is automatically entered into

the Commission field. The Commission Rate is read from

the Debtor form or from the Transaction Type settings. It

can be modified on an individual transaction.

Entering a 0 results in $0.00 commission. Enter 100

to retain all of a fee.

Don't Calculate Commission

While in this field, select the mouse or press the space

bar to flag the field with a check mark. This field may

already be flagged if it is set in the Transaction Type

settings.

When this field is flagged, the system will NOT

calculate Commission for this transaction. However,

if you switch this on after you complete entering

your transaction, it will have no effect.

Set this switch BEFORE you enter your

payment amount in the To Us or Direct

fields. If you fail to do this, and you see

an amount in the Commission Amount

field, simply delete it to remove the

calculated Commission.

Set this switch BEFORE you enter your

payment amount in the To Us or Direct

fields. If you fail to do this, and you see

an amount in the Commission Amount

field, simply delete it to remove the

calculated Commission.

Tax

Enter up to four tax rates with payment breakdown

settings. Total tax will be tallied in the Total Tax

field.

This is the rate at which the tax is calculated on

the Commission Amount value displayed in this

transaction. You can enter a rate here or accept

the default rate that may be displayed already

for you.

The default Tax Rate is taken from the debtor

information available when you select the Rate field

in the Debtor form. This displays the

Financial Detail form with a Tax section. Values in

Tax fields are copied to each transaction that you

post with commission and tax calculated.

To switch OFF the calculation of tax, make sure

the box next to 'Don't Calculation Tax' is checked.

Don't Calculate Tax

While in this field, select the mouse or press the space

bar to flag the field with a check mark. This field may

already be flagged if it is set in the Transaction Type

settings.

When this field is flagged, the system will NOT

calculate Tax for this transaction.

Breakdown

This section displays how the transaction amount

is broken down.

Currency

Multi currency settings. This section displays the

Currency the payment was made in. This should be

the Currency of the account if you are using the Collect!

Month End statement process.

If the Debtor pays in a Currency other than the one the

debt was recorded in you MUST convert the Currency

before entering the payment into Collect!

Collect! does not calculate using exchange

rates and currencies. These fields are

provided for your own informational purposes

only.

Collect! does not calculate using exchange

rates and currencies. These fields are

provided for your own informational purposes

only.

Press F1 for details when this section is highlighted.

Detail

This section contains user defined fields for storing

information for reports or your own record keeping.

Press F1 for details when this section is highlighted.

OK

Select this button to save any changes you may

have made to this transaction and return to the

previous form.

<<

Select this button to navigate to the

previous transaction in the database.

>>

Select this button to navigate to the

next transaction in the database.

Last Payment

Select this button to schedule a Plan Contact with a

Due Date matching this Transaction's Payment Date.

This button is visible only if you have

set up Last Payment Plan in the

Payment Plan Setup form.

This button is visible only if you have

set up Last Payment Plan in the

Payment Plan Setup form.

The switch is processed for new transactions only.

For existing transactions it is completely ignored.

If an In Progress Plan Contact already exists, it will be

updated with the new date, otherwise, a new Plan

Contact will be created.

Please refer to Help topic,

How to Run a Contact Plan on the Last Payment Date

for details.

New

Select this button to save any changes you may

have made to this transaction and then display

an empty Transaction form for you to continue to

enter new transactions.

Print

Select this button to view the list of all reports you

can print relating to debtor transactions.

Cancel

Select this button to ignore any changes you may

have made to this transaction and return to the

previous form.

Help

Select this button for help on the Transaction form

and links to related topics.

Payment Details

Click this button to display more information about the

payment from the payment gateway.

This button is only visible on transactions

processed via the Payment Processing Module.

This button is only visible on transactions

processed via the Payment Processing Module.

Delete

This button is visible on the list of all transactions.

Select it to delete the highlighted record from the

database.

Edit

This button is visible on the list of all transactions.

Select it to open highlighted record for editing.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org