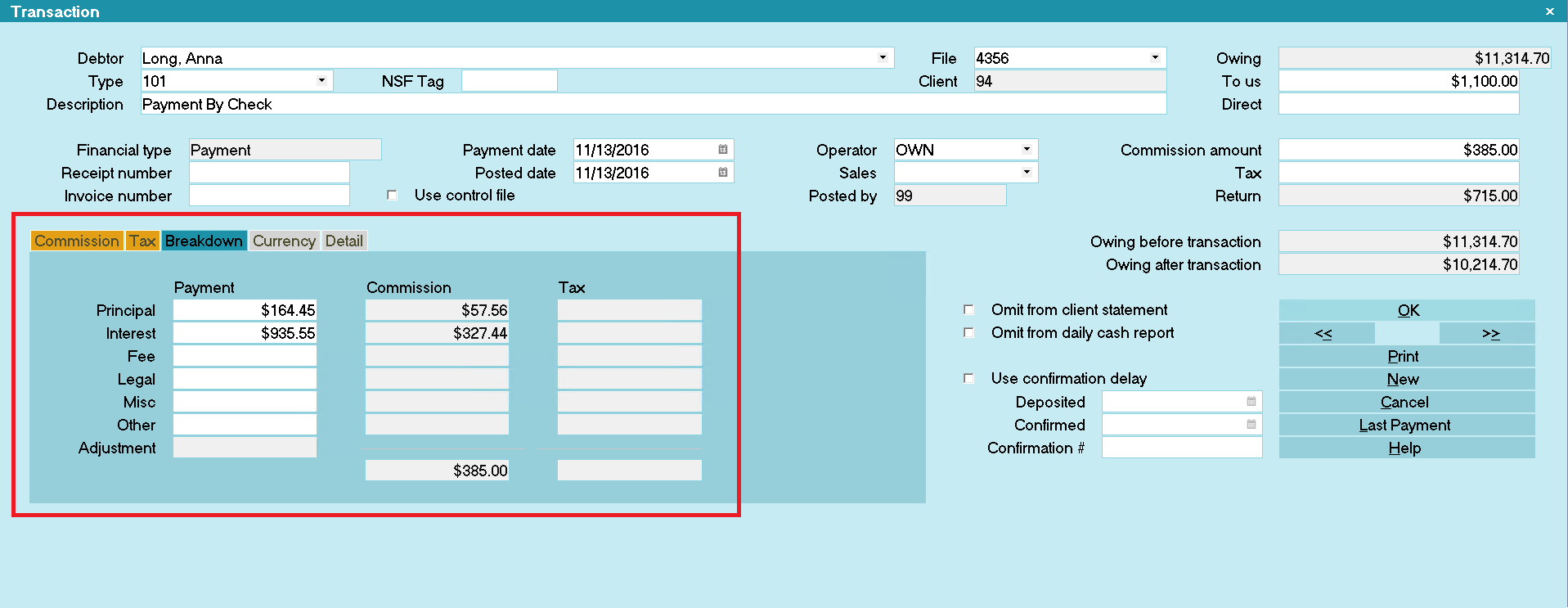

Breakdown

The Breakdown section of the Transaction form displays the

transaction's breakdown details. Select the Breakdown

tab in the Transaction form to view these details.

Breakdown Details

Payment breakdown depends on your settings

in each Payment Transaction Type. According to the settings

in the Transaction Type you choose, payment is disbursed

taking into consideration any payments already posted on

the accounts, any outstanding interest and/or fees and the

total amount of the payment you are posting.

Payment breakdown depends on your settings

in each Payment Transaction Type. According to the settings

in the Transaction Type you choose, payment is disbursed

taking into consideration any payments already posted on

the accounts, any outstanding interest and/or fees and the

total amount of the payment you are posting.

Please review the "Troubleshooting" section before for

important tips.

Payment

This column lists disbursements to Payment.

Commission

This column lists disbursements to Commission.

Tax

This column lists disbursements to Tax.

Principal

This row lists disbursements from Principal.

Interest

This row lists disbursements from Interest.

Fee

This row lists disbursements from Fees.

Legal

This row lists disbursements from Legal Fees.

Misc

This row lists disbursements from Misc.

Other

This row lists disbursements from Other.

Adjustment

This row lists disbursements from Adjustment.

Comm Princ

This is the disbursement to Commission from a

Principal transaction.

Comm Interest

This is the disbursement to Commission from an

Interest transaction.

Comm Fees

This is the disbursement to Commission from a

Fee transaction.

Comm Legal

This is the disbursement to Commission from a

Legal transaction.

Comm Misc

This is the disbursement to Commission from a

Misc transaction.

Comm Other

This is the disbursement to Commission from an

Other transaction.

Princ Tax

This is the disbursement to Tax from a

Principal transaction.

Int Tax

This is the disbursement to Tax from an

Interest transaction.

Fees Tax

This is the disbursement to Tax from a

Fee transaction.

Legal Tax

This is the disbursement to Tax from a

Legal transaction.

Misc Tax

This is the disbursement to Tax from a

Misc transaction.

Other Tax

This is the disbursement to Tax from an

Other transaction.

Commission Amount

This is the total amount of Commission for

this transaction.

Tax Amount

This is the total amount of Tax for this transaction.

Troubleshooting Payment Breakdown

If the payment is posted prior to the Payment Date of the

earliest Original Principal transaction, the payment will

be applied to the "Other" bucket, no matter how you have set up

your breakdown categories. This is because there is effectively

no Principal to apply the payment to on a date that is before the

earliest Original Principal transaction

So please ensure that you are entering a valid Payment

and Posted Date when you post your Payment Transactions.

Breakdown Display

Collect! displays breakdown details for every transaction.

Disbursements to Fees, Principal and so on are shown

in the appropriate "bucket."

When amortized interest is set, the breakdown display mode

is disabled since amortized calculations do not break down

totals on a per transaction basis.

Breakdown display for all transactions is enabled in

Collect! Version 11.5 build1.1 and newer. This enhancement

is enabled for new transactions as they are posted and for

existing transactions, if they are modified. In earlier versions

of Collect!, breakdown details are displayed only for "Payment"

type transactions with "Payment breakdown" enabled.

Breakdown display for all transactions is enabled in

Collect! Version 11.5 build1.1 and newer. This enhancement

is enabled for new transactions as they are posted and for

existing transactions, if they are modified. In earlier versions

of Collect!, breakdown details are displayed only for "Payment"

type transactions with "Payment breakdown" enabled.

Custom Breakdown

You can configure your own custom breakdown using a

control file. In Collect! version 11.5 Build 1.1 and newer,

the "Use control file" switch may be used. If a control file is

present and the switch is ON, the transaction will run the

control file instead of calculating the breakdown. It is assumed

that the control file will populate the breakdown buckets.

If the control file fails to execute or doesn't exist, or the

switch is OFF, then Collect! will break down the values normally.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org