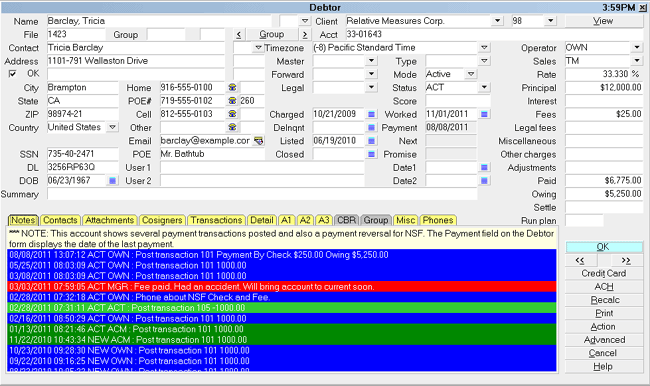

Debtor

The Debtor form stores all information that you need to work

and manage your accounts. Personal, financial and in-house

management information is displayed on the form. Tabs enable

you to open subforms to access various types of related

information, such as contacts scheduled for the debtor,

financial transactions posted, bank information and other

debtor details, cosigners and attachments. When you select

financial fields on the Debtor form, additional financial details

are displayed in summary screens.

Debtor form

Please refer to Debtor Basics for steps to access

this form.

Please refer to Debtor Basics for steps to access

this form.

Collect! uses the information entered in the Debtor form to:

- Help you manage your collectors' workloads

- Perform financial calculations

- Print a broad array of reports

- Keep track of all activity on each account

Information on the Debtor form can be loaded automatically

for each new Debtor that you create. This speeds up data entry

and minimizes errors. First, the settings and details are entered

into the other areas of Collect!. Then they are readily available

when each new Debtor is entered. For details, please see

- How To Enter A New Debtor

- How To Setup Debtors (Administrative concerns)

Name

The Name of the debtor entered as ' Last, First / Middle initial'.

Please ensure your spelling is correct. This field is INDEXED.

If you type a comma in the name, Collect! will split first and

last names automatically and put the result into the Contact

field below. For example, JONES, SAM = Sam Jones.

If you do not place a comma between the last and first name,

Collect! will assume the name is a business name.

FOR CBR: Hyphenate multiple last names,

e.g. 'Van-Deusen, Jack'.

FOR CBR: Please put ONE Debtor name ONLY

in this field. If you have a Cosigner,

use the Cosigner form.

FOR CBR: Don't include Generation titles in the

name here. Use the Generation field.

FOR CBR: When reporting Commercial accounts,

Collect! can detect a business name as long

as there is no comma in the Name. If there

are commas in the business name, please

ensure that you switch ON "Business/Commercial"

in the ECOA designation when setting up this

account for reporting.

Legal Entity

Press F2 or select the arrow to pick the Legal Entity

title of the Debtor. For example, Jr, Sr, II, III, Ltd. or Inc.

This field is optional.

FOR CBR: If there is a Legal Entity title for this

Debtor, it MUST go here, NOT in the

Name field.

File

The File Number of this account is automatically created

by Collect!. It looks at the highest numbered debtor and

adds 1 for numbering a new debtor. File Number is a

UNIQUE identifier for each account, up to 9 digits in

length. You must not have duplicate File Numbers in

your database.

Collect! uses this File Number for several functions, such

as storing Attachment and Data records attached to the

account. It is also sent as the UNIQUE identifier when

processing accounts for credit bureaus, letter service

and eBureau.

This field is INDEXED.

FOR CBR: the File Number must not change

while the account is being reported.

Collect! does allow you to modify the File

Number, if needed. Remember that you can

use up to 9 digits here. Each account must

have a UNIQUE File Number.

Collect! does allow you to modify the File

Number, if needed. Remember that you can

use up to 9 digits here. Each account must

have a UNIQUE File Number.

Contact

This is the name of the Contact person at the address

or phone number. This field is INDEXED. Unless you enter

a different name manually, Collect! uses the information in

the Debtor Name field to construct the Contact name.

Generation

Press F2 or select the arrow to pick the Generation of the

contact person. (Jr, Sr, II, III etc.) This field is optional.

Address

This is the Address of the debtor, if it is known. Two lines are

available. If you enter text into the first line, the Print switch

(Address OK) will be set automatically. This will enable printing

notices to this debtor using contact plans and action codes.

When you change an existing debtor Address line, the old

address line will be written automatically to the debtor's Notes.

*** IMPORTANT *** If you ever intend to report to

Credit Bureaus, you must use one of the

following address formats or an error will result.

FOR CBR: There are two acceptable formats:

- Format 1:

- Address = street address

- Addr1 = blank

- City = city

- State = state

- Zip = zip

- Country = country code

- Format 2:

- Address = street address

- Addr1 = suite or apartment number

- City = city

- State = state

- Zip = zip

- Country = country code

Do not include the # symbol in the

apartment number. The Credit Bureau

rejects addresses with the # sign.

Do not include the # symbol in the

apartment number. The Credit Bureau

rejects addresses with the # sign.

Street Number

Optionally, you can enter the Street Number here. This

provides a means of searching and/or filtering by street name.

This field is optional.

FOR CBR: Do not use this field if you intend to

report to the credit bureaus.

Addr 1

This is another Address line for the debtor. Use this line to enter

Suite or Apartment number if you intend to report to credit bureaus.

FOR CBR: Do not use the words "Suite", "Apt.",

etc. or the '#' symbol, just enter the

Number of the suite or apartment.

FOR IMPORTING: If you have a data file that combines city, state,

and zip into one field or string (Example: Los

Angeles CA 90210), you can import it into the

Addr 1 field and the import module will separate

the string into the applicable city, state, and

zip fields. In order for this to work, the city,

state, and zip fields can not have any existing

data in the fields.

Street Type

Optionally, you can enter the Street Type here. This field

is a numeric field.

You can add a pick list to this field for your own

needs.

You can add a pick list to this field for your own

needs.

FOR CBR: The information in this field is not sent to

credit bureaus.

Address OK

The Print Notice (Address OK) switch controls whether or not

letters are printed to this debtor. If the box contains a check mark,

letters will be printed. If it is blank, letters will NOT be printed for

the debtor. Only set this switch to print (by clicking into the box

to create a check mark), if you have a valid address to send notices

and letters to. Collect! checks the first line of the address. If it

finds an address, it will turn this switch ON automatically by

entering a check mark in it.

FOR CBR: Entering the correct address status

is important if you are reporting to CBR.

*** NOTE If this box is blank or you remove the check mark

from the box by clicking into it, the address fields

in the Debtor form change color. This is to alert the

operator that there is no valid address for this

debtor. This is the first step in skip tracing.

You can fine-tune Address OK functionality for

printing your daily letter batch. Please refer to

Help topic, Required Address Fields for

additional options for validation addresses.

You can fine-tune Address OK functionality for

printing your daily letter batch. Please refer to

Help topic, Required Address Fields for

additional options for validation addresses.

City

Enter the City Name here.

This field is INDEXED.

FOR CBR: truncate the rightmost positions

in this field to 20 characters. Alternatively,

you can use the standard 13-character

U.S. Postal Service city abbreviations.

State

Enter the State Name or Code here.

This field is INDEXED.

FOR CBR: you must enter State Codes in this

field. Refer to your CBR manual for

correct State Codes.

ZIP

Enter the Zip or Postal Code here.

This field is INDEXED.

FOR CBR: the zip or postal code must be entered

and it must be correct. The zip code may

be either 5 or 9 digits for U.S. zip codes,

or 6 digits for Canadian postal codes.

For example: 12345-6789 or 123456789 for U.S.and

X2Y 3Z4 or X2Y3Z4 for Canada.

Country

Enter the Country where the Debtor lives.

This field is INDEXED.

FOR CBR: The Country Code is read from the

Country Code field in Credit Report Details

for the debtor. Collect! uses standard

two-character country abbreviations

specified in the Metro 2 manual.

If you are not doing Credit Bureau Reporting, this field is optional.

Timezone

This field holds a POSITIVE or NEGATIVE integer

indicating the Timezone of this Debtor. Timezones

are standard integer values calculated from GMT

(Greenwich Mean Time). You can use the value in

this field to load contacts in the operator's

work queue according to the account's local time.

Please refer to Reload Work In Progress List for

details.

The control file that manages Debtor timezones

is called setzone.ctf and is stored in your

"\CV11\masterdb\control" folder.

As of version CV11.6.2.1, control files to set

timezones for Cosigners/Other Parties and record

items stored in the Phone tab are available for

download from the Member Center. They are

DCsetzone.ctf and PHsetzone.ctf, respectively.

If you are not currently a Member, contact

Administration at 250-391-0466 option 3 for pricing.

When the timezone is not "Local Time," the

title bar displays the Debtor's current

time.

When the timezone is not "Local Time," the

title bar displays the Debtor's current

time.

SSN

This is the Social Security Number of the Debtor.

If you are NOT reporting to credit bureaus, you

can use this field for other purposes.

This field is INDEXED.

FOR CBR: this field must be filled in.

If SSN is not known, Please check with

your Client/Account provider for the

required information.

DL

Debtor's Driver's License. You can use this

field for other purposes. This field is INDEXED.

DOB

This is the Debtor's Date of Birth.

This field is INDEXED.

Press F2 or select the small calendar icon. Select a

Date from the calendar that is displayed. Use the arrows

to scroll through years. Or type the date as MM DD YY.

If you are not reporting to credit bureaus, you can use

this field for other purposes. This field is INDEXED.

FOR CBR: Date of Birth must be entered. If DOB is not known,

Please check with your Client/Account provider

for the required information.

Group

The Group button allows you to group this debtor. When the

Debtor is in a group, the Group will display a Group ID

number and a Group Member number. All members in the

group share the same Group ID. The Group ID is INDEXED.

If the debtor is already grouped, the Group button will display

as yellow, instead of grey, and will display the debtor's

Group ID and Member number. To view other debtors in the

group, click the forward or backward arrow or press the Group

button to view Matching Accounts, or select the GROUP

tab.

If the debtor is not part of a group, you will be

prompted to choose debtors to form a group.

If the debtor is already part of a group, then

Matching Accounts information displays.

If the debtor is not part of a group, you will be

prompted to choose debtors to form a group.

If the debtor is already part of a group, then

Matching Accounts information displays.

Pressing the "G" key on your keyboard

will prompt you to add this account to

a group.

Pressing the "G" key on your keyboard

will prompt you to add this account to

a group.

Group Member

If this debtor is grouped, it will be assigned a

sequential number based on the order in which it

was added to the group.

If your Group Member IDs are no longer

sequential due to removing members from

the group, you can run the Tools, Utilities,

Group Member Renumbering utility to

restore sequential numbering to each group.

Home

This is the Home or Personal Telephone Number of the debtor.

This field is INDEXED. It holds up to 23 characters.

When you change an existing phone number, the

old number will automatically be written to the debtor's

notes. Select the telephone icon to initiate the

Phone Dialer to dial this number.

If your system is not setup for using

the Phone Dialer, you will not be able to

use this feature.

You can switch ON 'Only numerics in phone fields'

in Screens and Messages to remove any non-numeric

data from your phone fields.

Home Extension

This field is used to enter an Extension to the phone

number if needed. It might also be used to enter an

ID number.

POE#

This is the Work or Business Telephone Number of the debtor.

This field is INDEXED. It holds up to 23 characters.

When you change an existing phone number, the old

number will automatically be written to the debtor's notes.

Select the telephone icon to initiate the Phone Dialer

to dial this number.

If your system is not setup for using

the Phone Dialer, you will not be able

to use this feature.

If your system is not setup for using

the Phone Dialer, you will not be able

to use this feature.

You can switch ON 'Only numerics in phone fields'

in Screens and Messages to remove any non-numeric

data from your phone fields.

Work Extension

This field is used to enter an Extension to the phone

number if needed. It might also be used to enter an

ID number.

Cell

This is the Cellular or other number where you can reach the

debtor. This field is INDEXED. It holds up to 23 characters.

Select the telephone icon to initiate the Phone Dialer to

dial this number.

If your system is not setup for using the

Phone Dialer, you will not be able to use

this feature.

If your system is not setup for using the

Phone Dialer, you will not be able to use

this feature.

You can switch ON 'Only numerics in phone fields'

in Screens and Messages to remove any non-numeric

data from your phone fields.

Cell Extension

This field may be used to enter an Extension

to the phone number if needed. It might also

be used to enter a Cellular ID number.

Other

Use this field for an additional Phone Number. This field is

INDEXED. It holds up to 23 characters. Select the telephone

icon to initiate the Phone Dialer to dial this number.

If your system is not setup for using the

Phone Dialer, you will not be able to use

this feature.

If your system is not setup for using the

Phone Dialer, you will not be able to use

this feature.

You can switch ON 'Only numerics in phone fields'

in Screens and Messages to remove any non-numeric

data from your phone fields.

Other Extension

This field may be used to enter an Extension

to the phone number if needed. It might also

be used to enter an ID number.

Email

This field is used to enter the debtor's Email

Address. This field is INDEXED. Select

the field icon to open the Send Mail form

where you can compose an email and send it

to this debtor.

POE

Place of employment.

User 1

This field is for your own definition and use, but it may have

another function if you are reporting to credit bureaus.

If you are reporting to credit bureaus, this

field may contain Original Creditor information.

Please refer to Client Settings for details.

If you are reporting to credit bureaus, this

field may contain Original Creditor information.

Please refer to Client Settings for details.

User 2

This field is for your own definition and use, but it may have

another function if you are reporting to credit bureaus.

If you are reporting to credit bureaus, this

field may contain Original Creditor information.

Please refer to Client Settings for details.

If you are reporting to credit bureaus, this

field may contain Original Creditor information.

Please refer to Client Settings for details.

Client

Enter the Name of the Client in this field. You can

pick from your list of clients by pressing the F2 key

when the Client field is highlighted.

Your clients MUST be set up before

you begin to enter debtors.

Your clients MUST be set up before

you begin to enter debtors.

Acct

This is the Reference Number assigned to this debtor by

the client. This is printed on statements to your clients.

This field is INDEXED.

Client Number

This is the Client Number assigned by Collect!.

When you select a Client for the Client field,

the Client Number displays in this field. Also,

you may select a Client by selecting the pick

list attached to this field.

This field will change automatically if you change

the client's Number in the Client form.

You must set up clients before you

begin to enter Debtor information.

You must set up clients before you

begin to enter Debtor information.

View

Select this button to open the Client form for

this Debtor's client. This enables you to quickly

view the client's information with a single click.

Master

Click the arrow to view clients that you may select from for

this field.

This field is limited to 4 characters only.

If you are using longer Client Numbers

you may want to use the Client Owner

feature instead to create a Client with

a shorter client Number.

This field is limited to 4 characters only.

If you are using longer Client Numbers

you may want to use the Client Owner

feature instead to create a Client with

a shorter client Number.

Client ownership is a hierarchical system that

allows you to use the "Owned by client"

in the Client form.

Client ownership is a hierarchical system that

allows you to use the "Owned by client"

in the Client form.

Forward

Click the arrow to view clients to whom you can

forward this account.

Legal

The Legal field gives you a place to put an attorney that

you may want to forward this account to. Click the arrow

to display a list of clients.

You will have to setup your attorney client

first so that it shows up in the list of all clients.

Please refer to How To Post Attorney Fees

for information about setting up an attorney

client.

You will have to setup your attorney client

first so that it shows up in the list of all clients.

Please refer to How To Post Attorney Fees

for information about setting up an attorney

client.

Charged

This is the date the debt was originally incurred by the debtor.

This date is also used when applying an age-based

commission rate plan to the account. In that case, both Listed

and Charged dates are required to calculate the account age.

FOR CBR: If you do not enter a Delinquency Date, Collect!

automatically uses the Charged Date. For credit

grantors, a switch in the Credit Bureau Setup

form, 'Report charged date', allows the Charged

Date to be used instead of the Debtor's Listed

Date as the 'Date Opened' for CBR reporting

purposes.

Delnqnt

This is the date the account went Delinquent. This is usually

the date the account went 31 days past due.

Enter this date manually if you are a collection agency.

Or, the date can be filled in automatically by Collect!

as '31 days prior to the Listed Date' by turning on the

'Delinquent 31 days prior to listing' switch in the

Client Settings form.

FOR CBR: This is the 'Date of Occurrence'. If you do

not enter a Delinquency Date, Collect!

automatically uses the Charged Date.

FOR CBR: If you are a CREDIT GRANTOR and you

have switched ON ' Report as credit grantor'

in the Company Details form, an unmet

promise or a missed payment will show up

as delinquent in the debtor's Delnqnt field.

You must also switch ON 'Calculate

delinquency date' in the Financial Detail

form. The 'Calculate delinquency date'

check box is in effect only when you are

in Credit Grantor mode.

This date affects a person's credit

rating, so use it carefully.

This date affects a person's credit

rating, so use it carefully.

Delinquency Date For Credit Reporting

If you do not fill in a Delinquency Date, the credit

reporting function will use the Charged date, also known

as the 'Date of Last Service' or 'Service Date' and will

issue warnings to you.

You MUST provide a Delinquency Date for all

accounts reported to credit bureaus. The

Delinquency Date is defined as the date of the first

delinquency that led to the derogatory status being reported.

The date of delinquency is necessary to purge accounts

from the bureau databases in accordance with the

Fair Credit Reporting Act (FCRA).

The date an account is charged off or placed for collection,

is NOT the Delinquency Date. The Delinquency Date

should be the date the account became 31 days past due.

Listed

This is the Date the debtor was Listed with your agency.

Listed Date is automatically filled in when you create a

new debtor. This field is used in numerous reports and

is important to accurately keep track of your accounts.

This field is INDEXED.

FOR CBR: When reporting to credit bureaus,

this date is used for 'Date Opened'.

For credit grantors, a switch in the

Credit Bureau Setup form, 'Report charged

date', allows the Charged Date to be used

instead of the Debtor's Listed Date as

the 'Date Opened' for CBR reporting purposes.

For credit grantors, a switch in the

Credit Bureau Setup form, 'Report charged

date', allows the Charged Date to be used

instead of the Debtor's Listed Date as

the 'Date Opened' for CBR reporting purposes.

Closed

This field shows the Date When the Account was

Closed. It is visible only when an account is closed.

This field is INDEXED.

When you set the Mode to CLOSED, this

field auto-fills with the current date. This

may be modified as needed for your

purposes.

When you set the Mode to CLOSED, this

field auto-fills with the current date. This

may be modified as needed for your

purposes.

FOR CBR: This date is used for 'Closed Date'.

Type

This is a free form field. You can define your own types of

debts, or use this field as a sort criteria. This field is INDEXED.

You can attach a pick list to this field (as you can with

most fields in Collect!). Select System from the top menu

bar and then select Layout and Languages, Field Properties

to attach a pick list.

Mode

This is a very important field. The setting you

choose here affects contact management and

financial calculations. This field is INDEXED.

Select the field or select the arrow to choose

one of the following modes.

Active - activates the account.

Closed - closes the account and deletes all

pending Contacts, UNLESS a Contact has

the switch "Do not autodelete" set. However,

Promises and Transactions will be marked

completed when an account is closed,

regardless of the "Do not autodelete" setting.

Precollect - treats the debtor as 'Closed' but

does not delete Contacts.

Suspend - treats the debtor as 'Closed' but

does not delete Contacts.

Mode And WIP List

Only ACTIVE accounts appear in WIP Lists.

CLOSED or SUSPENDED accounts do not show even

if they have contacts scheduled for the day.

Closed Mode And Interest

When you close an account with interest, Collect!

posts a Total Accrued Interest transaction, Type 499,

for all interest that has accrued over the time that you

have been calculating interest on the account. If you

should re-open the account at a future date, this

record can be used to start up interest calculations

again.

Collect! needs Transaction Type 499, with

the correct settings, to perform the

calculations. If you do not have

Transaction Type 499, you can copy it

from your Demonstration database or

request it from Collect! Member Services.

Collect! needs Transaction Type 499, with

the correct settings, to perform the

calculations. If you do not have

Transaction Type 499, you can copy it

from your Demonstration database or

request it from Collect! Member Services.

Mode And CBR

Mode does not affect credit bureau reporting. As

long as "Report to credit bureau" is switched ON in

the Debtor's Credit Report Details, Collect! will continue

to report this Debtor, no matter what Mode is selected.

Status

This is the Status of the Account.

This field is INDEXED.

Press F2 or select the arrow to pick from a

list of Debtor Status codes. You can create

your own account status codes.

Score

Use this numeric field to store the

Debtor's credit score. This field holds up to

9 digits. Previous entries are logged

to notes whenever the Score is updated if

you have your 'Log to Notes' Access Right

switch checked. Right click in the Score

field to open the Access Rights window.

This field can be displayed in the Collector's

WIP List for targeted queueing of High to Low

Score accounts.

To insert the field into a WIP display, Right

Click on the column header beside where you

wish to insert the field. You will get a popup

which has options to Insert Fields. Select

this option and use your Up/Down arrow keys to

scroll down to Score until it is highlighted,

then click OK to insert the field.

Fields can be dragged and dropped if you wish

to rearrange the positioning.

The Score column can be sorted ascending or

descending by clicking on the black triangle

at the extreme right side of the field title.

Worked

This is the Date the debtor was Last Worked by an

operator.

The Worked Date is filled in, or updated,

automatically only when an operator is physically

working the account by doing one of the actions

listed below.

1. An operator creates or modifies the notes on

the account.

2. An operator runs a contact plan on the account.

The Worked Date is not updated by any other

method. You can not edit this field. It is used in

numerous reports and is important to accurately

keep track of your accounts.

When the Worked Date is the current date, this

field turns red to alert the operator that this

account has already been worked today.

Payment

This is the Date of the Last Payment made by the debtor.

Collect! automatically changes that date whenever a

transaction is posted for the debtor.

FOR CBR: When reporting to credit bureaus, this

date is used as the Date of the Last

Consumer Payment.

If the debtor has made a payment to the agency,

the Payment Date is used instead of the Charged

Date above.

You can inhibit Collect! from automatically altering the

date with a switch in the System menu,

Preferences, Plans and Reference Tables,

Payment Posting Options form.

If you turn off this switch and don't intend to do

Credit Bureau Reporting, you can use this field for

anything you want.

Next

This is the Next Payment Date field. The debtor's Next field

contains a date when you are applying Amortized interest

to the account. It is the date that the next payment is due.

This field is read only.

Next Payment Date is calculated as follows:

If the debtor is neither delinquent nor overpaid, according to

the amount in the Payment Amount field, then the Next Date

is the date the next scheduled payment is due, based on the

interest settings in the Interest Detail form. For example, if it

is early September, and the account is paid up, then the next

payment date could be September 31 or some such date in

the near future.

If the debtor is delinquent, then the Next Date shows

the last date when the debtor should have made a

payment. For example if it is September, and no payment

has been received for the July 31 payment, then the

next date would show July 31 in RED to indicate

delinquency.

If the debtor has overpaid, then the Next Date rolls forward

into the future to reflect the number of monthly payment

periods that have actually been covered in the overpayment

amount.

The ' Report as credit grantor' switch must be

turned ON in the Credit Bureau Setup form to

activate the Next payment date calculations

for Credit Bureau Reporting.

The ' Report as credit grantor' switch must be

turned ON in the Credit Bureau Setup form to

activate the Next payment date calculations

for Credit Bureau Reporting.

Promise

When a debtor has made a promise to pay, this field shows

the date that the promise is due. If the date is not displayed,

try pressing the Recalc button.

If there is more than one promise recorded for this debtor,

the date of the earliest unmet promise is displayed here.

Promises can be entered into Collect! by

creating a Promise Contact or by creating a

Transaction with no Posted Date. In either

case, Collect! will automatically display the

earliest due date of the debtor's promises in

this field IF "Automatically manage promises"

is switched ON in the Payment Posting Options

form.

Promises can be entered into Collect! by

creating a Promise Contact or by creating a

Transaction with no Posted Date. In either

case, Collect! will automatically display the

earliest due date of the debtor's promises in

this field IF "Automatically manage promises"

is switched ON in the Payment Posting Options

form.

When a promise becomes Past Due, this field is displayed

in red unless the " Report as credit grantor" switch is ON in

the Credit Bureau Setup form. In that case, only, past due

promises are considered delinquent and the date is displayed

in the Delnqnt field on the Debtor form.

You can open the Payment Posting Options

form through the System menu, Preferences,

Plans and Reference Tables.

You can open the Payment Posting Options

form through the System menu, Preferences,

Plans and Reference Tables.

Date1

This is a date field for your own definition and use.

Date2

This is a date field for your own definition and use.

Summary

This is a single Note Line to Summarize the account status

and add any pertinent vital information.

Last Action

This field is a shortcut to activating a Contact Plan. If you

know the code of the Contact Plan you wish to run on this

debtor, you can type it here or press F2 to pick from a list.

This field is located to the left of the OK button on the

Debtor form.

Typing the code here will not execute the plan

unless you press ENTER to leave the field.

Typing the code here will not execute the plan

unless you press ENTER to leave the field.

Operator

This is the ID of the Operator assigned to this account.

It is important to fill in this field since many other account

related functions depend on this Operator ID. For instance,

if you are using Account Access Control, this ID may be

used for restricting access to the account. Also, contact

scheduling and timely working of the account often rely

on this ID.

This field is INDEXED.

Press F2 when this field has focus or click

the arrow to pick from a list of available Operators.

Sales

This is the ID Code of the Salesperson assigned

to this account. When payments are posted, this ID is

used to determine collector's commission.

This field may also be used to display a Team ID

for commissions or for account access control.

This field is INDEXED.

Press F2 when this field has focus or select the

arrow to pick from a list of available Operators.

Rate

This is the current Commission Rate for payments

made by the debtor. If a commission rate is entered

in your Client Settings, the Rate field will be filled

automatically when you choose a client or enter a

new debtor for a client. You can override the setting

by entering a rate that applies only to this debtor.

Information is not entered in this field directly. The

Rate field displays information taken from the

Commission section of the Financial Detail form. Click into

his field or start typing to pop up the form where you can

select the Commission section to enter a enter a new

commission rate, or rate plan, and other commission

details for this account.

Any transactions that you post for this debtor load

the settings from the Financial Detail form.

Principal

This is the amount of the Original Debt, or the sum of

all transactions posted to the Principal account. (This

means Principal is dotted in the transaction 'Account'

column.) Information is not entered in this field directly.

The Principal field displays information taken from

the Financial Detail form. Click into this field, or start

typing, to pop up the Financial Detail form where you

can enter a Principal Amount or view the Principal Paid

To Date and other details for this account. Please press

F1 when the Financial Detail form is displayed for help

about the fields and buttons on this form.

When the debtor has a judgement, the Principal field will

be "overlaid" by the Judgement field which will be shown

in color. In this case, the Owing field will be calculated

based on the Judgement Principal and Judgement Interest,

rather than the Original Principal and Interest.

You can also set the debtor's currency here, if you have

the ' Multi Currency' switched ON in the Company Details

form.

If you are a Credit Grantor, you can choose to

display 30/60/90 fields on the Debtor form by

switching ON 'Show 30/60/90' in the Financial

Detail form.

For revolving compound interest accounts or

Amortized loan accounts, please access

the help available for these topics.

If you start typing the Principal in this field,

Collect! will open the Financial Detail field

with the Original Principal highlighted to

speed up your data entry.

If you start typing the Principal in this field,

Collect! will open the Financial Detail field

with the Original Principal highlighted to

speed up your data entry.

Judgement

When a judgement has been awarded, this field will

display the amount of the judgement. This field "overlays"

the Principal field. To view the amount of the Original

Principal, click in the field to bring up the Financial Detail

form.

All transactions posted prior to the

Judgement Date are ignored.

All transactions posted prior to the

Judgement Date are ignored.

If a debtor has a Judgement, all principal type transactions

that are not 194s are ignored and ALL transactions prior to

the Judgement Date are ignored.

Judgement interest calculation, if enabled, will always be

based on the 194 transaction, if present.

Multiple 194 and 195 transactions are ignored. The active

one is the most recent of each. If a Judgement Date is set,

ALL other Principal type transactions are ignored.

Interest

This field displays the Total Interest for this account. This

is the sum of Original Interest and all Accrued Interest

on this account. Information is not entered in this field directly.

The Interest field displays information taken from the

Financial Detail form. Click into the Principal field to pop

up the Financial Detail form where you can set and view all

interest details for this account.

Click into the Interest field or start typing to display

the Debtor Transaction Summary to view the list of

Interest transactions posted to this account. Press F1

for help when the Debtor Transaction Summary

is displayed.

If you want interest to be calculated for a given debtor, you

must enter an interest rate for the account in the

Financial Detail form. For revolving compound interest

accounts or Amortized loan accounts, please access

help when on these topics.

When the debtor has a Judgement, the Principal field

label changes to " Judgement" and the field is displayed in

color. Also, the Interest field displays only Judgement

Interest. The amount displayed in the Owing field is

calculated based on the Judgement Principal and

Judgement Interest, rather than the Original Principal

and Interest.

Fees

This field is a summary of all Fee transactions belonging

to this debtor. Information is not entered in this field directly.

The Fees field displays information taken from the

Financial Detail form.

To view Total Fees and Fees Paid To Date, click into

the Principal field to display the Financial Detail form.

There you can also Add Commission to the debtor's

Owing, assign fixed fees to both the client and the debtor

and view the Total Commissions earned to date on this

account.

Click into this field or start typing to pop up the

Debtor Transaction Summary form where you can view

a list of all Fee transactions posted to this account.

Legal Fees

This field is a summary of all Legal Fee transactions belonging

to this debtor. Information is not entered in this field directly.

The Legal Fees field displays information taken from the

Financial Detail form.

To view Total Legal Fees and Legal Fees Paid To Date, click

into the Principal field to display the Financial Detail form.

Click into this field or start typing to pop up the

Debtor Transaction Summary form where you can view

a list of all Legal Fee transactions posted to this account.

Miscellaneous

This field is a summary of all Misc transactions belonging

to this debtor. Information is not entered in this field directly.

The Misc field displays information taken from the

Financial Detail form.

To view Misc and Misc Paid To Date, click into the Principal

field to display the Financial Detail form.

Click into this field or start typing to pop up the

Debtor Transaction Summary form where you can view

a list of all Misc transactions posted to this account.

Other Charges

This field is a summary of all Other transactions belonging

to this debtor. Information is not entered in this field directly.

The Other Charges field displays information taken from the

Financial Detail form.

To view Other and Other Paid To Date, click into the Principal

field to display the Financial Detail form.

Click into this field or start typing to pop up the

Debtor Transaction Summary form where you can view

a list of all Other transactions posted to this account.

Adjustments

This field is the sum of all Adjustment transactions

belonging to this debtor. Information is not entered in this

field directly. The Adj field displays information tallied

from Adjustment transactions posted for this account.

Click into this field or start typing to pop up the

Debtor Transaction Summary where you can view

Adjustment transactions already posted to the account.

Paid

This is the Amount Paid by the debtor. This can be a

negative number if there are charges incurred on

the account. Information is not entered in this field

directly. The Paid field displays information tallied

from Payment transactions posted for this account.

Click into this field or start typing to pop up the

Debtor Transaction Summary where you can view

Payment transactions already posted to the account.

30 Days

This is the amount outstanding since the last statement.

This field is visible only if the Show 30/60/90 switch is

ON (checked) in the Financial Detail form. Values only

show in this field if you are applying Amortized Interest

and there is a date in the "Next" field that Collect! can use

for evaluation.

This field is useful if you are a Credit Grantor.

The ' Report as credit grantor' switch must be

turned ON in the Credit Bureau Setup form to

activate the 30/60/90 calculations for

Credit Bureau Reporting.

The ' Report as credit grantor' switch must be

turned ON in the Credit Bureau Setup form to

activate the 30/60/90 calculations for

Credit Bureau Reporting.

60 Days

This is the amount outstanding from between 30 and 60 days.

This field is visible only if the Show 30/60/90 switch is

ON (checked) in the Financial Detail form. Values only

show in this field if you are applying Amortized Interest

and there is a date in the "Next" field that Collect! can use

for evaluation.

This field is useful if you are a Credit Grantor.

The ' Report as credit grantor' switch must be

turned ON in the Credit Bureau Setup form to

activate the 30/60/90 calculations for

Credit Bureau Reporting.

The ' Report as credit grantor' switch must be

turned ON in the Credit Bureau Setup form to

activate the 30/60/90 calculations for

Credit Bureau Reporting.

90 Days

This field displays amounts owing longer than 60 days.

This field is visible only if the Show 30/60/90 switch is

ON (checked) in the Financial Detail form. Values only

show in this field if you are applying Amortized Interest

and there is a date in the "Next" field that Collect! can use

for evaluation.

This field is useful if you are a Credit Grantor.

The ' Report as credit grantor' switch must be

turned ON in the Credit Bureau Setup form to

activate the 30/60/90 calculations for

Credit Bureau Reporting.

The ' Report as credit grantor' switch must be

turned ON in the Credit Bureau Setup form to

activate the 30/60/90 calculations for

Credit Bureau Reporting.

Over 90

This field displays amounts owing longer than 90 days.

This field is visible only if the Show 30/60/90 switch is

ON (checked) in the Financial Detail form. Values only

show in this field if you are applying Amortized Interest

and there is a date in the "Next" field that Collect! can use

for evaluation.

This field is useful if you are a Credit Grantor.

The ' Report as credit grantor' switch must be

turned ON in the Credit Bureau Setup form to

activate the 30/60/90 calculations for

Credit Bureau Reporting.

The ' Report as credit grantor' switch must be

turned ON in the Credit Bureau Setup form to

activate the 30/60/90 calculations for

Credit Bureau Reporting.

Owing

This is the total amount Owing, the remaining balance

outstanding on this account. Information is not entered in this

field directly. The Owing field displays an amount tallied

from Original Principal and Interest, plus charges and interest

accrued, minus debtor payments. This is dependent on whether

the debtor has a judgement. If a judgement is recorded, then

the Judgement Principal and Judgement Interest are used

instead of the original values.

Click into this field to open the Debtor Financial Summary

This form shows all the charges and payment details for the

debtor's account, including total charges, total payments

and total owing amounts for Principal, Interest and Fees.

Overpayments and adjustments are displayed. For interest

and loan accounts, any amounts needed to bring the account

to current are also shown.

Settle

This field indicates an optional settlement amount for this debtor.

The amount entered here may be used to calculate

the promised payment amount when scheduling

a Promise with a contact plan. Please see Help

topic, Event for more information.

The amount entered here may be used to calculate

the promised payment amount when scheduling

a Promise with a contact plan. Please see Help

topic, Event for more information.

Run Plan

Enter a Contact Plan to run on this account. You can press

F2 to view the list of available plans.

Account Details

This area of the Debtor form contains tabs to sublists of

related Debtor information. The areas that may be

accessed are as follows.

* Notes

* Contacts

* Attachments

* Cosigners

* Transactions

* Detail

* A1

* A2

* A3

* CBR

* Group

* Misc

* Phones

Each of these subforms allow you to view records

related to this account and add new ones. If the tab is

displayed as YELLOW that means there are records in

that area.

Notes

Select the NOTES tab to view Notes for this account

or add new ones. Notes allow you to type free form

text. Today's date, the current time and the operator ID

are inserted automatically on the first line of text that

you type.

Users with Read Only rights to the Notes Text Editor

will be able to enter new notes but may not delete

existing ones. Please refer to Help topic,

Change Debtor Notes to Read Only for details.

Group Members who have the "Cascade Notes" switch enabled

in the "Member Setup" section of the Group tab will also

have their notes copied to all other Members of the Group.

Contacts

Select the CONTACTS tab to view contacts scheduled

for this account. This links to all contacts made for this

debtor. You may select an existing contact or create

a new one.

Attachments

Select the ATTACHMENTS tab to view Attachments

stored for this account. You may view existing attachments

or create a new one. Check the A1, A2 and A3 tabs to

access attachments that you classified as Type 1, Type 2

and Type 3.

Cosigners

Select the COSIGNERS tab to view the list of all related

parties assigned to this account, such as Attorney, Employer,

Spouse, Bank and others. You may view an existing

Debtor Cosigner or enter a new one.

Transactions

Select the TRANSACTIONS tab to view transactions

posted to this account. You may select an existing

Transaction or create a new one. This links to any

payments, promises or other related transactions

regarding this debtor.

You must set up transaction types

before you can post transactions.

You must set up transaction types

before you can post transactions.

Detail

Select the DETAIL tab to view the Debtor Detail

subform where you can enter information about a bank

account, as well as other details.

A1

Select the A1 tab to access attachments that

you classified as Type 1 in the Type field of the

Attachment.

A2

Select the A2 tab to access attachments that

you classified as Type 2 in the Type field of the

Attachment.

A3

Select the A3 tab to access attachments that

you classified as Type 3 in the Type field of the

Attachment.

CBR

Select the CBR tab to view the Credit Report Details

subform where you adjust the Credit Reporting settings

for this debtor or switch ON Credit Bureau reporting.

Use this subform to specify reporting and cosigner

details and a reporting date.

Your data must be entered in the correct

format if you intend to report to credit

bureaus. Review popup help for each field

that has a FOR CBR: note or press F1

when you are on the Debtor form to display

help for examples of formats for name,

address and other fields used in reporting to

credit bureaus.

Your data must be entered in the correct

format if you intend to report to credit

bureaus. Review popup help for each field

that has a FOR CBR: note or press F1

when you are on the Debtor form to display

help for examples of formats for name,

address and other fields used in reporting to

credit bureaus.

Group

Select the GROUP tab to view the list of Group Members

in this account's Group. This will only display if a Group ID

and Member number are displayed in the GROUP button.

Misc

Select the MISC tab to set additional switches for this

account. This is an area where you can set flags as

needed or store additional information on the account.

There are several user-defined Currency, Date, Number,

Time and Switch fields. Please refer to Help topic, Misc,

for more details.

Phones

The Phones tab displays phone numbers listed for this

account. Pertinent information is displayed in the listed

columns. Select an item to view further details, or select

one of the buttons to create a new record or modify an

existing one. Please refer to Help topic, Phone for

more information.

Group Notes

The Group Notes tab displays all notes from all Group Members

who have the "Share Notes" switch checked in the "Member Setup"

section on the group tab. Each note line contains the

respective file number of the account that the note line

belongs to.

OK

Select this button to save any changes you

have made and return you to the previous form.

Pressing the "O" key on your keyboard

will close the Debtor form.

Pressing the "O" key on your keyboard

will close the Debtor form.

<<

Select this button to take you

to the previous debtor in the database.

>>

Select this button to take you to the next debtor

in the database.

Credit Card

Select this button to open the Credit Card Payment Tasks

menu. You can post a single or recurring credit card

payment, or query Billing Tree to update the Debtor's

payment history.

This button is visible only if you have the

Billing Tree Module enabled in your

Collect! license.

This button is visible only if you have the

Billing Tree Module enabled in your

Collect! license.

Please refer to Help topic, Billing Tree Topics for details.

Pressing the "T" key on your keyboard brings

up the Credit Card Payment Tasks menu.

Pressing the "T" key on your keyboard brings

up the Credit Card Payment Tasks menu.

ACH

Select this button to open the ACH Payment Tasks

menu where you can post a single or recurring ACH

payment through Billing Tree.

This button is visible only if you have the

Billing Tree Module enabled in your

Collect! license.

This button is visible only if you have the

Billing Tree Module enabled in your

Collect! license.

Please refer to Help topic, Billing Tree Topics for details.

Pressing the "H" key on your keyboard brings

up the ACH Payment Tasks menu.

Pressing the "H" key on your keyboard brings

up the ACH Payment Tasks menu.

Recalc

Press this button to Recalculate and Update any fields

containing financial information relating to this debtor.

Pressing the "R" key on your keyboard

will Recalc this Debtor.

Pressing the "R" key on your keyboard

will Recalc this Debtor.

Mode And Recalc

RECALC is not done on CLOSED accounts, but accounts

with other modes are recalculated. The only exception is

when a payment is posted - if the account is closed then

the total is still recalculated.

Basically, if you close an account, its financial figures

are frozen where they are at the time you closed the

account, unless a payment is posted, at which time,

and only then, a Recalc actually alters the Owing.

Print

Select this button to view a list of reports available for

printing that relate to debtors.

You must setup your reports and

letters before you begin to enter

debtor information.

You must setup your reports and

letters before you begin to enter

debtor information.

Pressing the "P" key on your keyboard

will display the list of reports that you

can print from the Debtor form.

Pressing the "P" key on your keyboard

will display the list of reports that you

can print from the Debtor form.

Action

Select the ACTION button to pick a Contact Plan to run

on this account.

Pressing the "A" key on your keyboard

will display the list of contact plans that you

can run on this account.

Pressing the "A" key on your keyboard

will display the list of contact plans that you

can run on this account.

Advanced

Clicking this button opens the Financial Detail form, where

you can enter information relating to debtor's Principal,

Commission Rate, Taxes and Fees, as well as Interest and

Payment Plans.

Pressing the "D" key on your keyboard

will display the Financial Detail form.

Pressing the "D" key on your keyboard

will display the Financial Detail form.

Cancel

Select the CANCEL button to discard any changes

made to the Debtor form. You will be prompted to

discard the changes. If you selected SAVE or F8,

those changes will not be discarded. Also, any

Contacts or other records created from the Debtor

form will not be canceled.

Pressing the "C" key on your keyboard

will cancel your changes and close

the Debtor. You will be prompted to save

or discard changes.

Pressing the "C" key on your keyboard

will cancel your changes and close

the Debtor. You will be prompted to save

or discard changes.

Help

Select the HELP button for information on the

Debtor form and links to related topics.

Pressing the "H" key on your keyboard

will display the Help topic, Debtor.

Pressing the "H" key on your keyboard

will display the Help topic, Debtor.

See Also

- Debtor Basics - Introduction/Accessing

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org