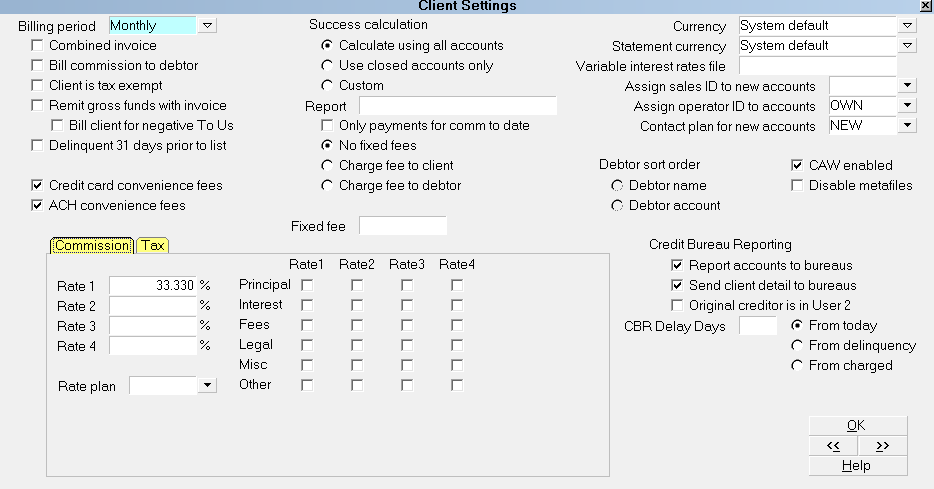

Client Settings

The Client Settings form lets you set up detailed accounting

and collection settings for each client. This information can

usually be taken directly from the contractual agreement you

have made with your client. It could also be determined by

your own way of doing business.

Client Settings form

Please refer to Client Settings Basics for steps to

access this form.

Please refer to Client Settings Basics for steps to

access this form.

The settings in this form thoroughly impact all aspects of

Collect! that require billing and fees information. You can enter

the information here and Collect! will automatically enter it

into fields on other forms where this information is required.

For instance, fields in Debtors, Payments, Invoices and

Credit Bureau Reporting forms can be filled in automatically

from information you set in the Client Settings form.

Although you could enter information directly into those forms

manually, it makes far more sense to let Collect! enter the

information, especially when you are processing hundreds

of records.

*** IMPORTANT ***

Fill in the Client Settings form BEFORE you enter Debtors

for your clients. That way Collect! can automatically enter

this information for every new debtor you create. Fields on

other forms mentioned above will also be filled in automatically.

Billing Period

This is the interval for generating invoice/statements

for this client. For instance, if you bill your clients on

a monthly basis, MONTHLY is the Billing Period that

you would choose.

Collect! uses MONTHLY as the default, but please

make a definite choice here. In order to generate

statements, Collect! needs to know what billing

period you have agreed upon with your client.

Press F2 to bring up a selection list for you to choose

from. Please decide on a definite billing period. Do not

leave this blank.

Combined Invoice

Switch this on to generate combined Net/Gross invoices

for this client. When you print your statements, Collect!

will use the CStatement report to break out the agency

and client portions of the total remit and return.

With this switched ON, Collect! ignores the

'Remit gross funds with invoice' switch. A

Net type statement is generated and the

totals are summarized when the statement

is printed.

With this switched ON, Collect! ignores the

'Remit gross funds with invoice' switch. A

Net type statement is generated and the

totals are summarized when the statement

is printed.

Bill Commission To Debtor

By setting this switch, the commission amount is added to

the debtor's Owing amount. Thus, any letters sent to the

debtor will show the updated total, while any calculations of

commission will take into account the fact that some portion

of the payment is commission. This switch takes effect when

you enter the financial details for the debtor, provided you

have set a commission rate for the client.

Do not set this switch unless you have a

signed agreement from the debtor on file

or the legal structure of your region permits

you to bill the debtor for your commission.

Do not set this switch unless you have a

signed agreement from the debtor on file

or the legal structure of your region permits

you to bill the debtor for your commission.

Client Is Tax Exempt

This means that the client is not charged tax on

commissions paid to your company. This setting

can be changed on a per transaction basis.

Remit Gross Funds With Invoice

All funds collected on behalf of a client are returned to the

client at the end of the billing period. The invoice sent to the

client at the same time lists all commission and taxes due

and payable by the client.

If you retain commission and taxes yourself and only

return the remaining funds to the client, then leave this

switch blank. At period end, Collect! will correctly

calculate the amount owed to the client, or what the

client owes your company based on the payments

received during the billing period.

This switch has no effect if you have a check

mark in the 'Combined Invoice' field.

This switch has no effect if you have a check

mark in the 'Combined Invoice' field.

See Also:

- How To Remit Gross or Net Funds

Bill Client For Negative To Us

Switch this ON for a Gross client when you need your

statements to reflect amounts owed to you for transactions

posted with a NEGATIVE To Us amount. By default,

Collect! does not bill a Gross client for a NEGATIVE

amount.

Report Accounts To Bureaus

Switch this ON when you wish to set up credit reporting for

a client.

Please be aware that this switch does not

automatically begin reporting debtors. You

must still switch ON credit bureau reporting

for each debtor that you want to report. Please

refer to How To Setup Credit Bureau Reporting

for details.

Please be aware that this switch does not

automatically begin reporting debtors. You

must still switch ON credit bureau reporting

for each debtor that you want to report. Please

refer to How To Setup Credit Bureau Reporting

for details.

You must also switch ON 'Send client detail to bureaus'

if you are reporting as a Collection Agency so that

Collect! can include the details when you run your report.

Send Client Detail To Bureaus

The FDCPA requires that the client details, K1 segment,

be sent with each debtor. FTC (Federal Trade Commission)

and ACB (Associated Credit Bureaus) policy stipulate that

the original creditor be identified.

When you switch ON 'Report accounts to bureaus', Collect!

will send the Client's Name in the K1 segment of data reported

to the credit bureaus. If you are reporting as a credit grantor

then this switch may be switched OFF.

If the credit grantor switch is OFF, the sending of K1

segments is UNCONDITIONAL regardless of the

setting in this field.

If the credit grantor switch is OFF, the sending of K1

segments is UNCONDITIONAL regardless of the

setting in this field.

Original Creditor Is In User 1

This switch may be used by portfolio purchasers who want to

use the Client record for tracking the portfolio, yet also want to

send the original creditor information to credit bureaus. Switch

this ON on a client by client basis and then place the original

creditor information into the User 1 field on the Debtor form.

Original Creditor Is In User 2

This switch may be used by portfolio purchasers who want to

use the Client record for tracking the portfolio, yet also want to

send the original creditor information to credit bureaus. Switch

this ON on a client by client basis and then place the original

creditor information into the User 2 field on the Debtor form.

Delinquent 31 Days Prior To List

Turn this switch ON to automatically fill in the Debtor

Delinquency Date to 31 days prior to the Listed Date.

This is useful if you do not know the exact

Delinquency Date for the account. It is always

better to put in the exact Delinquency Date, if

it is known.

This is useful if you do not know the exact

Delinquency Date for the account. It is always

better to put in the exact Delinquency Date, if

it is known.

When this switch is OFF, you must enter the Delinquency

Date manually whenever you set up an account for reporting

to the credit bureaus.

You MUST provide a delinquency date for

all accounts reported to the credit bureau.

The Delinquency Date appears on the

Debtor form in the 'Delnqnt' field below

the 'Charged' field and is defined as the

date of the first delinquency that led to the

derogatory status being reported.

You MUST provide a delinquency date for

all accounts reported to the credit bureau.

The Delinquency Date appears on the

Debtor form in the 'Delnqnt' field below

the 'Charged' field and is defined as the

date of the first delinquency that led to the

derogatory status being reported.

CBR Delay Days

When you first report credit on an account, you can

schedule for the report to be sent later, rather than

immediately. The date can be changed manually.

This is configured on the Credit Bureau Setup screen

by selecting the Delay Report opion.

This field allows you to overwrite the global Delay Days

value to report sooner or later than your global setting.

To have this client reporting based on the global settings,

leave the box empty.

From Today

This field is used with the DELAY DAYS field to delay reporting

to the bureau. This field is the default selection. If this option

is selected, the reporting delay will be based on the date that you

prepared the Debtor to be reported to the bureau.

From Delinquency

This field is used with the DELAY DAYS field to delay reporting

to the bureau. If this option is selected, the reporting delay

will be based on the Debtor's Delnqnt date.

From Charged

This field is used with the DELAY DAYS field to delay reporting

to the bureau. If this option is selected, the reporting delay

will be based on the Debtor's Charged date.

Success Calculation

Collect! provides two automatic processes for calculating

success rate for each given client. Either your success

can be based on only closed accounts, or on all the

accounts listed for the Client. If you need your own

custom calculation, you can create a report to perform

the calculations. You would then run the report yourself

when you want to determine the Success Rate.

Calculate Using All Accounts

This calculation method is based on all accounts that

belong to this Client. The Success Rate is total

payments to date over total listed dollar value. This is

the default calculation method.

Use Closed Accounts Only

This calculation method evaluates only closed accounts.

It gives you a more accurate performance figure over

long periods of time, but ignores any active accounts.

So it is less current that the All Accounts calculation.

This Success Rate is calculated using total payments

made on closed accounts over total listed dollar value

for the closed accounts.

Custom

This option indicates that you wish to perform your own

calculation for Success Rate. This only necessary if

the automatic calculations that Collect! provides do not

suit your purposes for some of your Clients.

When you select Custom, Collect! still displays the

default "All Accounts" for the Success Rate on the

Client form whenever the Client is Recalced. To see

your custom Success Rate, you would need to run

a writeback report or add a control file to the Client

form. For convenience, you can enter the name of

your report in the Report field.

If you are not familiar with creating reports

or control files in Collect!, you may want

to request help from Collect!

Technical Services for pricing of your

request which we can create for you.

If you are not familiar with creating reports

or control files in Collect!, you may want

to request help from Collect!

Technical Services for pricing of your

request which we can create for you.

Report

You can use this field to enter the name of a report

that you want to run to refresh the Success Rate

on the Client form. This is only necessary if you

have created a custom report for success calculation

that is different from the two options that Collect!

gives you.

You can create different reports for different

Clients, depending on your needs, or

you can use the two options that Collect!

provides for automatic calculation.

You can create different reports for different

Clients, depending on your needs, or

you can use the two options that Collect!

provides for automatic calculation.

Only Payments For Comm To Date

Switch this ON with a check mark to tell Collect! to use

only Payment type transactions when calculating the

total Commission to Date displayed on the Client form.

When this switch is OFF, Collect! will total commissions

from any transaction that has a commission amount entered.

No Fixed Fees

Turn this switch ON when you don't want to charge

a fixed fee to the client or the debtor.

Charge Fee To Client

Turn this switch ON and enter the amount of the fixed fee.

When you add a new debtor to this client, the fixed

fee amount is copied to the Debtor record. At period end,

when you generate statements for your client, this fee will

be included in the statement to your client.

Charge Fee To Debtor

Turn this switch ON and enter the amount of the fixed fee.

When you add a new debtor to this client, the fixed fee

amount is copied to the Debtor record. When you edit the

debtor's Fee field, you can verify the amount and then

Collect! posts a fee transaction to the debtor's account,

the fee amount to the debtor.

Fixed Fee

This is the amount of the fixed fee, and should be a

dollar amount. This is billed to either the client or the

debtor, depending on the Charge to Client or Debtor

options described above. If you turn the No Fixed Fees

switch ON, this value is ignored.

Currency

This is the default currency for debtors assigned

by this client.

This is visible only if you have the ' Multi Currency'

switch turned ON in the Company Details form,

available from the Options pull-down menu.

Each debtor can operate with a different currency.

Similarly, each transaction posted to a debtor can

have a different currency.

Collect! does not calculate using

exchange rates and currencies. These

fields are provided for your information

purpose only.

Collect! does not calculate using

exchange rates and currencies. These

fields are provided for your information

purpose only.

Statement Currency

This is the currency you use when generating

statements. This is for informational purposes

only at this time.

Collect! does not calculate using

exchange rates and currencies.

These fields are provided for your

information purpose only.

Collect! does not calculate using

exchange rates and currencies.

These fields are provided for your

information purpose only.

Variable Interest Rates File

This field is only used when you are using the

Variable Interest extension module. Enter the

exact name of the file containing your interest

rates table.

Please refer to Help topic, Variable Interest for

details.

ASSIGN SALES ID TO NEW ACCOUNTS

This Sales ID will be assigned to all new accounts

recorded for this client. It will be copied to the

Debtor record automatically and then the information

can be tracked for salesperson status and for

commission reporting.

Assign Operator ID To Accounts

This Operator ID will be assigned to all new accounts

recorded for this client. It will be copied to the

Debtor's record automatically. The Operator ID is

very important for following up on a debtor's account,

scheduling contacts and reviewing account activity.

Contact Plan For New Accounts

This loads the Contact plan's ID into the Debtor form.

Whenever a new account is entered, this plan will run

automatically. For instance, you could schedule a

phone call or a review for each new account.

Caw Enabled

This switch enables you to flag accounts for use

with Client Access Web.

Disable Metafiles

Switch this ON with a check mark if you do not want

to save METAFILES when letters are printed through

Collect!. Ordinarily, when printing from the Debtor or

Client, or in a scheduled letter batch, Collect! creates

and attaches a METAFILE to the Letter contact.

The "Disable metafiles" switch enables you to control

this at the Client level.

When this switch is ON, it overrides any

contact plan Letter Event where the "Create

metafile" switch is ON.

When this switch is ON, it overrides any

contact plan Letter Event where the "Create

metafile" switch is ON.

This switch is ignored when letters are

printed through the Scheduled Batch Letters

option. This means that Collect! will always

create a METAFILE for letters printed in

the Scheduled Batch Letters.

This switch is ignored when letters are

printed through the Scheduled Batch Letters

option. This means that Collect! will always

create a METAFILE for letters printed in

the Scheduled Batch Letters.

Credit Card Convenience Fees

Switch this ON with a check mark if this Client permits

you to charge a convenience fee when using Collect!'s

Billing Tree module for credit card payments.

To implement credit card convenience fees

you must set up your credit card convenience

fee Transaction Types. Please refer to

Help topic, Credit Card Setup for details.

To implement credit card convenience fees

you must set up your credit card convenience

fee Transaction Types. Please refer to

Help topic, Credit Card Setup for details.

ACH Convenience Fees

Switch this ON with a check mark if this Client permits

you to charge a convenience fee when using Collect!'s

Billing Tree module for ACH payments.

To implement ACH convenience fees you

must set up your ACH convenience fee

Transaction Types. Please refer to Help

topic, ACH Payments Setup for details.

To implement ACH convenience fees you

must set up your ACH convenience fee

Transaction Types. Please refer to Help

topic, ACH Payments Setup for details.

Debtor Sort Order

These switches display the order used to sort this

client's debtors. This is the order in which they will

be displayed when statements are generated.

These fields are read only. A dot in the radio button

indicates the current sort order.

If the Sort Order option is not set, then Collect! is

using the default Sort Order set by sorting all

debtors by Name or Account #. To set the switch

and for more details, please refer to Help

topic, Sort Accounts.

Debtor Name

A dot in the radio button for this field indicates that

this client's debtors are sorted by Debtor Name.

Statements for this client will be generated in

order of Debtor Name.

This field is read only.

If you notice that some of your debtors

are out of sort order at the top of this

client's debtors list, you may need to

run the sort utility. Please refer to the

help, Sort Accounts.

If you notice that some of your debtors

are out of sort order at the top of this

client's debtors list, you may need to

run the sort utility. Please refer to the

help, Sort Accounts.

Debtor Account

A dot in the radio button for this field indicates that

this client's debtors are sorted by Debtor Account.

Statements for this client will be generated in

order of Debtor Account.

This field is read only.

If you notice that some of your debtors

are out of sort order at the top of this

client's debtors list, you may need to

run the sort utility. Please refer to the

help, Sort Accounts.

If you notice that some of your debtors

are out of sort order at the top of this

client's debtors list, you may need to

run the sort utility. Please refer to the

help, Sort Accounts.

Commission

Enter up to four commission rates for this

client. Payment breakdown settings enable

you to specify a type of account for which

the commission is applied.

Rate 1

This rate is used if you leave the 'Rate Plan'

field blank. This is the standard commission

charged to accounts listed by this client. This

is automatically copied into new debtors as they

are assigned to this client. The individual

commission rate can be changed on an

account-by-account basis, and even for individual

transactions.

This is an absolute percentage rate. You should

use this if you have not entered a rate plan.

This is a flat commission rate charged to all

debtors assigned to this client. Choose EITHER

a rate plan or a commission rate but not both.

Rate Plan

You can specify a default Commission Rate Plan

for new debtors for this client. When a new debtor

is created and the client is assigned, the default rate

plan is copied to the debtor record where it can be

accepted or changed for each debtor.

Choose EITHER a rate plan or a commission rate,

but not both.

If you have selected a commission

rate plan, you should not have a

commission amount entered as well.

If you have selected a commission

rate plan, you should not have a

commission amount entered as well.

Tax

Enter up to four tax rates for this client. Payment

breakdown settings enable you to specify a type

of account for which the tax is applied.

Tax 1

This is the rate at which tax is calculated on

commissions for this client's debtors. Whenever

you enter a new debtor for this client, this tax rate

is copied to the new Debtor record. If you have

set a "global tax rate" in the Company Details form,

which is available from OPTIONS in the top menu bar,

that tax rate will be displayed here, whenever you

enter a new client into your system.

This can be changed on a debtor-by-debtor basis,

and for individual transactions.

Help

Press this button for help on the Client Settings

form and links to related topics.

Cancel

Select this button to ignore any changes you may

have made and return to the previous form.

OK

Select this button to save any changes you may

have made and return to the previous form.

See Also

- Client Settings Basics - Introduction/Accessing

- How To Enter A New Client

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org