How To Take Credit Card Payments - Legacy

WARNING: This document applies to the legacy payment processing

module. For the current payment processing module,

please go to Payment Processing Setup.

WARNING: This document applies to the legacy payment processing

module. For the current payment processing module,

please go to Payment Processing Setup.

This page is the guide for processing Credit Card payments in Collect! via the integrated

Payment Processing module.

Payment Processing Credit Card Setup

To be able to use Credit Card payments, there are two preliminary steps to be completed:

- You require licensing from Comtech Systems Inc. to license the Payment Processing Module on

your site. For pricing information and licensing, please contact us at 250-391-0466

or email sales@collect.org.

- You require an active account with a supported Payment Provider. They will provide you with

a url/web address and password to access the Credit Card Gateway.

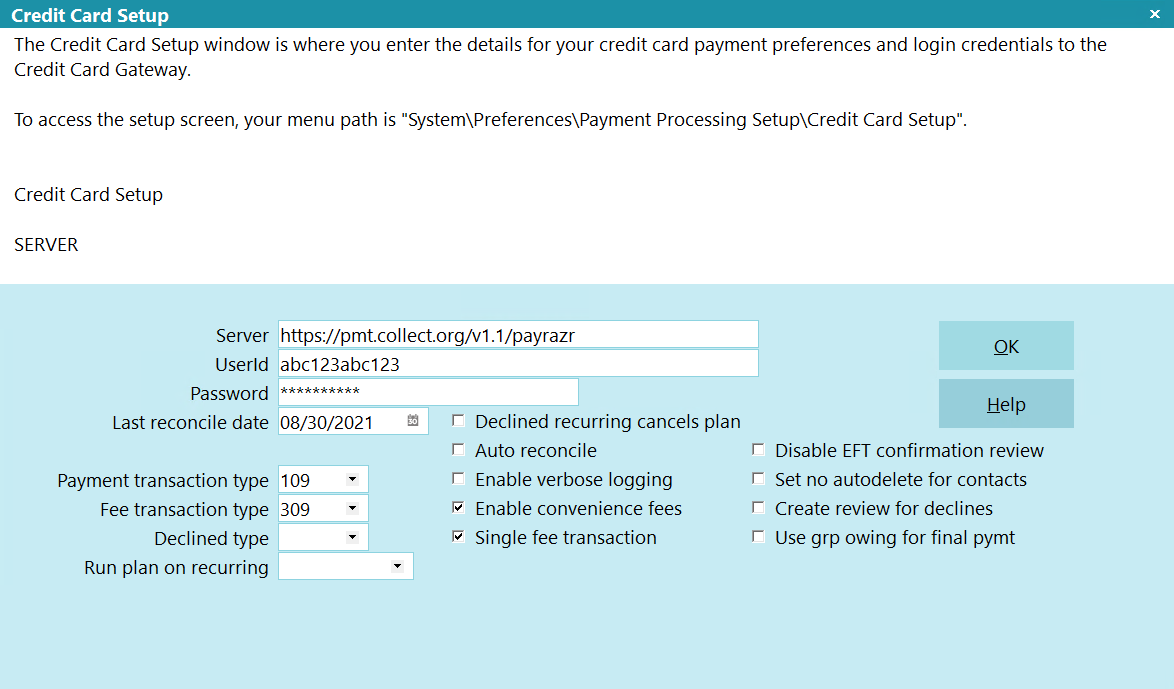

Credit Card Setup Form

Click Here to View this Form.

Click Here to Close this Form.

The Payment Processing Gateway window is where you

enter the details for your preferences and login

credentials to the gateway.

Each payment type (card or check) and each currency needs

to be setup as a separate record. This allows you to have

granular control on how different types and currencies

should be processed.

To access the setup screen, your menu path is

"System\Preferences\Payment Processing Setup\Payment Gateways".

Payment Processing Gateway

Gateway

Select the Provider and Gateway that you are using.

Example: Repay(usaepay)

Comtech Systems offers this as a white label service.

If you would like to use payment processing through us,

please contact support@collect.org.

Comtech Systems offers this as a white label service.

If you would like to use payment processing through us,

please contact support@collect.org.

Payment Type

Select from a list of supported payment instruments (card

or check) that you will be accepting.

If you are accepting both card and check, then

multiple gateway records need to be created

using the same login credentials.

If you are accepting both card and check, then

multiple gateway records need to be created

using the same login credentials.

Currency

Select from a list of supported currencies that you will

be accepting.

If you are accepting multiple currencies, then

multiple gateway records need to be created

using the same login credentials.

If you are accepting multiple currencies, then

multiple gateway records need to be created

using the same login credentials.

Default Gateway For Currency

If, for some reason, you should need to setup the same

currency for multiple gateways, then check this box to

indicate which gateway to use as the default for this

currency in the Client and Debtor/Consumer portals.

Gateway Configuration

Click this button to enter the login credentials provided

by your merchant provider.

As each merchant provider has different requirements

for connecting to their API, this screen is dynamic

and will display the applicable fields for the gateway

you selected.

As each merchant provider has different requirements

for connecting to their API, this screen is dynamic

and will display the applicable fields for the gateway

you selected.

Example Gateway Configuration

Vault

Select from a list of vault providers.

A vault is used to encrypt card data. This way PCI data is

not stored in Collect!.

At present, we only support Evervault. Comtech Systems

offers this as a white label service. If you would like

to use Evervault through us, please contact support@collect.org.

At present, we only support Evervault. Comtech Systems

offers this as a white label service. If you would like

to use Evervault through us, please contact support@collect.org.

Vault Configuration

Click this button to enter the login credentials provided

by your vault provider.

Example Vault Configuration

Last Reconcile Date

This is the last date that this gateway was reconciled.

It will be blank until you run your first reconciliation.

If the date is blank, the system will only look

back 2 days.

If the date is blank, the system will only look

back 2 days.

The Last Reconcile Date should NOT be manually

manipulated once you are actively using this gateway.

The Last Reconcile Date should NOT be manually

manipulated once you are actively using this gateway.

WARNING: If the last reconcile date is more

than 7 days into the past, Collect!

will only reconcile the last 2 days.

WARNING: If the last reconcile date is more

than 7 days into the past, Collect!

will only reconcile the last 2 days.

Reconcile

Push this button to reconcile just this gateway.

Payment Transaction

Select the Transaction Type that you want to use for your

payments. This Transaction Type must already exist in your

list of Transaction Types.

Payment Fees

You are able to select the preference to allow or disallow

the charging of fees in general. You must also

select on a per Client basis in the Client Settings screen

which of your clients will allow the to be charged

to its debtors.

To charge fees, it is every site's individual

responsibility to ensure you are lawfully able to charge

these fees in your your region and as per your clients'

individual wishes in this regard.

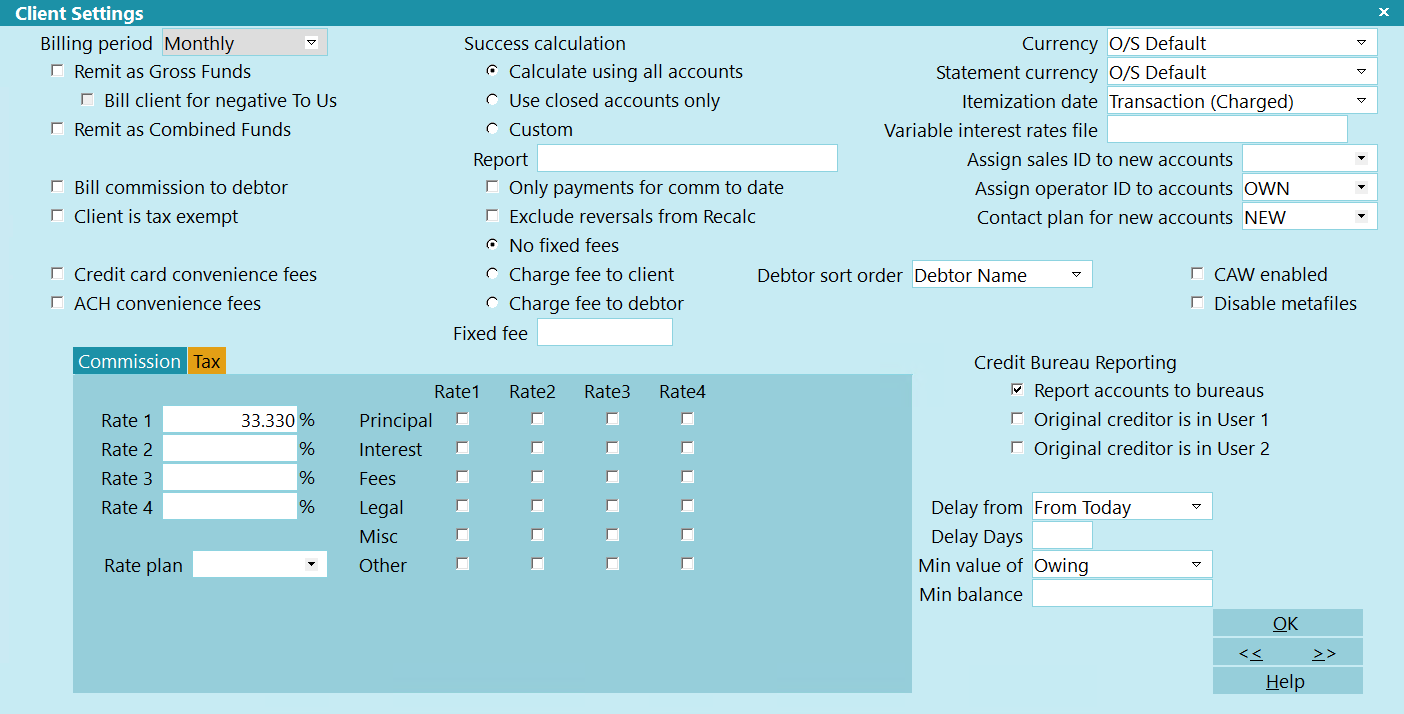

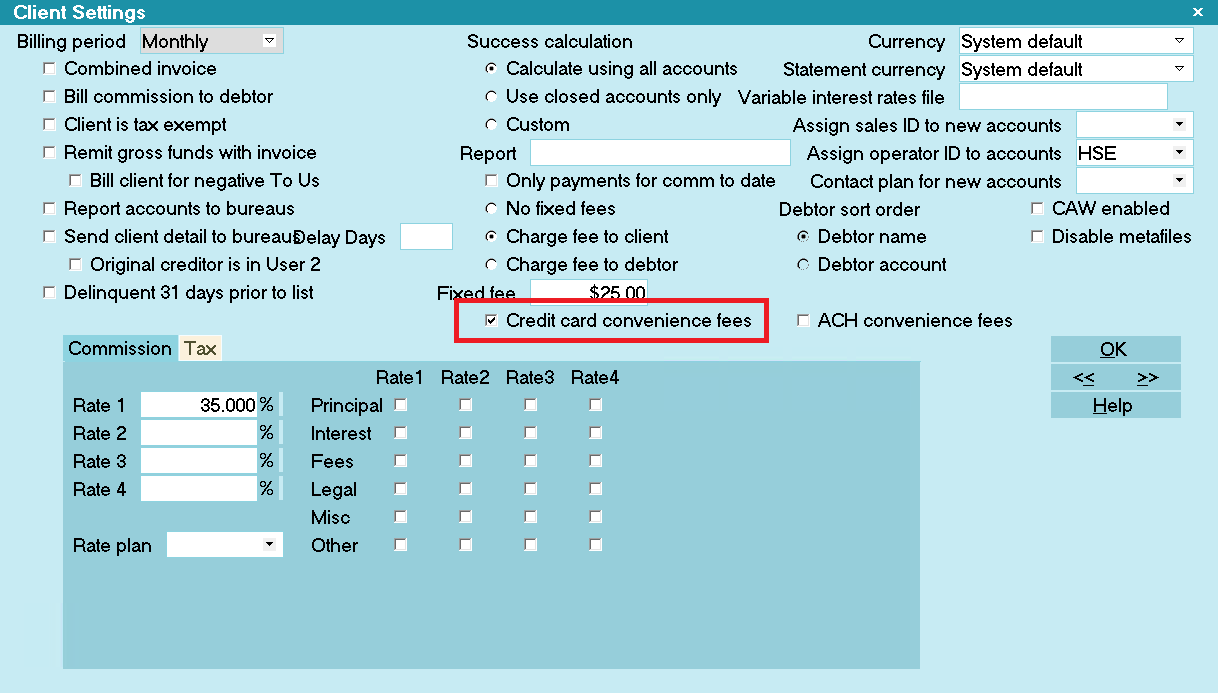

Click the Advanced button in the lower right corner of the

client screen and you will see a screen as follows, and

the "Credit Card convenience fees" (for card) and the

"ACH convenience fees" (for check) switches are shown

on the left.

Client Settings Screen

If you have a large client base which practicality

would preclude manually updating this switch

for ALL clients (or a large tagged list), contact

Technical Services for assistance with a write back

to enable a volume of clients in mass for this

switch.

If you have a large client base which practicality

would preclude manually updating this switch

for ALL clients (or a large tagged list), contact

Technical Services for assistance with a write back

to enable a volume of clients in mass for this

switch.

Enable Fees

Select the option that best applies to you:

- No: No fees will be charged for payments.

- Yes - Collect! Managed: A fee will

be added to payments based on rules defined in Collect!.

- Yes - Gateway Managed: A fee will

be added to payments based on rules defined by your

payment provider.

WARNING: Make sure the correct option is selected to

prevent incorrect fees from being added.

WARNING: Make sure the correct option is selected to

prevent incorrect fees from being added.

Fee Type

This option only appears for Collect! managed fees.

This option only appears for Collect! managed fees.

Select the option that best applies to you:

- Fixed Dollar: A flat dollar amount

to be added to each payment.

- Percentage: A percentage of the

payment amount to be added to each payment.

- Dynamic: Dynamic rules where

you can define fees by State.

Fee Amount

This option only appears for Collect! managed fees,

and Fee Type Fixed Dollar.

This option only appears for Collect! managed fees,

and Fee Type Fixed Dollar.

Enter the dollar amount for the fee.

Fee Percentage

This option only appears for Collect! managed fees,

and Fee Type Percentage.

This option only appears for Collect! managed fees,

and Fee Type Percentage.

Enter the percentage of payment amount for the fee.

Fee Plan

This option only appears for Collect! managed fees,

and Fee Type Dynamic.

This option only appears for Collect! managed fees,

and Fee Type Dynamic.

Enter the Fee Plan to use to determine the amount for the fee.

Apply Recur Fee To

This option only appears for Collect! managed fees.

This option only appears for Collect! managed fees.

Depending on your jurisdiction, some locations only allow

fees on the first payment. Others allow fees on all payments.

Select the option that best applies to you:

- First Payment Only: A fee will only

be added to the first payment in a recurring payment

plan.

- All Payments: A fee will be added to

all payments in the payment plan.

Lump sums are not considered payment plans, so if a

lump sum is paid first, then a recurring plan with

"First Payment Only" selected, then 2 fees will be added. If

multiple payment plans are added with "First Payment Only"

selected, the a fee will be added for each individual

payment plan.

Lump sums are not considered payment plans, so if a

lump sum is paid first, then a recurring plan with

"First Payment Only" selected, then 2 fees will be added. If

multiple payment plans are added with "First Payment Only"

selected, the a fee will be added for each individual

payment plan.

Fee Transaction

Select the Transaction Type that you want to use for your

fees. This Transaction Type must already exist in your

list of Transaction Types.

Fee Payment Transaction

This option only appears if "Single Payment

Transaction" below is unchecked.

This option only appears if "Single Payment

Transaction" below is unchecked.

Select the Transaction Type that you want to use for your

payment to fees. This Transaction Type must already exist in your

list of Transaction Types.

Create a dedicated payment Transaction Type and configure

it as Payment Breakdown, but only select Fees for the

breakdown types.

Create a dedicated payment Transaction Type and configure

it as Payment Breakdown, but only select Fees for the

breakdown types.

Declined Transaction

This option only appears if the Payment Type is card.

This option only appears if the Payment Type is card.

When payments are returned as Declined, you can

elect to use a dedicated Transaction Type.

If this field is blank, the "Payment Transaction" type

is used.

Select the Transaction Type that you want to use for your

card declines. This Transaction Type must already exist

in your list of Transaction Types.

You can configure the Transaction Type to be Internal

so it doesn't appear in your Payment Reports.

You can configure the Transaction Type to be Internal

so it doesn't appear in your Payment Reports.

Declined Attempts

This option only appears if the Payment Type is card.

This option only appears if the Payment Type is card.

If this field is blank, then a declined transaction will not

be retried.

If this field is populated with a number, then the system

will try to process it again for the specified number of days.

Reversal Transaction

Select the Transaction Type that you want to use for your

payment reversals. This Transaction Type must already exist

in your list of Transaction Types.

If none is specified, then "Payment Transaction" is used.

Reversal Fee Transaction

Select the Transaction Type that you want to use for your

fees on reversed payments. This Transaction Type must already

exist in your list of Transaction Types.

If none is specified, then "Fee Transaction" is used.

Description

Enter a custom description to display in the Gateway list

on the Payment Processing Form.

Receipt Letter

Enter a letter report to be used to send a printed letter

to the Debtor.

The module will just create a Letter Contact on the

account. You will need to run your batch letters to

print the letter or submit to the Letter Service.

The module will just create a Letter Contact on the

account. You will need to run your batch letters to

print the letter or submit to the Letter Service.

Receipt Email

Enter an email report to be used to send an email to the Debtor.

The module will just create a Letter Contact on the

account. You will need to run your batch letters to

email the letter.

The module will just create a Letter Contact on the

account. You will need to run your batch letters to

email the letter.

Receipt Text

Enter an text report to be used to send a text to the Debtor.

The module will just create a Letter Contact on the

account. You will need to run your batch letters to

text the letter.

The module will just create a Letter Contact on the

account. You will need to run your batch letters to

text the letter.

Use Active Grp Owing For Recur

When payments are submitted to the gateway, the payment

amount is compared to the Debtor's balance. If the owing

ever drops below the payment amount, then the payment

amount is adjusted to match the balance and any following

payments are deleted.

Click this ON with a check mark to enable the ability

to have Collect! use the Active Group Owing instead of

the Debtor's owing for this comparison. With this box ON,

a check box is enabled on the Payment Processing Form to

allow payment plans to be created on individual Debtors

or Grouped Debtors.

If this box is checked, and a payment plan is

posted to a Group, then when the Group Member's

balance reaches 0.00, the post-dated Transactions

reviews, and communication Contacts will remain

on the Closed Debtor. The payments will post to

the closed Debtor, reverse itself, then post to

the next group member. Your letter batch will

need to be configured to include Closed accounts

when printing.

If this box is checked, and a payment plan is

posted to a Group, then when the Group Member's

balance reaches 0.00, the post-dated Transactions

reviews, and communication Contacts will remain

on the Closed Debtor. The payments will post to

the closed Debtor, reverse itself, then post to

the next group member. Your letter batch will

need to be configured to include Closed accounts

when printing.

Single Payment Transaction

Switch this ON with a check mark if you want to only post

one fee transaction for the fee amount. The payment will

reflect the full amount of the payment. For example, a

$100 payment with a $5 fee would have a payment of $105

and a fee of $5.

Switch this OFF if you want the system to post the fee

transaction, then a payment to fee. The payment transaction

will reflect the amount less the fee. For example, a

$100 payment with a $5 fee would have a payment of $100,

a fee of $5, and a payment to fee of $5.

Leave this off for best results. The single payment

is posted before the fee, so the payment breakdown

won't reflect it properly.

Leave this off for best results. The single payment

is posted before the fee, so the payment breakdown

won't reflect it properly.

Disable EFT Confirmation Review

Click this ON with a check mark to stop Collect! from creating

the review contact that is dated 2 days before the payment is

due with the description of "Confirm EFT plan authorization."

Set No Autodelete For Contacts

Click this ON with a check mark to enable Collect! to check

the "Do not autodelete" and "Allow delete on close" boxes on

all contacts created for recurring payments.

If you have enabled "Use Active Grp Owing For Recur"

above, then check this box ON. When the group members

owing reaches 0.00, and the account is closed, this

box will preserve the Review, Promise, and Letter

Contacts. With this box OFF, the reviews and letters

will be deleted.

If you have enabled "Use Active Grp Owing For Recur"

above, then check this box ON. When the group members

owing reaches 0.00, and the account is closed, this

box will preserve the Review, Promise, and Letter

Contacts. With this box OFF, the reviews and letters

will be deleted.

Decl/Rtn Pymts Cancels Recur

Click this ON with a check mark to set your preference that

a declined card is to cancel the payment plan on the account.

If you have a value set in "Declined Attempts," then this

process won't run until after the number of days specified

in that field.

Cancelling a plan will automatically mark your Promise Contact

as Stopped, change your Due Date in the Review Contact marking

the end of the original terms to be the same as the delete date

and also delete any remaining EFT Notification letters scheduled.

Create Review For Decl/Rtn

Click this ON with a check mark to have Collect! create a

review contact when a declined payment (for cards) or a

returned payment (for check) is posted to an account.

Run Plan On Recurring

Select a Contact Plan to run whenever a recurring plan is setup.

Single Credit Card Transaction

There are two choices with which to post Credit Card Payments: single transactions

and recurring arrangements.

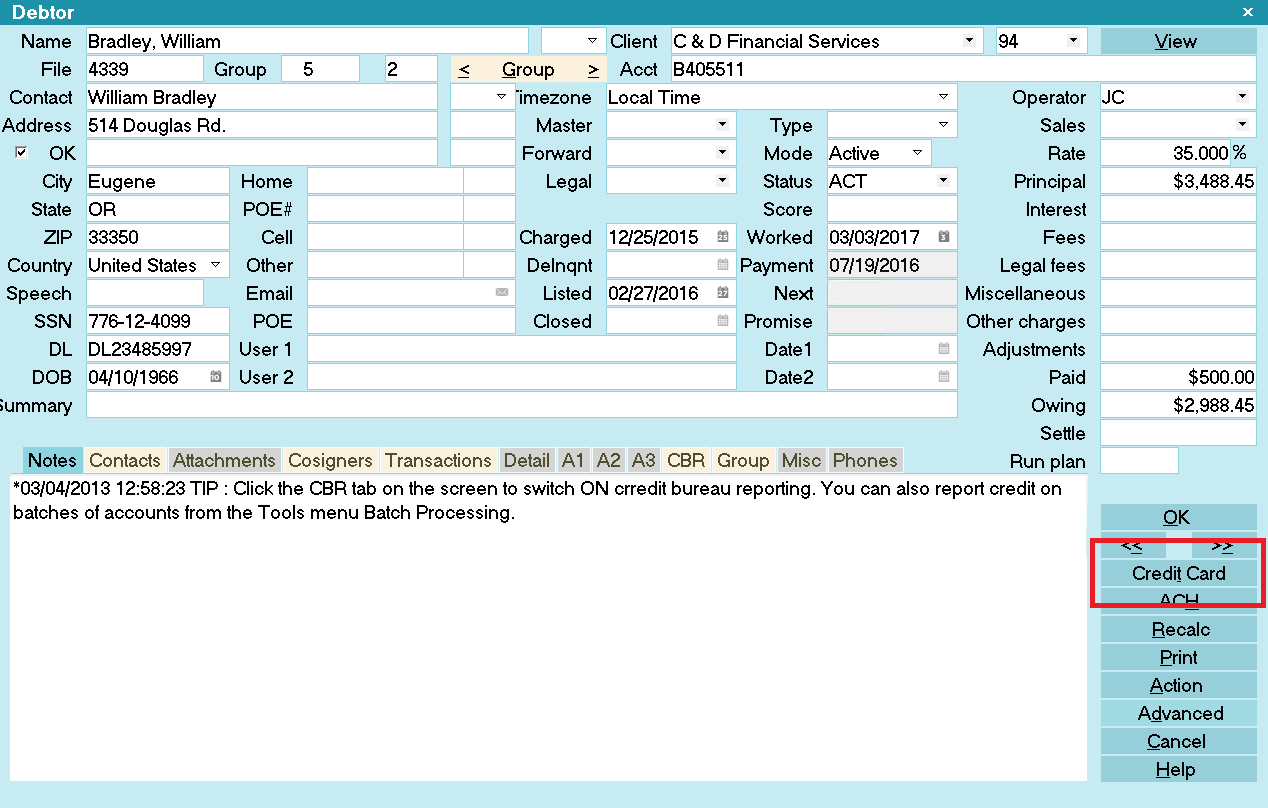

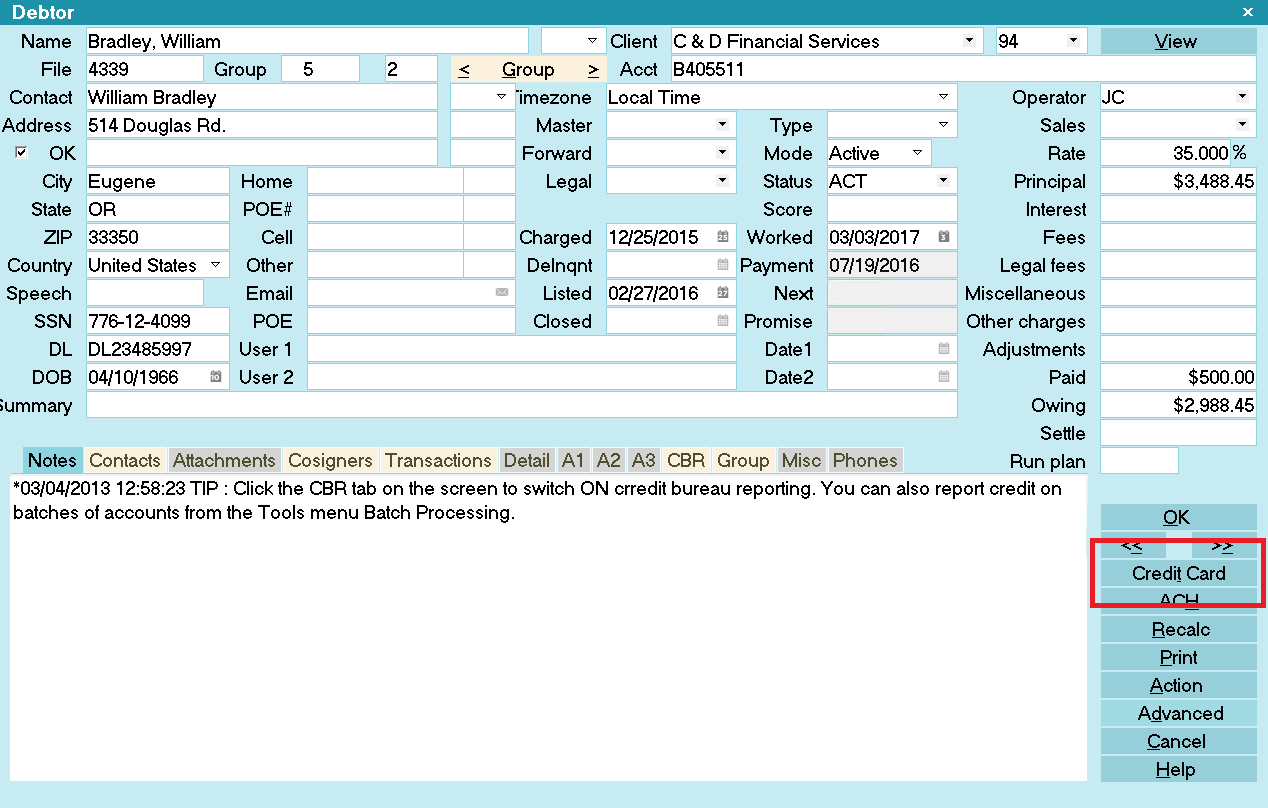

Click the Credit Card button in the lower right corner of the Debtor screen to access the

Credit Card Payment Tasks window.

Select the Credit Card button

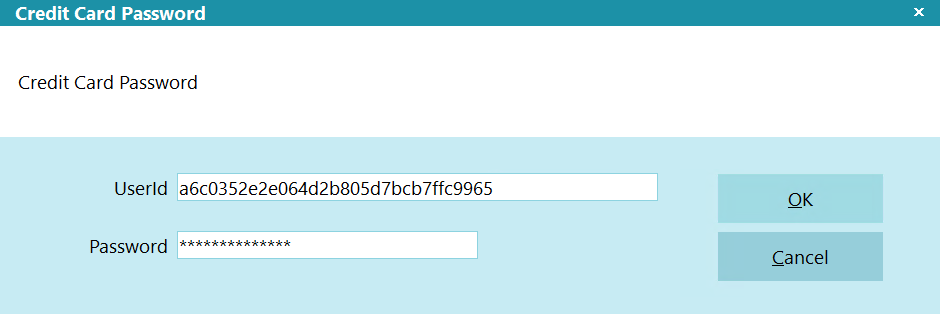

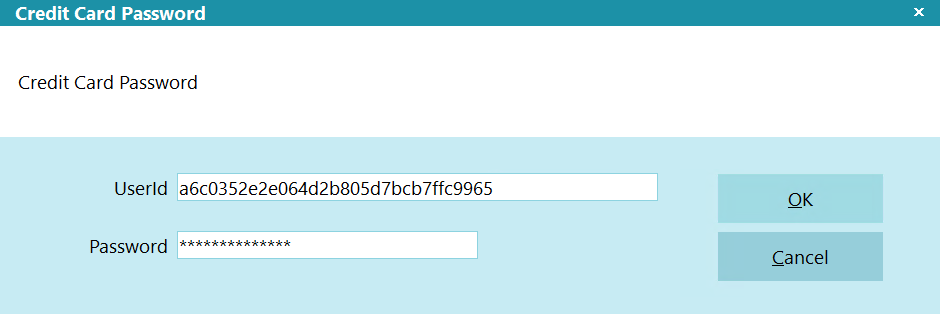

If you have not entered a Username or Password on the Credit Card Setup form, you will be

prompted to enter your Credit Card UserID and password.

If you have not entered a Username or Password on the Credit Card Setup form, you will be

prompted to enter your Credit Card UserID and password.

Payment Processing Credit Card Password

If applicable, enter your UserID and password.

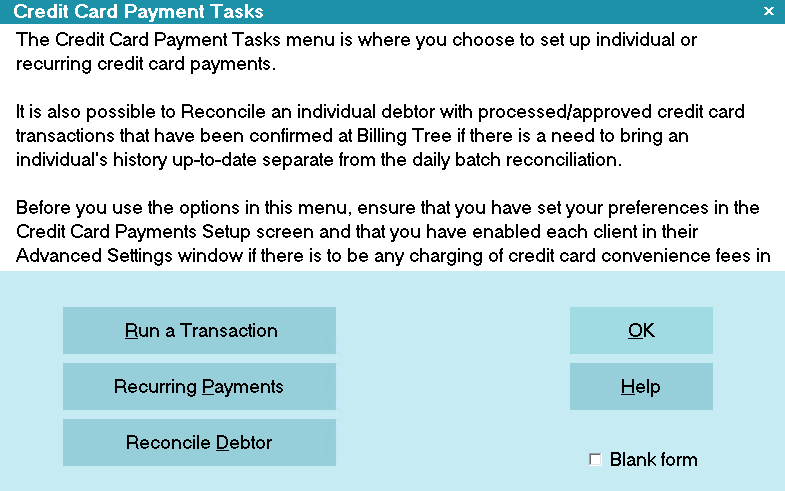

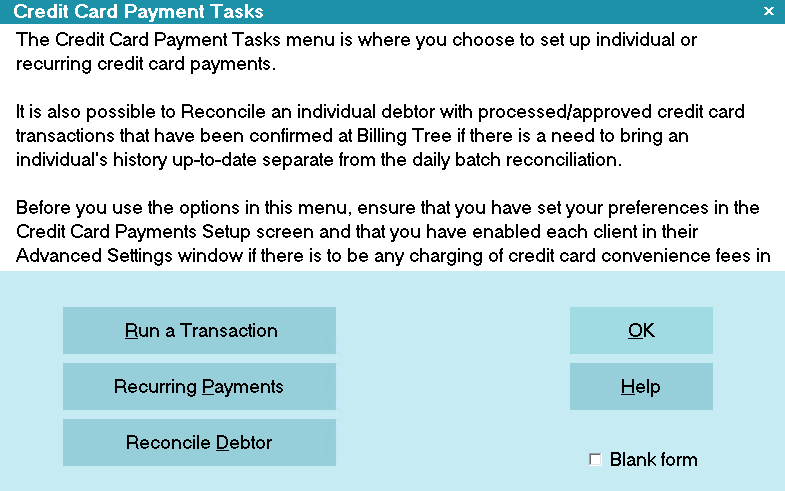

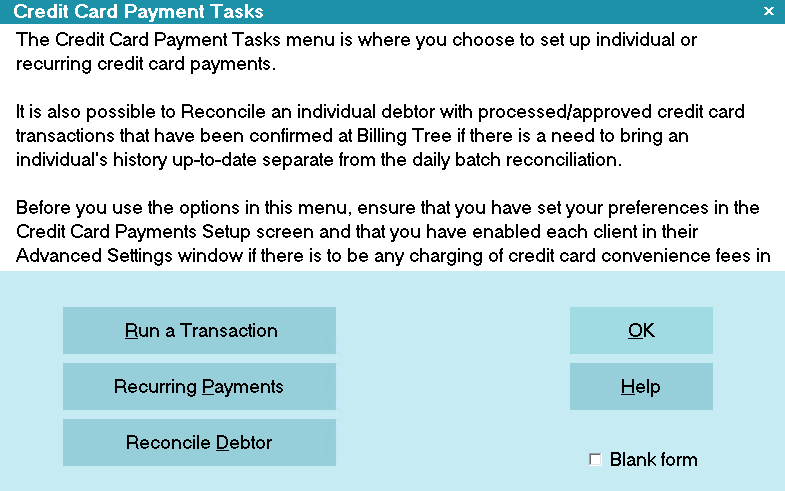

Credit Card Payment Tasks

Click RUN A TRANSACTION to open the Single Credit Card Transaction screen.

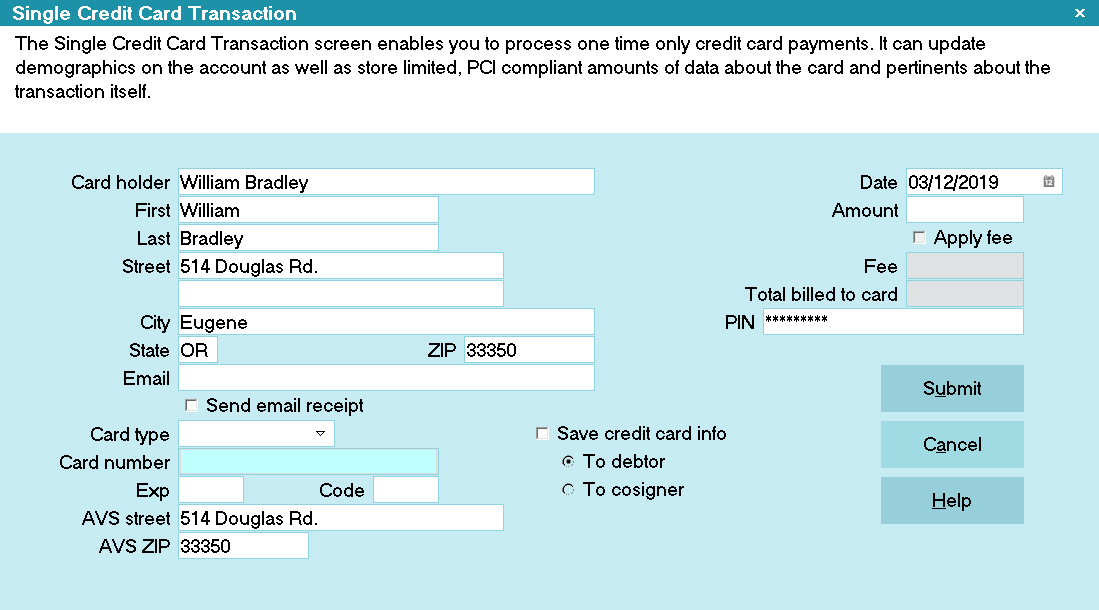

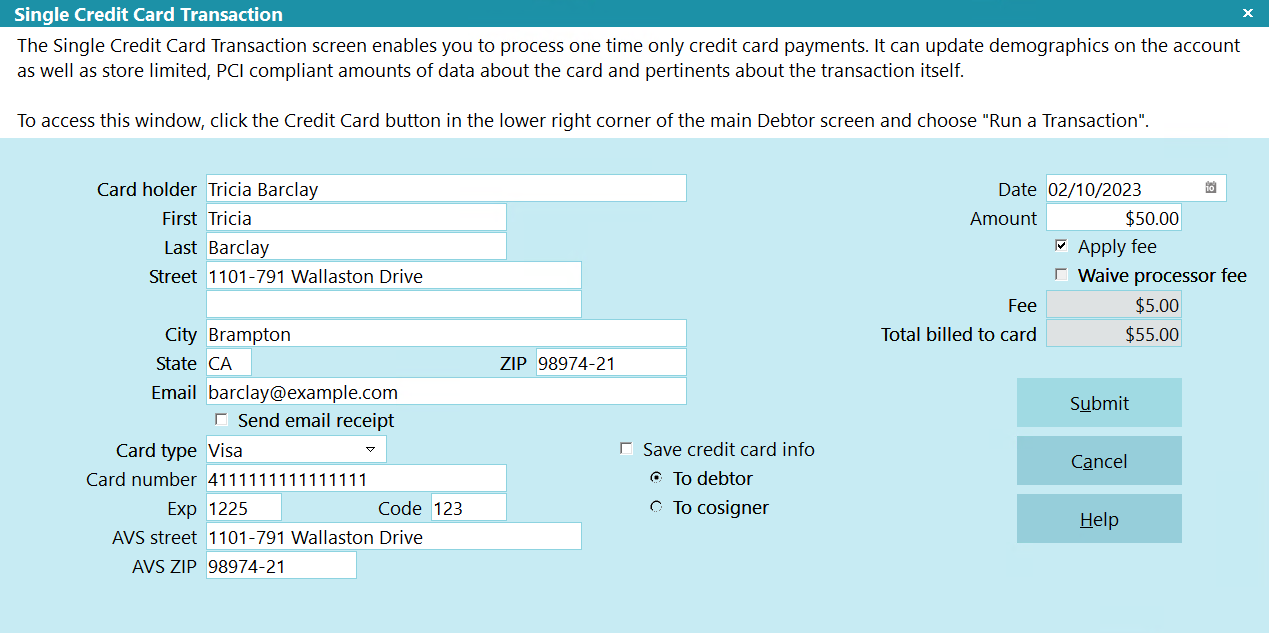

Single Credit Card Transaction

Some of the fields will be auto-filled for you as the window opens. Credit card information that you

enter will be stored in the Debtor Detail tab.

Special points of note on this intake screen are:

a) A valid billing address for the card holder is required.

b) A valid 2-character state code is required.

c) A valid zip code is required. The transaction will be rejected if an attempt to put in a

placeholder, non-valid zip is attempted in the absence of one which is known.

d) If you enabled convenience fees for this debtor's client, the check box will be accessible and

require your endorsement to charge the convenience fee by checking the "Apply fee" box first, before

you see the fee amount populate.

Save Credit Card Info

The "Save credit card info" switch is ON and grayed out. You can select either "To Debtor" or

"To Cosigner" but Collect! has to store the credit card information when you are using recurring

payments.

The switch to "Save credit card info" enables you to update your debtor screen with any new address

or name information. To update this information, click the radio button labeled "To debtor" and a

dot will appear beside the field.

This will also save the credit card information to the Debtor Detail tab on the main debtor screen.

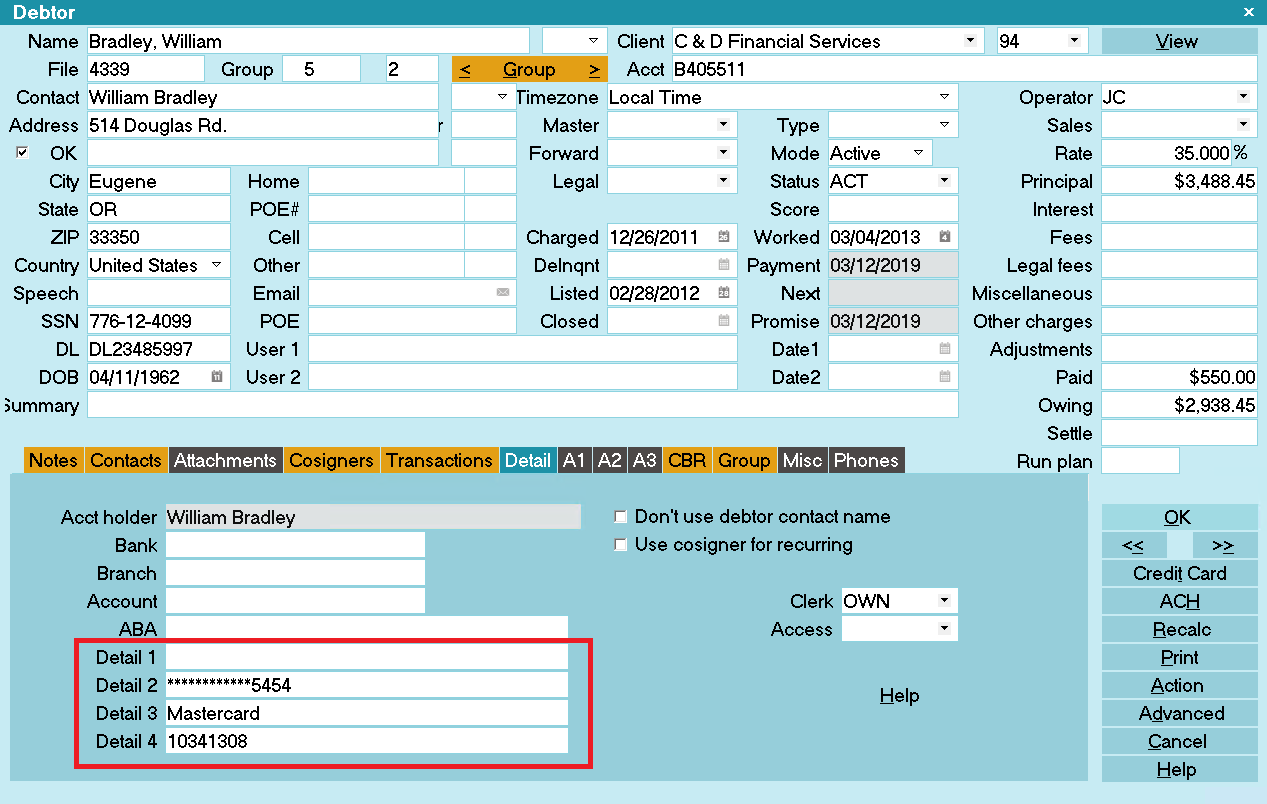

Credit Card Info Saved to Debtor Detail

Detail 2 is the masked Credit Card Number.

Detail 3 is the Credit Card type.

Detail 4 is the Payment Provider's unique Client Number for the stored debtor.

*** IMPORTANT: Don't change this number! If you plan to use Payment Processing,

this field must be left blank. The module will manage this field itself.

Be aware that this does overwrite any information that is currently stored in the Debtor

Detail 2, Debtor Detail 3, and Debtor Detail 4 fields. Alternatively, you can save the

information to the Cosigner and Collect! will create a new Cosigner record.

Be aware that this does overwrite any information that is currently stored in the Debtor

Detail 2, Debtor Detail 3, and Debtor Detail 4 fields. Alternatively, you can save the

information to the Cosigner and Collect! will create a new Cosigner record.

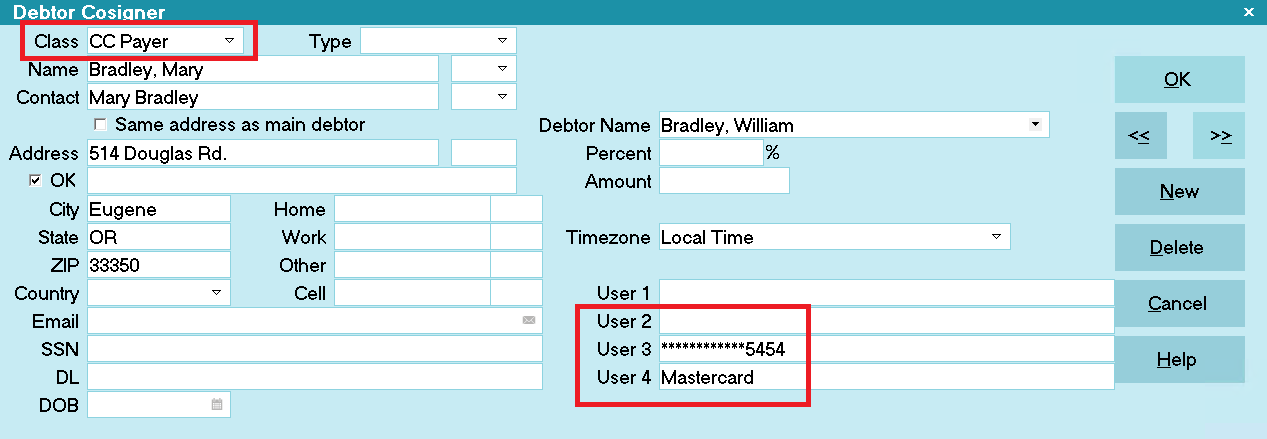

Save Credit Card Info To Cosigner

You can save all the Name, Address and Credit Card information to a new Cosigner window, if the payer

is not the Debtor. Collect! will set the Cosigner class to CC Payer.

Name, Address and Credit Card Info Saved to Cosigner

User 3 is the masked Credit Card Number.

User 4 is the Credit Card type.

At any given time, Collect! only stores one CC Payer Cosigner and one Recurring Credit Card

Payments Schedule per file.

At any given time, Collect! only stores one CC Payer Cosigner and one Recurring Credit Card

Payments Schedule per file.

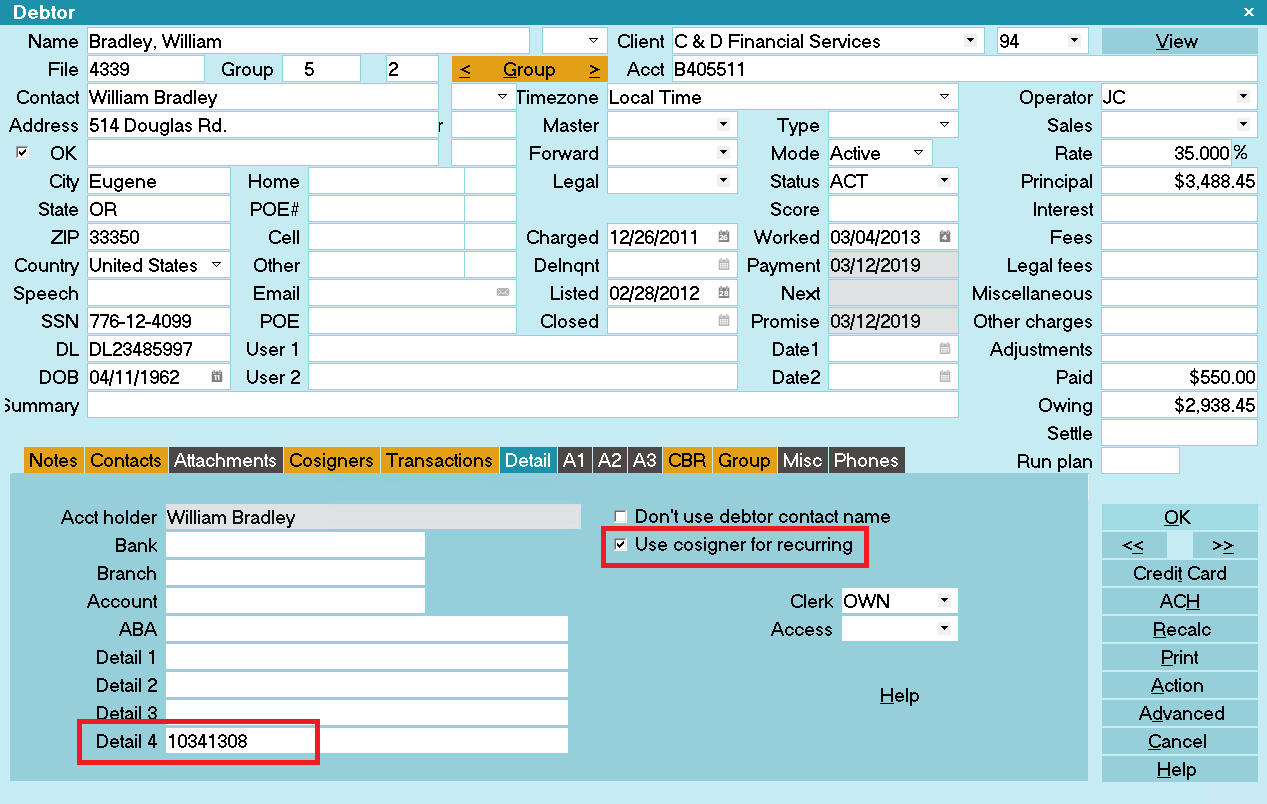

When if you save the credit card information to the Cosigner, the Client # is still stored in the

Debtor Detail 4 field because the stored record is always the Debtor.

Client Number in Debtor Detail

Detail 4 is the Payment Provider's unique Client Number for the stored debtor.

*** IMPORTANT: Don't change this number!

Leave this switch ON for the duration of your payment schedule so that Collect! can verify

the credit card information for the payer in the CC Payer Cosigner window during electronic

reconciliations with the Payment Provider.

Leave this switch ON for the duration of your payment schedule so that Collect! can verify

the credit card information for the payer in the CC Payer Cosigner window during electronic

reconciliations with the Payment Provider.

If you wish to charge a convenience fee, you must have enabled Credit Card convenience fees

in your Credit Card Setup screen and also for the individual Clients in the Advanced Settings

screen.

If you wish to charge a convenience fee, you must have enabled Credit Card convenience fees

in your Credit Card Setup screen and also for the individual Clients in the Advanced Settings

screen.

Client Settings screen

If enabled, you will be able to check the Apply Fee box and the designated fee amount will

auto-populate.

The Apply Fee check-box and Fee amount field both remain appear grayed out if the convenience fee

is not enabled.

You can fill in other details as needed, save the credit card and address information to the Debtor

or Cosigner and submit the payment.

Ready to Submit Single Credit Card Transaction

Collect! sends the credit card information to the Payment Provider immediately. If the credit card

is accepted, the information is stored for processing by the Payment Gateway.

Credit Card Transaction Approved by the Payment Provider

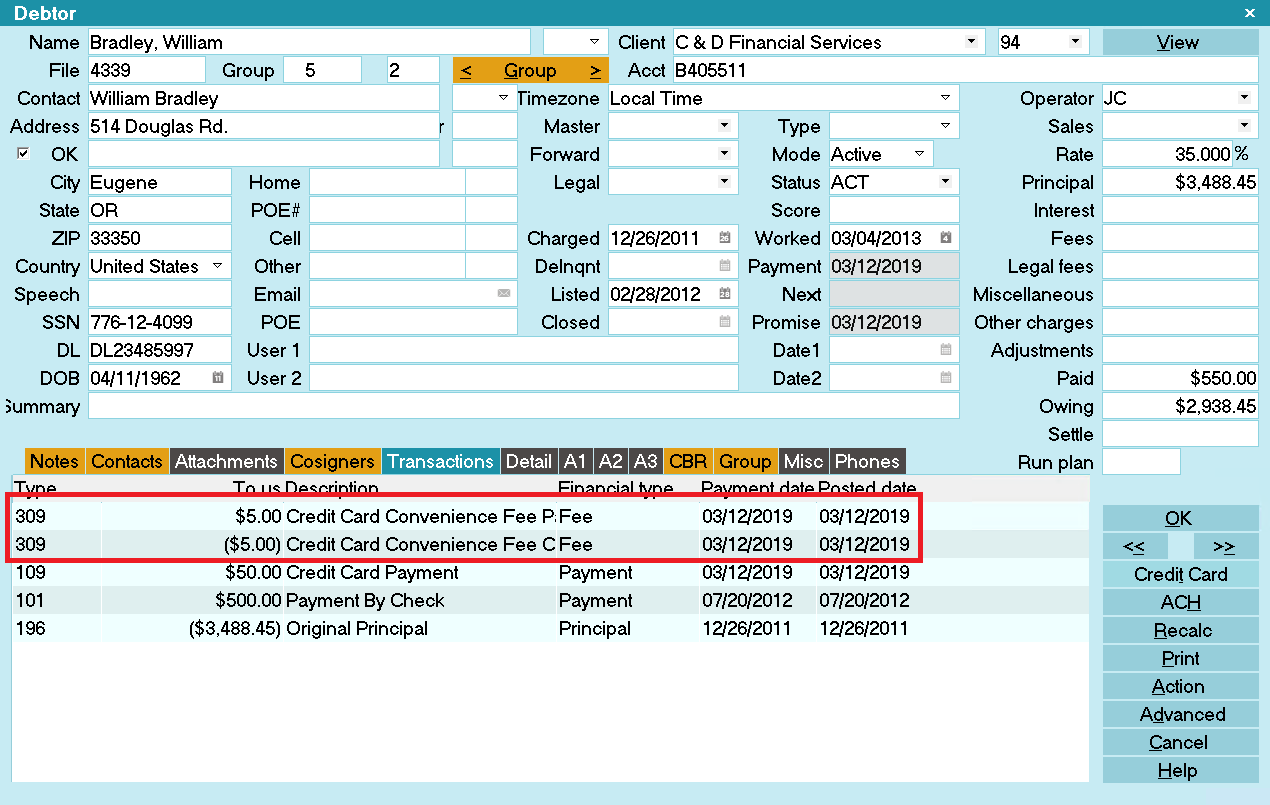

Credit Card Transactions Posted

Transaction Details

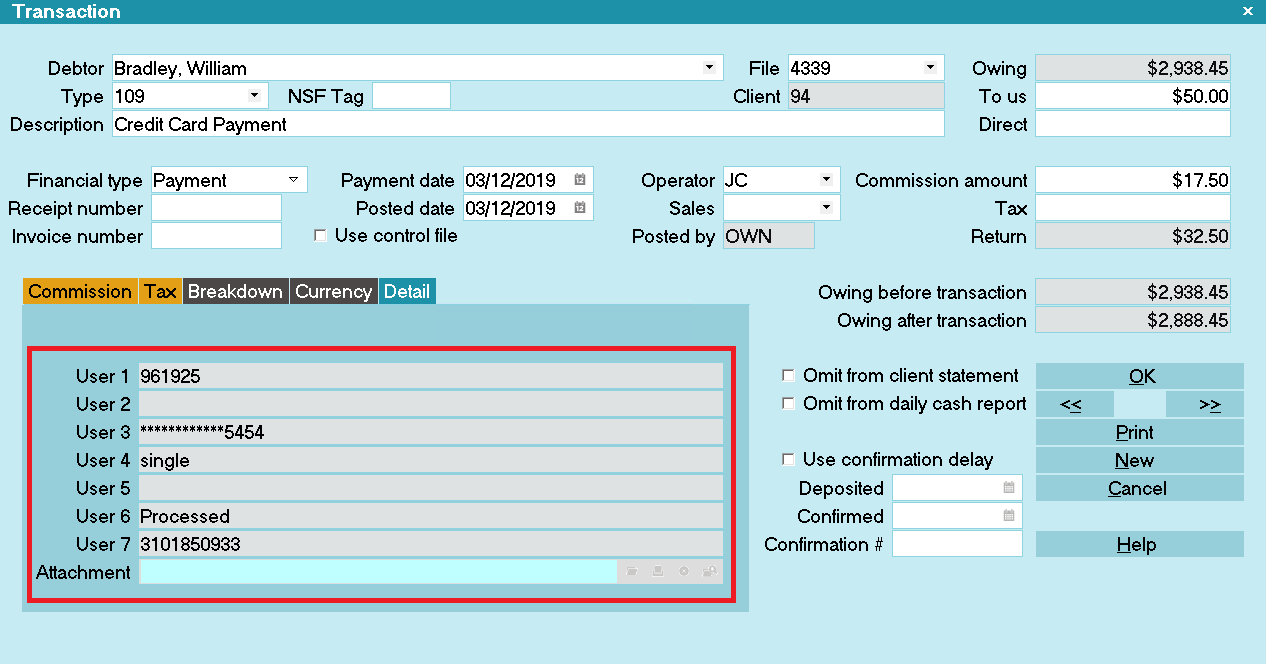

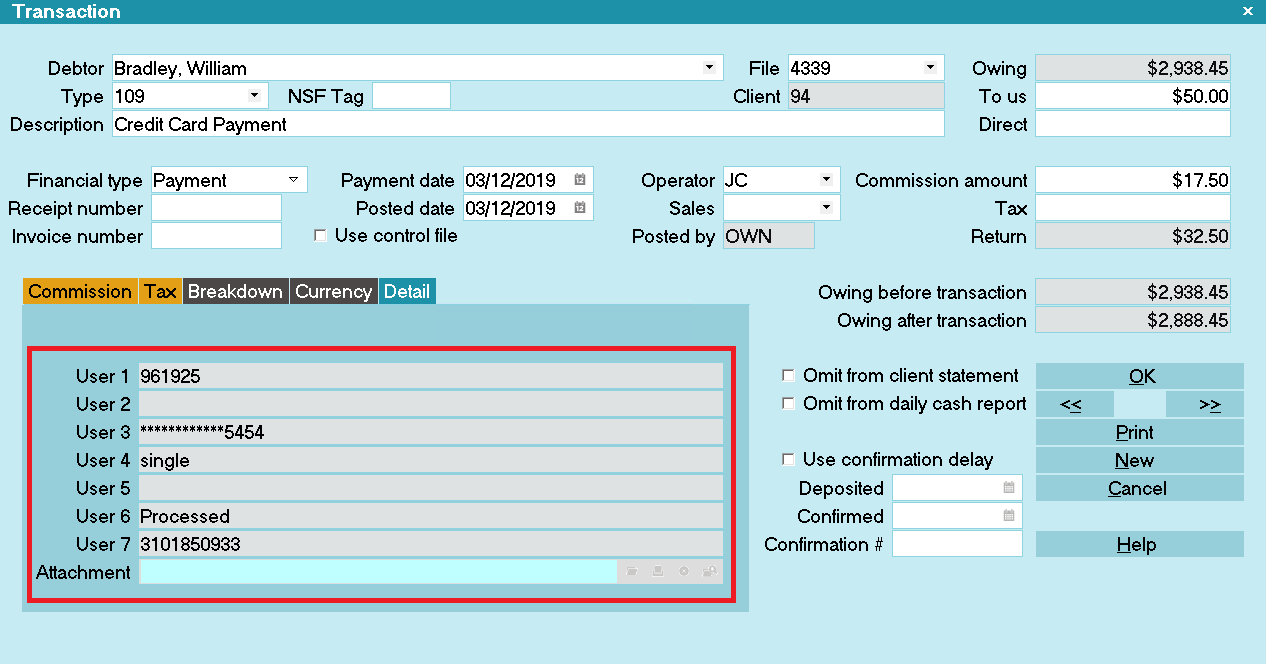

Processing confirmation details are stored in the Transaction Detail tab when your Credit Card

payments are finalized.

Transaction Details

User 1 is the Authorization Code.

User 2 stores the Payer's name if the Payer is not the Debtor.

User 3 is the masked Credit Card Number.

User 4 stores the source of the transaction. There are 3 options:

- single = Single Transaction run from Collect! by an Operator

- recurring = Recurring Transaction that was posted during the CC Reconciliation.

- vterm = Web Portal Transaction that was posted during the CC Reconciliation.

User 6 displays "Processed" for successful submits.

User 7 is the unique Transaction Reference Number assigned to this credit card

payment.

WARNING: To prevent duplicate postings and charges to the debtor, the user fields are all set to

Read Only regardless of your user level.

WARNING: To prevent duplicate postings and charges to the debtor, the user fields are all set to

Read Only regardless of your user level.

Recurring Credit Card Payments

Click the 'Credit Card' button in the lower right of the the Debtor Screen.

Select the Credit Card button

If you have not entered a Username or Password on the Credit Card Setup form, you

will be prompted to enter your Credit Card UserID and Password.

If you have not entered a Username or Password on the Credit Card Setup form, you

will be prompted to enter your Credit Card UserID and Password.

Payment Processing Credit Card Password

If applicable, enter your UserID and password.

Credit Card Payment Tasks

Click the RECURRING PAYMENTS button to open this entry window.

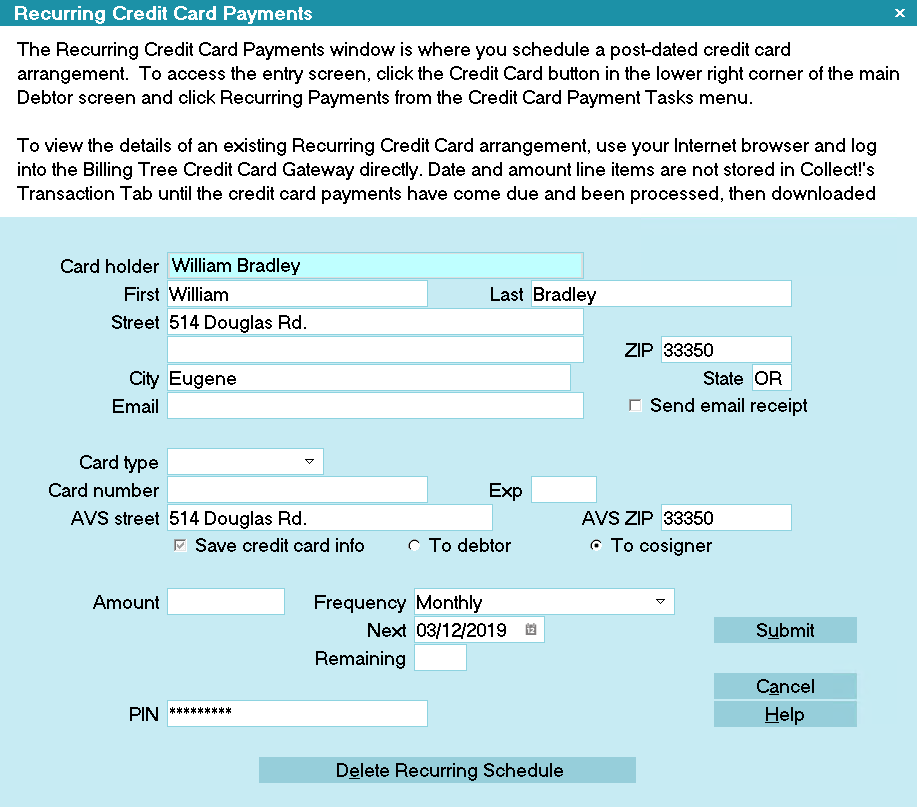

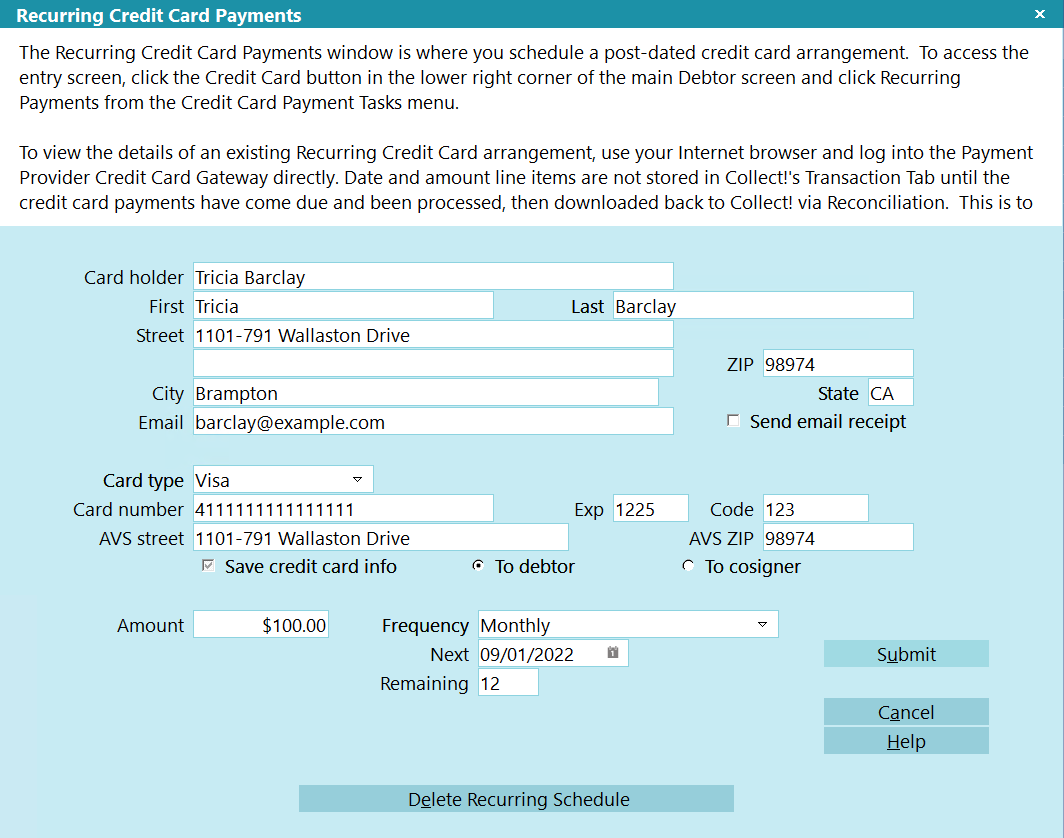

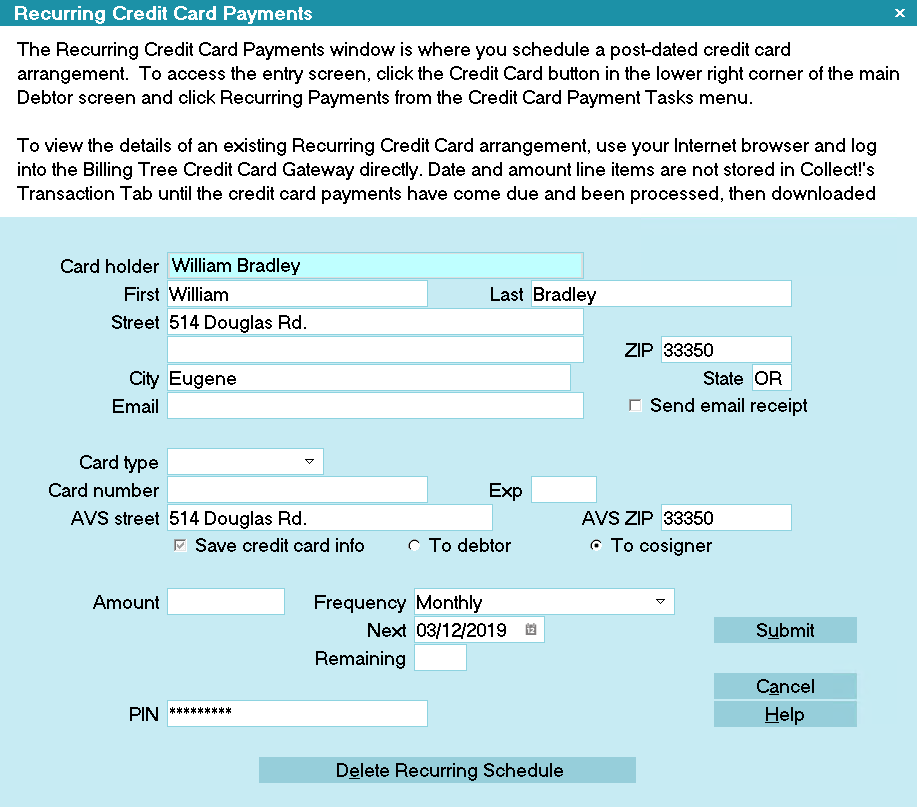

Recurring Credit Card Payments

Some of the fields will be auto-filled for you as soon as you open the window.

Credit Card Guidelines prohibit the charging of convenience fees on all but the first entry

in any recurring schedule arrangement. Our module is compliant with these regulations and

and currently does not support convenience fees on recurring payments.

Credit Card Guidelines prohibit the charging of convenience fees on all but the first entry

in any recurring schedule arrangement. Our module is compliant with these regulations and

and currently does not support convenience fees on recurring payments.

You can fill in other details as needed on the entry screen, save the credit card and address

information to the Debtor or Cosigner and Submit the payment schedule to the Payment Provider

Gateway.

Collect! will automatically adjust the final payment ONLY IF the owing amount is lower than

the final payment. For example: the final payment will adjust down if the payment amount is

$10.00 and the owing is $9.99 or lower. The payment amount will NOT adjust up of the payment

amount is $10.00 and the owing is $10.01 or higher. Collect! will also set the remaining

payment to 1.

Collect! will automatically adjust the final payment ONLY IF the owing amount is lower than

the final payment. For example: the final payment will adjust down if the payment amount is

$10.00 and the owing is $9.99 or lower. The payment amount will NOT adjust up of the payment

amount is $10.00 and the owing is $10.01 or higher. Collect! will also set the remaining

payment to 1.

Ready to Submit Recurring Credit Card Payments Schedule

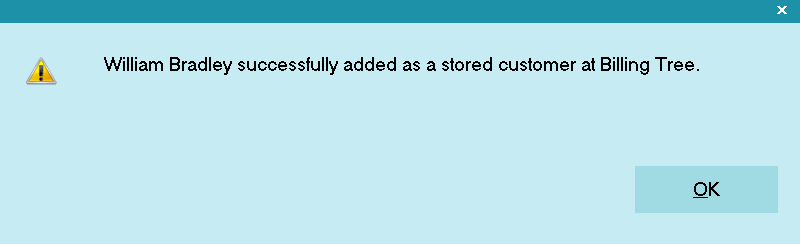

If the card is accepted, the Payment Provider stores the card details for the recurring credit card

payments. This is a requirement for PCI compliance. There will be a redacted version of the card

number retained only, with no expiry date or cvv numbers being retained in system for PCI Compliance.

Credit Card Schedule Stored at the Payment Provider

Recurring credit card payments are not posted in Collect! until you run batch "Reconcile

Credit Card History" the day on or after the payment comes due.

Recurring credit card payments are not posted in Collect! until you run batch "Reconcile

Credit Card History" the day on or after the payment comes due.

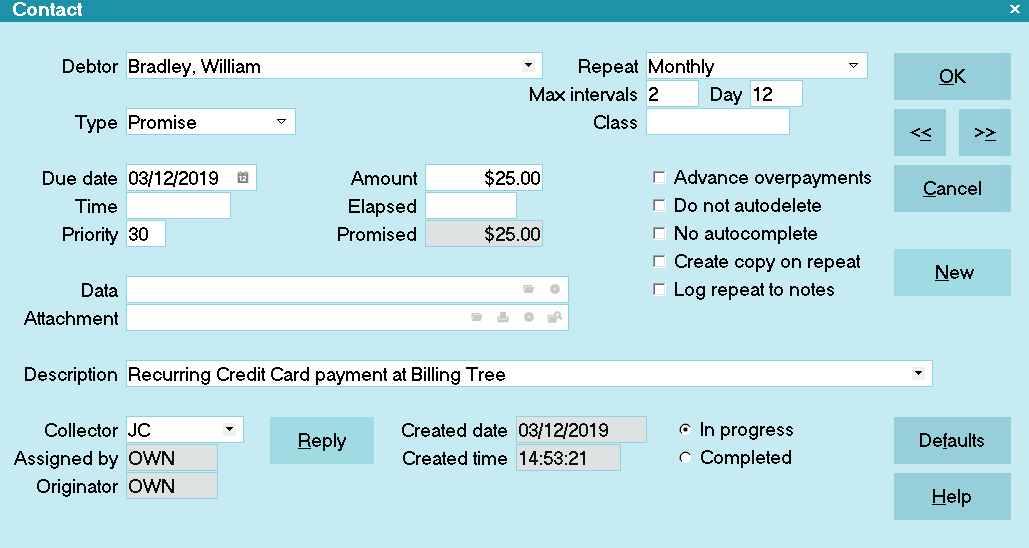

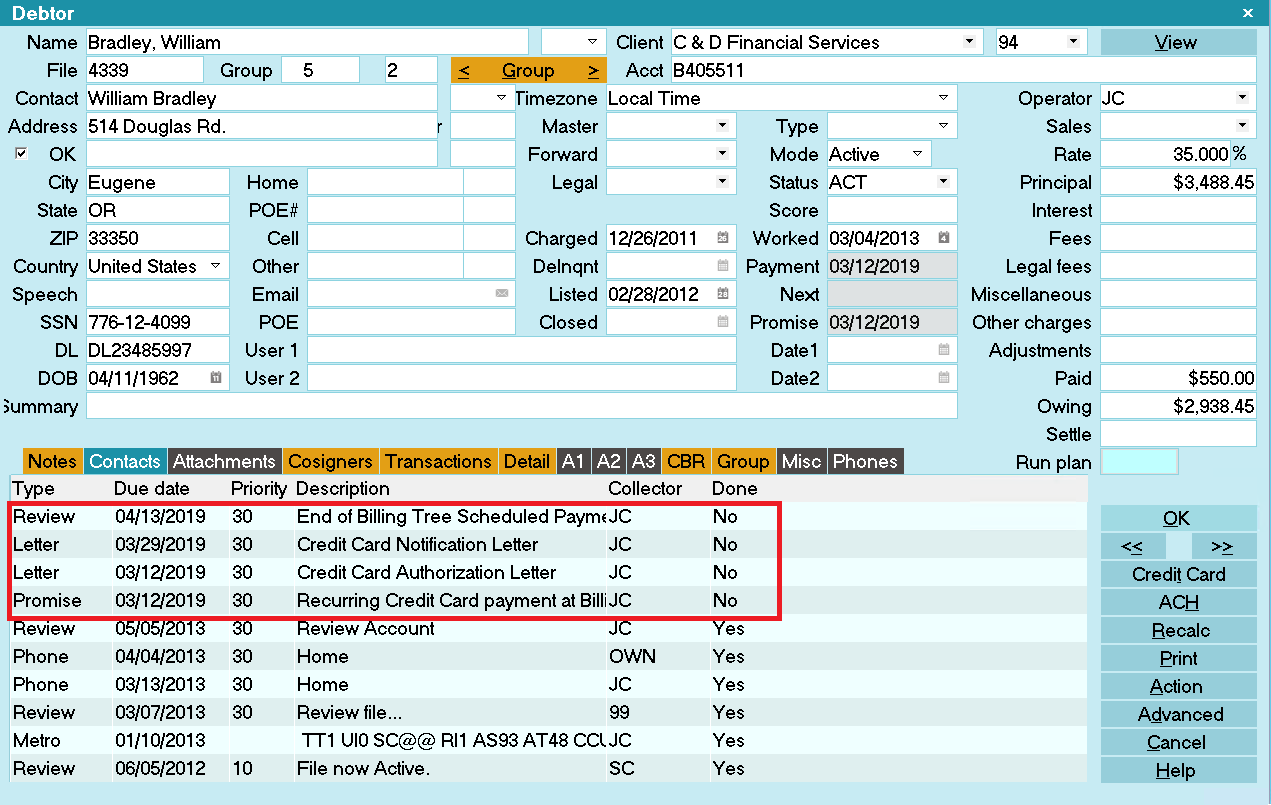

The module then creates a Promise contact to assist the collector with keeping the track of the

payment schedule.

Promise Contact for Recurring Credit Card Payments

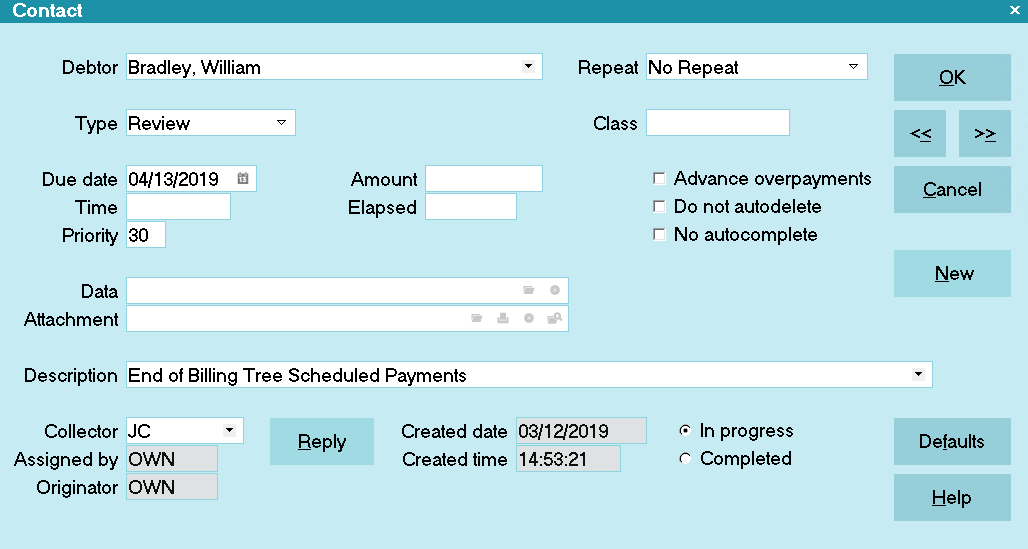

The module also inputs a post-dated Review Contact to make sure the collector is reminded of the end

of the payment schedule as well.

Review Contact for Recurring Credit Card Payments

Change Payment Information

On the Debtor, click the CREDIT CARD button.

Click the RECURRING PAYMENTS button to open this entry window.

Click the DELETE RECURRING SCHEDULE to cancel the contract with the Payment Provider.

Setup a new payment arrangement as per How to schedule recurring

payments.

Recurring Credit Card Payments

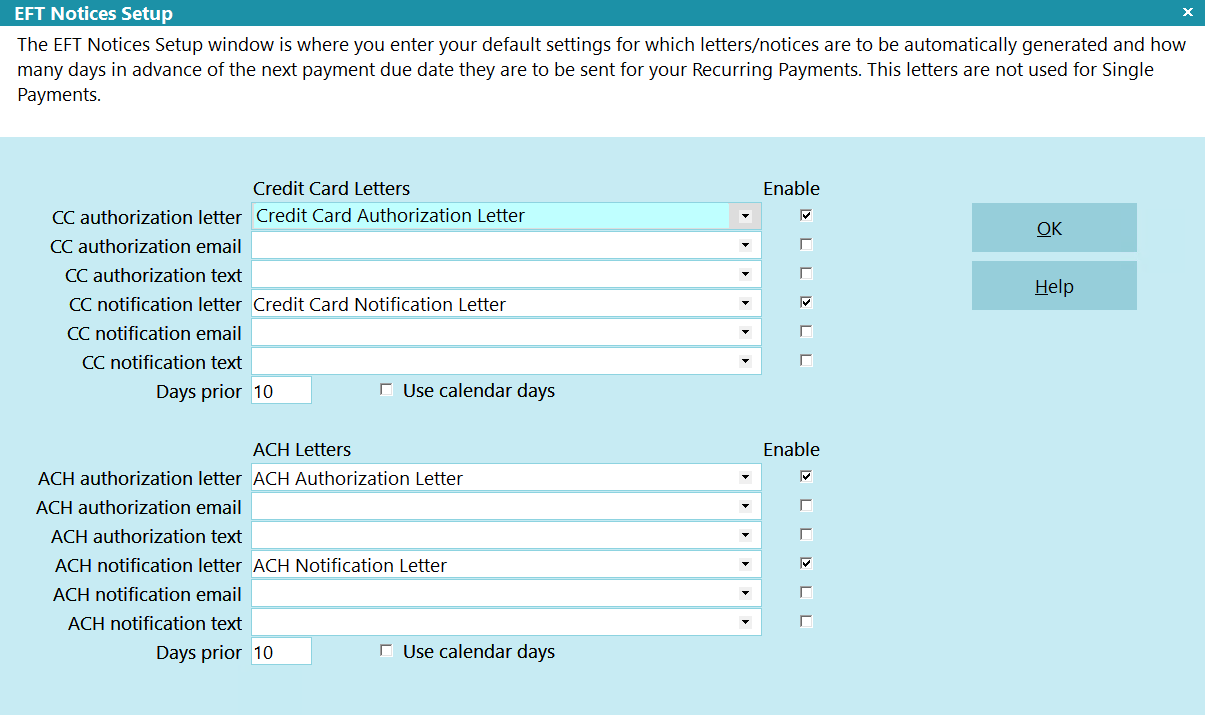

EFT Notices

The module includes an EFT Notice Setup which allows you to be able to schedule all pre-payment

reminder and/or authorization letters which you may be legislatively required to send to your debtors

making Electronic Funds Transfer payments by reliably sending them out "X" days ahead of the payment

due dates.

EFT Notices and Reviews

In compliance with EFT requirements, the module has the ability to automatically schedule authorization

letters and EFT notices for recurring credit card and ACH payments.

You can access this setup window from the menu path "System\Preferences\ Payment Processing Setup\

EFT Notices Setup". It allows you to be able to select which letter you wish to send from the letter

library you have stored in your Print Menu and set a predefined number of days ahead of any due date

that the letter should be sent.

EFT Notices Setup

It is your responsibility to ensure that any letters you send to debtors are compliant in

format and content with legislation and regulations in your region.

It is your responsibility to ensure that any letters you send to debtors are compliant in

format and content with legislation and regulations in your region.

View EFT Notices samples.

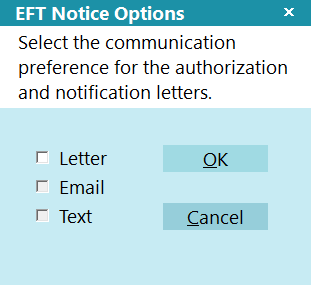

You can configure EFT notices to be sent via Letter, Email, and Text. If multiple communication

methods have been configured, the below EFT Notice Options form will appear to allow you to select

the method that the Debtor prefers.

EFT Notice Options

Run A Contact Plan

If you set a contact plan in the 'Run plan on recurring' field on the ACH Payments Setup form, it

will run when the recurring payments is posted.

Reconcile Credit Card History

The Reconcile Credit Card History is a batch process that queries the Payment Provider for all credit

card payments processed by them but have not been posted in Collect! yet. This will include any

payments which any Debtors have made directly on the Payment Provider website, provided they have

used their Collect! file number as their unique identifier on the Gateway website along with any

recurring payments which came due since your last Reconcile. You will also receive any new

declines / chargeback (reversals) when you run the Reconcile process.

WARNING: If the last reconcile date is more than 7 days into the past, Collect! will prompt you

during the reconciliation process to confirm that you want to proceed. If you run the task

via the Task Scheduler, Collect! will not run the reconciliation and will put an entry

in the Application Log that the task failed.

WARNING: If the last reconcile date is more than 7 days into the past, Collect! will prompt you

during the reconciliation process to confirm that you want to proceed. If you run the task

via the Task Scheduler, Collect! will not run the reconciliation and will put an entry

in the Application Log that the task failed.

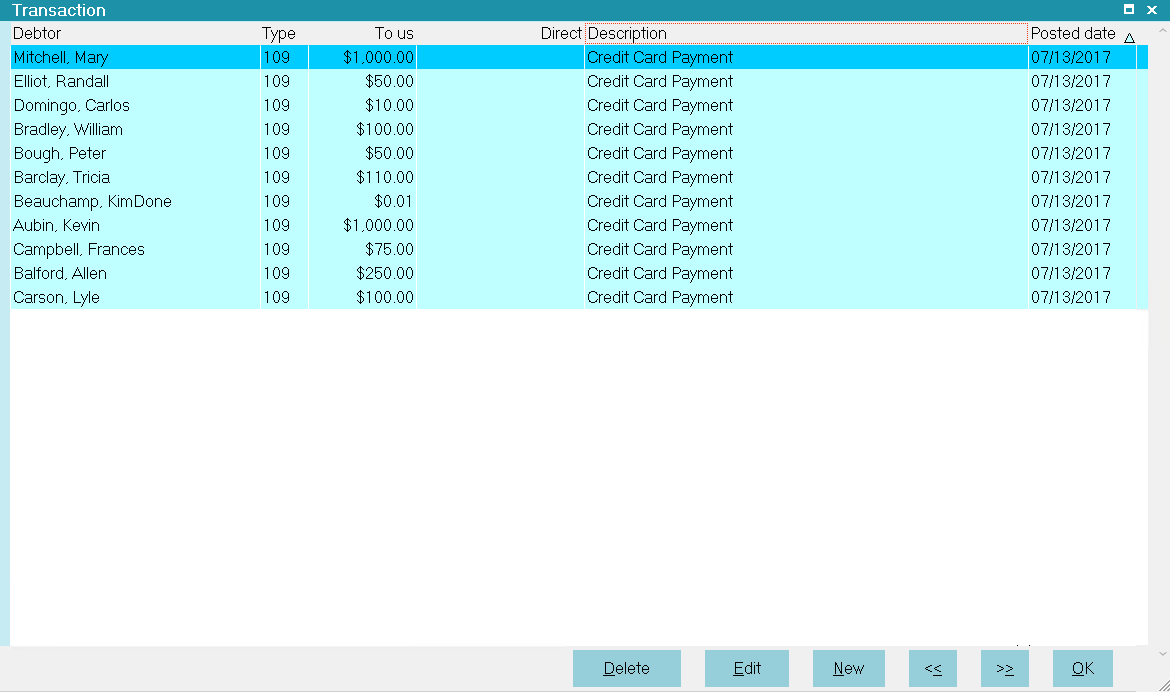

Reconcile Credit Card History

Credit Card Transactions Posted

Debtors may enter their own payments directly at the Payment Provider Gateway provided they

are advised to use their Collect! file number as their unique identifier/account number.

Debtors may enter their own payments directly at the Payment Provider Gateway provided they

are advised to use their Collect! file number as their unique identifier/account number.

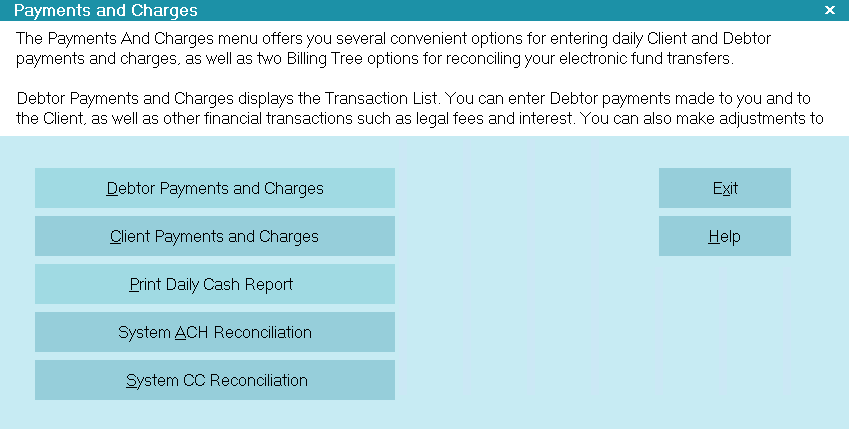

To download the latest batch of credit card transactions not yet posted in Collect!, follow the menu

path " Daily Administration\ Payments and Charges\Reconcile Credit Card History". Selecting this

process will query the Payment Provider for all approved transactions, declines and/or reversals which

have taken place since your last reconciliation.

WARNING: If you use different login IDs for staff with different permissions, i.e. for max amount

allowed to submit, then it is necessary to run separate reconciliations for EACH separate

login.

WARNING: If you use different login IDs for staff with different permissions, i.e. for max amount

allowed to submit, then it is necessary to run separate reconciliations for EACH separate

login.

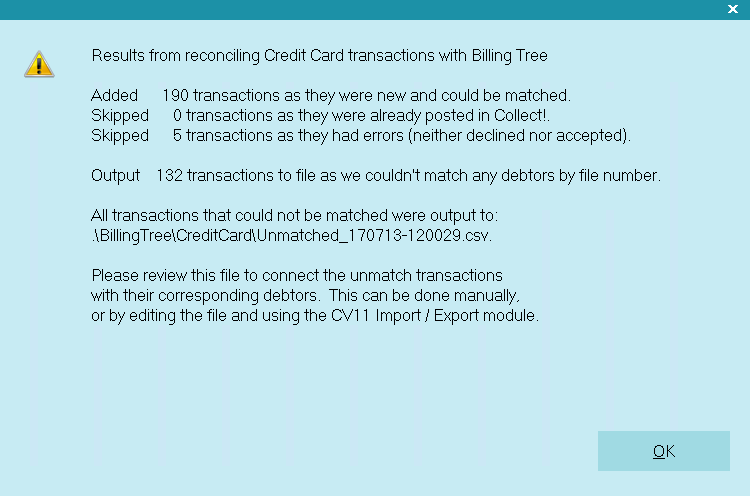

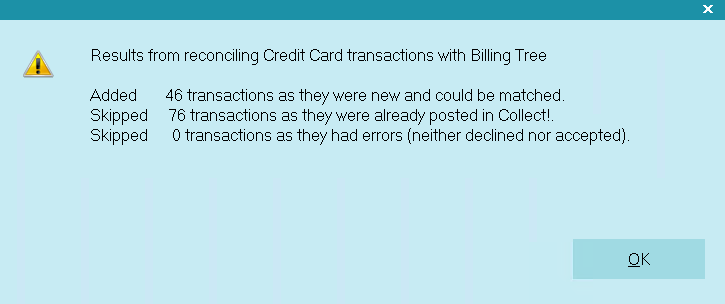

Once the process is invoked, as information is exchanged between Collect! and the Payment Provider.

You will see a summary screen with batch download results. If payments cannot be matched, for

reasons such as invalid file number or some kind of modification to a pre-existing transaction

which now no longer matches the Payment Provider's records, then these items will be written out to

an exception report stored in your logs folder; Collect\Log Files\payments\CreditCard. The file

naming convention is "Unmatched", followed by the date in YYMMDD format, and lastly the time stamp

HHMMSS. Transactions in this report require manual review and posting in Collect!.

Reconcile Credit Card History Results

If a credit card is declined when an attempt made to process a recurring payment, then Collect!

processes the payment as "Declined" and uses your settings from the Credit Card Setup options.

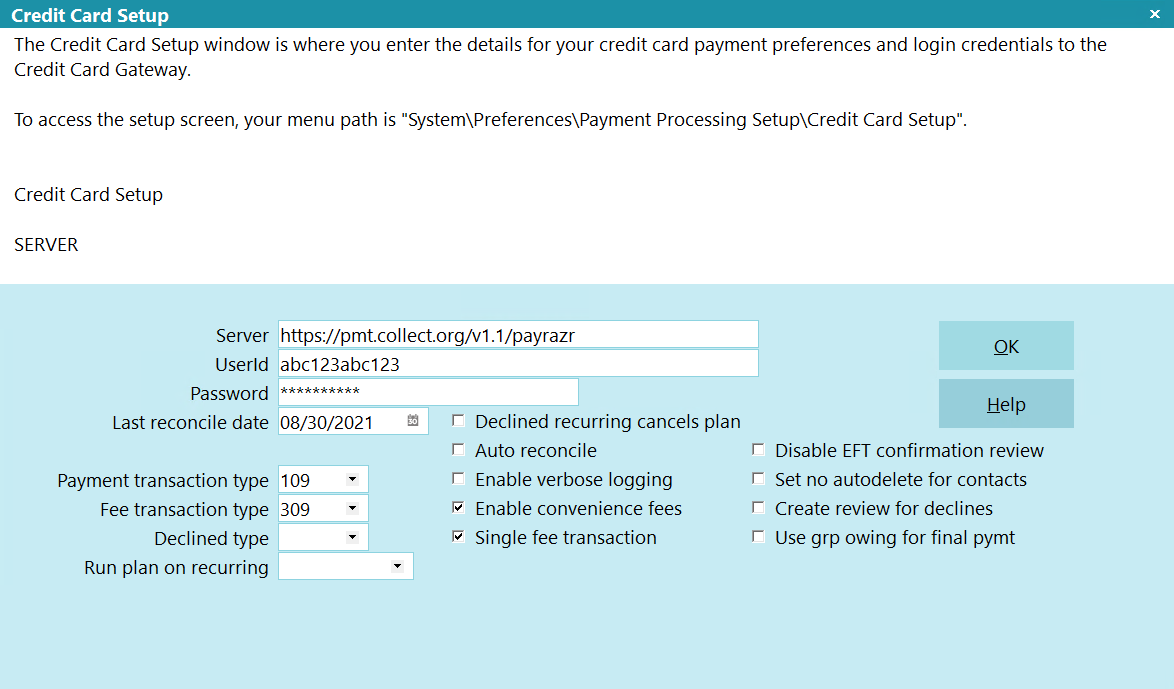

Credit Card Setup

If a file number match is made during reconciliation but the transaction is skipped or errored out

for any reason, you will see a Note line logged to the specific debtor account that the transaction

belongs to, identifying what was skipped or errored. The note line will be prefixed

"Failed Transaction:" and indicate that an "Error" occurred, as well as provide the Payment Date and

amount. This is a transaction that would need to be manually reviewed for what caused the issue and

corrective action would depend on what was ascertained as root cause (i.e. was the transaction

manually modified between upload of transaction and download of process confirmation).

It also writes a detailed log into the Application Log.

Users who are also licensed for the Scheduler Module have an enhanced automation with the

Reconcile process being available in the Scheduler Task list of options. You may run this

process unattended. Contact us at sales@collect.org for module pricing.

Users who are also licensed for the Scheduler Module have an enhanced automation with the

Reconcile process being available in the Scheduler Task list of options. You may run this

process unattended. Contact us at sales@collect.org for module pricing.

Reconcile Debtor

The Reconcile Debtor function enables you to query the Payment Provider for any credit card payments

that may have been processed by the Payment Provider for a particular Debtor but not yet posted in

Collect!.

Reconcile Debtor

When you run the Reconcile Debtor function, Collect! displays a summary screen to let you know what,

if any, action was taken. If transactions are found for this debtor that are not in Collect! then

the payments will be posted as soon as the Reconcile Debtor function runs.

Reconcile Debtor Results

WARNING: If you use different login IDs for staff with different permissions, i.e. for max amount

allowed to submit, then it is necessary to run separate reconciliations for EACH separate

login.

WARNING: If you use different login IDs for staff with different permissions, i.e. for max amount

allowed to submit, then it is necessary to run separate reconciliations for EACH separate

login.

Processing transaction confirmation will appear in the Transaction record, where the Confirmation #

is stored in the lower right of the screen and additional information specific to the transaction

is retained in the Transaction Detail Tab.

Viewing Results

Collect! launches several steps when you reconcile.

Credit card payments that have been processed by the Payment Provider since your last reconcile are

posted in Collect!. Key details are stored in the Transaction Detail tab.

Transaction Details

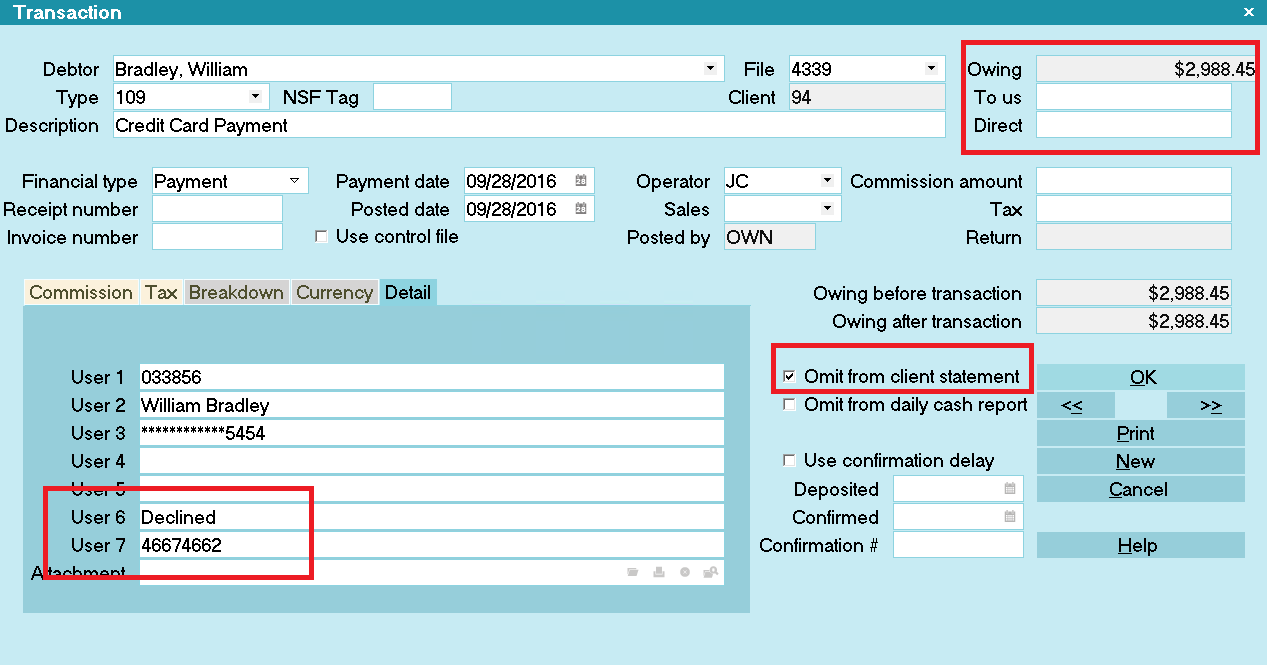

If the Payment Provider is unable to process a payment due to a stored credit card being declined,

Collect! posts a zero value transaction. "Omit from client statement" is switched ON. Several details

are written to the Transaction Detail tab.

Credit Card Declined

User 6 displays "Declined" for rejected credit card transactions.

Credit Card Setup

If a credit card is reported as "Declined" when you reconcile credit card history, Collect! can

automatically stop the recurring payment schedule. If you switched ON "Declined recurring cancels plan"

in the Credit Card Setup, Collect! uploads notification to the Payment Provider to cancel the payment

schedule. Collect! will remove the EFT notices.

If any payments have been posted at the the Payment Provider rather than through Collect!, they are

also processed when you reconcile. If they cannot be matched to debtors in your database, a file is

stored with all relevant information so that you can process the payments as required. It is stored

in the Collect\Log Files\payments\CreditCard folder.

For example: Collect\Log Files\payments\CreditCard\Unmatched_180519-130554.csv, where 180519 represents

May 15th, 2015 and 130554 represents a time stamp in the format HH:MM:SS.

Viewing Application Log Entries

You may also find additional information in the Collect! Application Log when you run your reconcile

and errors are encountered PROVIDED you had checked the box for 'Enable Verbose Logging' in your

initial Credit Card Setup screen.

Switch ON " Misc" and "Error" in the Collect! Log Viewer settings to quickly filter the

Application Log for Payment Processing module entries. You can also use "Credit Card" for

Credit card log entries.

Switch ON " Misc" and "Error" in the Collect! Log Viewer settings to quickly filter the

Application Log for Payment Processing module entries. You can also use "Credit Card" for

Credit card log entries.

If a file number match is made during reconciliation but the transaction is skipped or errored out

for any reason, you will see a Note line logged to the specific debtor account that the transaction

belongs to identifying what was skipped or errored. The note line will be prefixed

"Failed Transaction:" and indicate that an "Error" occurred, as well as provide the Payment Date and

amount. This is a transaction that would need to be manually reviewed for what caused the issue and

corrective action would depend on what was ascertained as root cause (i.e. was the transaction manually

modified between upload of transaction and download of process confirmation).

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org