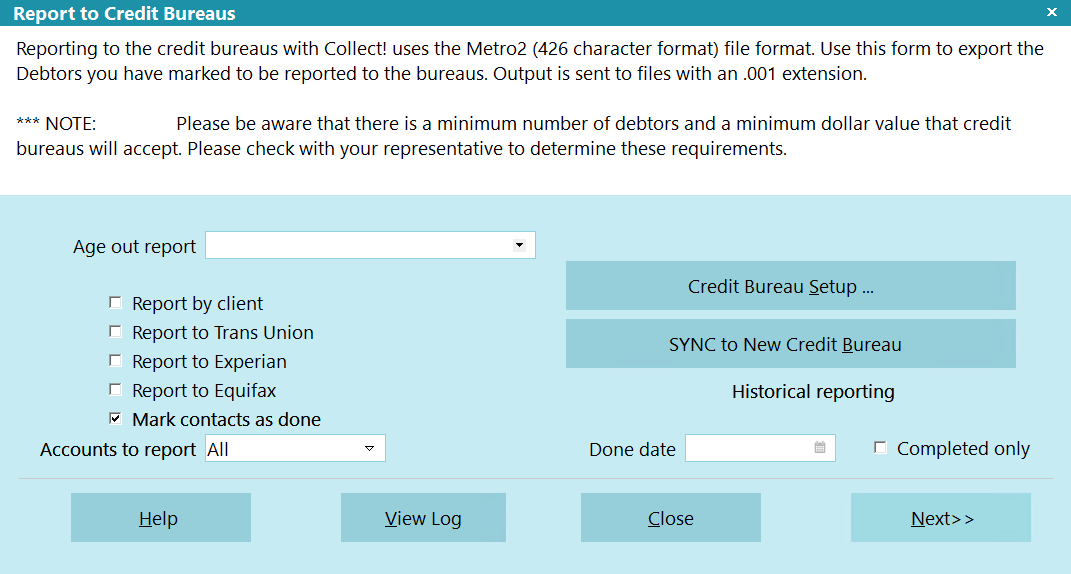

Report To Credit Bureaus

Reporting to the credit bureaus with Collect! uses the

Metro2 (426 character format) file format. Use this form

to export the Debtors you have marked to be reported to the

bureaus. Output is sent to files with an .001 extension.

Please be aware that there is a minimum number of

debtors and a minimum dollar value that credit bureaus will accept.

Please check with your representative to determine these

requirements.

Please be aware that there is a minimum number of

debtors and a minimum dollar value that credit bureaus will accept.

Please check with your representative to determine these

requirements.

Credit Reporting is a three step process. First, print a Summary

Report to review the accounts being reported. Second, select the

bureaus you want to send to and create the disk files or save the

file to your hard drive, e.g. C:\ N.B. Be sure

to check the log to correct any errors. It is most important to

correct errors before sending to Credit Bureau. Finally, you can

mark the contacts done. Please note that you must correct

all errors before marking as done.

Before using the Report To Credit Bureaus form, setup

the details of your reporting specifications using the

Credit Bureau Setup form, the Credit Report Preferences form

and the information given you by your credit reporting agency.

Before using the Report To Credit Bureaus form, setup

the details of your reporting specifications using the

Credit Bureau Setup form, the Credit Report Preferences form

and the information given you by your credit reporting agency.

You can also schedule credit bureau reports to run

using Collect!'s Scheduler.

You can also schedule credit bureau reports to run

using Collect!'s Scheduler.

Credit Reporting Process

WARNING: Reporting credit is a legal matter. You are

responsible for ensuring that the information you are sending

is accurate and complete. Do not report credit without being

ABSOLUTELY SURE about your legal rights and the legal

rights of the person or entity you are reporting.

WARNING: Reporting credit is a legal matter. You are

responsible for ensuring that the information you are sending

is accurate and complete. Do not report credit without being

ABSOLUTELY SURE about your legal rights and the legal

rights of the person or entity you are reporting.

This is a high-level overview of the process. For more information, please

refer to the Help topic How to Run a Credit Bureau Report.

Step 1

Select Tools from the top menu bar and then select

Credit Reporting from the drop-down choices. This will

display the Report to Credit Bureaus dialog.

First, print a Summary Report. It is important to review the output

to be sure the desired accounts are being reported. This creates

a report that you can print and keep for your records.

Step 2

Next, if applicable, select the Age Out report that you want

to run to mark older accounts for deletion from the credit

bureaus.

Step 3

Next, select the bureaus you want to send to, and create the

files. Ensure that the log is free of errors.

During this step, you have a chance to correct any

errors the system detects in your credit reporting information.

These errors can be invalid addresses, incorrect or missing

dates, and any other information.

During this step, you have a chance to correct any

errors the system detects in your credit reporting information.

These errors can be invalid addresses, incorrect or missing

dates, and any other information.

During this step, you typically want to send the output to

drive C (see the Help on Credit Bureau Setup), and only

select one bureau to send to. After the file has been created,

select the View Log button to review any errors. The files in which

the errors are found are listed in the log. Go to each file listed and

correct the error.

Only after you have corrected all errors should you make a final

pass to create the files you will send to the credit bureaus.

Then you can proceed to step 3

Step 4

Finally, you can Mark the Contacts as Done so the system

knows they have been reported.

WARNING: Only take this step after you have completed

step 2 and all errors have been corrected.

WARNING: Only take this step after you have completed

step 2 and all errors have been corrected.

Age Out Report

After a period of time, you may have to close accounts due to

their age. If this applies to you, you can select a report here

to run you process to mark the accounts for deletion from the

credit bureaus. This process will run first, then proceed with

the rest of the export process.

The report that you use must Start On Anywhere in the

Report Definition and there must not be any tagged

records in the background.

The report that you use must Start On Anywhere in the

Report Definition and there must not be any tagged

records in the background.

Report By Client

If report by client is switched ON, a client list will appear.

Select the client to report for.

Tagging multiple clients will not work. Please select

only one Client.

Tagging multiple clients will not work. Please select

only one Client.

Before doing this you must set up the Client User2, User3, and

User4 fields with values specific to the credit bureau being

reported to.

User 2 = Trans union codes

User 3 = Experian codes

User 4 = Equifax codes

Each user field should contain 4 numbers separated by commas

(control number[5]) , (grantor code[10]), (center code[3]), (area

code[3]), (identification number[10]) The number in brackets

represents the maximum number of characters for each code. You do

not need to put spaces before or after the commas.

Examples:

TRANS UNION

Client User 2 = 12345,1234567890,123,123,1235467890

EXPERIAN

Client User 3 = 54321,0987654321,321,321,0987654321

EQUIFAX

Client User 4 = 35125,5328598124,451,271,5328598124

If any numbers at the end are left out, the defaults will be used

from the Credit Bureau Setup dialog. If there is only a Control

Number present then it will be used, and the remaining 3 values

will be default ones. This applies only to values missing at the

end of the list.

Please do not simply supply a Grantor Code, for

instance, and expect it to work. The first number in

the list is always assumed to be the Control Number,

the second is always assumed to be the Grantor

Code, etc.

Please do not simply supply a Grantor Code, for

instance, and expect it to work. The first number in

the list is always assumed to be the Control Number,

the second is always assumed to be the Grantor

Code, etc.

Examples:

INPUT (CONTROL NUMBER)

control number = overrides default

grantor code = default

center code = default

area code = default

identification = default

INPUT (CONTROL NUMBER, GRANTOR CODE)

control number = overrides default

grantor code = overrides default

center code = default

area code = default

identification = default

INPUT (CONTROL NUMBER, GRANTOR CODE, CENTER CODE)

control number = overrides default

grantor code = overrides default

center code = overrides default

area code = default

identification = default

INPUT (CONTROL NUMBER, GRANTOR CODE, CENTER CODE, AREA CODE)

control number = overrides default

grantor code = overrides default

center code = overrides default

area code = overrides default

identification = default

INPUT (CONTROL NUMBER, GRANTOR CODE, CENTER CODE, AREA CODE, IDENTIFICATION NUMBER)

control number = overrides default

grantor code = overrides default

center code = overrides default

area code = overrides default

identification = overrides default

It will only work in the order specified above. You

cannot override the Center Code unless the Grantor

Code and Control Number are also overridden. In other

words, you can only override a code if the codes prior

to it are overridden as well.

It will only work in the order specified above. You

cannot override the Center Code unless the Grantor

Code and Control Number are also overridden. In other

words, you can only override a code if the codes prior

to it are overridden as well.

Report AS Client

WARNING: This option is only for 3rd party agencies that are reporting on behalf of their

client. When the above Report by Client box is selected, this box is visible.

Select a client to report as them. The Client must have the applicable credit

bureau settings in the applicable user 2 to 4 fields as outlined above.

WARNING: This option is only for 3rd party agencies that are reporting on behalf of their

client. When the above Report by Client box is selected, this box is visible.

Select a client to report as them. The Client must have the applicable credit

bureau settings in the applicable user 2 to 4 fields as outlined above.

Report To Trans Union

A check in this field tells the system to use the values

defined for Trans Union in the Credit Bureau Setup, and

to export the Debtors in the metro tape format. The name

of the output file will be {dbname}_TU.001. If a file with

this name exists, it will be overwritten.

Report To Experian

A check in this field tells the system to use the values

defined for Experian in the Credit Bureau Setup and to

export the Debtors in the metro tape format. The name

of the output file will be {dbname}_EXP.001. If a file with

this name exists, it will be overwritten.

Report To Equifax

A check in this field tells the system to use the values

defined for Equifax in the Credit Bureau Setup, and to

export the Debtors in the metro tape format. The name

of the output file will be {dbname}_EFX.001. If a file with

this name exists, it will be overwritten.

Equifax also requires that the Client details (K1 segment)

be sent with each Debtor. This can be set by selecting the

check box labeled Send Client Detail in Reports

in the Client Settings form.

Mark Contacts AS Done

A check in this field tells the system that it is OK to mark

all Metro contacts as done. When you have successfully

completed your credit bureau report, you will be prompted to

mark the contacts as done. This step has to be taken to

insure that proper reporting has taken place.

If the system reports errors, choose View Log

to find the errors. Fix them and run your report

again.

If the system reports errors, choose View Log

to find the errors. Fix them and run your report

again.

The next time a transaction takes place, if the Debtor has a

check in the Report to credit bureau field, a new Metro

contact is automatically scheduled. Access the

Credit Report Details form by selecting the CBR tab

on the Debtor form. The Report to credit bureau switch is

in the Credit Report Details form.

WARNING: Only take this step after you have

completed step 2 and all errors have been

corrected. Press F1 for details.

WARNING: Only take this step after you have

completed step 2 and all errors have been

corrected. Press F1 for details.

Accounts To Report

Select which accounts to include in the report. The default

is All. If All is selected, the standard behavior will occur

where all accounts are run to a single Metro2 file. If

Consumer is selected, then only accounts where the Legal Entity

is 0 (not set) or greater than 99 will be processed and outputted

to a file post-fixed with _CON in the filename. If Commercial

is selected, then only accounts where the Legal Entity is between

1 and 99 will be processed and outputted to a file post-fixed with

_COM in the filename.

Credit Bureau Setup

Selecting this will take you to the Credit Bureau Setup form

where you can enter settings for reporting to credit bureaus.

Sync To New Credit Bureau

Select this to run your first credit report to an additional

bureau. There are a few steps to this procedure so please

refer to help documentation first.

Historical Reporting

There are times when you may want to report to credit

bureaus in a fashion that is not covered by the normal

scheduled events. For instance, you may need to rerun

a report that was already completed.

The historical reporting section is designed to handle these

anomalous reporting procedures. You can specify a date

and run your report on completed or uncompleted contacts.

Done Date

Done Date is used only for historical reporting.

It works with the Completed Only switch to

determine historical reporting behavior.

If you switch ON 'Completed Only', then Collect! will

look for Metro contacts that were marked DONE on

the particular date you select here.

If you leave 'Completed Only' switched OFF, then

Collect! will look for IN PROGRESS Metro contacts

PRIOR to the particular date you select here.

Completed Only

Completed Only is used only for historical

reporting.

Switch this ON to include only completed Metro

contacts in this historical credit bureau report.

Leave this switch OFF to include only In Progress

Metro contacts in this historical credit bureau report.

Help

Press this button for help on the Report To Credit Bureaus

dialog and links to related topics.

View Log

Selecting this will display the results of your credit bureau

reporting session. If the system reported errors, you can

find the details by viewing this Log and fix them.

If you don't usually clear the contents of this log

when asked to "Clear Log" after viewing it,

you may need to scroll to the bottom of the

log to see the most recent session entries.

If you don't usually clear the contents of this log

when asked to "Clear Log" after viewing it,

you may need to scroll to the bottom of the

log to see the most recent session entries.

Close

Select this button to close this form without reporting to

credit bureaus and return to the previous screen.

Next

Selecting this will take you to the next step of the credit

bureau reporting session, depending on the selection you

have made. Either the report will be processed or a summary

report will be printed.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org