How To Turn Off Credit Bureau Reporting

Occasionally, you may want to switch off Credit Bureau Reporting for one of your clients. The

client's accounts may or may not have been reported already. If they have been reported,

you must inform the credit bureau if you want to stop reporting them.

Please ensure that you have a recent backup of your data before proceeding.

Please ensure that you have a recent backup of your data before proceeding.

WARNING: Reporting credit is a legal matter. You are responsible for ensuring that the information

you are sending is accurate and complete. Do not report credit without being ABSOLUTELY

SURE about your legal rights and the legal rights of the person or entity you are reporting.

WARNING: Reporting credit is a legal matter. You are responsible for ensuring that the information

you are sending is accurate and complete. Do not report credit without being ABSOLUTELY

SURE about your legal rights and the legal rights of the person or entity you are reporting.

Accounts Previously Reported For A Client

Accounts which have been reported must be deleted from the Credit Bureau records as well as your own.

This procedure will switch OFF Credit Bureau reporting on these accounts and prepare them to be

reported as deletions the next time you run your credit bureau report.

Please make sure that you understand the conditions for removing accounts from the bureau.

Ask your CBR representative for details, if you are unsure.

Please make sure that you understand the conditions for removing accounts from the bureau.

Ask your CBR representative for details, if you are unsure.

The procedure for switching OFF reporting is straightforward. We will perform a batch process to set

the accounts for deletion. This means "DA" in credit reporting terms. When we are finished, all

accounts that were previously reported will be reported one more time, as a "DA." All accounts that

were never reported will simply have the CBR switched OFF.

- You need to identify the accounts that you want to turn off. If this is a particular Client,

you can open the Client and select all the Debtors. Otherwise, you can use the Edit Search

Criteria to filter the accounts according to your requirements. Once you have the accounts

that you need to switch OFF tagged, you can proceed.

- Now that they are tagged (all highlighted in blue), select Tools from the top menu bar and

select Batch Process from the drop-down choices. Select Prepare Accounts for Reporting to

Credit Bureau in the Batch Processing form. Then select NEXT.

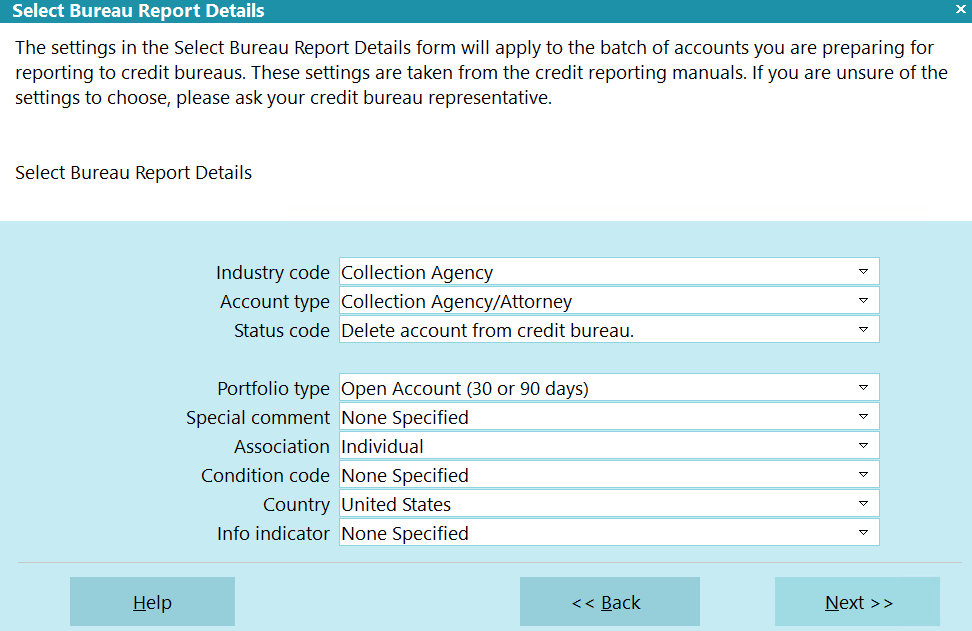

- Select Tag Individual Records and select Next. The Bureau Reporting Details screen shows all

the settings that will be applied. You will want to set the Status Code to the appropriate

deletion choice. The choices are "Delete account from bureau" and "Delete account from bureau

due to fraud." Set the other settings as needed and then select NEXT.

Click Here to View this Form.

Click Here to Close this Form.

The settings in the Select Bureau Report Details form

will apply to the batch of accounts you are preparing

for reporting to credit bureaus. These settings are

taken from the credit reporting manuals. If you are

unsure of the settings to choose, please ask your

credit bureau representative.

Select Bureau Report Details

Press F1 or select the HELP button for more

information.

Transaction Type

Collect! will automatically populate the transaction type.

If you are processing accounts that have been previously

reported, nothing will be appended to the TT code. If you

are process new accounts, the number 1 will be appended to

the TT code.

Industry Code

This field contains the industry type that classifies the

reporting agency.

Account Type

This field contains the account type code that identifies the

account classification.

Status Code

This field contains the status code that properly identifies

the current condition of the account.

Portfolio Type

This field contains the type of the debt.

Special Comment

This field is used in conjunction with the Account Status to

further define the account. Special comment codes, when

found, will however take precedence over the value in

Account Status.

Association

This is used to designate an account in compliance with

the ECOA.

Condition Code

This field allows for reporting of a condition that is

required for legal compliance; e.g., according to the

Fair Credit Reporting Act (FCRA).

Country

This is the country that the Debtor lives in.

Info Indicator

This field contains a value indicating a special condition

which applies to the Debtor cosigner.

Help

Press this button for help on the Select Bureau Report Details

dialog and links to related topics.

Back

Select this to return to the previous form. You can then

alter your settings or choose to close the batch processing

procedure without running a batch.

Next

Select this to proceed with the batch process. The form

that is displayed depends on the type of batch process

you are preparing to run.

Selecting Accounts To Process

- Select Tools from the top menu bar and then select

Batch Processing from the drop-down choices.

- Choose Prepare accounts for reporting to credit bureaus.

Choose Next to tag the accounts you want to setup.

- Press F8 after you have selected your accounts. Then choose Next.

The Select Bureau Report Details form will be displayed.

- Set the credit bureau report details for the accounts you have just

selected.

- Press Next to display the Run Credit Report Batch form where

you can Start your batch process.

You can run this process numerous times on different

sets of accounts, and after setting up many groups, you can then

create files for all the selected accounts at once.

You can run this process numerous times on different

sets of accounts, and after setting up many groups, you can then

create files for all the selected accounts at once.

If you have Debtors in your search criteria that belong

to Clients who are not set to report to the bureau,

Collect! will skip these debtors during the preparation

phase. Only Debtors belonging to Clients setup to

report will be prepared for CBR reporting.

If you have Debtors in your search criteria that belong

to Clients who are not set to report to the bureau,

Collect! will skip these debtors during the preparation

phase. Only Debtors belonging to Clients setup to

report will be prepared for CBR reporting.

- When you are ready, select START to process all the accounts that you tagged.

The batch process will examine each of the client's debtors, creating a new Metro contact to inform

the bureau to delete the account. If an account has never been reported, CBR will be switched off.

When you run your credit report, the Metro contacts will be processed and CBR will be switched OFF

on the accounts.

If you stopped reporting on all accounts for a particular client, you will want to visit the

Client Settings through the ADVANCED button on the Client form, and switch OFF the 'Report

accounts to bureaus' and 'Send client detail to bureaus'. If you had set specific delay days

for this client, you may zero out Delay Days as well.

If you stopped reporting on all accounts for a particular client, you will want to visit the

Client Settings through the ADVANCED button on the Client form, and switch OFF the 'Report

accounts to bureaus' and 'Send client detail to bureaus'. If you had set specific delay days

for this client, you may zero out Delay Days as well.

Accounts Not Yet Reported For A Client

For accounts which have never been reported to the credit bureau, it is only necessary to switch OFF

reporting in your own records.

You can use the same steps as outlined above.

The batch process will examine each of the client's debtors, creating a new Metro contact to inform

the bureau to delete the account, if any have been previously reported. All accounts that have never

been reported will simply have CBR switched off and the Metro contact deleted.

If appropriate, go into the Client Settings through the ADVANCED button on the Client form and switch

OFF "Report Accounts to Bureau."

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org