Credit Report Preferences

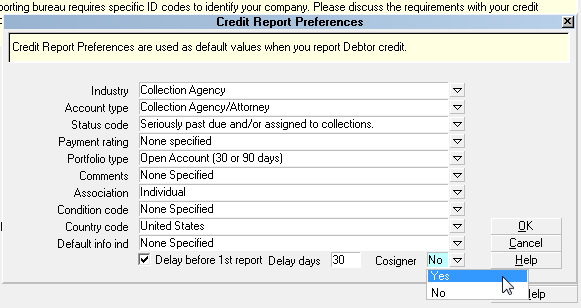

Credit Report Preferences are used as default values when

you report Debtor credit.

These default settings are used for every account you switch

ON for reporting. They can be changed globally or on a per

debtor basis. When you select an item from the pick list,

the corresponding code will be set in the Debtor's

Credit Report Details.

Credit Report Preferences

The pick lists on the fields are interdependent. You will notice

that the available choices change depending on what you

have selected for other fields.

Default values from the Metro 2 Standard are

provided for normal collection and credit management

reporting. Please refer to your Metro 2 Manual for help

selecting from the pick lists. If you are not sure which default

values you should use, please discuss with your credit

bureau representative.

Default values from the Metro 2 Standard are

provided for normal collection and credit management

reporting. Please refer to your Metro 2 Manual for help

selecting from the pick lists. If you are not sure which default

values you should use, please discuss with your credit

bureau representative.

WARNING: Reporting credit is a legal matter. You are

responsible for ensuring that the information you are sending

is accurate and complete. Do not report credit without being

ABSOLUTELY SURE about your legal rights and the legal

rights of the person or entity you are reporting.

WARNING: Reporting credit is a legal matter. You are

responsible for ensuring that the information you are sending

is accurate and complete. Do not report credit without being

ABSOLUTELY SURE about your legal rights and the legal

rights of the person or entity you are reporting.

The Credit Report Preferences form is accessed by

selecting the DEFAULTS button on the Credit Bureau Setup

form.

Industry

This field contains the industry type that classifies the reporting

agency. Common examples of Industry are "Collection Agency"

and "Mortgage Loan."

This is the field that holds the value Collect! uses

if you want to "Report by Industry" as described

in Credit Bureau Setup.

This is the field that holds the value Collect! uses

if you want to "Report by Industry" as described

in Credit Bureau Setup.

Account Type

This field contains the account type code that identifies the

account classification. You will notice that the choices

depend on what you have selected as the "Industry" in

the previous field.

Status Code

This field contains the status code that properly identifies

the current condition of the account. Available Status Codes

change depending on the "Account Type." For instance,

a "Collection Agency/ Attorney" reports statuses such

as "Seriously past due" and "Paid in Full." While an

accounts such as "Real Estate Mortgage" reports statuses

like "Current" or "150 days past due."

Payment Rating

This field contains settings for specifying whether

or not an account is Current or Past Due. It is only

visible for certain Status Codes that Collect! does

not handle automatically. Please refer to

Credit Reporting Functional Description for details.

Portfolio Type

This field contains the type of the debt. The pick list offers

choices for common credit and loan types. Examples of

Portfolio Type are " Open Account" and "Line of Credit."

Comments

This field is used in conjunction with the Account Status to

further define the account. Special comment codes, when

found, will however take precedence over the value in

Account Status.

Association

This is used to designate an account in compliance with the

ECOA. This setting can be changed for an individual Debtor

through the Credit Report Details form accessed from the

Debtor form.

Condition Code

This field allows for reporting of a condition that is required

for legal compliance; e.g., according to the

Fair Credit Reporting Act (FCRA).

Country Code

This is the country that the Debtor lives in.

The list of default country codes provided by Collect! shows

only a few of the most used country codes. Please refer to

your Metro 2 Manual if you need to use a different code.

Default Info Ind

This field provides for entering a value indicating a

bankruptcy condition that applies to the Debtor

cosigner.

Delay Before 1St Report

Switch this On to Delay before the first Credit Report. Enter

the number of days to delay in the Delay Days field.

This switch is used in conjunction with the

Credit Report Details form accessed from the

Debtor form. When you switch ON "Report to

credit bureau" in the Credit Report Details form,

the "Start reporting" date will be calculated

according the defaults you set here. You can

override these by choosing a new "Start

reporting" date in the Credit Report Details

form for a particular Debtor.

This switch is used in conjunction with the

Credit Report Details form accessed from the

Debtor form. When you switch ON "Report to

credit bureau" in the Credit Report Details form,

the "Start reporting" date will be calculated

according the defaults you set here. You can

override these by choosing a new "Start

reporting" date in the Credit Report Details

form for a particular Debtor.

Delay Days

Enter the number of days that you wish to delay before

reporting a new Debtor or an existing Debtor that you

choose to report to credit bureaus. The number you enter

here will be calculated into the "Start reporting" date in the

Credit Report Details form accessed from the Debtor form.

Cosigner

This field is used to determine if the Debtor has a cosigner

to be reported on. ECOA choices and details are filled in on

the Debtor Cosigner form. Select the Cosigners tab in the

Debtor form to access Cosigner information for the Debtor.

Press F1 when the Debtor Cosigner form is displayed. The

Help topic contains valuable information about credit bureau

reporting formats for each field.

Help

Press this button for help on the Credit Report Preferences

form and links to related topics.

Cancel

Selecting this button will ignore any changes you

have made and return you to the previous form.

OK

Selecting this button will save any changes

you may have made and return you to the

previous form.

See Also

- Credit Report Details

- Credit Bureau Reporting Topics

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org