How To Understand Net Or Gross Or Combined Remittances

This topic covers the three different options you have to remit funds to Clients.

On occasions where your company is making the remit type decision for a Client that has expressed no specific preference,

Net remittance is the most favorable to your company. This is the choice that allows you to recover the amounts due you off

the top of the amount you owe the Client.

Gross and Combined favor the Client which means your company will be waiting on the Client to send you a check for amounts

earned rather than you being able to offset your amounts owed off the top, as in Net. However, where you do have a Client

who has a Remittance preference, you have the system ability to accommodate them.

Background

The three different Accounting methods of Client remittance are:

- Net Remit

- Gross Remit

- Combined Remit

Each type has its own calculation which determines the order of operations that the system will track and

account for trust funds and commissions/fees/taxes due your company. The remit type preference is software switch located

in the Client Advanced Settings Screen. You have the option and flexibility to make this decision on an per

Client basis. The output documents for each remittance type ship standard with Collect! and are stored in your list of

Letters and Reports off your Print menu. The types and document names are:

- Net - Statement and Check

- Gross - GStatement and GCheck

- Combined - CStatement and CCheck.

If you are at any time manually reprinting a statement for a Client, it is very important to choose the correct

document for the remit type of the Client, as each type manages the figures differently.

Contact Technical Services at 250-391-0466 to

explore your options to have your corporate logo

added to your Statements for that extra polished touch.

Contact Technical Services at 250-391-0466 to

explore your options to have your corporate logo

added to your Statements for that extra polished touch.

WARNING: If an occasion arises where you are asked by a Client to switch their remit type from one of the

three types to a completely different type, if this Client also owes you on a balance forward,

how this amount is handled can be drastically altered. There is a very specific process if you

need to change your client's remittance type. Please see below for more information.

WARNING: If an occasion arises where you are asked by a Client to switch their remit type from one of the

three types to a completely different type, if this Client also owes you on a balance forward,

how this amount is handled can be drastically altered. There is a very specific process if you

need to change your client's remittance type. Please see below for more information.

1. Net Remittance

This is the default remit type in Collect! and the one which is indicated by the absence of any other choice in the

Client Advanced Screen Settings.

The calculation used is:

Check Amount = (Tot Pd Agency)-(Total Comm)-(Fees/Charges/Taxes Due)-(Bal Forward)

The Statement will print a line which reads, "Please find enclosed our check for $x,xxx.xx".

Exceptions where you may see that your output for the month does not include a check going out to your Net Client:

- If your Statement reflects more Paid Client direct payments than Paid Agency payments, OR

- If you have had a volume of NSF postings in the remit collection month that exceeds the total Paid Agency amount

for the same month, THEN The Statement will print a line which reads "Please remit to Agency your check

in the amount of $x,xxx.xx".

- If your Client owes you due to a volume of direct payments or reversals, creating a balance forward, the Net

Statement/ Invoice will display the 30/60/90+ Accounts Receivable information as part of the figure handling.

- If you do not see any 30/60/90+ detail on a Net Statement, then this Client does not have a balance forward with you.

To keep an eye on your aging Accounts Receivable

dynamically, insert your aged balance forward detail

into your Invoices Tab list view. This will enable to

you see at a glance any Client who owes you money and

in what aging categories as of the last/most current

Invoice generated in the Invoices detail history Tab.

To keep an eye on your aging Accounts Receivable

dynamically, insert your aged balance forward detail

into your Invoices Tab list view. This will enable to

you see at a glance any Client who owes you money and

in what aging categories as of the last/most current

Invoice generated in the Invoices detail history Tab.

To insert Aged Balance Forward columns into your Invoices Tab list view, Right click on the column label

line inside this View. You will get the a pop up which offers you the choice to Insert Fields. Select this and

scroll to where you find the 30/60/90/120/150 aged columns and select them individually into your list view.

This will save and hold as your view inside this Tab go forward. It will not affect other users in your Operator

Level unless a User ID 99/Level 99 made the selection globally, which updates all users' custom list views.

2. Gross Remit

This preference requires that you check the "Remit gross funds with invoice" AND "Bill Client for negative To Us".

BOTH switches being selected are important if you are permitted by contact to recover any reversals posted back

from monies you already issued to the Client. The reason the "Bill Client for negative To Us" exists is in deference

to the number of Credit Grantors which have a No NSF/Reversal policy with their agencies.In practice, there are still a great

many Gross remit type Client who will permit the Agency to recover previously posted commissions if a Paid Agency amount

goes NSF. If your Gross Client has the No NSF policy, the correct switch setting for this scenario is check "Remit Gross

funds with invoice" AND leave blank the check box beside "Bill Client for negative To Us".

The Gross remit preference with the "Bill Client for negative To Us" switch checked ON will generate Statement/Invoices

which do the following:

- Check issued to Client for the billing period = Total Amount Paid Agency

- The GStatement will print a line which reads, "Please find enclosed our check for $x,xxx.xx".

- Invoice to Client for amounts due you = Total Commissions (Paid Agency comm + Paid Direct comm) + Total Other

(Any applicable Total Paid Agency Amount Reversed - Paid Agency Reversal comm previously billed + Taxes + Fees +

Charges + Balance Forwards)

- The GStatement will print a line that reads, "Please remit your check to Agency for $x,xxx.xx".

The Gross remit preference with the "Bill Client for negative To Us" switched unchecked indicating the OFF position will

generate Statements/Invoices which do the following:

- Check issued to Client for the billing period = Total Amount Paid Agency

- Invoice to Client for amounts due you = Total Commissions (Paid Agency comm + Paid Direct comm) + Total Other

(Any applicable Taxes + Fees + Charges + Balance Forwards)

- If your Client owes you for balance forwards, the Gross Statement/Invoice will display the 30/60/90+ Accounts Receivable

information as part of the figure handling.

- If you do not see any 30/60/90+ detail on a Gross Statement, then this Client does not have any outstanding balance

forward with you.

To keep an eye on your aging Accounts Receivable

dynamically, insert your Aged Balance Forward detail

into your Invoices Tab list view. This will enable to

you see at a glance any Client who owes you money and

in what aging categories as of the last/most current

Invoice generated in the Invoices detail history Tab.

To keep an eye on your aging Accounts Receivable

dynamically, insert your Aged Balance Forward detail

into your Invoices Tab list view. This will enable to

you see at a glance any Client who owes you money and

in what aging categories as of the last/most current

Invoice generated in the Invoices detail history Tab.

To insert Aged Balance Forward columns into your Invoices Tab list view, Right click on the column label line inside this View.

You will get the a pop up which offers you the choice to Insert Fields. Select this and scroll to where you find the

30/60/90/120/150 aged columns and select them individually into your list view. This will save and hold as your view

inside this Tab go forward. It will not affect other users in your Operator Level unless a User ID 99/Level 99

made the selection globally with updated to all users' custom list views.

3. Combined Remit

This is the most complex of remittance types. If your Client is requesting that you invoice your services such

that all Paid Agency money is remitted Net style while all Paid Client direct money is remitted Gross style, the

Combined is the remit type they are asking for.

This type of remittance does exactly what it describes:

- It separates Paid Agency and Paid Client payments and calculates figure handling separately for each type of payment.

- It shows all Paid Agency money first, and does output calculations strictly on the basis of that payment type.

Final output of calculations is reserved for the last page of the CStatement.

- It shows all Paid Client direct money from the current billing cycle next. Final output

of calculations is reserved for the last page of the CStatement.

- In a series of sections with verbose explanations, the last page of a CStatement has the final calculations

for how much is to be remitted to your combined Client and how much they owe you for services rendered, in the

current billing cycle only.

- As of the current shipping version of Collect!, the CStatement does NOT include aged balance forward detail.

Make sure you print your monthly Receivables Report to keep track of your balance forwards on Combined Clients.

Once you have selected the Combined remit type in

your Advanced Client Screen Settings, no other

remit switch options are read by the program.

Once you have selected the Combined remit type in

your Advanced Client Screen Settings, no other

remit switch options are read by the program.

Once you have set the Client to a Combined remit type, the system no longer reads the two switches governing Gross remit.

Specifically, the "Remit gross funds with invoice" or "Bill Client for negative To Us" switches located in the

Advanced Settings Client screen.

Changing Remittance Types

It is preferable where possible to refrain from switching remit types once a statement cycle is established, particularly

if there is a balance forward. If the request to switch comes from your Client, endeavor to have them bring their account

completely current before switching them over. This is the cleanest, least risky way to make the change. If there

is an aged Account Receivable for this Client, contact Technical Services to assist you with figure modifications to your

Invoice History to assist with the conversion of this Client from one type of remittance to another.

If you do need to change types, here is the process. For this example, we will assume that you are changing the remittance

type effective at the January Statement. This process must be done before generating the January Statement.

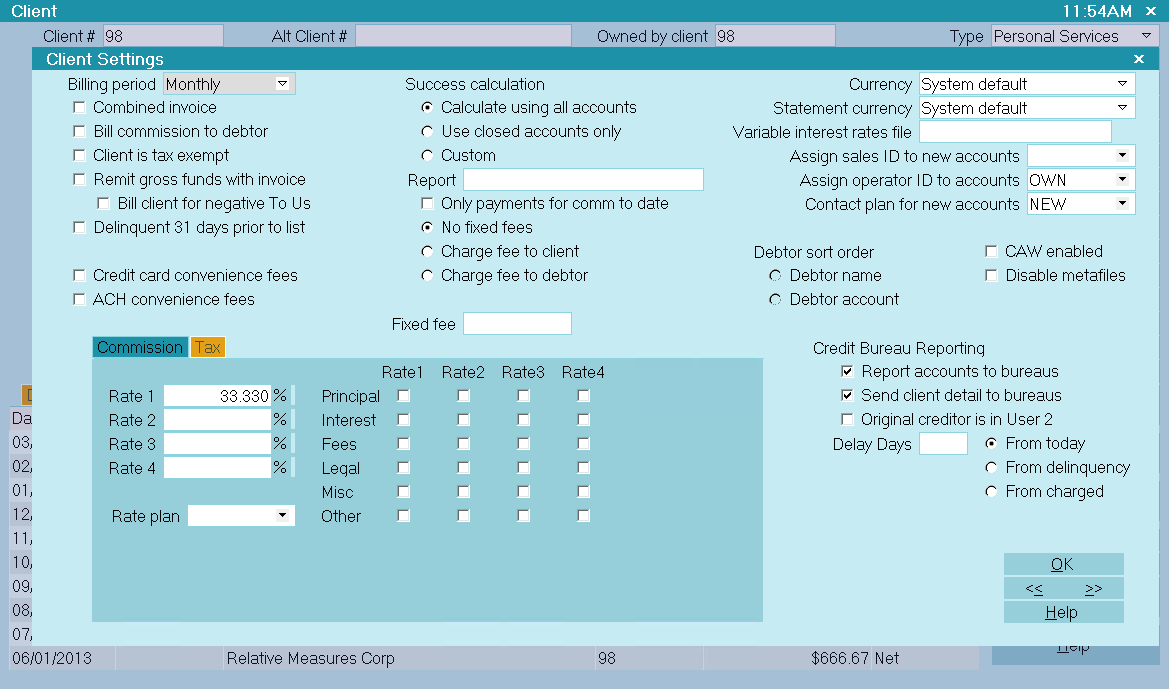

1. Open the Client you are changing and click the Advanced button to open the Client Settings.

2. Select your new Remittance Type:

NET = 'Combined Invoice' and 'Remit Gross Funds with Invoice' are both unchecked.

GROSS = 'Remit Gross Funds with Invoice' is checked and Combined Invoice' is not checked.

COMBINED = 'Combined Invoice' is checked and 'Remit Gross Funds with Invoice' is not checked.

For Gross Clients, we also recommend checking the 'Bill Client for Negative To Us'; otherwise, NSF checkes or

or other payment reversals will not appear on a statement.

For Gross Clients, we also recommend checking the 'Bill Client for Negative To Us'; otherwise, NSF checkes or

or other payment reversals will not appear on a statement.

Client Settings Form

If you are changing from Gross to Combined or Combined to Gross, then you are done.

If you are changing from Net to Gross or Combined or from Gross or Combined to Net, then Collect! will automatically

alter the last Invoice/Statement record by negating the TOTAL field.

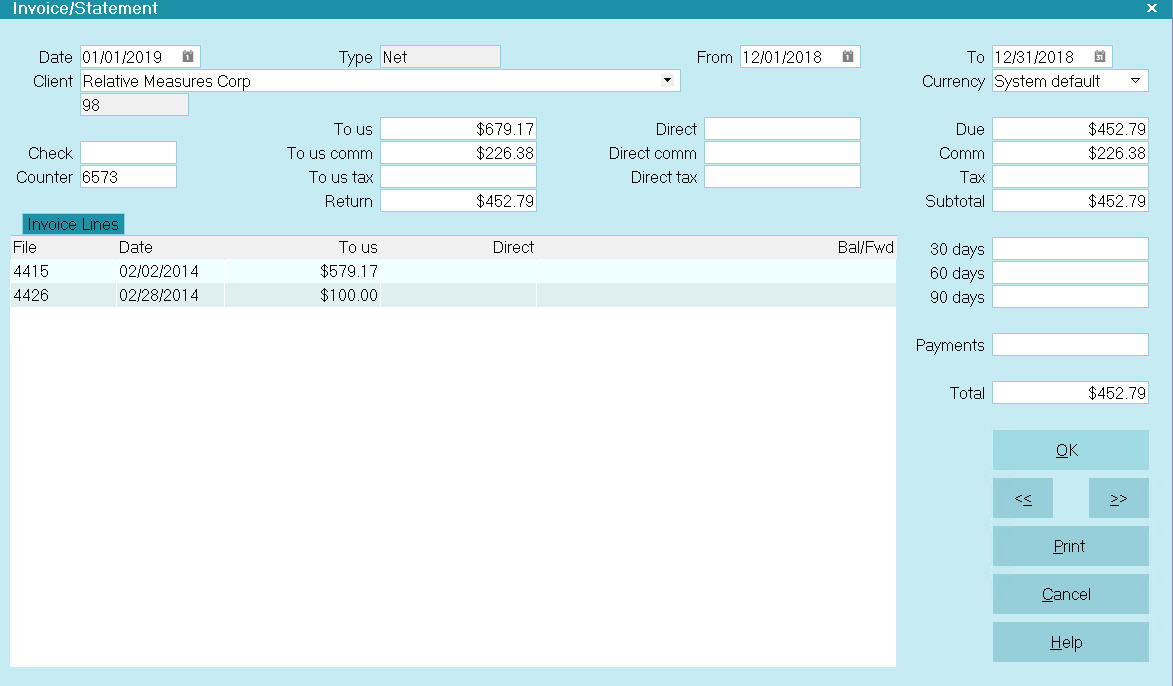

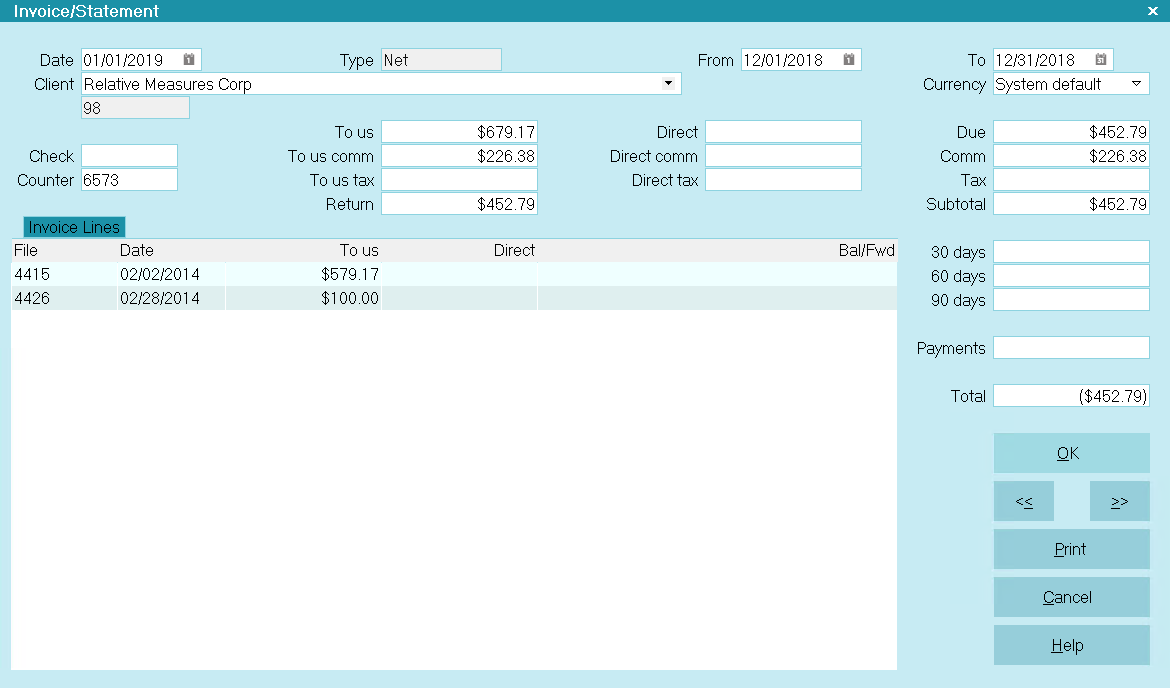

December Statement Before Changing

If it's a positive number, Collect! will make it negative. If it's a negative number, Collect! will make it positive.

On Gross and Combined Statements, a positive total field means a balance forward. On Net Statements, a negative number

means a balance forward, which is why negating the Total field is important.

December Statement After Changing

3. Generate your January Statements.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org