How To Use Commission Rate Plans

Commission Rate Plans allow you to specify a sliding scale for the commission rate to be used when calculating commission

amounts on transactions posted to an account. These plans are used when you need more than two rates for calculating commission

due on a transaction.

Sample commission rate plans found below will give you an idea of how commission rate plans can be used to quickly and

accurately calculate commission using a sliding scale. Experiment with the commission rate plan choices to see the effects each

plan has on the debtor's commission rate.

Some commission rate plans set the commission rate when you have completed entering a new debtor. If the rate depends on values

only from the Debtor form, then the commission rate can be calculated and established immediately.

Other commission rate plans depend on posting a transaction before Collect! can establish the appropriate commission rate. This

may result in a Debtor form that does not show a commission rate percentage, at first. This is quite normal. Once a payment is

posted, Collect! will calculate the commission rate and set it appropriately.

Commission rates set by certain types of commission rate plans are averaged before being displayed in Collect! The data

evaluated may need to be calculated over more than one commission rate step set in the plan. The two steps are averaged

in these cases. You can view more details by trying the sample plans that have this effect.

Using Minimum and Maximum values can also result in calculation and display of an unexpected commission rate percentage.

Commission rate plans are most efficient when you have commission rates that slide many levels. If you only change the

commission rate once, for instance, when an account goes Legal, you should consider using a Rate type contact to

change the commission rate at the required time. For example, if your commission rate changes from 30% to 50% when

you send an account to Legal, use a contact event to change the rate to 50% instead of using a commission rate plan.

Commission rate plans are most efficient when you have commission rates that slide many levels. If you only change the

commission rate once, for instance, when an account goes Legal, you should consider using a Rate type contact to

change the commission rate at the required time. For example, if your commission rate changes from 30% to 50% when

you send an account to Legal, use a contact event to change the rate to 50% instead of using a commission rate plan.

To Use a Rate Plan, simply fill in the Rate Plan field on the Client Settings form.

Setting Min And Max Values

When designing your commission rate plans, there are fields where you can specify minimum and maximum payment amounts to be

considered when posting transactions.

When using MIN or MAX values, it may be confusing when the commission rate is displayed. For example, you have a commission

rate plan based on Payment Amount, but you have an agreement with your client that the minimum commission amount on any

transaction will be set to $25.00.

Setting the minimum values as shown below will guarantee that no matter how small a payment is received, you will always be

guaranteed $25.00 (unless, of course, the payment is $15.00. Collect! would then take the complete $15.00.)

When you create a transaction to post a payment of $50.00, Collect! will calculate the rate to be 35%, which would result in a

commission amount of $17.50. Then Collect! would check the minimum and maximum values in the appropriate range of the

commission rate plan, seeing that a minimum value of $25.00 is set, Collect! would overwrite the commission amount of $17.50

with $25.00. Because $25.00 is equal to 50% of the $50.00 being posted, the commission rate value will be changed from 35%

to 50%.

Commission Rate Plan - Min and Max Values

You can also set maximum values for Collect! to consider when posting transactions. The same theory applies.

When you use minimum or maximum values, if they replace the commission amount, Collect! will calculate the percentage of the

payment amount they represent and reset the commission rate percent accordingly.

If you are using commission rate plans and feel that the commission is not calculating as it should, check out the commission

rate plan. Maybe there are minimum and maximum values present.

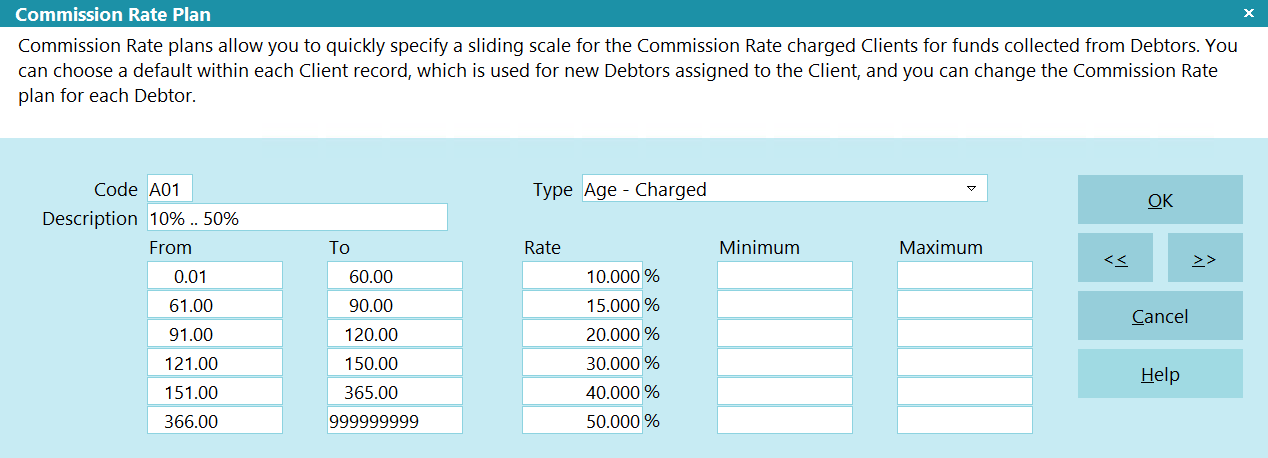

Commission Rate Plan Sample - Age - Charged

Age commission rate plans use the number of days between the Listed Date and the Charged Date to determine which commission

rate should be set. Therefore to use this commission rate plan you must have entered a Charged Date and a Listed Date.

The sample below will show you how Collect! determines the commission rate to set when you have assigned this commission rate

plan to the account.

Commission Rate Plan - Age

With this sample:

If the difference between the Listed Date and the Charged Date is less than or equal to 60 days, the commission rate set for

the debtor will be 10%. Any time you post a transaction that is set to calculate a commission amount, 10% of the To Us or Direct

amount will be calculated.

If the difference between the Listed Date and the Charged Date is greater than or 60 days, or less than or equal to 90 days,

the commission rate set for the debtor will be 15%. Any time you post a transaction that is set to calculate a commission

amount, 15% of the To Us or Direct amount will be calculated.

If the difference between the Listed Date and the Charged Date is greater than or 90 days, or less than or equal to 120 days,

the commission rate set for the debtor will be 20%. Any time you post a transaction that is set to calculate a commission

amount, 20% of the To Us or Direct amount will be calculated.

If the difference between the Listed Date and the Charged Date is greater than or 120 days, or less than or equal to 150 days,

the commission rate set for the debtor will be 30%. Any time you post a transaction that is set to calculate a commission

amount, 30% of the To Us or Direct amount will be calculated.

If the difference between the Listed Date and the Charged Date is greater than or 150 days, or less than or equal to 365 days,

the commission rate set for the debtor will be 40%. Any time you post a transaction that is set to calculate a commission

amount, 40% of the To Us or Direct amount will be calculated.

If the difference between the Listed Date and the Charged Date is greater than or 365 days, or less than or equal to 9999999

days, the commission rate set for the debtor will be 50%. Any time you post a transaction that is set to calculate a commission

amount, 50% of the To Us or Direct amount will be calculated.

With this commission rate plan type, no minimum or maximum values should be set. If you enter values for the minimum or maximum

values, Collect! will ignore them when calculating a commission.

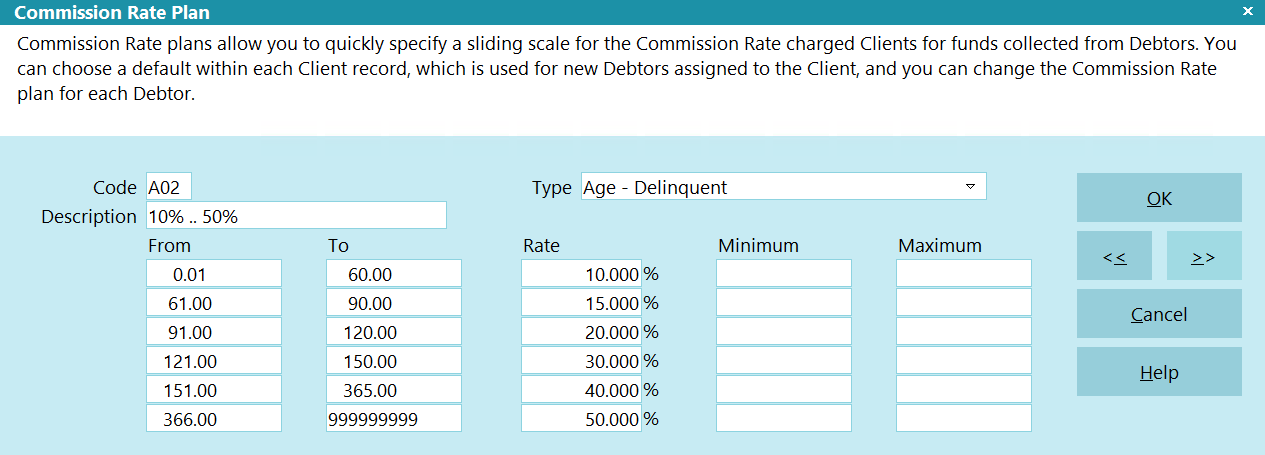

Commission Rate Plan Sample - Age - Delinquent

Age commission rate plans use the number of days between the Listed Date and the Delnqnt Date to determine which commission

rate should be set. Therefore to use this commission rate plan you must have entered a Delnqnt Date and a Listed Date.

The sample below will show you how Collect! determines the commission rate to set when you have assigned this commission rate

plan to the account.

Commission Rate Plan - Age

With this sample:

If the difference between the Listed Date and the Delnqnt Date is less than or equal to 60 days, the commission rate set for

the debtor will be 10%. Any time you post a transaction that is set to calculate a commission amount, 10% of the To Us or Direct

amount will be calculated.

If the difference between the Listed Date and the Delnqnt Date is greater than or 60 days, or less than or equal to 90 days,

the commission rate set for the debtor will be 15%. Any time you post a transaction that is set to calculate a commission

amount, 15% of the To Us or Direct amount will be calculated.

If the difference between the Listed Date and the Delnqnt Date is greater than or 90 days, or less than or equal to 120 days,

the commission rate set for the debtor will be 20%. Any time you post a transaction that is set to calculate a commission

amount, 20% of the To Us or Direct amount will be calculated.

If the difference between the Listed Date and the Delnqnt Date is greater than or 120 days, or less than or equal to 150 days,

the commission rate set for the debtor will be 30%. Any time you post a transaction that is set to calculate a commission

amount, 30% of the To Us or Direct amount will be calculated.

If the difference between the Listed Date and the Delnqnt Date is greater than or 150 days, or less than or equal to 365 days,

the commission rate set for the debtor will be 40%. Any time you post a transaction that is set to calculate a commission

amount, 40% of the To Us or Direct amount will be calculated.

If the difference between the Listed Date and the Delnqnt Date is greater than or 365 days, or less than or equal to 9999999

days, the commission rate set for the debtor will be 50%. Any time you post a transaction that is set to calculate a commission

amount, 50% of the To Us or Direct amount will be calculated.

With this commission rate plan type, no minimum or maximum values should be set. If you enter values for the minimum or maximum

values, Collect! will ignore them when calculating a commission.

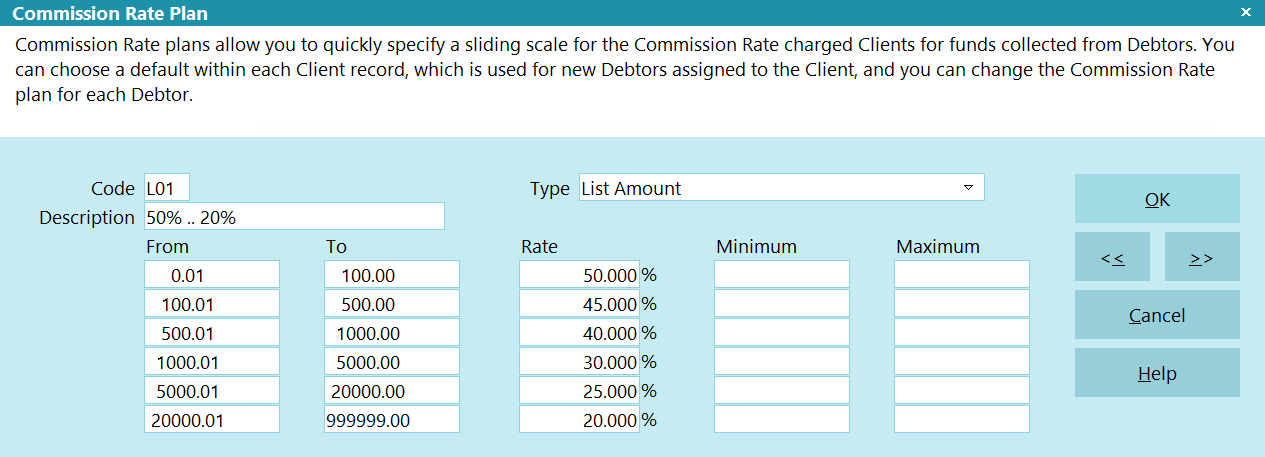

Commission Rate Plan Sample - List Amount

The List Amount commission rate plan uses the Original Principal and Original Interest amounts together when calculating the

commission rate. If you wish the commission rate plan to use only the Original Principal, then you must post an interest

transaction adjustment to set the interest amount. Do not use the 197 Original Interest transaction type, as this also sets the

Original Interest field on the Interest Detail form on the debtor. Adding to the original principal or original interest may

reset the commission rate.

The sample below will show you how Collect! determines the commission rate to set when you have assigned this commission rate

plan to the account.

Commission Rate Plan - List Amount

With this sample:

If the total of the Original Principal and Original Interest is between $00.0 and $100.00, the commission rate of 50% will

be set in the Rate field on the Debtor form.

If the total of the Original Principal and Original Interest is between $100.01 and $500.00, the commission rate of 45% will

be set in the Rate field on the Debtor form.

If the total of the Original Principal and Original Interest is between $500.01 and $1000.00, the commission rate of 40% will

be set in the Rate field on the Debtor form.

If the total of the Original Principal and Original Interest is between $1000.01 and $5000.00, the commission rate of 30% will

be set in the Rate field on the Debtor form.

If the total of the Original Principal and Original Interest is between $5000.01 and $20000.00, the commission rate of 25% will

be set in the Rate field on the Debtor form.

If the total of the Original Principal and Original Interest is between $20000.01 and $999,999.00, the commission rate of 20%

will be set in the Rate field on the Debtor form.

Posting transactions that change the total of Original Principal and Original Interest will force the commission rate plan to

recalculate and reset the commission rate. This new rate will apply to any further transactions posted.

With this commission rate play type, no minimum or maximum values should be set. If you enter values for the minimum or maximum

values, Collect! will ignore them when calculating a commission.

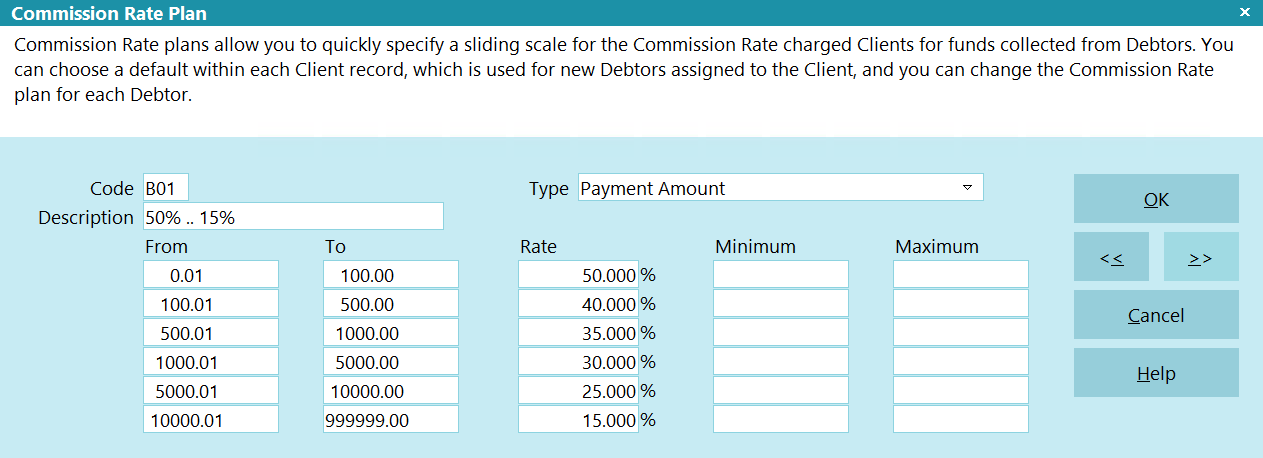

Commission Rate Plan Sample - Payment Amount

Payment amount plans look at each individual payment and use that amount to determine which commission rate to use when posting

a payment. The commission rate is set at data entry and when working with financials.

The sample below will show you how Collect! determines which commission rate to set when you have assigned this commission rate

plan to an account.

Commission Rate Plan - Payment Amount

When using this type of commission rate plan, you will notice Collect! does not assign any commission rate on the Debtor form.

The field labeled Rate will always be empty. The commission rate is calculated and applied to each payment transaction when

posting. This commission rate plan evaluates the amount of the payment entered in the To Us or Direct field on the payment

transaction. Collect! determines the commission rate percentage to use when you exit the To Us or Direct fields, or when you

uncheck the 'Don't calculate commission' check box, or when you select OK on the transaction.

The commission rate is calculated each time a transaction type is posted that requires commission or when an existing

transaction is modified.

With this sample:

When posting a transaction for anywhere between $0.01 to $100.00, the commission rate on the transaction will be set to 50%

automatically.

When posting a transaction for anywhere between $100.01 to $500.00, the commission rate on the transaction will be set to 40%

automatically.

When posting a transaction for anywhere between $500.01 to $1000.00, the commission rate on the transaction will be set to 35%

automatically.

When posting a transaction for anywhere between $1000.01 to $5000.00, the commission rate on the transaction will be set to 30%

automatically.

When posting a transaction for anywhere between $5000.01 to $10000.00, the commission rate on the transaction will be set to 25%

automatically.

When posting a transaction for anywhere between $10000.01 to $999,999.00, the commission rate on the transaction will be set to

15% automatically.

With this sample, no minimum or maximum values have been set. If you enter values for the appropriate minimum or maximum values,

Collect! will reset the commission amount accordingly when posting a transaction that calculates commissions. If you are going

to use minimum and maximum commission amounts, you should view the section above called Setting Min And Max Values.

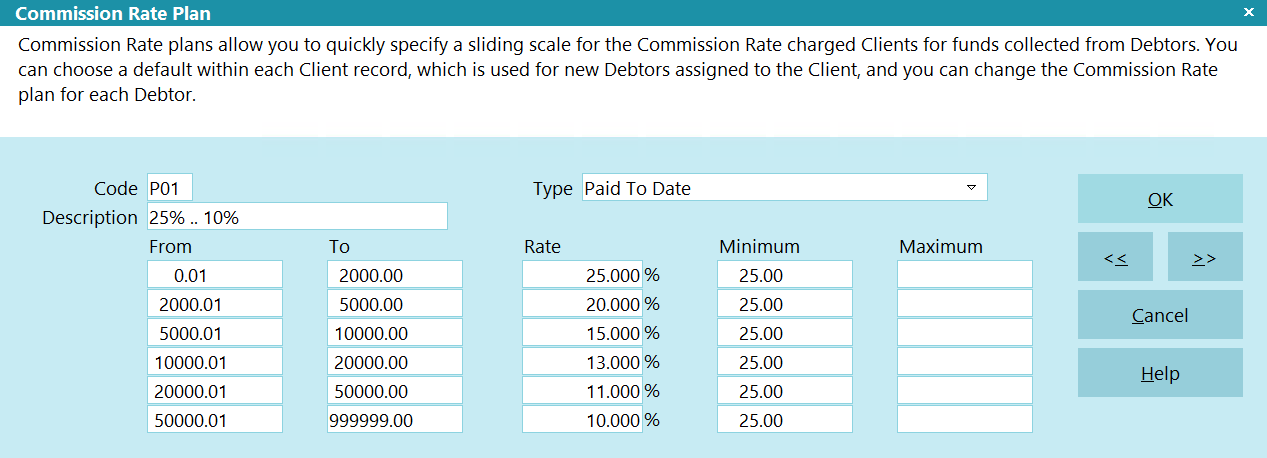

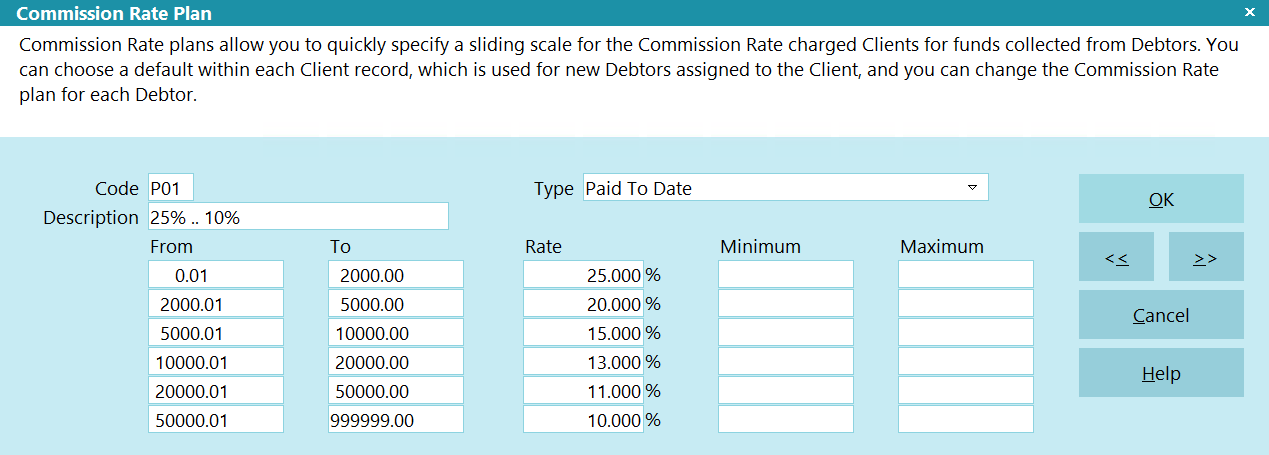

Commission Rate Plan Sample - Paid To Date

Paid to date plans look at the Paid field on the Debtor form to evaluate the commission rate to set. The total paid, including

the current payment transaction, is used to calculate the commission rate. This may cause a commission percentage to display

erroneously. This is a progressive commission rate plan example. It is possible at the time of posting the transaction, that

the amount posted causes Collect! to use multiple levels of your commission rate plan to come to the appropriate rate. Please

review the example below to be completely comfortable and confident that the true commission rate percentage is being calculated.

Collect! will display the commission rate percentage of the current level set in the commission rate plan. If your total paid

to date is below $2,000.00 then 25% will be set on the Debtor form in the Rate field. If the total paid to date is between

$2,000.01 and $5,000.00 the rate will display as 20%, for example. This commission rate plan is used each time you post a

transaction that effects the Paid field and is set to calculate a commission rate.

The sample below will show you how Collect! determines the commission rate to set when you have assigned this commission rate

plan to an account.

Commission Rate Plan - Paid To Date

The commission rate is automatically set to your first level when entering a new account. (No payments will have been made yet,

so the rate is set for the first level.) Then the rate is recalculated and applied to each payment transaction when posting.

This commission rate plans evaluates the amount of the payment entered in the To Us or Direct field on the payment transaction.

Collect! determines the commission rate percentage to use when you exit the To Us or Direct fields, or when you uncheck the

'Don't calculate commission' check box, or when you select OK on the transaction.

The commission rate is calculated each time a transaction type is posted that requires commission or when modifying an existing

transaction. Caution should be taken if you need to modify any amount on previously payments. You may want to make an

adjustment for any error or delete all payments posted after the modified transaction.

With this sample:

The first $2,000.00 dollars paid will have commission calculated at 25%.

The next $2,000.01 to $5,000.00 dollars paid will be have commission calculated at 20%.

The next $5,000.01 to $10,000.00 dollars paid will be have commission calculated at 15%.

The next $10,000.01 to $20,000.00 dollars paid will be have commission calculated at 13%.

The next $20,000.01 to $50,000.00 dollars paid will be have commission calculated at 11%.

The next $50,000.01 to $99,999,999.00 dollars paid will be have commission calculated at 10%.

Because the amount paid to date can actually span multiple ranges set in the commission rate plan, sometimes the resulting

commission rate percentage can look erroneous. The examples below will help you to understand the commission rate percentage

displayed on each transaction.

We list a debtor with $50,000.00 Principal.

Post the first $500.00 payment. You will see the commission rate set to 25% and the calculated commission amount of $125.00.

Total paid to date is $500.00 and you are still in the $0.00 to $2,000.00 range at 25%.

Post the next $1,000.00 payment. You will see the commission rate set to 25% and the calculated commission amount of $250.00.

Total paid to date is $1,500 and you are still in the $0.00 to $2,000.00 range at 25%.

Post the next $1,000.00 payment. You will see the commission rate set to 22.50% and the calculated commission amount of

$225.00. Total paid to date is $2,500.00. This payment has taken us into the next range of $2,000.01 to $5,000.00 at 20%.

Collect! has calculated the portion of $500.00 at 25% for you for $125.00, bringing the total paid to date to $2,000.00. Then

the remainder of $500.00 is calculated at 20% for a commission amount of $100.00. This results in a total commission amount of

$225.00 which happens to be 22.50% of the $1,000.00 posted.

Post the next $2,000.00 payment and you will see the commission rate set to 20% for a calculated commission amount of $400.00.

The total paid to date is $4,500.00. This payment was completely in the range of $2,000.01 and $5,000.00 for a 20% commission

rate.

Post the next $2,000.00 payment and you will see the commission rate set to 16.25% and the calculated commission amount of

$325.00. Total paid to date is $6,500.00. This payment has taken us into the next range of $5,000.01 to $10,000.00 at 15%.

Collect! has calculated the portion of $500.00 at 20% for you for $100.00, bringing the total paid to date to $5,000.00. Then

the remaining $1500 is calculated at 15% for a commission amount of $225.00. This results in a total commission amount of

$325.00 which happens to be 16.25% of the $2,000.00 posted.

Collect! will continue to use the settings from your commission rate plan to calculate the commission rate to use for any

transaction. Experiment with transactions in the Demonstration database to become completely confident with how Collect!

calculates commission rates and commission amounts.

With this sample, no minimum or maximum values have been set. If you enter values for the appropriate minimum or maximum

values, Collect! will reset the commission amount accordingly when posting a transaction that calculates commissions. If you

are going to use minimum and maximum commission amounts, you should view the section above called Setting Min And Max Values.

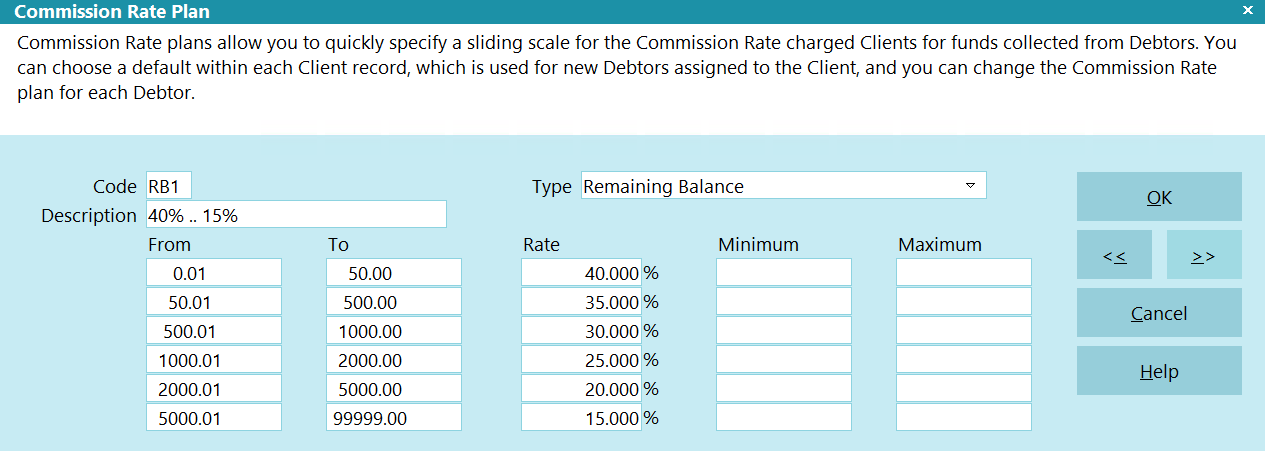

Commission Rate Plan Sample - Remaining Balance

Remaining balance commission rate plans use the current Owing on the Debtor form to calculate the appropriate commission rate.

You need to be extra careful when you use this type of plan. Collect! evaluates the balance remaining prior to posting the

transaction, so caution is needed if you enter an NSF payment or if you need to modify any previously entered transactions.

The sample below will show you how Collect! determines the commission rate to set when you have assigned this commission rate

plan to the account.

Commission Rate Plan - Remaining Balance

With this sample:

If the balance owing on a debtor account is between $5,000.01 and $99,999.00 when posting a transaction, Collect! will set the

commission rate of 15% and set calculate the commission amount accordingly.

If the balance owing on a debtor account is between $2,000.01 and $5,000.00 when posting a transaction, Collect! will set the

commission rate of 20% and set calculate the commission amount accordingly.

If the balance owing on a debtor account is between $1,000.01 and $2,000.00 when posting a transaction, Collect! will set the

commission rate of 25% and set calculate the commission amount accordingly.

If the balance owing on a debtor account is between $500.01 and $1,000.00 when posting a transaction, Collect! will set the

commission rate of 30% and set calculate the commission amount accordingly.

If the balance owing on a debtor account is between $50.01 and $500.00 when posting a transaction, Collect! will set the

commission rate of 35% and set calculate the commission amount accordingly.

If the balance owing on a debtor account is between $0.00 and $50.00 when posting a transaction, Collect! will set the

commission rate of 40% and set calculate the commission amount accordingly.

With this sample, no minimum or maximum values have been set. If you enter values for the appropriate minimum or maximum

values, Collect! will reset the commission amount accordingly when posting a transaction that calculates commissions. If you

are going to use minimum and maximum commission amounts, you should view the section above called Setting Min And Max Values.

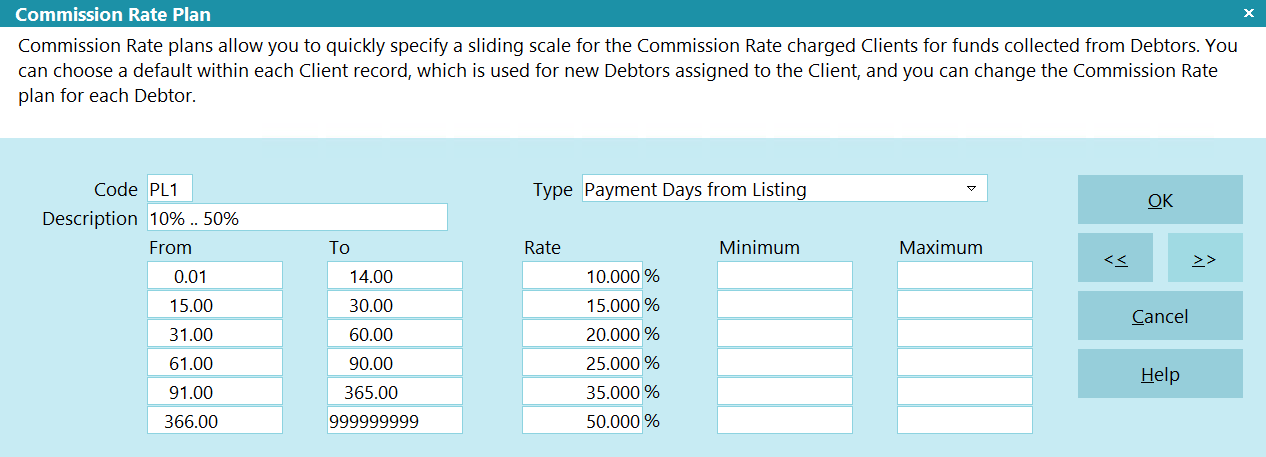

Commission Rate Plan Sample - Payment Days From Listing

Payment days from listing commission rate plans calculate the number of days difference from the Listed Date to the Payment

Date used when posting a transaction that requires commission to be calculated. Because Collect! evaluates the difference in

days when entering the Payment Date on the transaction being posted, you will need to be very careful if you need to modify any

previously entered transactions.

The sample below will show you how Collect! determines the commission rate to set when you have assigned this commission rate

plan to the account.

Commission Rate Plan - Payment Days From Listing

Collect! will calculate and set the commission rate percentage on the Debtor form immediately after you select the commission

rate plan in the Financial Detail form accessed through the Debtor form's Rate field. Select the Commission tab.

With this sample:

If the difference between the Listed Date and the Payment Date on the transaction when posting is between 0 days and 14 days,

Collect! will set the commission rate of 10% and set calculate the commission amount accordingly.

If the difference between the Listed Date and the Payment Date on the transaction when posting is between 15 days and 30 days,

Collect! will set the commission rate of 15% and set calculate the commission amount accordingly.

If the difference between the Listed Date and the Payment Date on the transaction when posting is between 31 days and 60 days,

Collect! will set the commission rate of 20% and set calculate the commission amount accordingly.

If the difference between the Listed Date and the Payment Date on the transaction when posting is between 61 days and 90 days,

Collect! will set the commission rate of 25% and set calculate the commission amount accordingly.

If the difference between the Listed Date and the Payment Date on the transaction when posting is between 91 days and 365 days,

Collect! will set the commission rate of 35% and set calculate the commission amount accordingly.

If the difference between the Listed Date and the Payment Date on the transaction when posting is between 366 days and 99999999

days, Collect! will set the commission rate of 50% and set calculate the commission amount accordingly.

With this sample, no minimum or maximum values have been set. If you enter values for the appropriate minimum or maximum

values, Collect! will reset the commission amount accordingly when posting a transaction that calculates commissions. If you

are going to use minimum and maximum commission amounts, you should view the section above called Setting Min And Max Values.

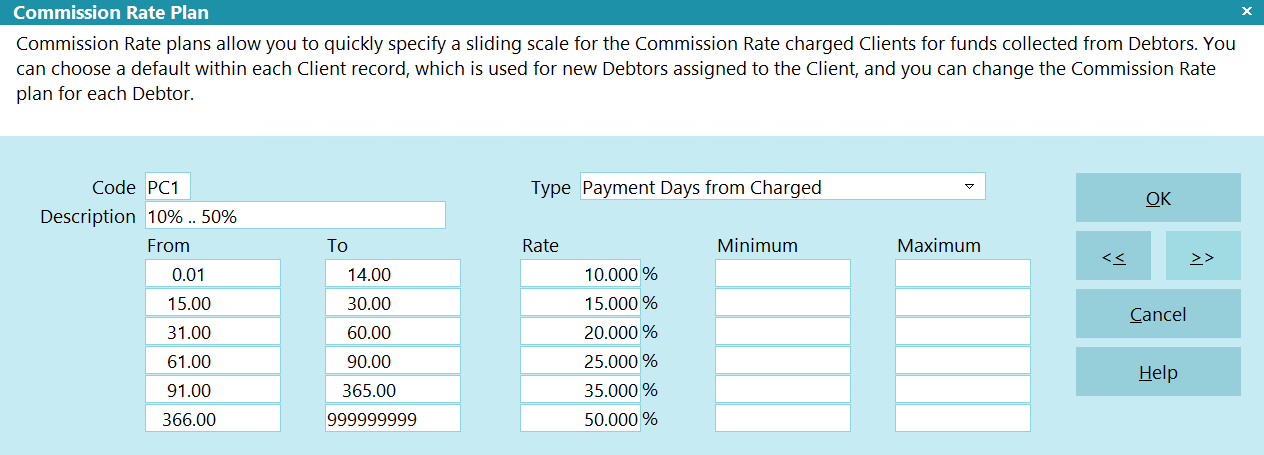

Commission Rate Plan Sample - Payment Days From Charged

Payment days from charged commission rate plans calculate the number of days difference from the Charged Date to the Payment

Date used when posting a transaction that requires commission to be calculated. Because Collect! evaluates the difference in

days when entering the Payment Date on the transaction being posted, you will need to be very careful if you need to modify any

previously entered transactions.

The sample below will show you how Collect! determines the commission rate to set when you have assigned this commission rate

plan to the account.

Commission Rate Plan - Payment Days From Charged

Collect! will calculate and set the commission rate percentage on the Debtor form immediately after you select the commission

rate plan in the Financial Detail form accessed through the Debtor form's Rate field. Select the Commission tab.

With this sample:

If the difference between the Charged Date and the Payment Date on the transaction when posting is between 0 days and 14 days,

Collect! will set the commission rate of 10% and set calculate the commission amount accordingly.

If the difference between the Charged Date and the Payment Date on the transaction when posting is between 15 days and 30 days,

Collect! will set the commission rate of 15% and set calculate the commission amount accordingly.

If the difference between the Charged Date and the Payment Date on the transaction when posting is between 31 days and 60 days,

Collect! will set the commission rate of 20% and set calculate the commission amount accordingly.

If the difference between the Charged Date and the Payment Date on the transaction when posting is between 61 days and 90 days,

Collect! will set the commission rate of 25% and set calculate the commission amount accordingly.

If the difference between the Charged Date and the Payment Date on the transaction when posting is between 91 days and 365 days,

Collect! will set the commission rate of 35% and set calculate the commission amount accordingly.

If the difference between the Charged Date and the Payment Date on the transaction when posting is between 366 days and 99999999

days, Collect! will set the commission rate of 50% and set calculate the commission amount accordingly.

With this sample, no minimum or maximum values have been set. If you enter values for the appropriate minimum or maximum

values, Collect! will reset the commission amount accordingly when posting a transaction that calculates commissions. If you

are going to use minimum and maximum commission amounts, you should view the section above called Setting Min And Max Values.

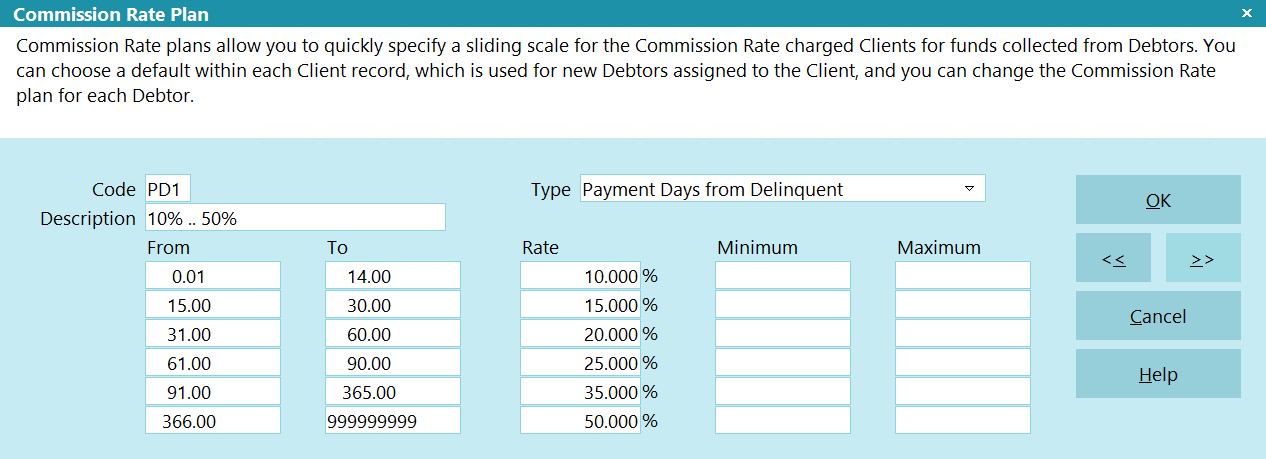

Commission Rate Plan Sample - Payment Days From Delinquent

Payment days from delinquent commission rate plans calculate the number of days difference from the Delnqnt Date to the Payment

Date used when posting a transaction that requires commission to be calculated. Because Collect! evaluates the difference in

days when entering the Payment Date on the transaction being posted, you will need to be very careful if you need to modify any

previously entered transactions.

The sample below will show you how Collect! determines the commission rate to set when you have assigned this commission rate

plan to the account.

Commission Rate Plan - Payment Days From Delinquent

Collect! will calculate and set the commission rate percentage on the Debtor form immediately after you select the commission

rate plan in the Financial Detail form accessed through the Debtor form's Rate field. Select the Commission tab.

With this sample:

If the difference between the Delnqnt Date and the Payment Date on the transaction when posting is between 0 days and 14 days,

Collect! will set the commission rate of 10% and set calculate the commission amount accordingly.

If the difference between the Delnqnt Date and the Payment Date on the transaction when posting is between 15 days and 30 days,

Collect! will set the commission rate of 15% and set calculate the commission amount accordingly.

If the difference between the Delnqnt Date and the Payment Date on the transaction when posting is between 31 days and 60 days,

Collect! will set the commission rate of 20% and set calculate the commission amount accordingly.

If the difference between the Delnqnt Date and the Payment Date on the transaction when posting is between 61 days and 90 days,

Collect! will set the commission rate of 25% and set calculate the commission amount accordingly.

If the difference between the Delnqnt Date and the Payment Date on the transaction when posting is between 91 days and 365 days,

Collect! will set the commission rate of 35% and set calculate the commission amount accordingly.

If the difference between the Delnqnt Date and the Payment Date on the transaction when posting is between 366 days and 99999999

days, Collect! will set the commission rate of 50% and set calculate the commission amount accordingly.

With this sample, no minimum or maximum values have been set. If you enter values for the appropriate minimum or maximum values,

Collect! will reset the commission amount accordingly when posting a transaction that calculates commissions. If you are going

to use minimum and maximum commission amounts, you should view the section above called Setting Min And Max Values.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org