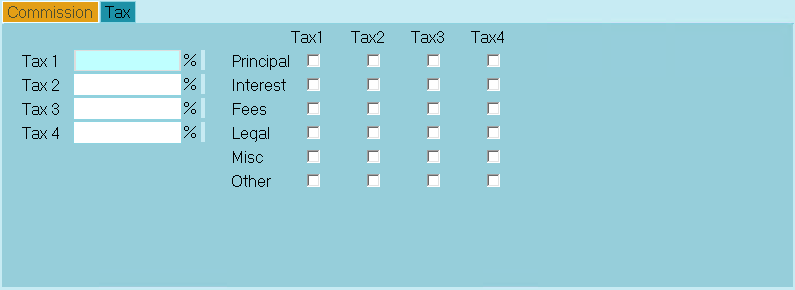

Tax

The Tax form stores your tax rates. Tax is calculated on the

commission you receive from your clients when you post

debtor payments. Whenever you post a payment transaction

with a commission amount, the settings in the Tax form

will be used to calculate any tax charges.

Up to four tax rates may be set on the account.

Breakdown settings enable you to apply separate

tax rates to various types of transactions. Please see the

Tax and Breakdown example at the end of this document

for details.

Accessing And Setting Tax Rates

You can view tax rate settings from the Financial Detail

form or from the Client Settings form, if you have set the

rates at the Client level. You can also set a Tax Rate for

a particular Transaction or a particular Transaction Type.

The Tax form is accessed from the Client form by

selecting the ADVANCED button to open the Client Settings

form. It is recommended that you set the rate in the Client

Settings form, if possible.

Tax

The Tax form is accessed from the Debtor form by selecting

the Rate field or by tabbing into the Rate field and pressing F2.

Select the Tax tab when the Financial Detail form is displayed.

You can set the rate at the Debtor level if you have different

rates for Debtors belonging to the same Client.

When you view a Transaction Type or a Transaction, you

will also see the Tax tab. It may already have values in

it "inherited" from the Client or Debtor settings. You can

set the rate here, if needed, for special types of payments.

Tax 1

If you charge tax on commissions that you earn,

enter a percentage tax rate here. (e.g. Enter 7.0

for 7%) This is the tax charged on any commissions

that you receive for debtor payments. This rate is

automatically written into the Tax Rate field for any

transaction posted for this debtor when there is a

commission amount. Tax is calculated on the

commission amount only and is displayed in the

Tax field of the transaction.

This field must contain a value if you are calculating

tax on commissions for this debtor.

When a new debtor is entered, this field is filled

automatically from the Client Settings Tax Rate field.

You can change the rate for this particular debtor to

override the rate used generally for the client.

Select the type of transaction to apply this tax to

by placing a check mark in the appropriate box in

the columns next to this field.

Please refer to Tax and Breakdown below.

Tax 2

You can enter a percentage here if you need to charge

a different tax rate for the breakdown type that is

check marked for Tax 2.

Please refer to Tax and Breakdown below.

Tax 3

You can enter a percentage here if you need to charge

a different tax rate for the breakdown type that is

check marked for Tax 3.

Please refer to Tax and Breakdown below.

Tax 4

You can enter a percentage here if you need to charge

a different tax rate for the breakdown type that is

check marked for Tax 4.

Please refer to Tax and Breakdown below.

Principal

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Principal.

Please refer to Tax and Breakdown below.

Interest

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Interest.

Please refer to Tax and Breakdown below.

Fees

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Fees.

Please refer to Tax and Breakdown below.

Legal

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Legal.

Please refer to Tax and Breakdown below.

Misc

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Misc.

Please refer to Tax and Breakdown below.

Other

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Other.

Please refer to Tax and Breakdown below.

Don't Calculate Tax

Switch this ON to prevent the calculation of tax for this debtor or

transaction. This switch is visible only when you are viewing

Financial Details, Transaction Type or Transaction form.

Set this switch BEFORE you enter your payment

amount in the To Us or Direct fields. If you fail to

do this, and you see an amount in the Tax field,

simply delete it to remove the calculated Tax.

Set this switch BEFORE you enter your payment

amount in the To Us or Direct fields. If you fail to

do this, and you see an amount in the Tax field,

simply delete it to remove the calculated Tax.

Client Is Tax Exempt

If you switch ON "Client is Tax Exempt" in the Client Settings,

Tax will not be calculated even if you have set tax rates at

the Debtor level.

Total Tax

Summary calculation of all tax charged on this transaction.

This field is visible only when you are viewing a Transaction.

Tax And Breakdown

Collect! enables you to calculate up to four tax rates in the

Tax settings. These rates may be applied to different categories

of monies posted on the account. We will demonstrate all of

Collect!'s settings.

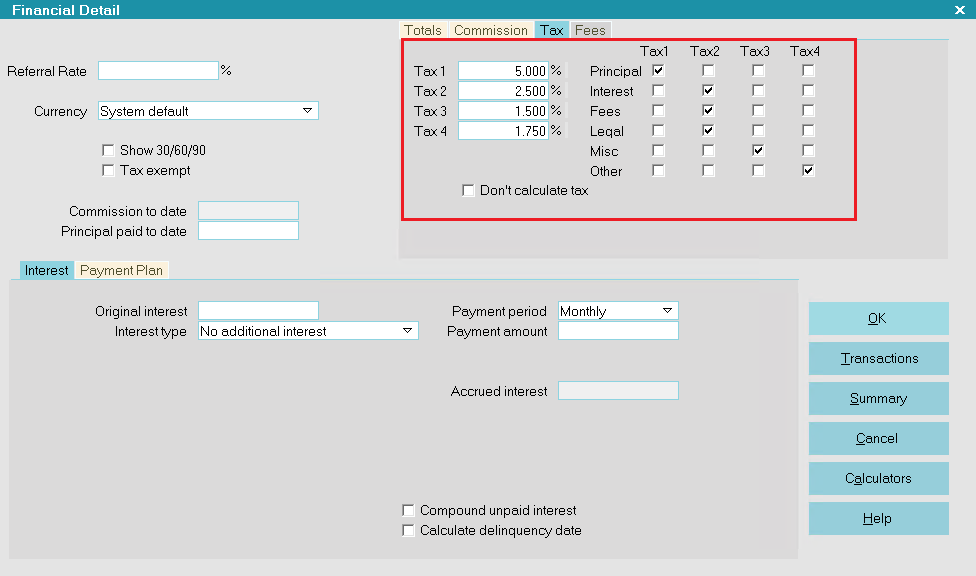

Below is an example of a Debtor's Tax Rate settings

using all the available settings, just to demonstrate how

Collect! calculates tax with multiple rates and breakdown.

You may not require this level of complexity in your tax

calculations. Use only what you need.

Tax Rates Settings

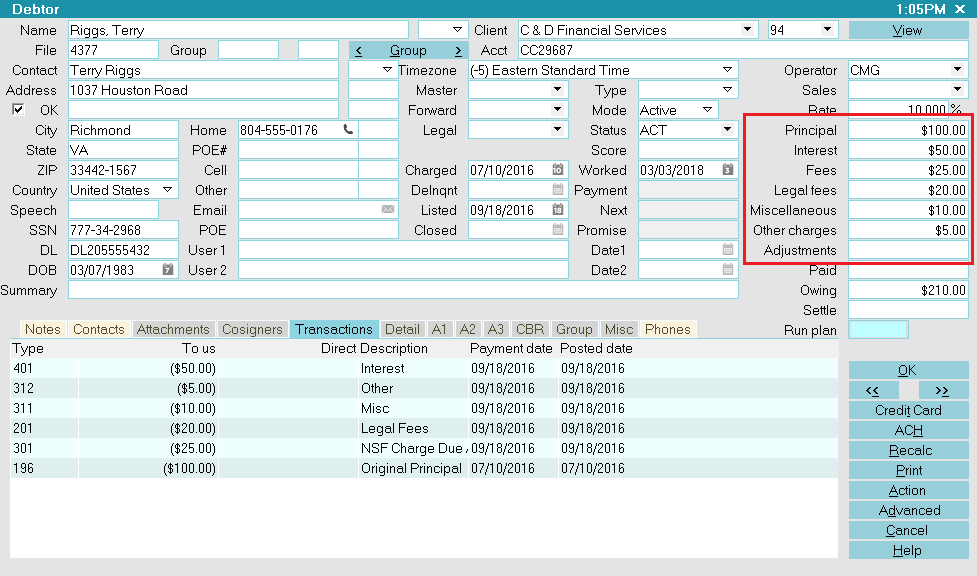

For our example, this Debtor owes $210 posted in the following way.

We have posted an amount to each one of Collect!'s Financial Types

to demonstrate.

Debtor Screen with Transactions Posted

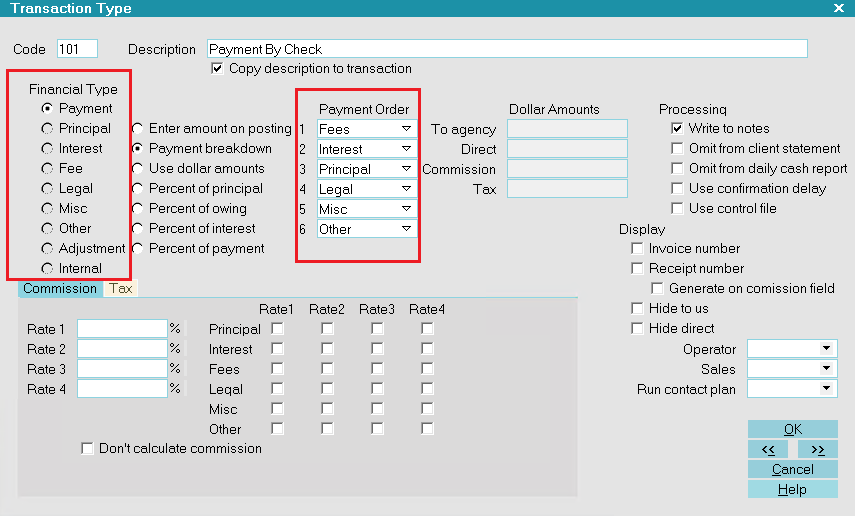

Next we ensure that the Financial Types breakdown order in

the Transaction Type suits our demonstration's purposes.

This order can be changed as needed in your use.

Transaction Type with Breakdown

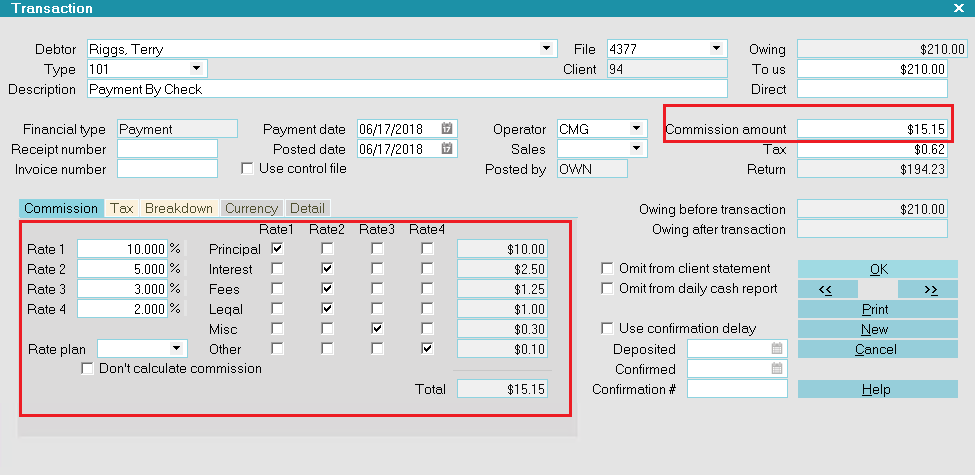

Now, we post a payment for the entire amount, $210. Notice

that Collect! has copied into the Transaction, all of the settings

from the Debtor's Commission Rates. Collect! has also performed

the calculations and has arrived at the total commission owing.

We see all the rates and the commission amounts.

Payment Posted with Commission Calculated

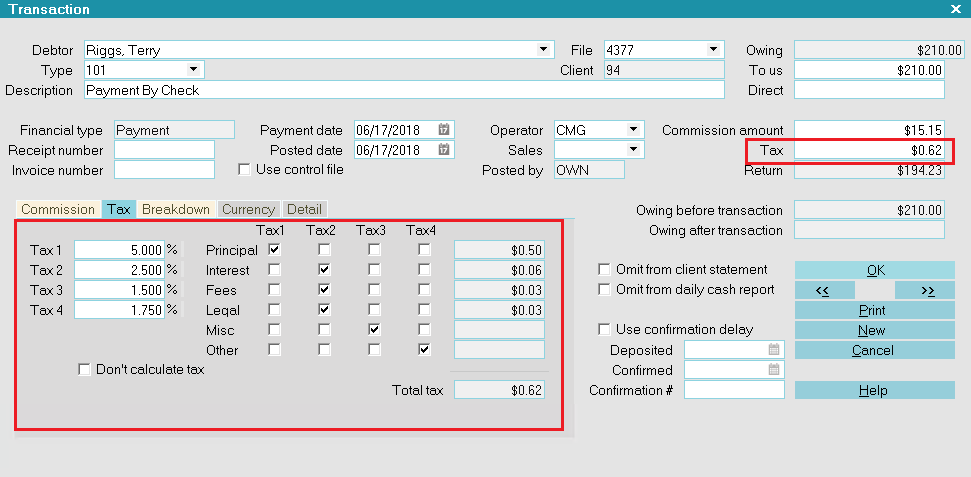

Notice that Collect! has also copied into the Transaction, all of the

settings from the Debtor's Tax Rates. Collect! has also performed

the calculations and has arrived at the total tax owing on the

Commission Amount. We see all the rates and the tax amounts.

Payment Posted with Tax Calculated

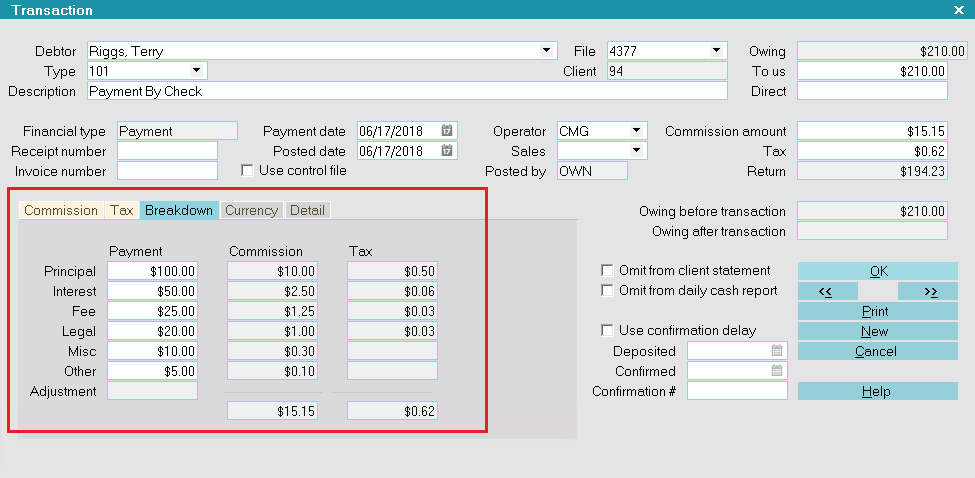

When we select the Breakdown tab in the payment we just entered,

we see the totals for each category. We see the dollar amount for

each Financial Type and the commission and tax amounts.

Amount Posted to Each Financial Type

This short example shows you the impressive amount of

flexibility Collect! offers for managing your accounts

and calculating your commission and tax.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org