Transaction Type Sample - Original Principal

The Original Principal transaction type is needed

if you are going to apply interest, apply a judgement,

or add more principal at a later date. If you are not

using any of the above items, then you can skip this

transaction type.

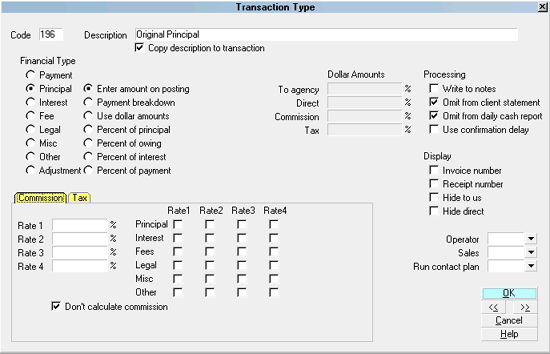

By default, Collect! ships and uses the 196

Original Principal transaction type shown

below when it is required to perform interest or

judgement calculations.

You may adjust or add to the Principal amount

using Principal transaction types. Multiple principal

transaction types are added together and the total

is set in the Original Principal field on the

Financial Details form.

You may enter an Original Principal

amount using the Financial Detail form accessed

from the Debtor form's Principal field. If you have no

need of anything more complicated, this is all you

have to do to record the Original Principal for the

account.

You may enter an Original Principal

amount using the Financial Detail form accessed

from the Debtor form's Principal field. If you have no

need of anything more complicated, this is all you

have to do to record the Original Principal for the

account.

The sample shown below sets the Original Principal

amount when entering a new debtor. There are

several instances when you will need this.

- If you ever intend to apply interest of any type,

- need to add more principal later,

- use Collect!'s judgement functions,

- use payment plans as a credit grantor,

then you will want to apply this transaction type to the

account.

Original Principal Transaction Type 196

When you create a 196 Original Principal transaction on

a debtor account, the description from the transaction

type form will be copied to the transaction being posted.

The 'Enter amount on posting' radio button is switched

ON to allow you to enter the amount at the time of

posting the transaction.

Entering a negative amount in either the To Us or

Direct field will add to the debtor's Principal amount.

If more than one of these transaction types is

posted to an account, the total will be calculated

automatically and displayed in the Principal field

on the Debtor form.

Entering a positive amount will reduce the amount of

Principal. Interest will be recalculated accordingly.

Interest, if used, is calculated from the Payment

Date entered when the transaction is posted and

the amount entered in the To Us or Direct field. If you

are using multiple principal transactions, interest

is calculated on the resulting principal total after

each transaction's payment date. For more details

please see Interest Detail and documentation

for specific types of interest.

In this sample, the reporting check boxes tell

Collect! to omit this transaction when creating a

statement for your client and also to omit

the transaction when generating the

daily cash report.

Calculations are checked not to calculate commission

and not to calculate tax on any commission

amount present.

Display is set to leave both the To Us and the Direct

fields visible at all times when viewing the transaction

or Transactions List.

No operator or sales operator ID's have been set to be

used as default values when posting this transaction

type. You may want to set the Operator or Sales values

to HSE or OWN, if you wish to always have operator and

sales operator ID's on every transaction.

No contact plans have been set to be run when posting

this transaction type.

No commission rate has been set to override the

commission rate that may be set on the Debtor form.

All the above settings will be automatically filled in

for you when you post a 196 Original Principal

transaction to an account. You may override any

setting when posting the transaction.

See Also

- Transaction Type

- Transaction Type Basics - Introduction/Accessing

- Transaction Type Samples

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org