How To Use Promises

What is a Promise? A Promise is an agreement with a debtor to pay a specific sum of money on a definite date. A promise

may be a single payment, multiple payments or a repeating payment at regular intervals. How do we record these

promises in Collect!? Keep track of when the promise is due? Know when it is met or broken?

A Promise may easily be managed in Collect! using a Promise contact. Promise contacts are very useful for

scheduling single promise payments, multiple promise payments, or a series of payments promised at a

repeating interval. Promise contacts provide a loosely structured " payment plan" with far more leeway that

an actual payment plan. If payments are irregular, incomplete or missed, Promise contacts keep track of

this and calculate correctly with no extra work on your part.

When you create a Promise contact, the due date of the Promise will be displayed on the Debtor form in the Promise field. The

Promise will show up in the Operator's WIP List on that day.

Processing promised payments is controlled by the "Automatically Manage Promises" switch in the Payment Posting Options form.

If this switch in ON, Collect! will automatically keep track of whether or not the promise is met, forwarding the date to the

next Repeat period when appropriate, or marking the Promise contact as Done, if needed.

When there is a Repeat value, Collect! forwards the contact when a full payment is received for the dollar amount of the

Promise contact. The contact's Due Date is advanced to the next Repeat period's date. Normally, the Promise Due Date is

advanced one Repeat period when a full payment is received. If you switch ON 'Advance overpayments', the Due Date will

advance as far ahead as necessary if a payment is made that fulfills the promise for several Repeat periods.

An unfulfilled promise or partial payment does not advance and stays in the WIP List as delinquent. The Promise field

on the Debtor form turns RED when the Due Date passes.

Promises may be automated with contact plans. For instance, you may want to send a letter when you set up

a promise on an account, write a line to the debtor's Notes, and maybe print a coupon book. Also, several

actions may be taken automatically when a promised payment is received. These are controlled by

Promise Contact Actions in the Payment Posting Options form. Payment in Full, Overpayment, Underpayment, NSF

Payment and Broken Promises each trigger a contact plan. These may be modified to suit your needs, or you may

choose not to run any of them.

Step By Step Process For Taking Promised Payments

We will cover:

- Single Promise

- Creating a Promise Contact

- Viewing the Debtor form

- Loading the WIP List

- Posting Promised Payments

- What Collect! does when you post a payment for a promise

- When an NSF Check is returned

- Multiple Single Promises

- Creating multiple single promises

- Repeating Promises

- What is a repeating promise?

- Creating a repeating promise

- Viewing the Interest Detail form

- Special Settings

- Automatically Manage Promises

- Advance Overpayments

- Max Intervals

- Grace Days

- Promise Contact Actions

- Payment Values

Single Promise

When you receive a promise from a debtor to pay a certain dollar amount on a specific date, you can create a Promise

contact to keep track of the agreement. When a payment is received, Collect! will mark the contact as Done.

Creating A Promise Contact

To enter a Promise Contact for an account, we must first open the Contact form while on the debtor's account.

1. Once the Debtor form is displayed, select the field labeled Owing. This will display the

Debtor Financial Summary.

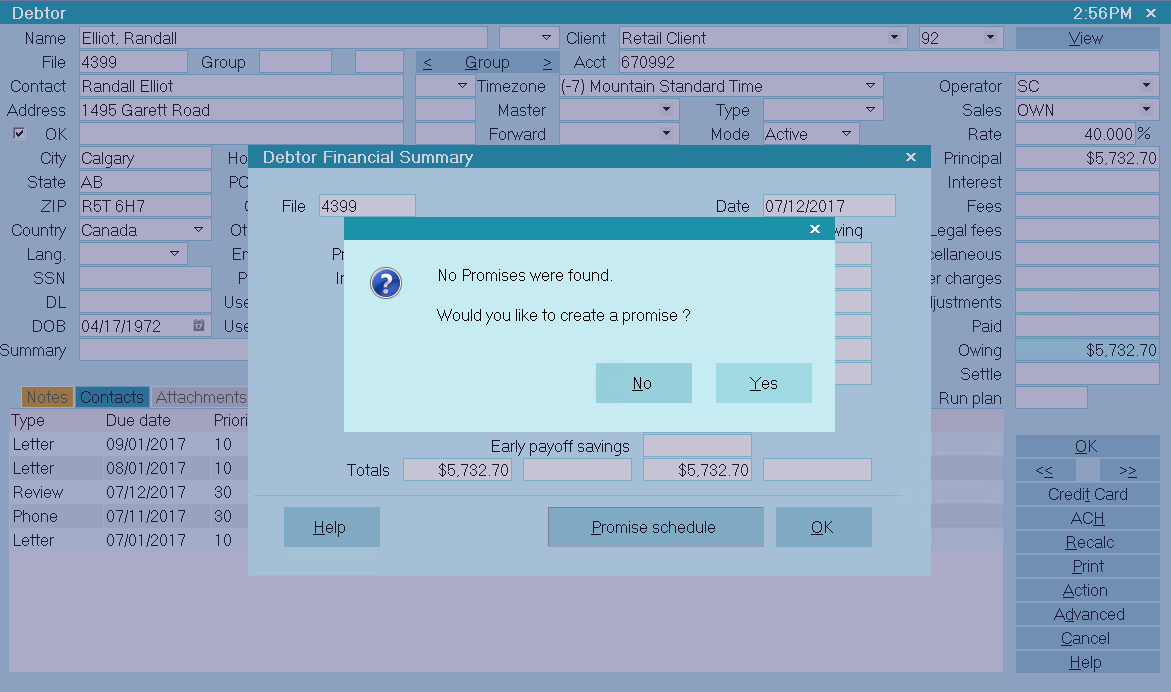

2. Select the PROMISE SCHEDULE button on the Debtor Financial Summary. You will be prompted to create a Promise.

Prompt to Create a Promise

Select YES to display a new Contact form.

The Contact form will display, filled with any defaults, such as Priority and Delays Days, that have been set in the

WIP Options.

The Contact form will display, filled with any defaults, such as Priority and Delays Days, that have been set in the

WIP Options.

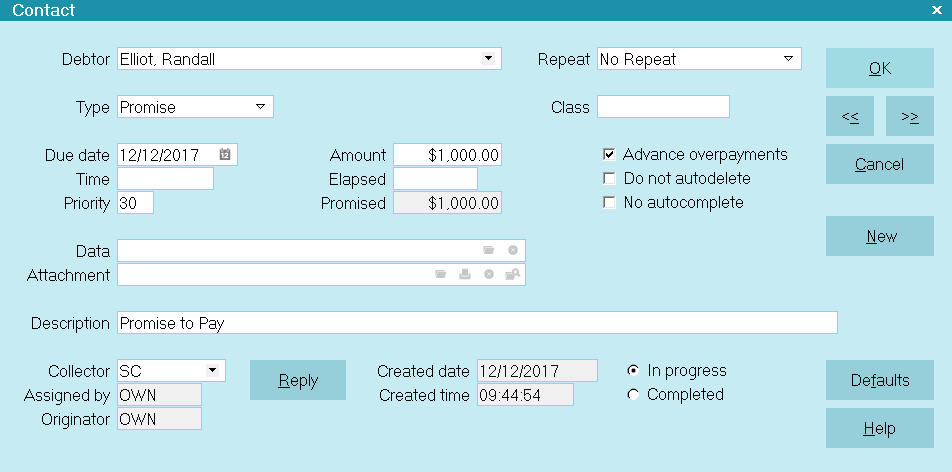

You will notice that the Debtor's Name and Due Date are entered automatically. The Due Date may be in the future

if you have "Delay Days" set in the WIP Options form. As well, the default contact Type field should already display "Promise."

5. If needed, you can select the field labeled Type to view the list of Contact types. Use the PageUp or

PageDown key to see the whole list. Select PROMISE from the list, if it is not already displayed in the Type field.

6. The Contact's Due Date determines when the promised payment is due. The default is today, but the Due Date may

be in the future, if you have "Delay Days" set in the WIP Options. Select the Calendar icon to the right of the

Due Date field and choose the date the payment must be made.

7. Locate the field labeled Repeat. This field is used to schedule repeating promise payments.

Ensure that "No Repeat" is selected for now, as we are scheduling a single Promise.

8. Locate the field labeled Advance overpayments. This field is used to manage repeating promise payments.

Ensure that it is unchecked as we are scheduling a single promise.

9. Enter the amount of the promised payment in the field labeled Amount.

10. In the Description field, enter a description or a short note for the operator, such as, "Promise to pay."

11. If you want to assign this promise to another Operator's WIP List, select the down arrow next to the field

labeled Collector to view the list of operators and make your selection.

Contact for Single Promise

12. Press F8 to save this Contact.

If you see a prompt to "automatically manage promises," please refer to that section below.

If you see a prompt to "automatically manage promises," please refer to that section below.

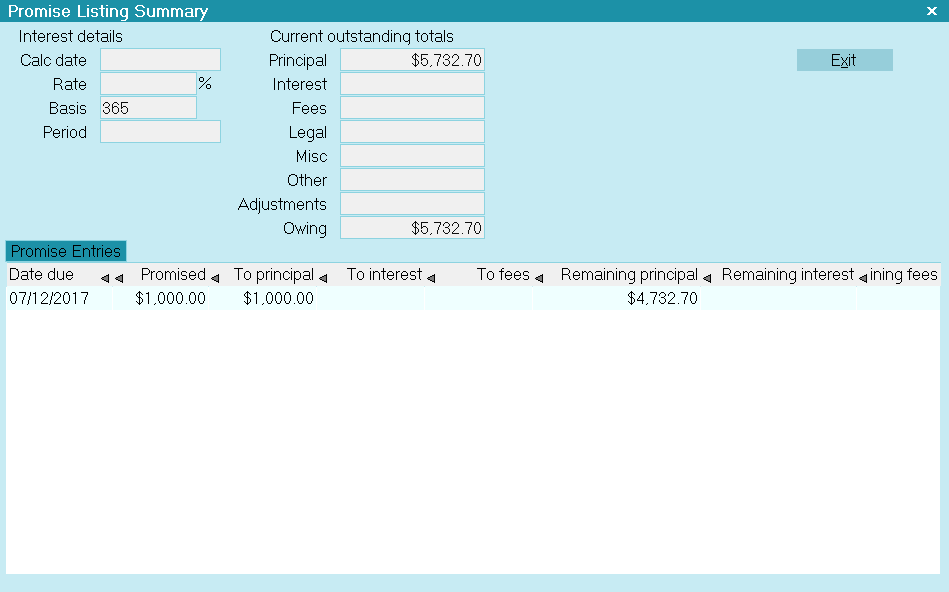

13. The Promise Listing Summary will be displayed with the newly created promise details displayed.

Promise Listing Summary with Promise Displayed

14. Select EXIT to close the Promise Listing Summary. Then select OK to close the Debtor Financial Summary.

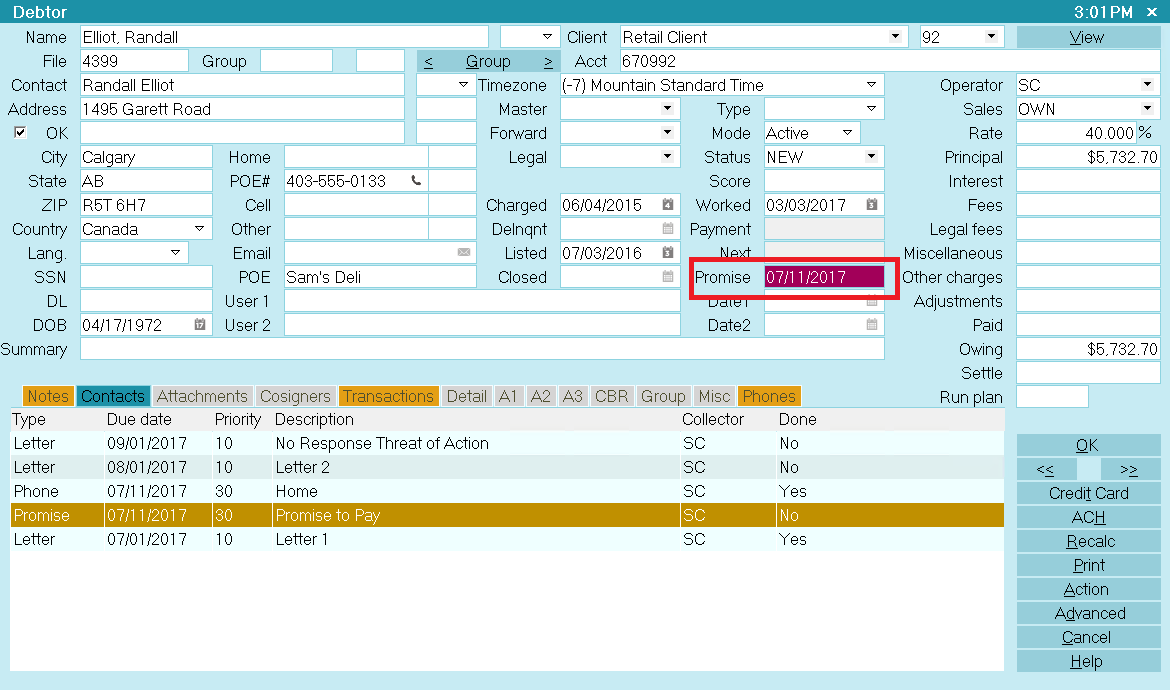

Viewing The Debtor Form

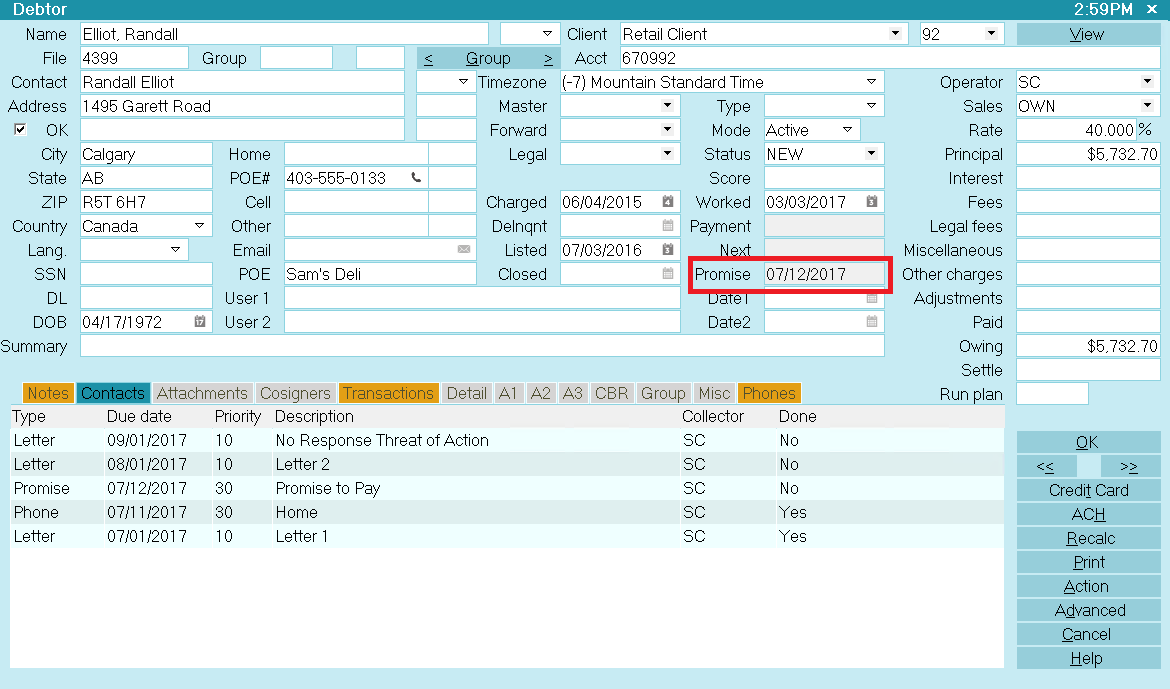

When you are back at the Debtor form, select the RECALC button to refresh the account information.

The Due Date of the Promise will be displayed in a field labeled Promise on the

Debtor form, to the left of the OK button.

Debtor Screen with Promise Date

If the promised payment is not received by this date, the Promise field will turn RED.

Debtor Screen with Promise Date Delinquent

To automatically refresh the financials on the Debtor form, switch ON 'Automatic recalc' for

the Operator. This switch is set in the Operator form.

To automatically refresh the financials on the Debtor form, switch ON 'Automatic recalc' for

the Operator. This switch is set in the Operator form.

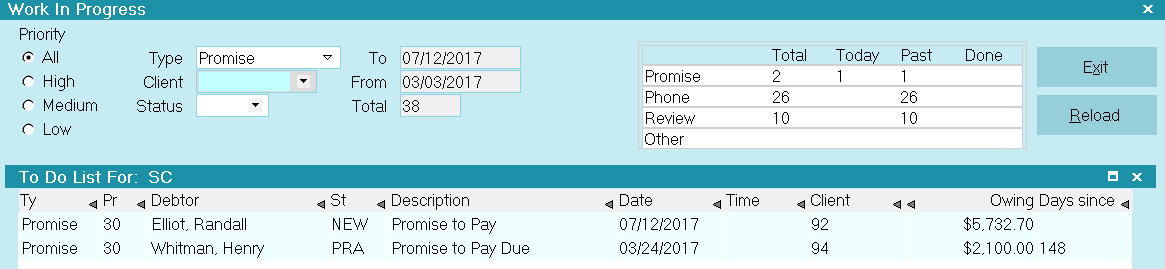

Loading The WIP List

The day that this promise comes due, the Promise Contact will show up in the operator's WIP list.

WIP List With Promise Contact Loaded

If the promised payment is not received, the Promise will stay in the operator's WIP list as delinquent.

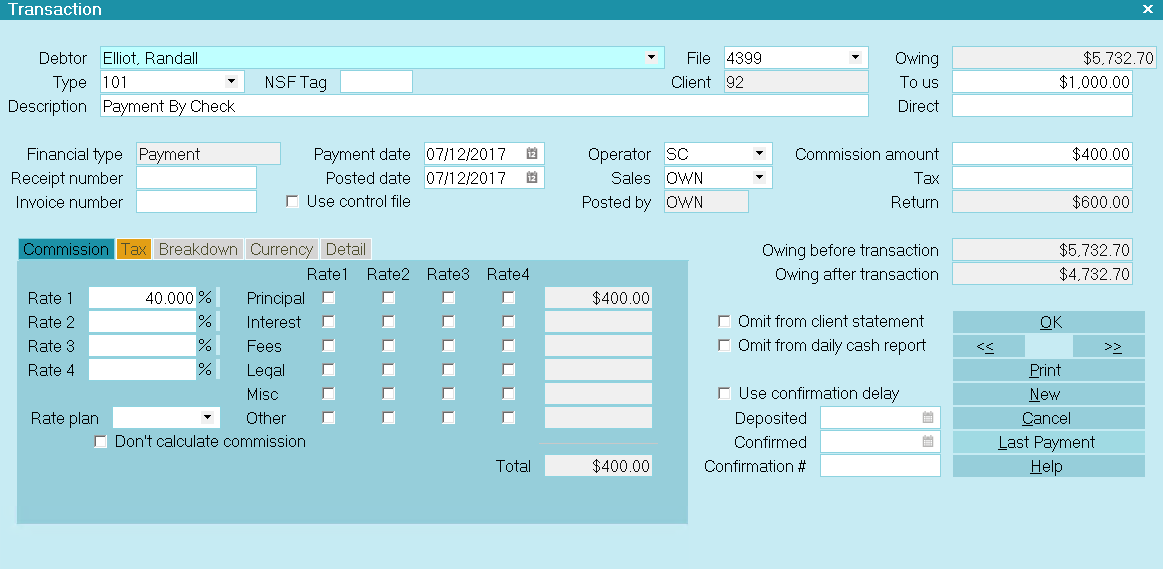

Posting A Promise Payment

Now you can use the Promise contact to record and process Debtor payments.

Ensure that Automatically Manage Promises is switched ON in the Payment Posting Options form.

Ensure that Automatically Manage Promises is switched ON in the Payment Posting Options form.

When a payment is received, post a Payment transaction. The To Us field in the Transaction form will show the Promise Amount.

Payment Transactions with Promise Amount

After the transaction is posted, Collect! will locate the Promise contact, evaluate the payment and mark the

contact as done if the promise has been met. When the promise is met and there are no other outstanding

promises, the debtor's Promise field is empty. A partial or incomplete payment does not satisfy the

Promise and it remains In Progress after the payment is posted.

If there is interest to be calculated, this is calculated and added to the

Owing before the promise amount is displayed.

If there is interest to be calculated, this is calculated and added to the

Owing before the promise amount is displayed.

When An NSF Check Is Returned

When an NSF check is returned, enter the amount as a negative and Collect! will back date the

promise to its outstanding date and amount.

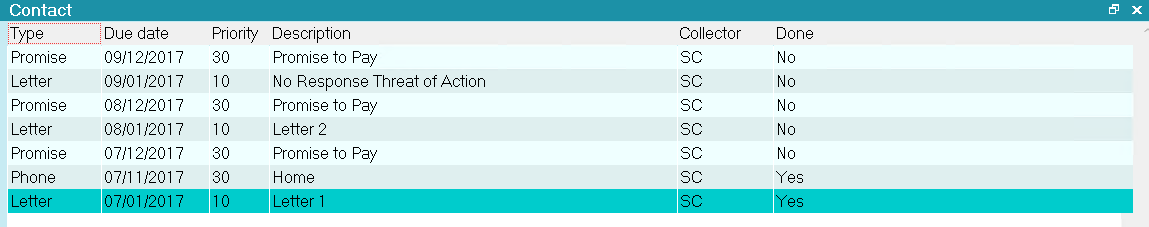

Multiple Single Promises

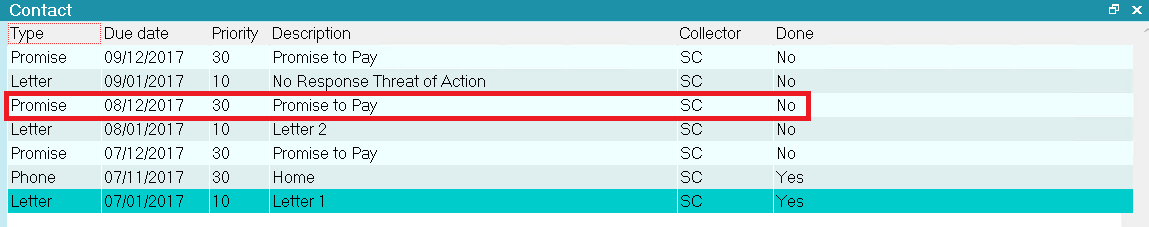

Following the same steps as outlined above, you may enter more than one promise payment. The screen shot below

shows three promises scheduled for different dates and amounts.

Multiple Single Promises

The Promise field on the Debtor form will display the date of the earliest unmet promise in the contact list.

When a payment is posted, the amount of the earliest unmet promise will be automatically filled in. This contact will be

marked done when the payment is posted.

One Promise Met with Two Outstanding

Ensure that 'Automatically Manage Promises' is switched ON in the Payment Posting Options form.

Ensure that 'Automatically Manage Promises' is switched ON in the Payment Posting Options form.

Repeating Promises

What is a repeating Promise? A repeating Promise is a Promise contact with a Repeat value and an Amount

filled in. Collect! will manage this contact, evaluating it whenever a payment is posting and forwarding the Promise

Due Date as necessary according to the Promise contact settings.

The "Automatically manage promises" switch must be switched ON in Payment Posting Options for this method to work.

The "Automatically manage promises" switch must be switched ON in Payment Posting Options for this method to work.

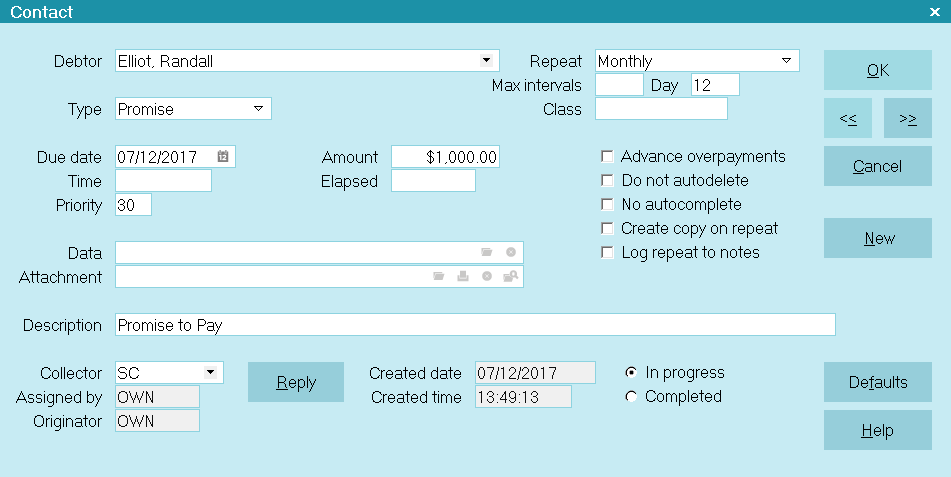

1. As described above, create a Promise contact for the debtor through the Debtor Financial Summary form.

2. When the new Contact form is displayed, select Promise from the Type pick list.

3. In the Due Date field, select the calendar icon to display the Calendar, and select a date for the first promised payment.

4. Enter a value in the Repeat field, such as Monthly. This creates a revolving contact.

5. In the Amount field, enter the dollar amount that the Debtor has promised to pay each month.

6. Locate the field labeled Advance overpayments. Switch this ON if you wish to consider overpayments as

fulfillment for future promises.

7. Enter a description in the Description field. Assign the contact to a specific operator if desired.

Contact for Monthly Promise To Pay

8. Press F8 to save this Contact. The Promise Listing Summary will be displayed with the newly created promise details displayed.

If you see a prompt to "automatically manage promises," please refer to that section below.

If you see a prompt to "automatically manage promises," please refer to that section below.

Select EXIT to close the Promise Listing Summary. Then select OK to close the Debtor Financial Summary.

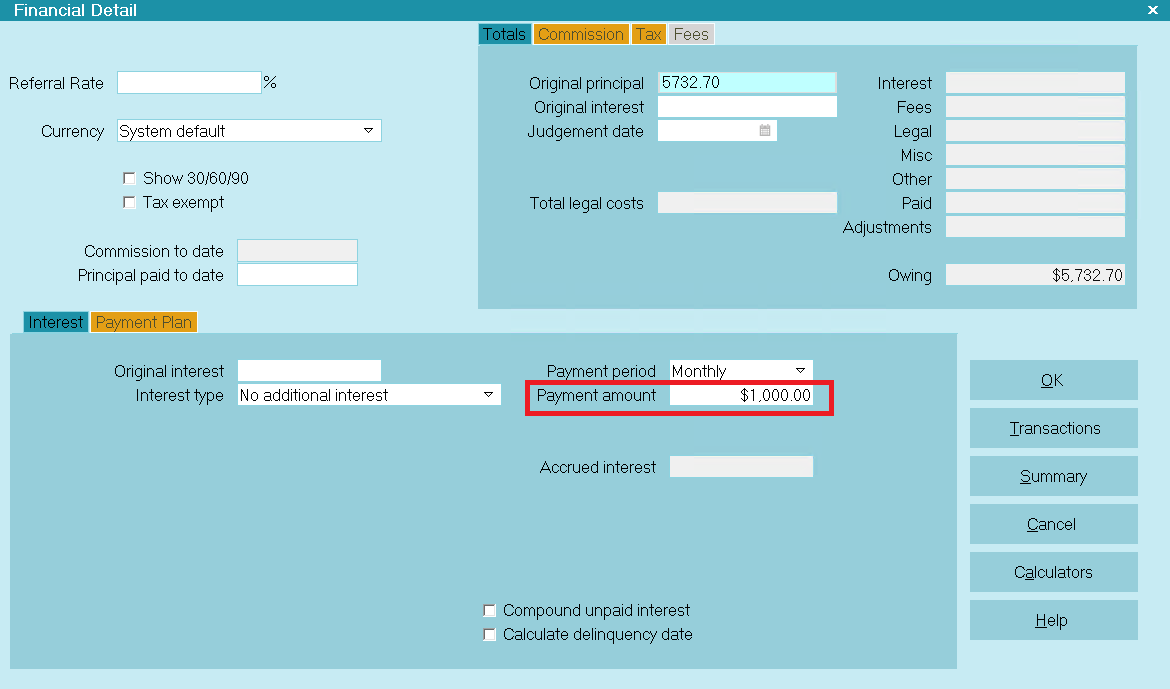

Viewing The Interest Detail Form

Collect! automatically stores the Payment Amount dollar value in the Interest Detail for the account.

Promise Amount Stored in Interest Detail

Collect! uses this each month to see whether or not the Promise is met. If the Promise is met, the Promise Contact

Due Date will roll forward to next month, same day. If the Promise is not met, the Promise Contact Due Date does

not roll forward. When the debt is completely settled, Collect! marks the Promise Contact as Done.

When a payment is partial, Collect! does not forward the promise.

Instead, the remaining amount is still due on the current promise date.

When the payment is nearing completion, Collect! automatically adjusts the final payment to reflect the actual

amount outstanding. The last payment turns off the promise contact cycle automatically when the Owing reaches zero.

Ensure that 'Automatically Manage Promises' is switched ON in the Payment Posting Options form.

Ensure that 'Automatically Manage Promises' is switched ON in the Payment Posting Options form.

Special Settings

Several settings in Collect! influence how promises are handled. These are described below.

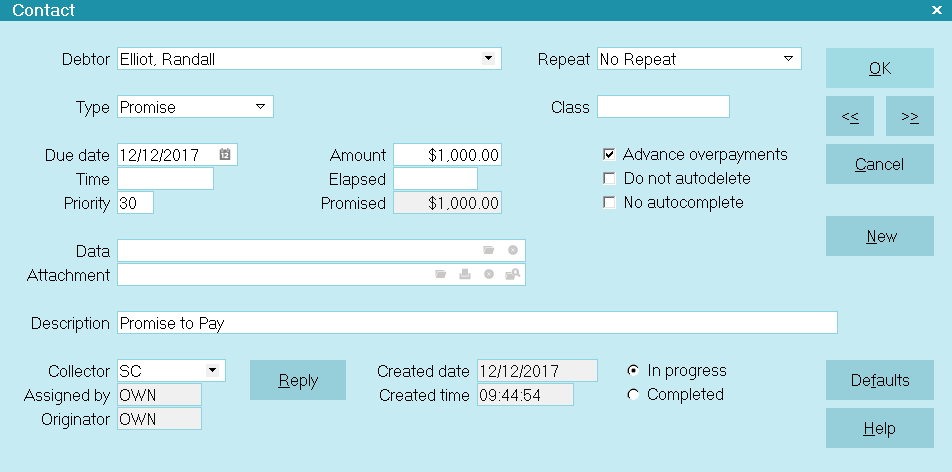

Advance Overpayments

The 'Advance Overpayments' switch on the Contact form is used to manage overpayments when a promise payment is received.

Advance Overpayments Enabled

With this switch enabled, Collect! will roll the Promise Due Date forward according to how many periods are satisfied

by the payment. For example, if the debtor pays $300 at once, and that satisfies 2 monthly payments of $150,

the Date Due will roll forward 2 months when this switch is enabled. If it is not enabled, the Date Due will roll forward

only one month, no matter how much is overpaid.

Max Intervals

Optionally, you can set a number of repeats for a Promise. Collect! will only repeat the Promise the number of times

you set, even if this does not fully pay off the debt.

When a repeating Promise rolls forward and there is a value in the Max Intervals field, the value will be decremented.

When it reaches 0, the Contact will be completed regardless of the Debtor's Owing. This enables you to accept a series of

Promise payments even if this agreement does not fully pay off the debt. Without a value in the Max Intervals field,

a Promise repeats until the debt reaches zero.

Max Intervals will also work with the Copy on Repeat switch, the Advance Overpayments switch, and contact plans

that schedule repeating Promise contacts.

Grace Days

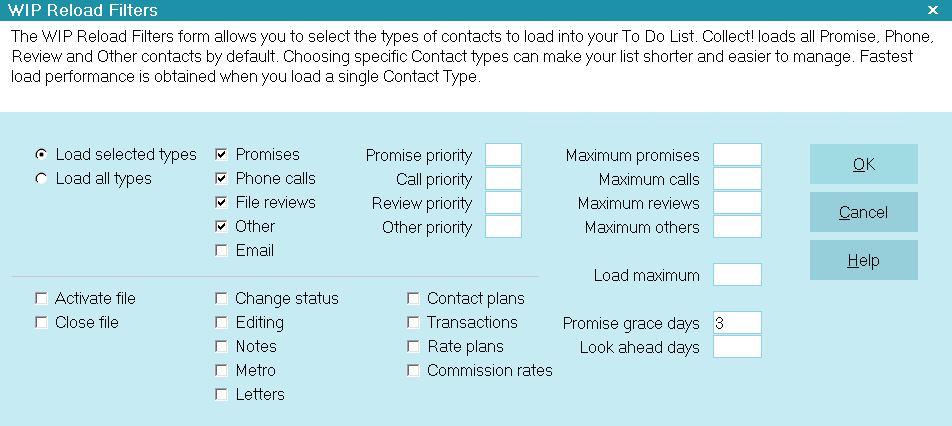

If you wish to wait a few days grace before considering the Promise as overdue, open the WIP Reload Filters and

enter a number of days in the 'Promise Grace Days' field.

WIP Reload Filters with Promise Grace Days

The Promise will only display in the WIP List when the grace period has expired. This means the Due Date of the

promise plus the Promise Grace Days exceeds today. For instance, on April 12th, a Promise for April 8th with

a 3 grace days is now overdue. On April 12th, the Promise will show up in the operator's WIP List.

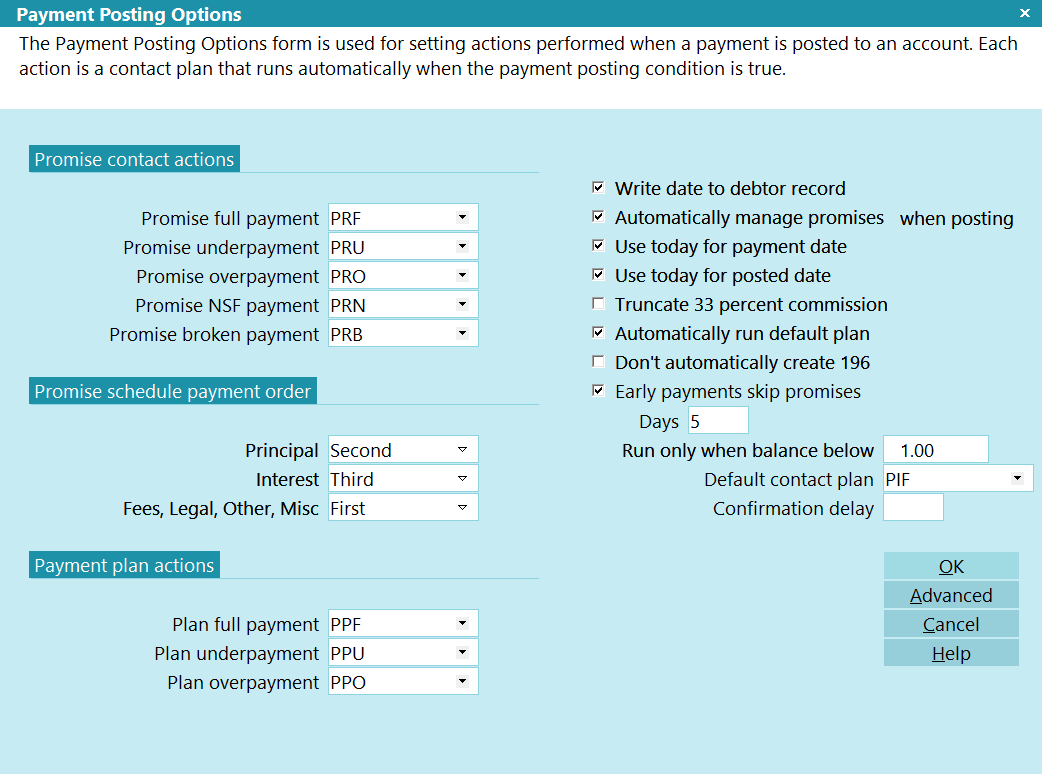

Automatic Promise Actions Set In The Payment Posting Options

Promise Contact Actions are contact plans that enable you to perform custom actions as Collect! automatically

manages promises on your accounts. You can schedule whatever events you need for full payment, underpayment,

overpayment, NSF payment and broken promises. Any payment posted to an account with a Promise will

trigger one of the promise contact plans. Broken promises are managed through Batch Processing.

Remember that whenever you use contact plans, you have to be careful that you know every step the plans will

take on your accounts.

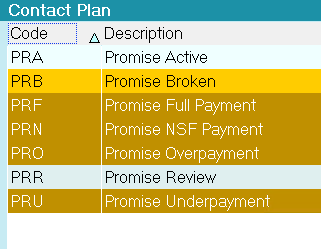

Other promise contact plans shipped with the Demonstration database are Promise Activate (PRA) to start a Promise on

an account and Promise Review (PRR) to review an account that has a Promise set up.

Promise Contact Actions are set in the Payment Posting Options form and are enabled when you switch

ON 'Automatically manage promises' in the same form.

Promise Contact Actions set in Payment Posting Options

The contact plans used for promises must be set up beforehand or must exist already in your system.

They are shipped with Collect! and may be copied from the Demonstration database.

The contact plans used for promises must be set up beforehand or must exist already in your system.

They are shipped with Collect! and may be copied from the Demonstration database.

Contact Plan list with Promise Contact Plans

Collect! ships with plans and settings in place to manage promises automatically. We will explain how each plan performs.

We will cover:

- Automatically Manage Promises

- Promise Full Payment

- Promise Underpayment

- Promise Overpayment

- Promise NSF Payment

- Promise Broken Payment

Automatically Manage Promises

'Automatically Manage Promises' must be switched ON in the Payment Posting Options form so that Collect! can perform

automatic functions regarding promises, such as marking the Promise contact as Done, or rolling the Due Date forward, or

running contact plans when a promised payment is received.

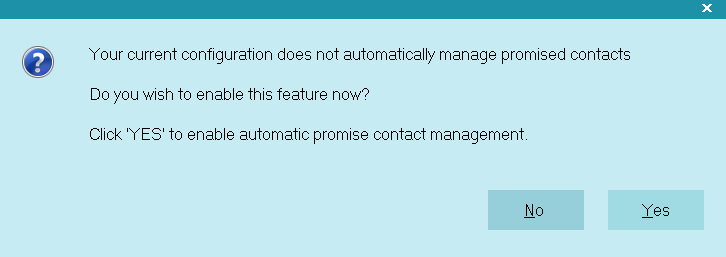

When you create your Promise, you may be alerted by Collect! if the setting 'Automatically manage promises' is not switched ON.

Prompt to Manage Promises Automatically

Please select YES when prompted so that Collect! can set this switch for you.

It is necessary for managing promise payments and broken promises.

Promise Settings Updated

Select the OK button to proceed.

You can also set this switch by selecting System from the top menu bar. Then select

Preferences, Plans and Reference Tables, Payment Posting Options and put a check mark in the check box

labeled Automatically Manage Promises.

You can also set this switch by selecting System from the top menu bar. Then select

Preferences, Plans and Reference Tables, Payment Posting Options and put a check mark in the check box

labeled Automatically Manage Promises.

- Collect! will advance the promise Due Date on a repeating promise when a full payment is posted to the account.

When the account is paid in full, the Promise Contact will be marked Completed.

- Collect! will not advance the promise Due Date when an underpayment is posted to the account, but will keep track

of how much more is needed to satisfy the Promise.

- Collect! will advance the promise Due Date on a repeating promise when an overpayment is posted to the

account.

- Collect! will roll back the Due Date and reactivate the Promise, when an NSF check is posted to the

account.

If there are contact plan codes in the Promise Contact Actions section, then additional steps will be taken

whenever an account has an active Promise. Each of these steps is described below.

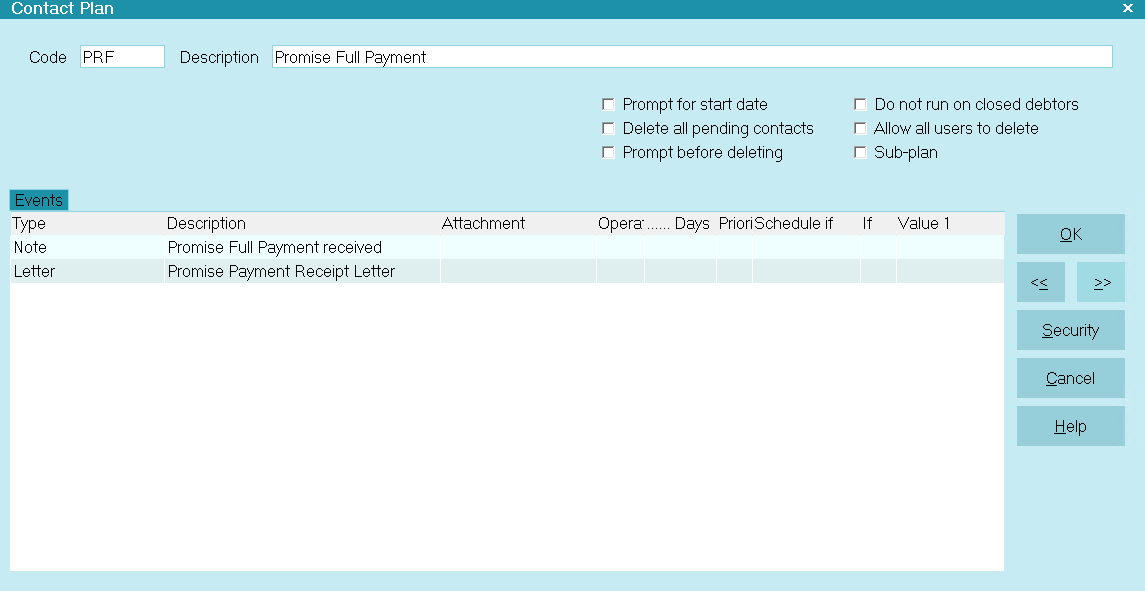

Promise Full Payment

The Promise Full Payment (PRF) plan will run when a payment is posted that matches the Amount set in the

Promise contact for the account.

Promise Full Payment Actions

This plan writes a line to the debtor's Notes and queues a letter confirming receipt of payment.

Even without a plan in this section, Collect! will advance a repeating promise Due Date when a

full payment is posted to the account.

Even without a plan in this section, Collect! will advance a repeating promise Due Date when a

full payment is posted to the account.

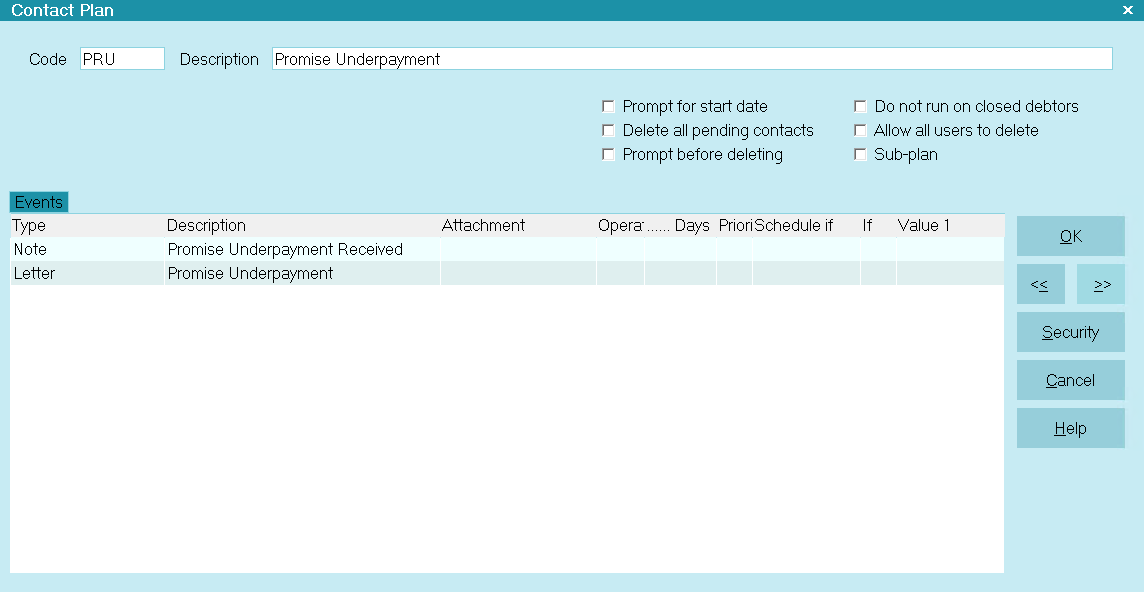

Promise Underpayment

The Promise Underpayment (PRU) plan will run when a payment is posted that is LESS than the Amount set in the

Promise contact for the account.

Promise Underpayment Actions

This plan writes a line to the debtor's Notes and queues a letter informing the debtor that the

amount received did not satisfy the Promise.

Even without a plan in this section, Collect! will not advance the promise Due Date when an

underpayment is posted to the account, but will keep track of how much more is needed to satisfy the Promise.

Even without a plan in this section, Collect! will not advance the promise Due Date when an

underpayment is posted to the account, but will keep track of how much more is needed to satisfy the Promise.

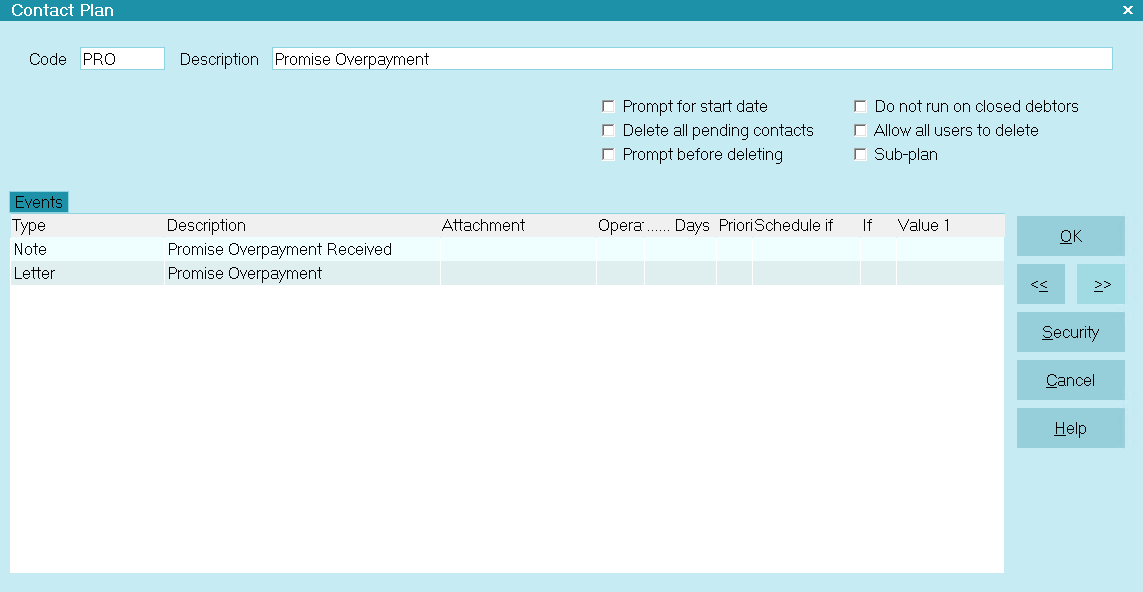

Promise Overpayment

The Promise Overpayment (PRO) plan will run when a payment is posted that is MORE than the Amount set in the

Promise contact for the account.

Promise Overpayment Actions

This plan writes a line to the debtor's Notes and queues a letter confirming receipt of payment and informing the

debtor that the amount received more than satisfies the Promise.

Even without a plan in this section, Collect! will advance a repeating promise Due Date when an

overpayment is posted to the account. You can set the 'Advance overpayments' switch in the

Promise contact if you wish to consider overpayments as fulfilling future promises. By default, the

Promise Due Date always rolls forward only one Repeat interval, regardless of the amount overpaid.

Even without a plan in this section, Collect! will advance a repeating promise Due Date when an

overpayment is posted to the account. You can set the 'Advance overpayments' switch in the

Promise contact if you wish to consider overpayments as fulfilling future promises. By default, the

Promise Due Date always rolls forward only one Repeat interval, regardless of the amount overpaid.

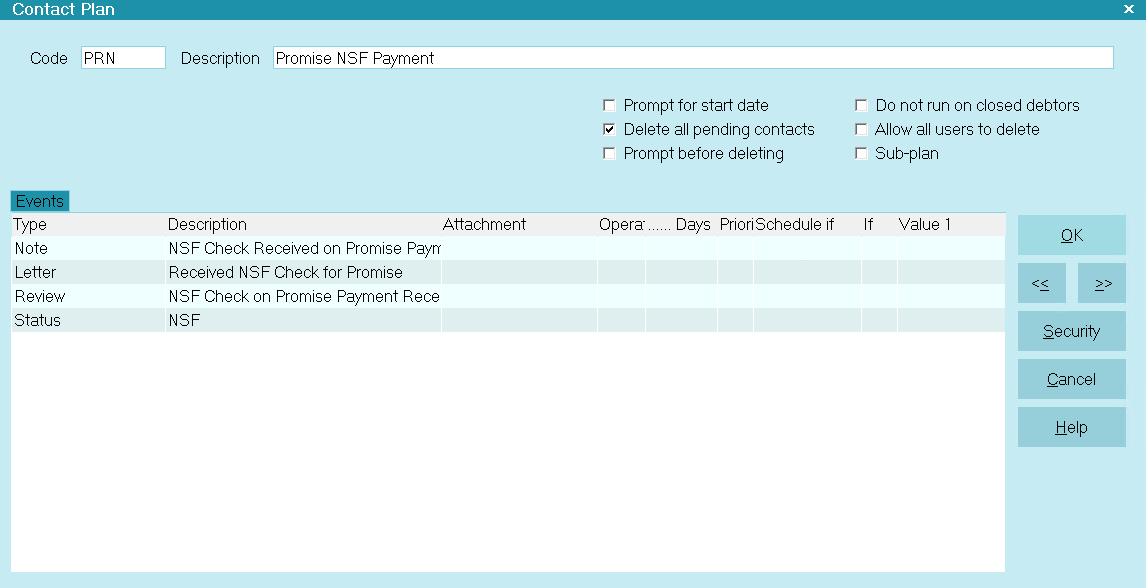

Promise NSF Payment

The Promise NSF Payment (PRN) plan will run when you post a returned NSF payment on an account that has a Promise.

Promise NSF Payment

This plan writes a line to the debtor's Notes, queues a letter informing the debtor that the promise payment

has gone NSF, schedules a Review of the account and changes the account's Status to NSF.

The Promise NSF Payment action also deletes pending contacts on the account. This deletes the

Promise contact, effectively ending the Promise agreement. You are prompted before the plan

deletes the contacts, so you may cancel that action.

If you do not want Collect! to delete the Promise contact, you can switch ON "Do not autodelete" when you first set

up the Promise contact. The PRA - Promise Active plan has this switch set to prevent auto-deleting promises.

Even without a plan in this section, Collect! will roll back the Due Date and reactivate the Promise, when

an NSF check is posted to the account.

Even without a plan in this section, Collect! will roll back the Due Date and reactivate the Promise, when

an NSF check is posted to the account.

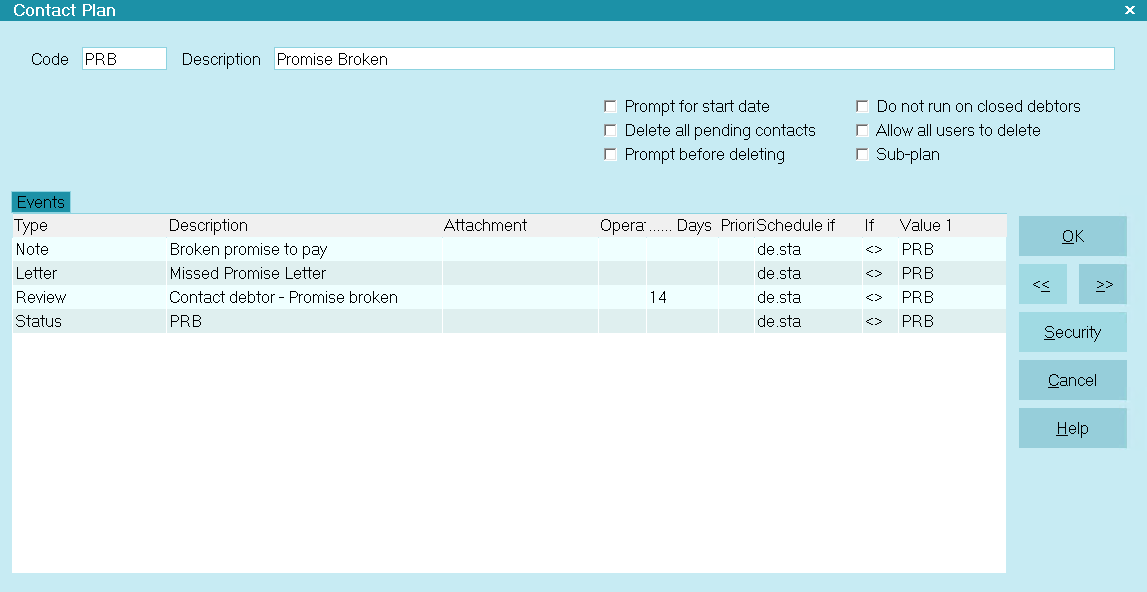

Promise Broken

The Promise Broken (PRB) plan will run when you process your broken promises using Batch Processing.

Promise Broken

This plan writes a line to the debtor's Notes, queues a letter informing the debtor that they missed their promised payment,

schedules a Review of the account with a Delay of 14 days and changes the account's Status to PRB.

To use this Promise Contact Action to manage your broken promises, you must use Batch Processing.

Unlike the other plans, It does not run automatically.

To use this Promise Contact Action to manage your broken promises, you must use Batch Processing.

Unlike the other plans, It does not run automatically.

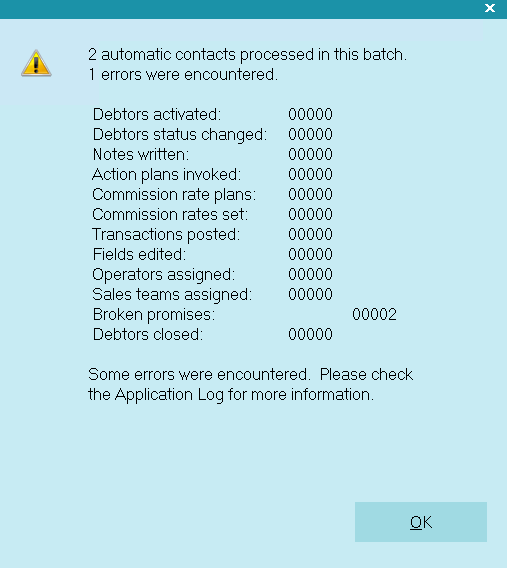

To Run Promise Broken

1. Select Tools and then select Batch Processing from the drop-down choices.

2. Ensure that ' Process automatic contacts previously scheduled' is enabled with a dot in the radio button. Select NEXT.

3. Enable 'Selected contacts only' and switch ON 'Broken promises' with a check mark. Select NEXT. Then select

START when you are ready to proceed.

4. Collect! will process your broken promises and display results.

Results of Processing Broken Promises

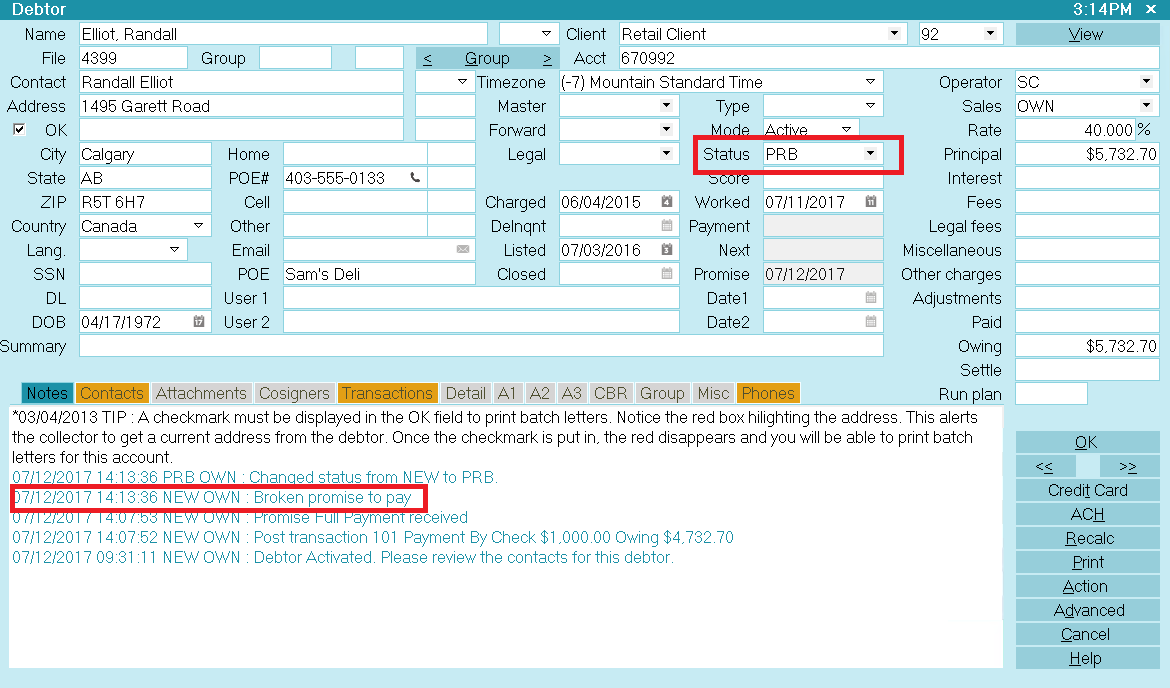

5. If you go to an account with a broken promise, you will see the changes that the plan made to the account.

The Status is changed and a line is written to Notes.

Debtor with Broken Promise

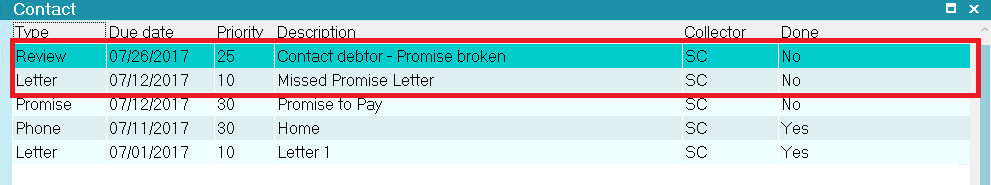

Viewing the Contact list for the account, we can see that a letter and a review have also been scheduled. The review

is delayed 14 days to give the debtor time to respond to the letter.

Contacts Scheduled for Broken Promise

You may want to handle broken promises differently. This is easily managed by modifying the actions in

the Promise Broken plan to suit your needs.

Payment Values

When you are viewing the Payment Posting Options form, there is an ADVANCED button that takes you to the

Payment Values form. There you can enter defaults to consider when posting promised payments. You can select

a Transaction Type to use for promised payments. Values may be entered for evaluating a payment as an underpayment

or an overpayment, if the amount paid is not exactly the same as the promised Amount.

Managing Promises For Grouped Accounts

Collect! allows you to manage promises for for an entire group by only having a single promise on any group member

and posting the payment to any group member. When the payment is posted, Collect! will search all the group members

to find an in progress promise contact and manage it accordingly.

This feature requires that "Automatically manage promises when posting", located in the Payment Posting Options

form, is turned ON.

This feature also requires the following check boxes to be checked:

(a) A check box in Account Matching Setup called "Manage Group Promises"

(b) A check box in Group Member Setup also called "Manage Group Promises" for each of the group members of a group

In addition to retroactively setting up existing debtors in groups, you will need to add a step to your new

business processing to check this Member Setup box ON for newly grouped debtors going forward.

For pre-existing accounts in groups for small to medium sized databases, this may be done with a Report Writer

write back that edits gms.mgp=x.

You may also contact Tech Support for assistance in retroactively fitting your grouped accounts for this feature and

recommendation as to the best way your site can maintain new accounts being added to groups going forward.

Notes regarding function

1. When a payment is posted to the group, irrespective of whether it is the group member whose Contact tab has the

In Progress Promise, the Promise event that is affected will be the most current In Progress Promise as assessed

from all the group members. This is in case there are multiple Promises within the group.

It is not recommended to have multiple Repeating Promises inside the same account or spread across the same group.

It is not recommended to have multiple Repeating Promises inside the same account or spread across the same group.

2. The Promise contact that gets Completed, rolled forward as a function of being completed, had a Copy created on

Repeat or Due Date rolled backwards due to a reversal no longer relies on the account where the transaction was posted;

the Promise being affected can be positioned anywhere in the grouped accounts.

3. The promise contact "Amount" field is linked to the debtor that contains the Promise. If a single payment is being

split among group members, the Amount field will continue to subtract amounts being posted until $0.00 is reached,

indicating a full Promise has been kept. It is then that the Promise Due Date will roll forward, and invoke any other

actions as applicable for the account as per Payment Posting Options.

4. If the total amount paid is split among group members (or posted to a single account within the group) is less than

the In Progress Promise amount, the Due Date will NOT roll forward and the Amount field will show the shortfall that

hasn't been paid yet to fulfill this period's Promise. Example: Debtor was to pay $150.00. $100.00 was received and

posted $10 each to 10 accounts. The Amount field in the Promise will show $50.00. The Due Date will not roll forward.

The Promised field will still be displaying the original amount of $150.00. If the site has grace days, this will be

a broken promise the day after the grace days expire.

If you have a contact plan setup to run in the event of an Underpayment, Collect! will run that plan for each

payment until the promise is fulfilled.

If you have a contact plan setup to run in the event of an Underpayment, Collect! will run that plan for each

payment until the promise is fulfilled.

5. If the total amount paid is split among group members (or posted to a single account within the group) is more than

the In Progress Promise, then the Promise Due Date will roll forward one cycle (if it is a Repeating Promise) UNLESS

you have also checked "Advance overpayments". In this case, it will roll forward as per existing Collect!

functionality. Please refer to Advance Overpayments above.

6. It is recommended to use "Advance overpayments" so that the software has proper rollback capability in the event of

a payment reversal insofar as resetting the correct Due Date. The Advance overpayments field to edit with Report Writer

is cc.ao=x, or contact Tech Support for assistance.

7. Group Promises will function as expected if a Repeating Promise has "Copy on Repeat" checked ON.

8. Promise related Contact Plans in Payment Posting Options will execute on the debtor containing the Promise. This

would mean that Reminder Letters or Broken Promise Letters should be queued on the account that contains the Promise

event for best self-maintaining results.

Billing Tree Module For Promised Payments

The Billing Tree Module enables you to process credit card and ACH payments electronically through Collect!'s Billing Tree

connection. This is a full-featured solution for managing single and recurring payments made by credit card or by bank draft.

External payments posted at the Billing Tree web site are also reconciled and posted within Collect!. Recurring

scheduled payments are fully managed within Collect!'s promised payment system.

Coupon Books With Promises

A Coupon Book is a printed schedule of payments that may be given to a debtor when a repeating Promise contact

is set up on an account. A coupon is printed for each scheduled payment. The Due Date and Payment Amount are printed to make

it easier for the debtor to keep track of when payments are due.

A sample Promise Coupon Book report is shipped with Collect! in the Demonstration database. This report expects a

Due Date between the 1st and 28th of the month.

A sample Promise Coupon Book report is shipped with Collect! in the Demonstration database. This report expects a

Due Date between the 1st and 28th of the month.

The sample coupon book has borders and a place for your company logo. You may modify it to suit your needs.

To print a coupon book when you start a Promise, You may add a letter event to a plan that you run to schedule the

Promise on an account.

To print a coupon book when you start a Promise, You may add a letter event to a plan that you run to schedule the

Promise on an account.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org