How To Setup Credit Bureau Reporting

Once you have set up your account with the Credit Bureau(s) of your choice, you should have the information needed to set up

credit reporting in Collect!.

This Help topic describes how to setup the credit reporting features and how Collect!'s credit reporting functions work. This

requires familiarity with setting up Company Details and Debtors in Collect!, as well as experience using Collect! in your

day to day business operations.

When you set up your credit bureau reporting correctly, Collect! takes care of all the details by automatically scheduling

a Metro contact for each debtor that you want to report. After you report, Collect! forwards this contact for the next

reporting period. Collect! tracks changes in the debtor's profile for credit bureau purposes and reports the

correct codes to the bureau.

The Credit Bureau Reporting module is optional and

must be purchased prior to use for reporting credit. There is a

fully functional Credit Bureau demonstration module in the Demodb

database that ships with Collect!

The Credit Bureau Reporting module is optional and

must be purchased prior to use for reporting credit. There is a

fully functional Credit Bureau demonstration module in the Demodb

database that ships with Collect!

You can easily send credit reports to the major credit bureaus using the standard Metro2 (426 character format) file format.

WARNING: Reporting credit is a legal matter. You are responsible

for ensuring that the information you are sending is accurate and

complete. Do not report credit without being ABSOLUTELY SURE

about your legal rights and the legal rights of the person or entity

you are reporting.

WARNING: Reporting credit is a legal matter. You are responsible

for ensuring that the information you are sending is accurate and

complete. Do not report credit without being ABSOLUTELY SURE

about your legal rights and the legal rights of the person or entity

you are reporting.

We will go through several steps in this topic:

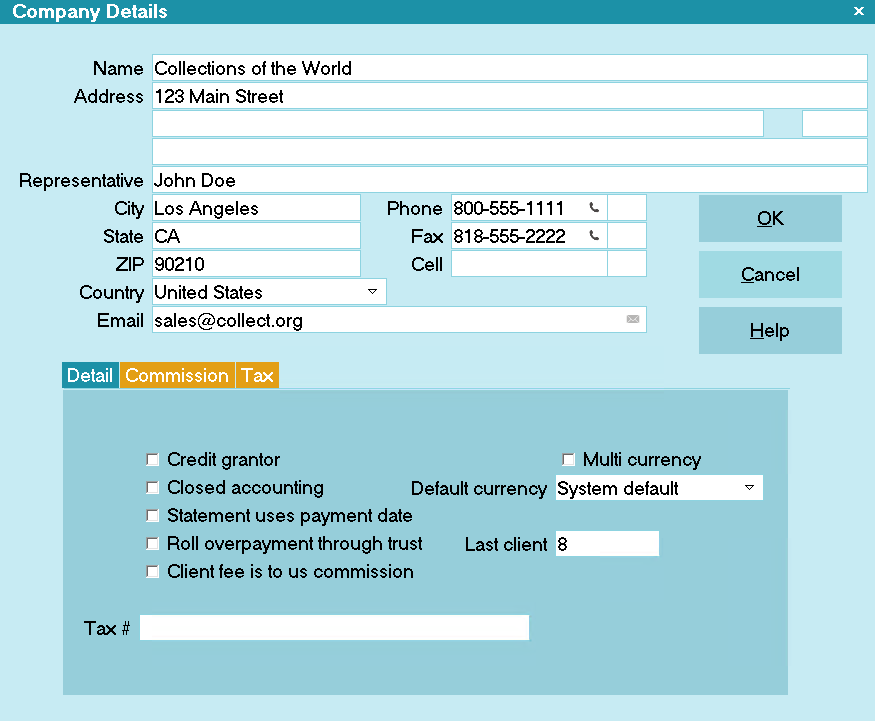

Setting Company Details

Your Company Details need to be entered. Some of this information is output to the credit bureau file. Also, in the

DETAIL tab for the Company Details form there is one setting you need to use ONLY IF you are a Credit Grantor.

Company Details

Report As Credit Grantor

The 'Credit Grantor' field is only switched ON if you are reporting as a Credit Grantor. This setting affects other

credit reporting settings so only switch it ON if you are a Credit Grantor.

When you set this switch, the Delinquency Date is used to report the Date of Occurrence for all status codes except 4, 10, 13

and 61 to 68. In those cases, the date the contact was scheduled is sent as the date of occurrence. When you leave this

switch off, the Date of Occurrence is always taken from the Delinquency date, regardless of status code.

Leave this switch off if you are operating a collection agency.

If you are not sure if you are a credit grantor, discuss this with your CBR representative.

If you are not sure if you are a credit grantor, discuss this with your CBR representative.

Delinquency Date For Credit Grantor

When you have switched ON 'Report as credit grantor' in the Company Details form, an unmet promise will show

up as delinquent in the debtor's Delnqnt field.

You must also switch ON 'Calculate delinquency date' in the debtor's Financial Detail form. The 'Calculate

delinquency date' check box is visible only when you are in Credit Grantor mode.

You must also switch ON 'Calculate delinquency date' in the debtor's Financial Detail form. The 'Calculate

delinquency date' check box is visible only when you are in Credit Grantor mode.

If you are a Credit Grantor, a number of things affect the Delinquency Date based on your settings.

The Delinquency Date is normally set to 31 days after the promise date. Thus, if you set a promise contact on the

account and no payment is received, when 31 days have lapsed, the Delinquency Date will be set to the promise date plus 31 days.

Promise contacts contain a dollar Amount, and the promise is only satisfied when the full Amount

has been paid. Set the term Payment Amount in the Interest Detail form and Collect! can manage payments,

underpayments and overpayments. Please refer to How To Manage Contacts for details.

Promise contacts contain a dollar Amount, and the promise is only satisfied when the full Amount

has been paid. Set the term Payment Amount in the Interest Detail form and Collect! can manage payments,

underpayments and overpayments. Please refer to How To Manage Contacts for details.

In the Credit Bureau Setup form, you can switch ON 'No posted date mods delinquency'. When this is switched

ON, Collect! uses the Payment Date of the promise transaction as the ' Delinquency Date ' for the account,

rather than allowing the default 31 day delay in determining delinquency.

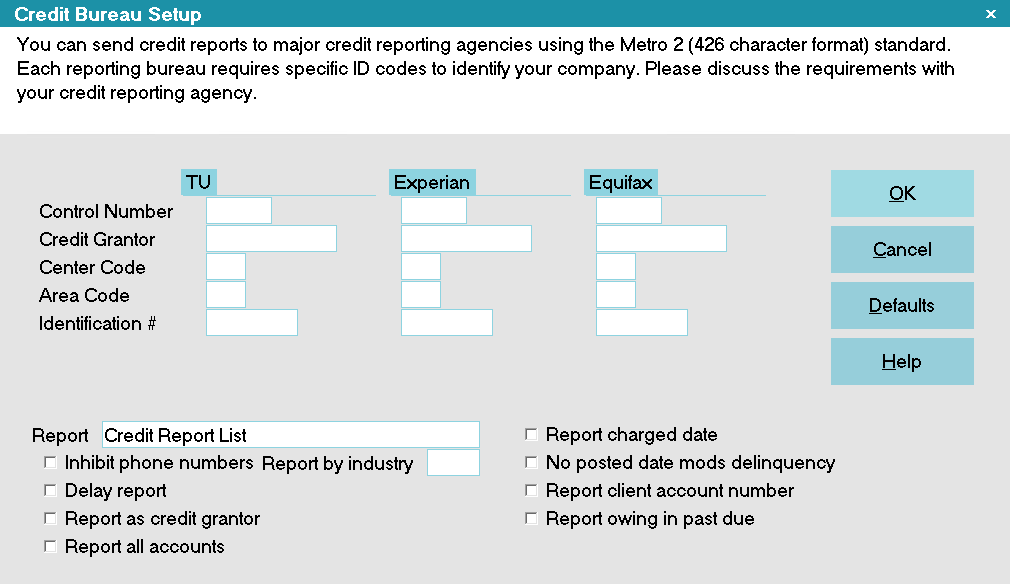

Credit Bureau Setup

The Credit Bureau Setup form holds many global settings for your Credit Bureau information.

When you set up your Account/Contract with the

Credit Bureau of you choice, they supply some information

that will help you set up the fields in the Credit Bureau Setup form.

When you set up your Account/Contract with the

Credit Bureau of you choice, they supply some information

that will help you set up the fields in the Credit Bureau Setup form.

Open the Credit Bureau Setup form form System/Preference/Credit Bureau Setup.

Credit Bureau Setup

Now that you are looking at the Credit Bureau Setup form, let's discuss the fields. You will notice that there are 3 rows

of fields called TU (Trans Union), Experian and Equifax.

These are the names of the Credit Bureaus. Here you will input your member information from the Credit Bureau.

You can report to one or several bureaus. If you are reporting to Trans Union, you will fill in the fields under TU. If you are

reporting to Experian, you will fill in the fields under Experian. If you are reporting to Equifax, you will fill in the

fields under Equifax. Please refer to the Credit Bureau Setup form in this link

for more details on each of the fields.

Before going on, make sure you know which Credit Bureau or Credit Bureaus you will be reporting to

and that you have the information the Credit Bureau supplied to you in front of you to help you fill in the fields.

Before going on, make sure you know which Credit Bureau or Credit Bureaus you will be reporting to

and that you have the information the Credit Bureau supplied to you in front of you to help you fill in the fields.

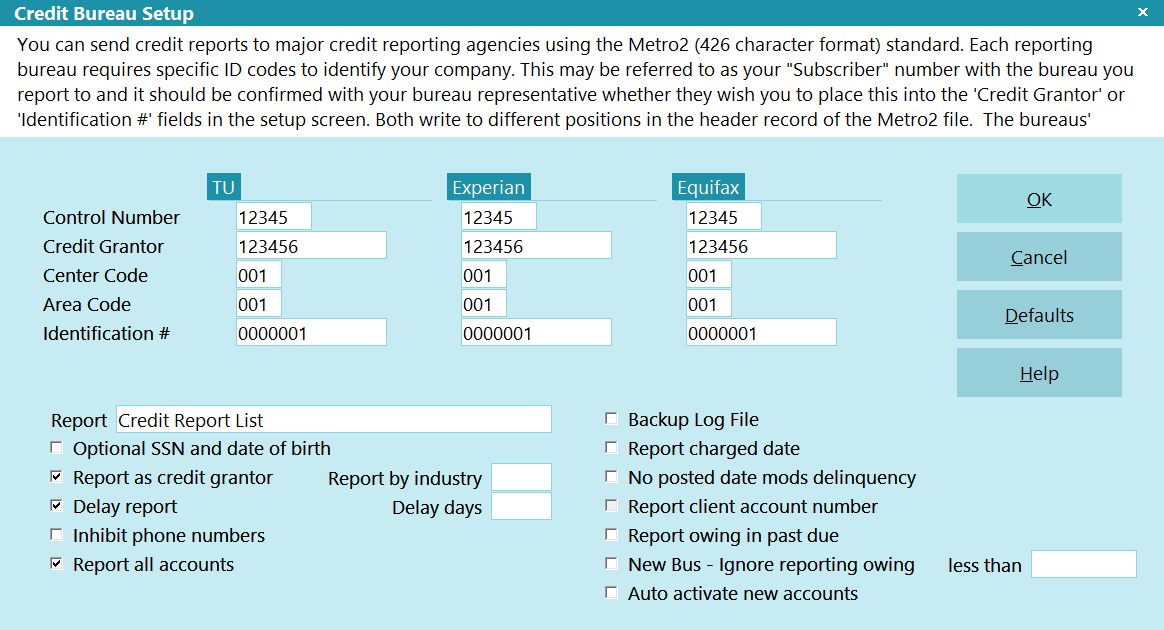

Default Values For CBR Settings

Your unique subscriber codes will be placed at the top of the file that Collect! creates for you to send to the credit bureau.

- If reporting to Equifax and/or Trans Union, place the Subscriber ID they give you into the "Credit Grantor" field.

- If reporting to Experian, place the D-Number into the "Control Number" field.

- Other fields are filled with defaults as shown in the screen shot.

It is important to fill in all fields for the credit bureau(s) of your choice in the Credit Bureau Setup form. Only a few fields

hold actual values as indicated below. The rest of the fields should be filled with a default value, such as zeroes and one,

as shown.

Credit Bureau Setup Settings

Press F1 (or click here)

from the Credit Bureau Setup form for information about the fields on this form.

Press F1 (or click here)

from the Credit Bureau Setup form for information about the fields on this form.

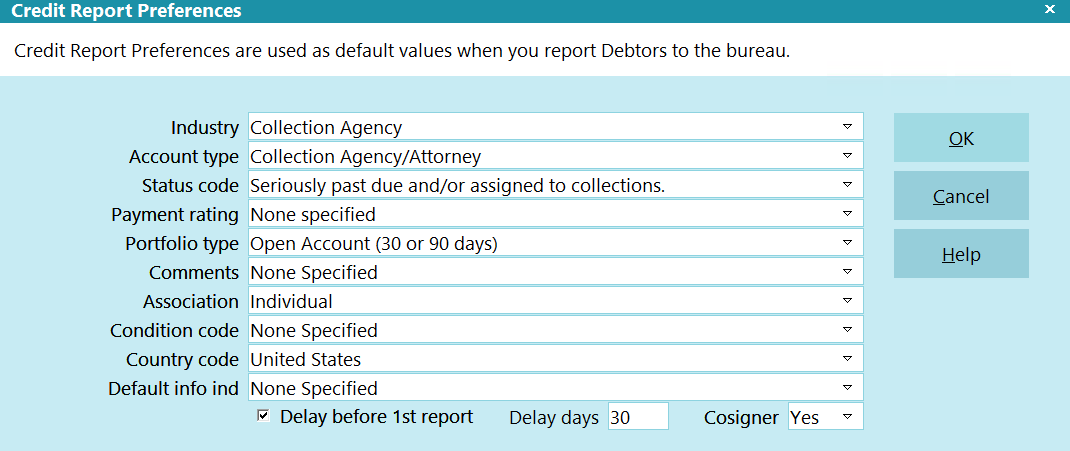

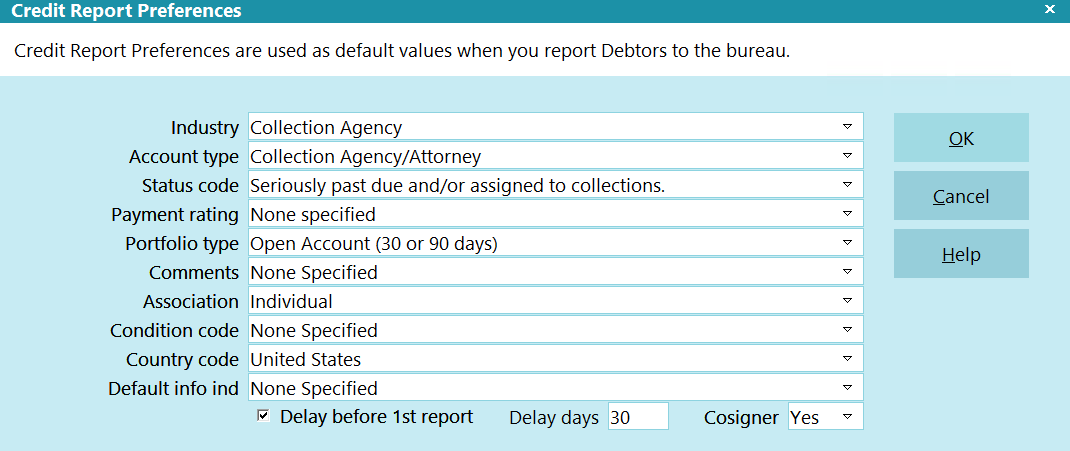

Credit Report Preferences

Credit Report Preferences

Select the DEFAULTS button on the Credit Bureau Setup form to view the Credit Report Preferences. These default

settings are used for every account you switch ON for reporting. They can be changed globally or on a per debtor basis.

Credit Report Preferences

Default values from the Metro2 Standard are provided for normal collection and credit management. If you are not

sure which default values you should use, please discuss with your credit bureau representative.

Press F1 (or click here)

from the Credit Report Preferences form for information about the fields on this form.

Press F1 (or click here)

from the Credit Report Preferences form for information about the fields on this form.

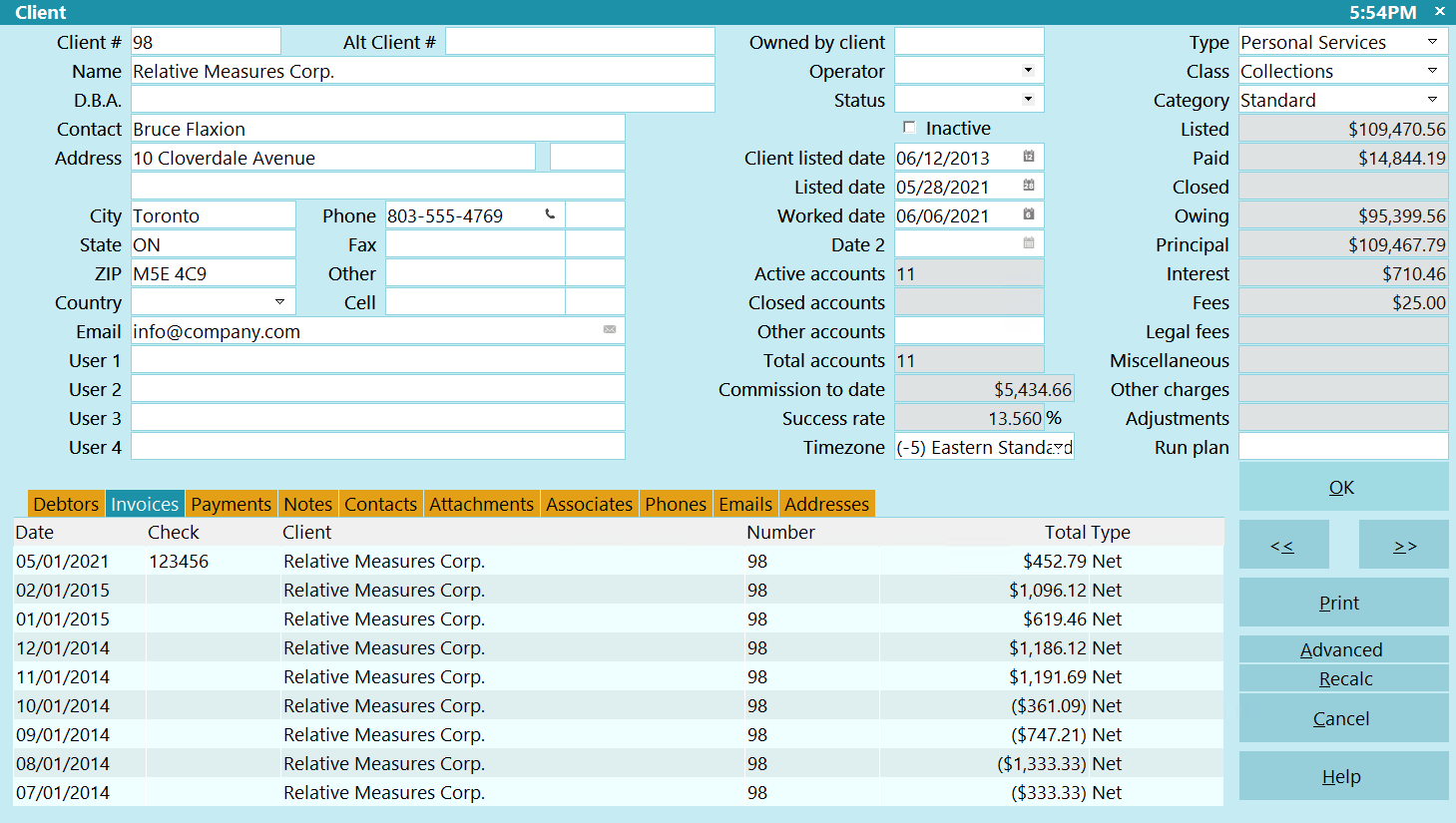

Client Type

The Client Type field is used. In credit reporting terms, this is the Creditor Classification.

Open one of the Clients you wish to report and select the down arrow beside the Type field and pick a Creditor Classification

from the list of choices.

You must choose a valid creditor classification for each Client that you intend to report. If the choice you

need is not in this list, please discuss this with your representative as these choices come directly from the

Credit Reporting Guidelines.

You must choose a valid creditor classification for each Client that you intend to report. If the choice you

need is not in this list, please discuss this with your representative as these choices come directly from the

Credit Reporting Guidelines.

Client Settings

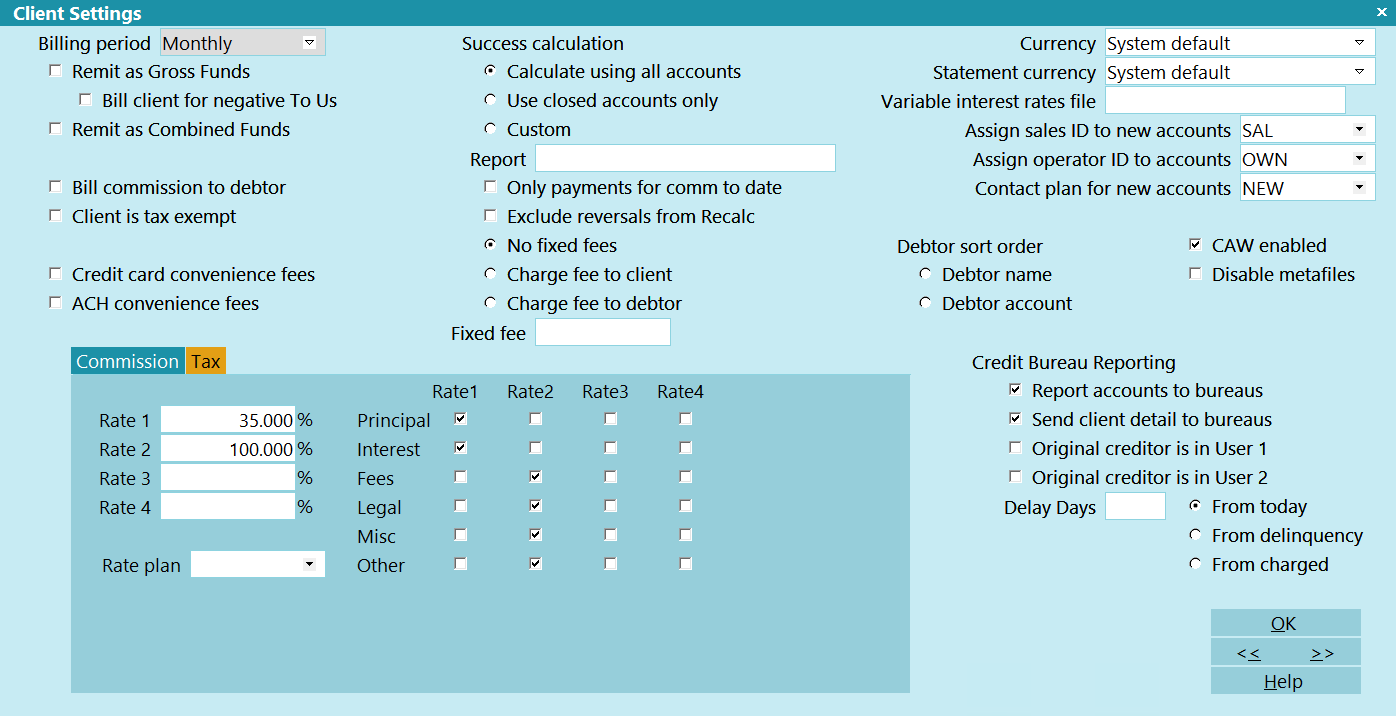

The Client Settings form stores several selections used by Collect! when reporting is switched ON for a Debtor and when the

file is produced.

1. Open one of the Clients you wish to report and select the ADVANCED button.

Client Form

2. Select ADVANCED and the Client Settings form will now be displayed.

Client Settings Form

You will notice in the Client Settings form, that on the right side, two of the boxes relating to Credit Bureau reporting

are checked.

Report accounts to bureaus When this is checked, Collect! knows that the Client is set to report credit.

When this Switch is off, Collect will warn you that it is not set up to report credit.

Send client detail to bureaus When this is checked, the client's details will be sent to the Bureau. This is

a requirement for Collection Agency reporting.

*** IMPORTANT*** You must provide a delinquency date for all accounts reported to the Credit Bureau. The delinquency

date appears on the Debtor form and is defined as the date of the first delinquency that led to the derogatory status

being reported.

K1 Segment Original Creditor Client Detail

You must be sure put a check in the box labeled Send client detail to bureaus in the Client Settings form to

send the K1 segment.

The date an account is charged off or placed for collection is not the delinquency date. The delinquency date should be

the date the account became past due. The date of the delinquency is necessary to purge accounts from

the Credit Bureau database in accordance with the Fair Credit Reporting Act (FCRA).

Debtor Information

WARNING: Reporting credit is a legal matter. You are responsible for ensuring that the information you are sending

is accurate and complete. Do not report credit without being ABSOLUTELY SURE about your legal rights and the legal

rights of the person or entity you are reporting.

WARNING: Reporting credit is a legal matter. You are responsible for ensuring that the information you are sending

is accurate and complete. Do not report credit without being ABSOLUTELY SURE about your legal rights and the legal

rights of the person or entity you are reporting.

Many fields on the Debtor form are included in the credit report, so you need to make sure they are filled in correctly.

When sending reports to credit bureaus, it is the user's responsibility to make sure that the name and the address

fields are in the required format.

Press F1 from the Debtor and Cosigner forms to view details for entering information that pertains to

credit reporting. Information sent to credit bureaus must be in an EXACT format.

Press F1 from the Debtor and Cosigner forms to view details for entering information that pertains to

credit reporting. Information sent to credit bureaus must be in an EXACT format.

The following information is entered in the Debtor form. Open each of the Debtors you wish to report and review

the fields explained below.

File Number

By default, Collect! sends the Debtor File Number of the account to the credit bureau. Once you start reporting to

the credit bureaus, the Debtor's File Number must not change while the account is being reported.

You must not have duplicate File Numbers in your database. This is Collect!'s UNIQUE identifier for each account.

Name

The Name of the Debtor entered as 'Last, First Middle Initial'. Please ensure your spelling is correct. If you do

not type a comma in the name, Collect! will assume the name is a business name.

Multiple last names must be hyphenated. e.g. Van-Deusen, Jack.

Only enter one Debtor's Name in this field. If you have a Cosigner, use the Cosigner form.

Only enter one Debtor's Name in this field. If you have a Cosigner, use the Cosigner form.

Generation

Use this field for generation, not the Name field. (Jr., Sr., II, III, etc.)

Address

For accurate reporting of addresses, checkout the handbook called Postal Addressing Standards at your local US Post

Office. Use standard postal abbreviations for type of street.

For example, 'Pkwy' for Parkway or 'St' for Street

There are two acceptable address formats. Please note that the commas between City and State are required where shown

below, and Address Line 1 is interpreted as a contact name only if there are no numbers in the field.

- Format 1:

- Address = street address

- Addr1 = blank

- City = city

- State = state

- Zip = zip

- Country = country code

- Format 2:

- Address = street address

- Addr1 = suite or apartment number

- City = city

- State = state

- Zip = zip

- Country = country code

Do not include the # symbol in the apartment number. The Credit Bureau rejects addresses with the #

sign. If no zip code is found, THE ACCOUNT WILL STILL BE REPORTED, but the missing Zip will be logged to the

CBR log if the Address OK box is checked.

Do not include the # symbol in the apartment number. The Credit Bureau rejects addresses with the #

sign. If no zip code is found, THE ACCOUNT WILL STILL BE REPORTED, but the missing Zip will be logged to the

CBR log if the Address OK box is checked.

Addr 1

Do not use words like "Suite", "Apt.", etc. or the '#' symbol, just enter the Number of the suite or apartment.

City

Truncate the rightmost portion of this field to 20 characters, or use the standard 13-character U.S. Postal Service

city abbreviations.

State

Enter the State or Province code in this field. Us the correct Postal Service codes.

For Example: WA for Washington

ZIP Codes

The zip code may be either 5 or 9 digits for U.S. zip codes, or 6 digits for Canadian postal codes.

For example: 12345-6789 or 123456789 for U.S. and X2Y 3Z4 or X2Y3Z4 for Canada.

Country

Enter the standard two-character country abbreviation.

SSN

If SSN is not known, zero - or 9 - fill all positions.

DOB

Date of Birth must be entered. If the month and day are not known, use 0101. The year is required.

Please refer to F1 help from the Debtor form for additional information regarding fields for credit bureau reporting.

Please refer to F1 help from the Debtor form for additional information regarding fields for credit bureau reporting.

Delinquency Date

You MUST not manufacture dates for accounts reported to credit bureaus. This date must be provided by client.

The Delinquency Date is defined as the date of the first delinquency that led to the derogatory status being reported.

The date of delinquency is necessary to purge accounts from the bureau databases in accordance with the

Fair Credit Reporting Act (FCRA).

If you do not fill in a Delinquency Date, the credit reporting function will use the Charged date, also known as the 'Date

of Last Service' or 'Service Date' and will issue warnings to you.

The date an account is charged off or placed for collection, is NOT the Delinquency Date. The Delinquency Date

should be the date the account became past due.

The date an account is charged off or placed for collection, is NOT the Delinquency Date. The Delinquency Date

should be the date the account became past due.

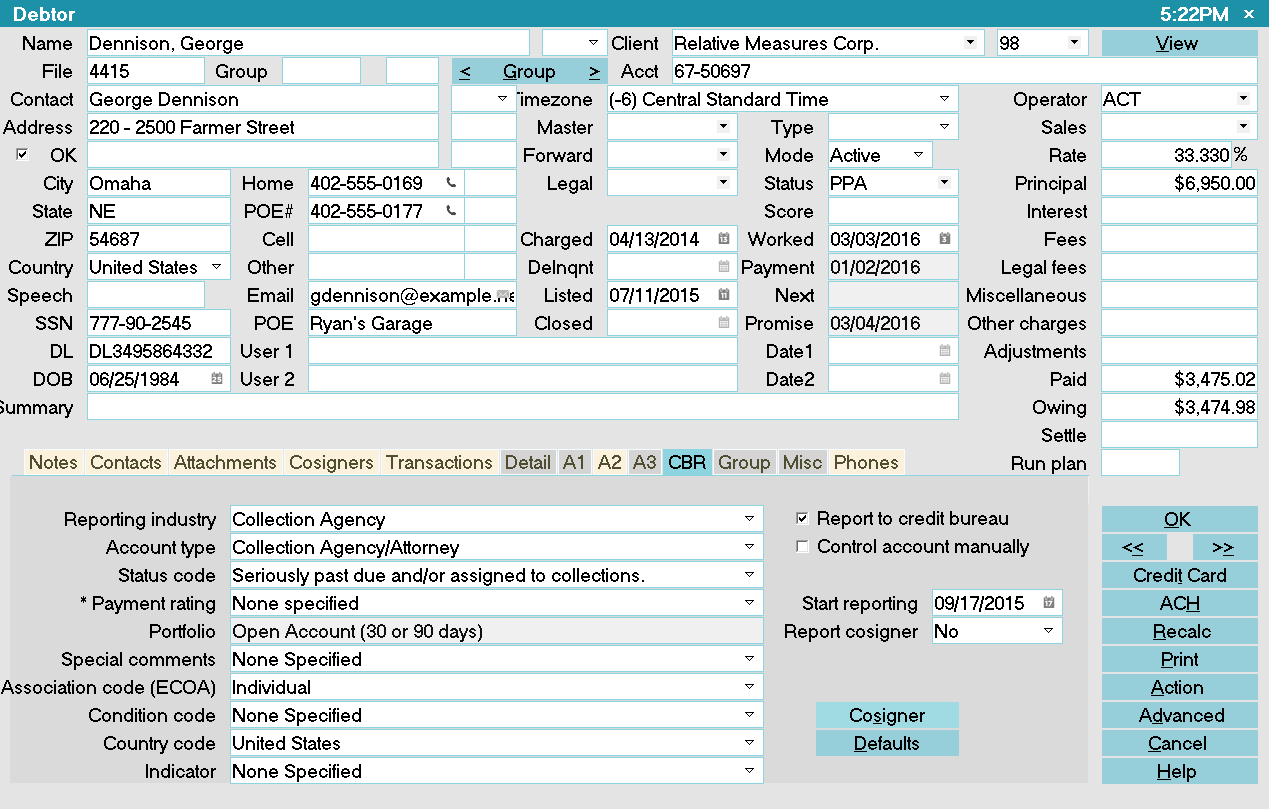

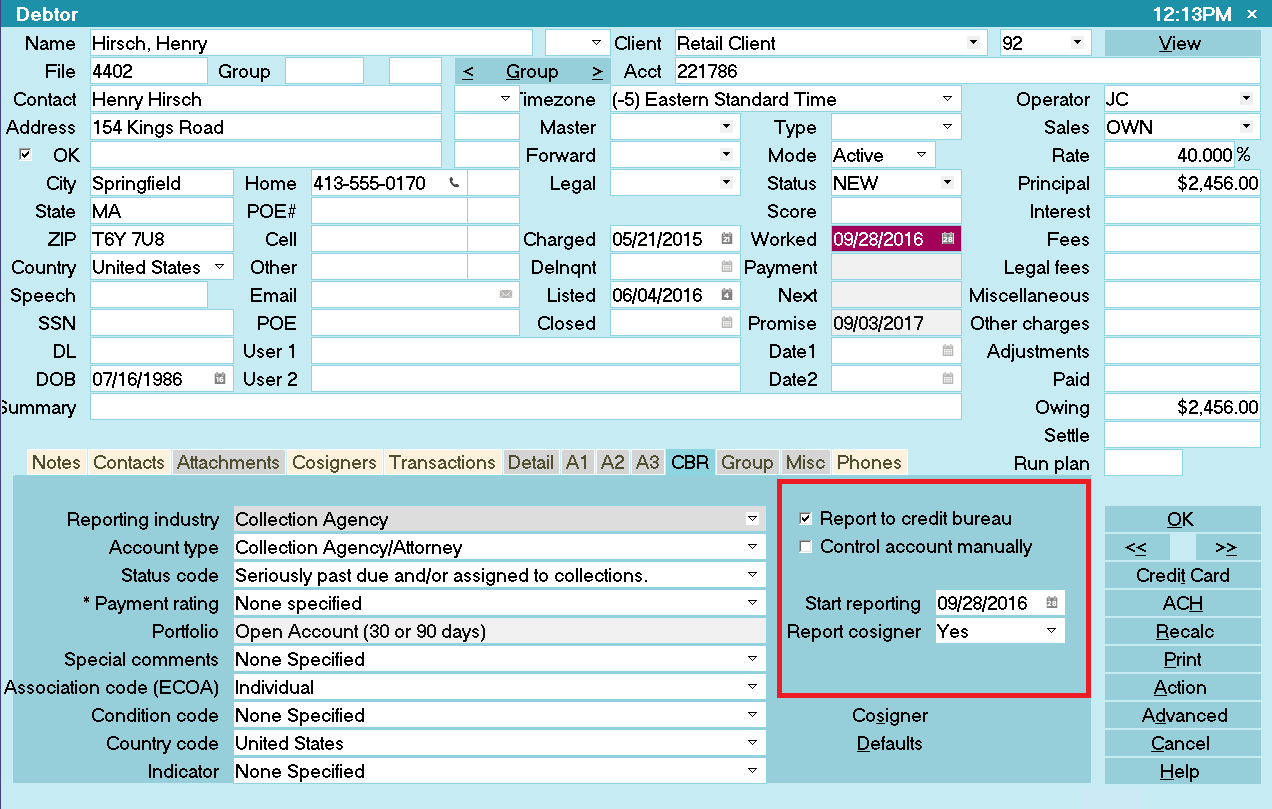

Credit Report Details

This form holds all the current settings for an individual who is being reported. This is where you switch ON credit bureau

reporting for an account. Most of the fields fill automatically based on your other settings. Any field can be changed as

needed provided you follow correct reporting practices.

Debtor with Credit Report Details

The options used as default values when you report Debtor credit are set in the Credit Report Preferences form. These

settings can be changed here, at the individual Debtor level, if necessary. In most cases, the defaults should be fine.

Collect! will update some of these settings throughout the life cycle of the debt. For instance, when an account balance

reaches zero and the account is paid in full, Collect! automatically changes the Status Code that gets reported

to the bureau. You may need to adjust settings manually, if you delete an account from the bureau or close it as

"Settled in full," for instance.

Please press F1 from the Credit Report Details form for more information about these settings.

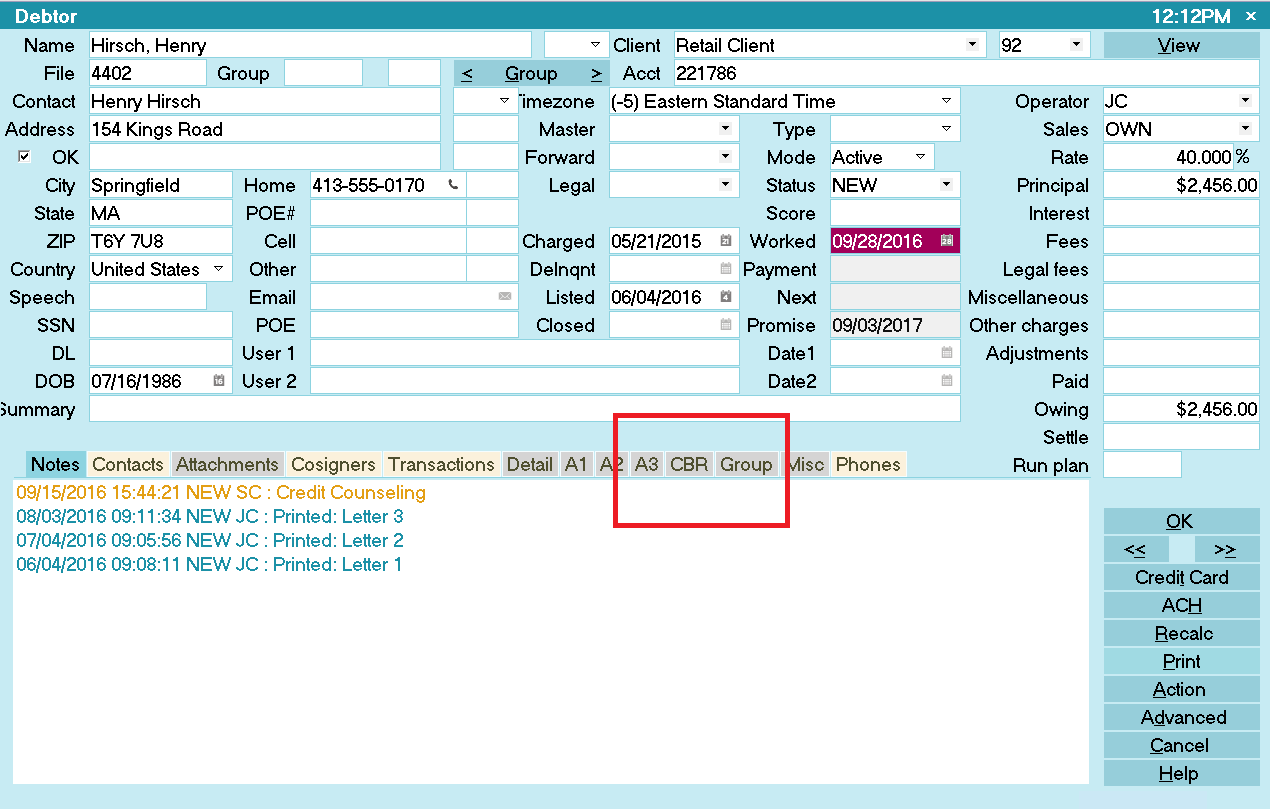

1. Select the CBR tab on the Debtor form to access this form.

Selecting the CBR tab for the Debtor

2. When you select the CBR tab, the Credit Report Details form is displayed.

Credit Report Details

3. Place a check mark in the Report to credit bureau box. Now this Debtor is set to be reported to the Credit Bureaus.

4. The rest of the fields are set up by default in Collect!, but it is your responsibility to ensure that they are correct.

Start Reporting Field

Press F2 while in this field will bring up the Calendar where you can select the date that you wish to start reporting

this Debtor to the Credit Bureau. You may also enter a date in the MM/DD/YY format.

Set The Account's CBR Status

Collect! automatically sets the CBR Account Status as you work your accounts. If you need to manually change the

status due to deleting an account from the bureau or reporting a bankruptcy, you can select the CBR tab at

any time to display the current Credit Report Details and change the settings as needed.

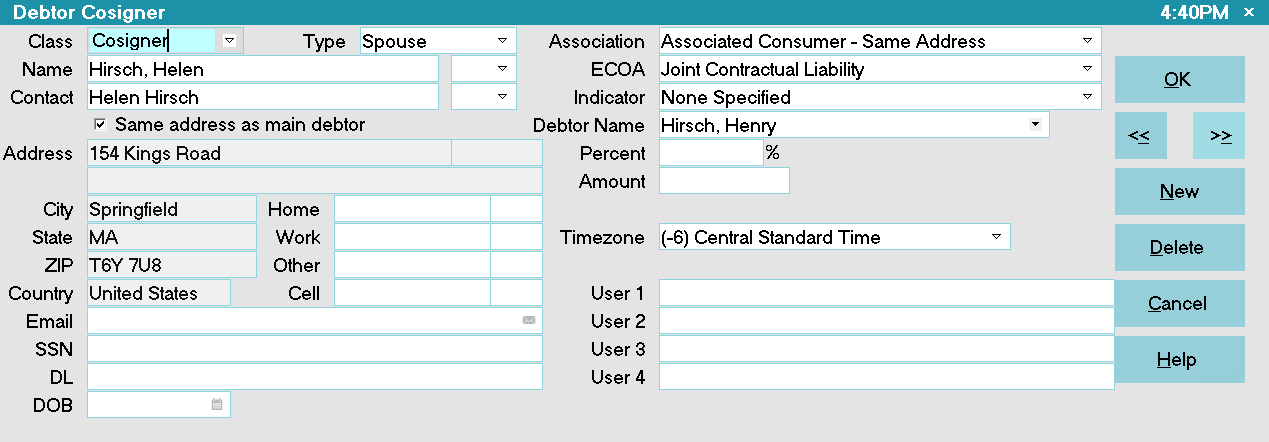

Reporting Cosigners

If you selected YES to report Cosigners, you must switch ON reporting in the Cosigner form for each cosigner that you wish

to report.

Cosigner Settings

If you are reporting Cosigners, additional fields need to be set up on each Cosigner that you are reporting. Select the

COSIGNER tab on the Debtor form to access the Cosigners. Here is an example setup.

Cosigner with Credit Reporting Setup

Press F1 when you are on the Cosigner form for details. Look for information labeled "FOR CBR:"

Press F1 when you are on the Cosigner form for details. Look for information labeled "FOR CBR:"

Please note that Name and Address fields on the Cosigner form must be filled in correctly, just as for the Debtor, if

you are reporting the Cosigner to the Credit Bureau.

Run A Credit Bureau Report Test

Testing a credit bureau report helps you see what happens in Collect! when you run a credit bureau report to report a number

of accounts to the credit bureau. It will show you where the finished file is placed. Also, it gives you the opportunity to go

through the motions of physically sending the generated file to your credit bureau provider.

When your provider receives the test file, they, too, will treat it as a test run and let you know if it is correct. Also,

they will supply you with an error report if something is not appropriate in the data set. Because you will have informed

them that it is simply a test run, they will not automatically update their files with your information.

When you run through this test for credit bureau reporting, do NOT mark the contacts as done. If the file is accepted, then the

accounts will still be prepared for the actual credit bureau report.

Follow the instructions for How To Run A Credit Bureau Report using only the few debtor accounts you set up in the first part

of preparing for credit bureau reporting.

Keep your test data set small. If the bureau does send back an error report, it is much easier to deal with correcting the

test debtors than correcting hundreds of accounts.

Summary

Credit Reporting setup must be completed in several areas of Collect! as described in this topic. Once you have set up

all the areas, Collect! automatically updates accounts as needed so that the information that is output to your file

is always the latest information for each debtor. It is your responsibility to examine this data and make sure you are

satisfied with the results. If needed, you can manually change settings for special cases such as deleting accounts from

the bureau.

WARNING: Reporting to Credit Bureaus is a legal matter and you may be sued for providing incorrect or out of date

information! Collect! cannot take responsibility for the correctness of the data that you submit. You must verify your data!

WARNING: Reporting to Credit Bureaus is a legal matter and you may be sued for providing incorrect or out of date

information! Collect! cannot take responsibility for the correctness of the data that you submit. You must verify your data!

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org