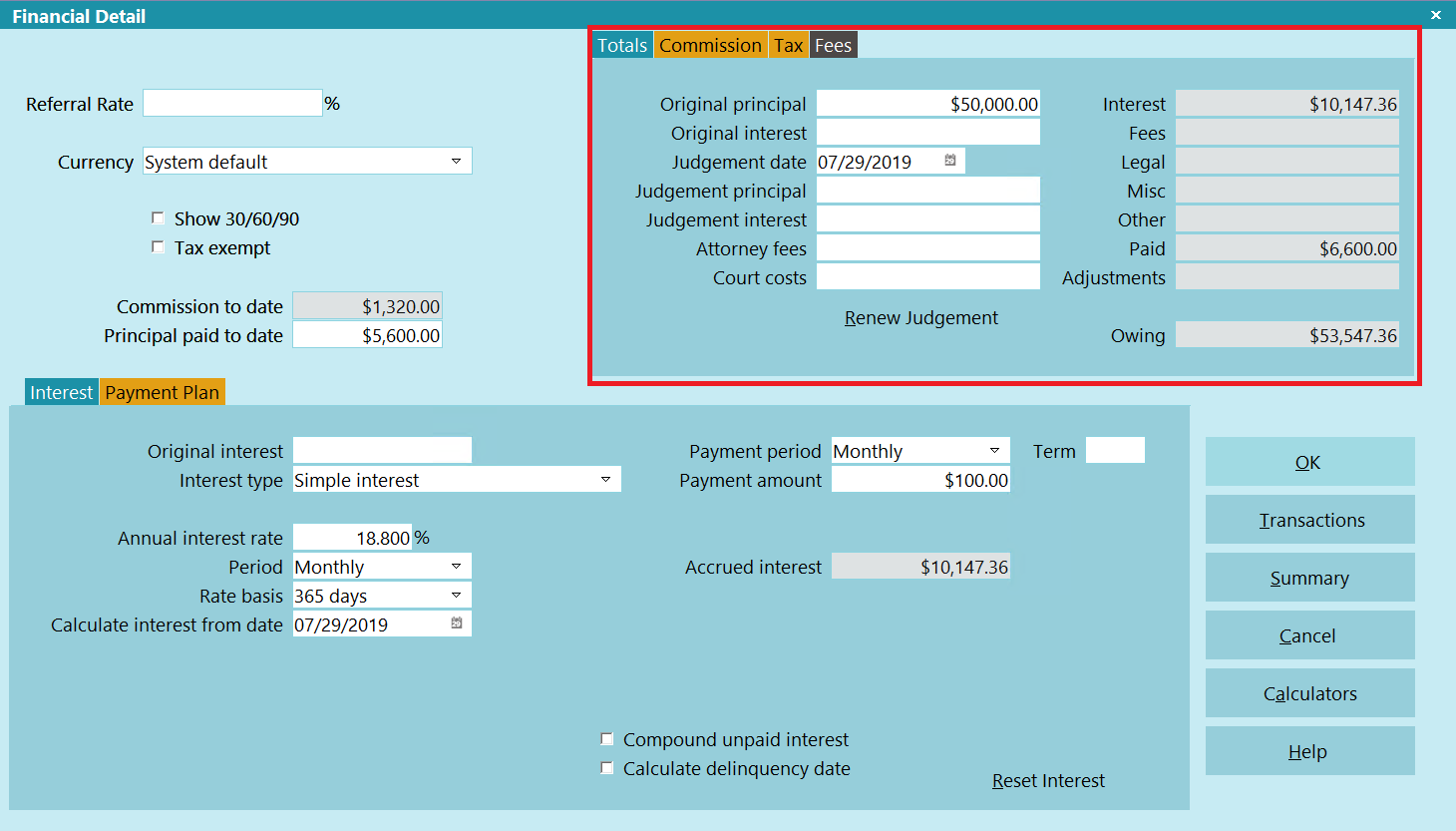

Financial Summary Totals

This section of the Financial Detail form is used to

enter debt and judgment details. It displays summaries

for all financial activity on the account.

To access this form, select the Principal field on

the Debtor form. Select the Totals tab.

To access this form, select the Principal field on

the Debtor form. Select the Totals tab.

Financial Summary Totals

Original Principal

This is the amount of the original debt. Normally, you

enter a dollar amount here, but you can also let Collect!

calculate the Original Principal from transactions posted

to the 'Principal' account.

WARNING: If you use transactions to define principal

amounts, any amount entered into the

Original Principal field will be wiped out

by the totals of all Principal transactions.

WARNING: If you use transactions to define principal

amounts, any amount entered into the

Original Principal field will be wiped out

by the totals of all Principal transactions.

This field is grayed out when compound interest is being

charged on the account.

When the debtor has a Judgment, instead of the

Original Principal, the Judgment Principal is used

for financial calculations.

Principal Paid To Date

This field displays the amount of Principal that has been paid

on this account. The amount is determined by the way your

payments are broken down and also by any Principal type

transactions that are posted as a credit to the account.

This is a convenient display for quickly determining the total

principal paid on the account. You can pull this information

into reports.

Original Interest

This is the amount of the original interest.

Judgement Date

This is the date of the Judgment against the debtor if one

exists. This date is very important in determining the

charges and credits to the account. When a Judgment

is awarded, all financial activity that occurred prior to the

Judgment Date is ignored. When you enter the Judgment

Date, the Debtor form will show a Judgment field

which "overlays" the Principal field and displays in color to

indicate that judgment amounts are being used for Principal

and Interest when calculating the amount Owing.

WARNING: When you enter a Judgment Date for an

account with Interest, the 'Calculate interest

from date' in the Interest Detail form changes

to the Judgment Date and previously accrued

interest is erased. If you wish to preserve a

record of any interest accrued prior to Judgment,

please refer to the Help topic, Reset Interest

BEFORE entering a Judgment Date.

WARNING: When you enter a Judgment Date for an

account with Interest, the 'Calculate interest

from date' in the Interest Detail form changes

to the Judgment Date and previously accrued

interest is erased. If you wish to preserve a

record of any interest accrued prior to Judgment,

please refer to the Help topic, Reset Interest

BEFORE entering a Judgment Date.

The Judgment Principal and Judgment Paid To Date fields

are visible after you have entered a Judgment Date. Enter

the judgment amount into the Judgment Principal field.

When the Judgment is entered, the Judgment is stored

as a 194 transaction and the Original Principal is stored as

a 196 transaction.

When you enter a Judgment, Collect! creates a 194

Judgment Principal transaction and grays out the

Judgment Principal and Judgment Date fields. You

can re-enable them, if needed, by deleting the 194 transaction.

If you modify the 194 transaction, by changing the dates or

the amount, the changes take effect immediately and are

displayed in the Judgment Principal and Judgment Date

fields.

Judgement Principal

This is the amount of the Judgment. This field is only

visible after you have entered a Judgment Date. This

amount displays in the Debtor form in the Judgment

field (which replaces the Principal field when the

Judgment Date is entered.) This is the debtor's new

principal amount. All calculations will be based on this

Judgment Principal going forward from the Judgment

Date. This field displays in color on the Debtor form

to indicate that judgment amounts are being used for

Principal and Interest when calculating the amount Owing.

When you enter a Judgment, Collect! creates a 194

Judgment Principal transaction and grays out the

Judgment Principal and Judgment Date fields. You

can re-enable them, if needed, by deleting the 194 transaction.

If you modify the 194 transaction, by changing the dates or

the amount, the changes take effect immediately and are

displayed in the Judgment Principal and Judgment Date

fields.

Judgement Interest

This is the amount of Original Interest permitted in the judgment.

The amount is added to the debtor's Owing. If you entered a

judgment amount and date, the Judgment Interest field is

used rather than Original Interest when calculating the debtor's

Total Interest. When there is a Judgment, only the Judgment

Interest is displayed in the Interest field on the Debtor form.

When you enter a Judgment, Collect! grays out

the Judgment Principal and Judgment Date fields.

You can re-enable them, if needed, by deleting

the 194 transaction.

When you enter a Judgment, Collect! grays out

the Judgment Principal and Judgment Date fields.

You can re-enable them, if needed, by deleting

the 194 transaction.

Collect! stores the amount of the Original Judgment Interest

in a Transaction Type 195 Interest transaction. You can only

have one 195 transaction on an account. 195 is a special

reserved transaction type for the original Judgment Interest

posted along with the Judgment Principal.

If you need to post additional interest transactions on

the account, you can use any other interest type

transaction, such as the Type 495, Additional

Judgment Interest.

If you need to post additional interest transactions on

the account, you can use any other interest type

transaction, such as the Type 495, Additional

Judgment Interest.

Collect! looks for Financial Type "Interest" when adding up

all the interest on the account, posted AFTER the Judgment

Date. It displays this total interest on the Debtor form. However,

the Judgment Interest field will only display the Original

Judgment Interest amount stored in the 195 transaction.

Attorney Fees

This is the amount of Attorney Fees permitted in the judgment.

The amount is added to the debtor's Owing. This field is only

visible when the Judgement Date is filled in.

When you enter a Judgment, Collect! grays out

the Judgment Principal and Judgment Date fields.

You can re-enable them, if needed, by deleting

the 194 transaction.

When you enter a Judgment, Collect! grays out

the Judgment Principal and Judgment Date fields.

You can re-enable them, if needed, by deleting

the 194 transaction.

Collect! stores the amount of the Attorney Fees

in a Transaction Type 394 Fee transaction. You can

have multiple 394 transactions on an account, but only the ones

posted after the Judgement date are factored into calculations.

394 is a special reserved transaction type for the Attorney Fees

posted along with the Judgment Principal.

Collect! looks for Financial Type "Fees" when adding up

all the Fees on the account, posted AFTER the Judgment

Date. It displays this total fees on the Debtor form. However,

the Attorney Fees field will only display the total of the Original

Attorney Fees amount stored in the first 394 transaction.

Court Costs

This is the amount of Court Costs permitted in the judgment.

The amount is added to the debtor's Owing. This field is only

visible when the Judgement Date is filled in.

When you enter a Judgment, Collect! grays out

the Judgment Principal and Judgment Date fields.

You can re-enable them, if needed, by deleting

the 194 transaction.

When you enter a Judgment, Collect! grays out

the Judgment Principal and Judgment Date fields.

You can re-enable them, if needed, by deleting

the 194 transaction.

Collect! stores the amount of the Court Costs

in a Transaction Type 294 Fee transaction. You can

have multiple 294 transactions on an account, but only the ones

posted after the Judgement date are factored into calculations.

294 is a special reserved transaction type for the Court Costs

posted along with the Judgment Principal.

Collect! looks for Financial Type "Fees" when adding up

all the Fees on the account, posted AFTER the Judgment

Date. It displays this total fees on the Debtor form. However,

the Court Costs field will only display the total of the Original

Court Costs amount stored in the first 294 transaction.

Renew Judgement

This button re-enables the Judgement Date field to allow a new

date to be entered. Once entered, the other Judgement fields

will become available for entering a new Judgement.

Interest

Total interest to date.

Fees

Total fees to date.

Legal

Total legal fees to date.

Misc

Total miscellaneous charges to date.

Other

Total other charges to date.

Paid

Total paid to date.

Adjustments

Total adjustments to date.

Owing

This is the current Owing on the account. This is

the same as the Owing displayed on the Debtor screen.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org